Wirestock/iStock Editorial via Getty Images

In the past six months, Costamare (NYSE:CMRE) stock price decreased by %30 as container vessel and dry bulk vessel charter rates dropped. Due to the trade disruptions caused by the war in Ukraine, hiked interest rates in the United States, zero-COVID19 policy in China, and last but not the least, decreased port congestion, charter rates may decrease further. However, it is important to know that charter rates are still significantly higher than the pre-pandemic levels. Furthermore, with contracted revenues for the containership fleet of $3.5 billion, and considerably high fixed revenue days in 2023, the company will make huge profits in the next quarters. The stock is a buy.

Quarterly results

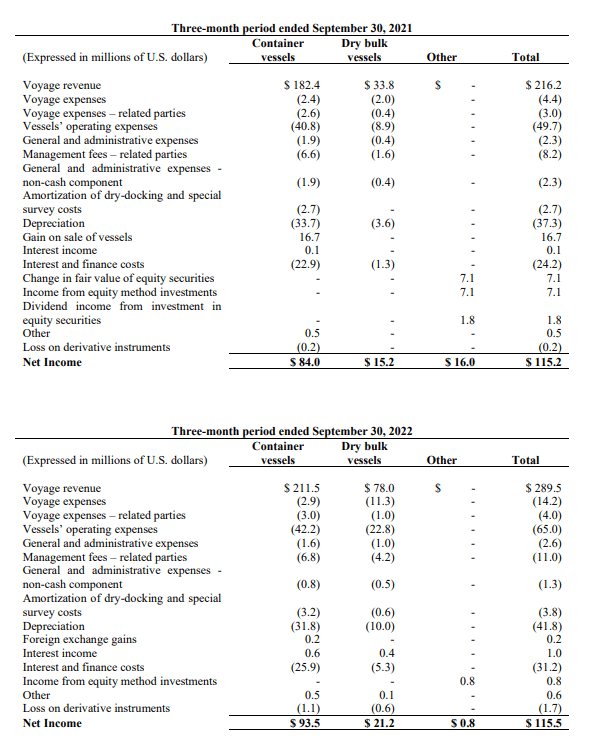

In its 3Q 2022 financial results, Costamare reported voyage revenue of $289 million, compared with 3Q 202 voyage revenue of $216 million. CMRE reported a net income of $115 million in the third quarter of 2021 and the third quarter of 2022. However, the company’s adjusted net income available to common stockholders increased from $82 million, or $0.66 per share in 3Q 2021 to $107 million, or $0.88 per share in 3Q 2022.

CMRE’s voyage operating expenses increased from $50 million in 3Q 2021 to $65 million in 3Q 2022. The company’s average number of vessels in the third quarter of 2022 was 117.0, compared with 91.7 in the same period last year. Its ownership days increased from 8434 in 3Q 2021 to 10764 in 3Q 2022. Also, Costamare’s number of vessels under dry-docking decreased from 5 in 3Q 2021 to 4 in 3Q 2022. CMRE reported depreciation expenses of $42 million in 3Q 2022, compared with $37 million in 3Q 2021.

The company’s 3Q 2021 net cash provided in operating activities of $126 million increased to $142 million in 3Q 2022. Also, its net cash used in operating activities dropped from $396 million in 3Q 2021 to $18 million in 3Q 2022. CMRE’s 3Q 2021 net cash provided by financing activities of $219 million, turned into net cash used in financing activities of $96 million in 3Q 2022.

“Focusing on increasing visibility and our contracted cash flow base, we recently chartered with a leading liner company a total of 11 containerships with existing charters originally expiring between 2023 and 2025. Seven of those vessels were chartered for a period ranging from four to five years starting from 2025 onwards, and the remaining ships, with forward starts in 2023 and 2024. The new charters increase our contracted revenues by about $420 million and result in incremental charter coverage of about 4.5 years,“ the CEO commented.

According to Figure 1, in 3Q 2022, CMRE’s container vessels voyage revenue, voyage expenses, operating expenses, and net income were $211.5 million (up 16% YoY), $2.9 million (up 21% YoY), $42.2 million (up 3% YoY), and $93.5 million (up 11% YoY), respectively. Also, the company’s dry bulk vessels voyage revenue, voyage expenses, operating expenses, and net income were $78.0 million (up 131% YoY), $11.3 million (up 465% YoY), $22.8 million (up 156% YoY), and $21.2 million (up 39% YoY), respectively. Thus, container vessel charter rates and the number of CMRE’s charter agreements play a major role in the company’s profitability.

Figure 1 – CMRE’s container vessels and dry bulk vessels results

3Q 2022 results

The market outlook

Due to the trade disruptions caused by the war in Ukraine, high inflation and hiked energy prices, and the global recession, the container market is not as strong as it was six months ago. As a result, the number of charter deals with fixed rates decreased significantly and most of the new fixtures are for short-term employment. Costamare had a limited number of fixtures over the past few months. “The company’s latest fixtures have been for shorter periods, and rates have been trending lower,” CMRE stated. However, charter rates are still historically firm.

Furthermore, port congestion around the world is declining, making container freight rates reach normal prices at a faster pace. Before the pandemic, only 3% of global container ships were facing port congestion problems. As a result of the COVID-19 lockdowns, in January 2022, 14% of global container ships were held up due to port congestion. Now, port congestion affects 8% of vessels.

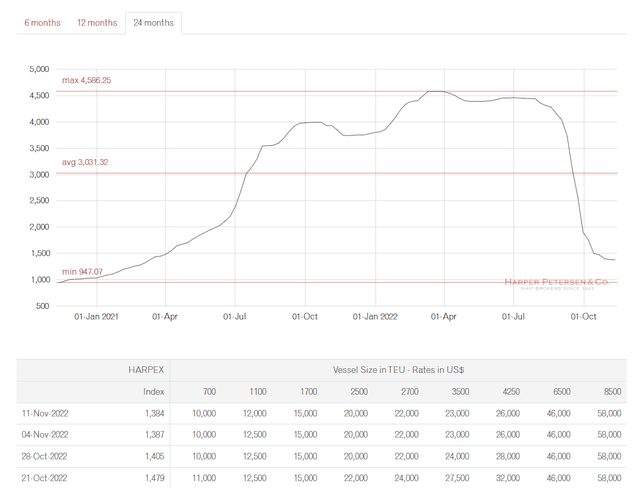

Figure 2 shows that since September, the HARPEX (HARPER PETERSEN Charter Rates Index) dropped from more than 4000 to 1500. However, charter rates are still 45% higher than the pre-pandemic levels. Also, Figure 1 shows that from 21 October 2022 to 11 November 2022, charter rates for 1700 TEUs, 6500 TEUs, and 8500 TEUs vessels didn’t change. In the mentioned period, the HARPEX decreased by 6.4% to 1384.

Figure 2 – HARPER PETERSEN Charter Rates Index

www.harperpetersen.com

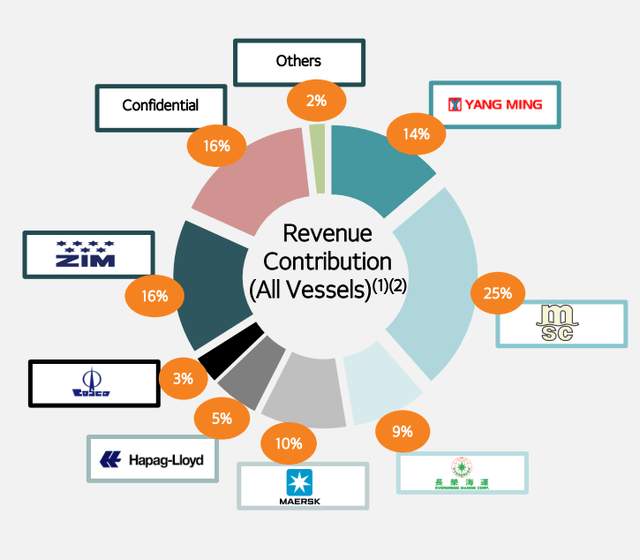

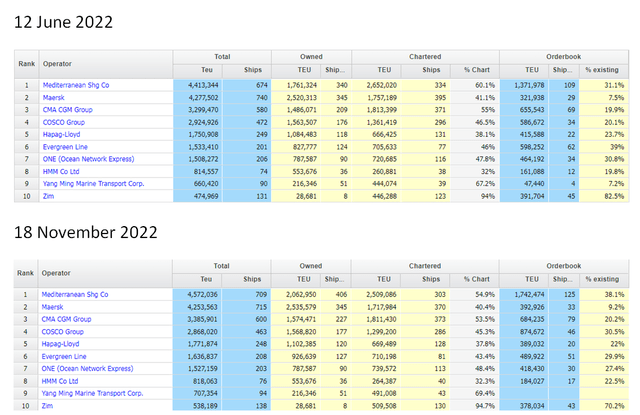

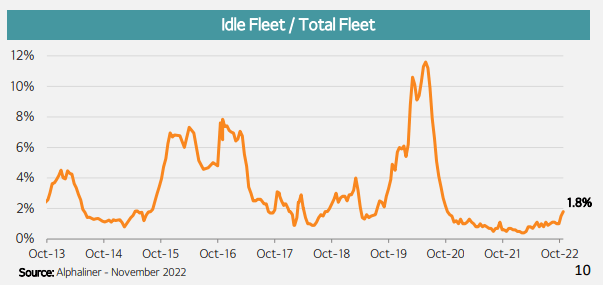

Figure 3 shows the liner companies that have chartered CMRE’s container vessels. According to Figure 4, from 12 June to 18 November 2022, the chartered capacity of Mediterranean Shg and Maersk, decreased by 142934 TEUs and 39205 TEUs, respectively. However, in the same period, the chartered capacity of Yang Ming, Hapag Lloyd, and ZIM, increased by 46934 TEUs, 3064 TEUs, and 63217 TEUs, respectively. It implies that despite lowered freight rates, a considerable portion of the liner companies increased their chartered capacity. It is important to know that the idle fleet to total fleet ratio is below 2%, meaning vessel availability is still low (see Figure 5).

With a strong chartering performance and new forward charter arrangements, CMRE will make huge profits in the following years. The company chartered 11 containerships on a forward basis with incremental contracted revenues of $420 million. More than 96%, 84%, and 71% of CMRE’s containership fleet have fixed contracts for 2023, 2024, and 2025 respectively. Altogether, CMRE has contracted revenues for the containership fleet of $3.2 billion. The company’s TEU-weighted average remaining time charter duration for its containership fleet is 4.4 years.

Figure 3 – Liner companies that have chartered CMRE’s container vessels

3Q 2022 presentation

Figure 4 – Alphaliner top operators as of 12 Jun 2022 and as of 18 November 2022

alphaliner.axsmarine.com

Figure 5 – Ilde fleet to total fleet ratio

3Q 2022 presentation

CMRE performance outlook

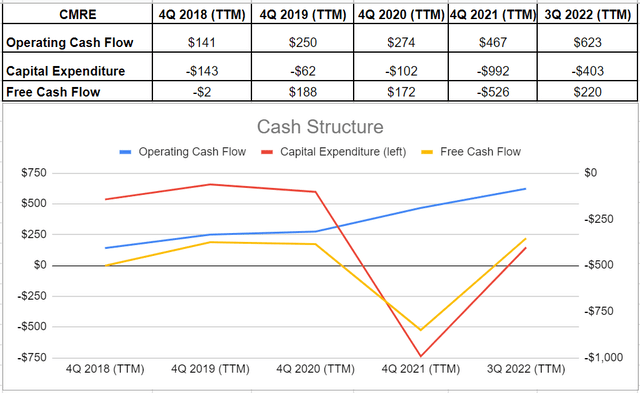

Analyzing the cash and capital structures of Costamare indicates that the company’s operating cash flow has successfully recovered during 2022 and reached a peak of $623 million in 2022. It is observable that the company’s cash conditions have improved considerably since 2020. In minutiae, CMRE’s cash in operation surged by 70% and set a new record of $467 million in 2021 compared with its previous level of $274 million at the end of 2020. Regarding its capital expenditure, the company boosted its amount of capital expenditure in 2021 to $992 million versus its previous amount of $102 million at the end of 2020. Notwithstanding a decline to $403 million in 2022, CMRE’s capital expenditure is high enough to bring more benefits to its shareholders. When all was said and done, Costamare ultimately catered a massive growth in free cash flow and sat at $220 million in 2022, which is the highest amount in recent years (see Figure 6).

Figure 6 – CMRE’s cash structure (in millions)

Author (based on SA data)

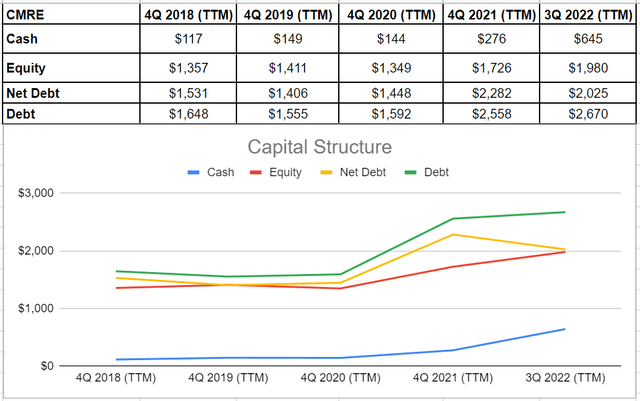

In spite of watching their total debt increase considerably to $2558 million and $2670 million in 2021 and 2022, respectively, versus its level of $1592 million at the end of 2020, CMRE’s net debt of $2282 million in 2021 waned to $2025 million in 2022. It was because of an impressive increase in the company’s cash balance. Its cash level has been on an increasing path during recent years and ultimately boosted amazingly and sat at the highest record of $645 million in 2022 compared with its amount of $276 million at the end of 2021. Moreover, its total equity advanced to $1980 million in 2022 versus its previous level of $1726 million in 2021. On the other hand, albeit an increase in total equity, it is still beneath the company’s level of net debt. All in all, the capital structure of Costamare will likely see further improvements in the future (see Figure 7).

Figure 7 – CMRE’s capital structure

Author (based on SA data)

Summary

Despite lowering charter rates, CMRE is well-positioned to continue making significant profits in the following quarters. Charter rates are still historically high, and the idle fleet to total fleet ratio is still below 2%. Also, despite a limited number of fixtures over the past few months, CMRE’s containership fleet TEU-weighted average remaining time charter duration is 4.4 years. The company can continue rewarding its shareholders. I am bullish on CMRE.

Be the first to comment