Henrik5000/E+ via Getty Images

Cimpress plc (NASDAQ:CMPR), specialized in the mass production of printing products, is currently undertaking a transformation of business segment Vista. Besides, the company announced a more decentralized structure and larger presence of online orders. Considering CMPR’s FCF expectations, I wouldn’t be worried about the company’s financial debt. Yes, there are risks from failed acquisitions and lack of innovation. However, my financial models indicate that the stock appears undervalued.

Cimpress

With a business model perfected through experience with its clients, Cimpress focuses on the design and mass production of printing products, such as business cards, books, magazines, packaging design for product packaging, invitations, and announcements among others.

The business expansion in the last 17 years is impressive. According to statistics provided by management, Cimpress obtained revenue of 0.2 billion towards the year 2006, reaching 2.9 million in sales in 2022. In my view, growth was supported by the company’s current customer base, which appears to exceed 17 million throughout the world.

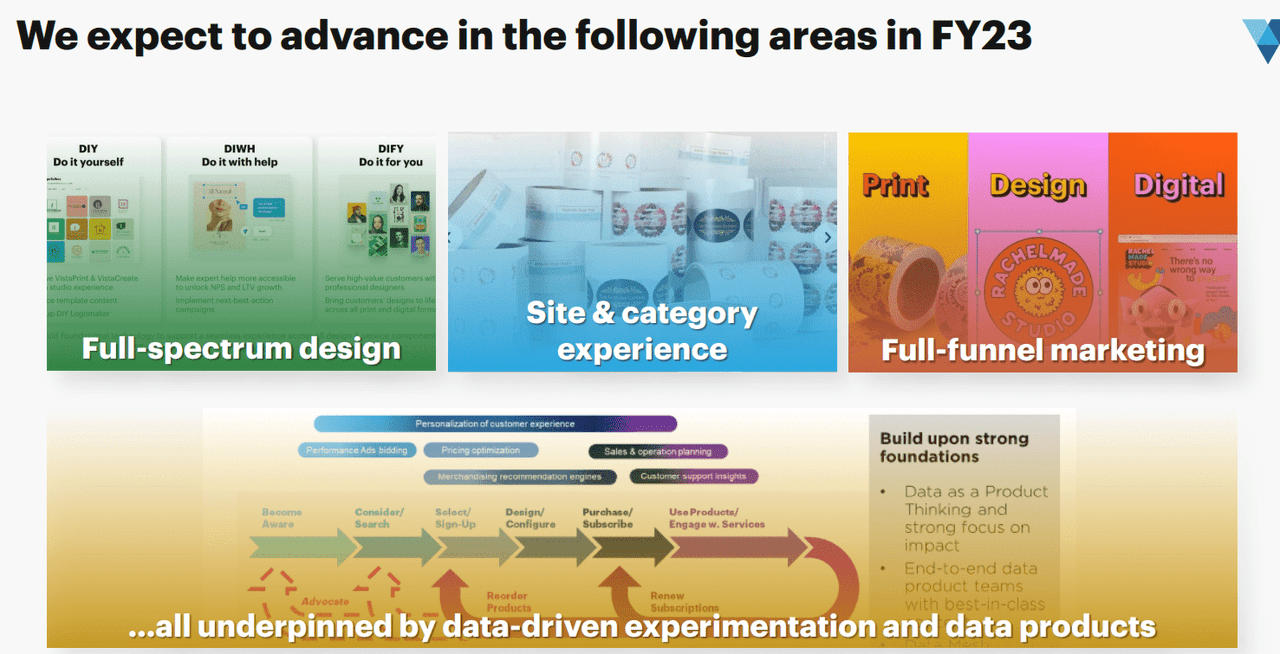

With that about the past, the future appears sweet too. In a recent presentation given to investors, management noted beneficial expectations thanks to data-driven experimentation, data products, full-funnel marketing, and full-spectrum design.

Source: Investors Day

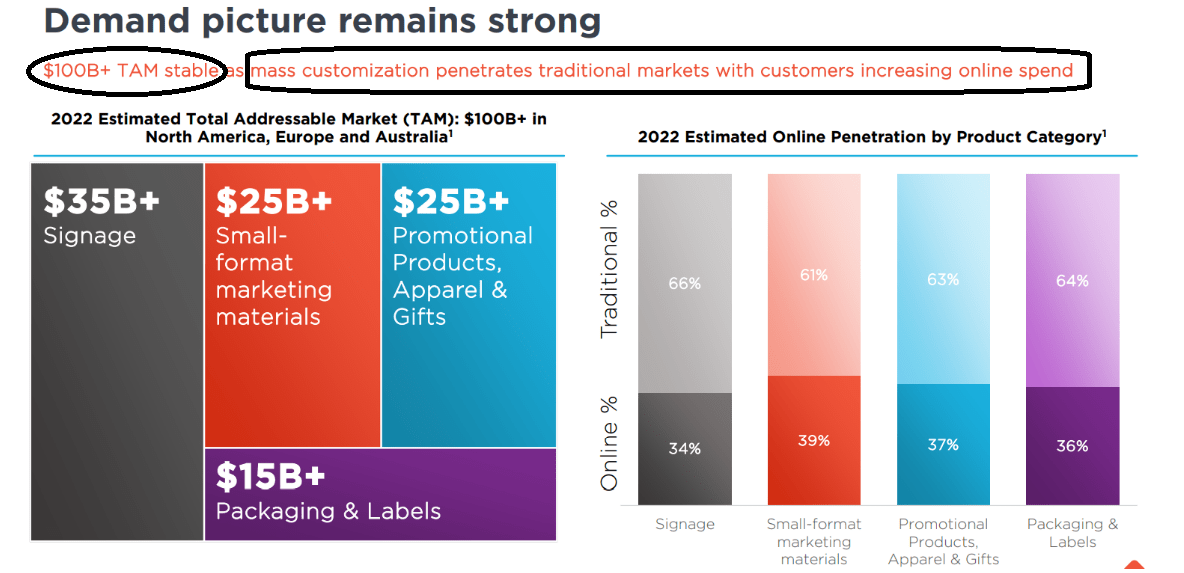

Cimpress’ focus is on its mass customization program, which means the mass customization of a certain number of products. In technical terms, this is the production of a small number of objects that have the same reliability, quality, and affordability as a traditional product in the market. Based on its motto of personal expression as the maximum reference of our era, Cimpress offers its clients the possibility of commissioning the small-scale production of design objects that feel like an expansion of the business owner himself.

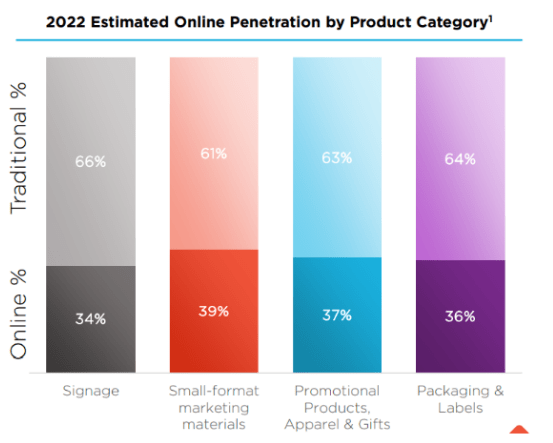

In a recent quarterly report, the company noted that mass customization could receive significant demand in the coming years. Management noted a total market opportunity of close to $100 million. The target market includes $35 billion from signage, $25 billion from small format and marketing materials, $25 billion from promotional products, and $15 billion from packaging and labels.

Source: Investors Day

Balance Sheet

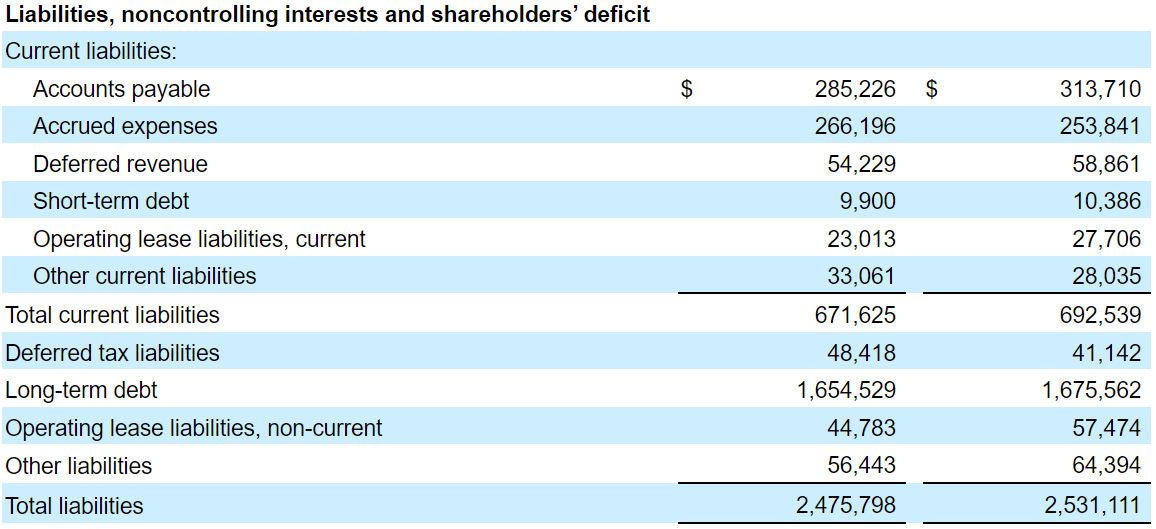

As of September 30, 2022, Cimpress reported cash of $132.100 million with marketable securities worth $101.726 million and an inventory of $153.504 million. Prepaid expenses stand at $121.428 million with total current assets worth $579.291 million. Total current assets are lower than total current liabilities, however Cimpress delivers constant free cash flow generation. So, many investors would not worry about the company’s liquidity risks.

Long-term liabilities include property, plant and equipment worth $272.625 million, deferred tax assets worth $114.020 million, and goodwill of $748 million. The total amount of assets is equal to $2.098 billion, which is lower than the total amount of liabilities, which does not seem ideal even taking into account the company’s FCF.

Source: 10-Q

Cimpress reports accounts payable of $285.226 million with accrued expenses of $266.196 million and total current liabilities of $671.625 million. Long-term debt stands at $1.65 billion million, and total liabilities are equal to $2.47 million.

Source: 10-Q

The level of debt may affect the company’s EV/EBITDA multiple. With that, in my view, if the net income and FCF continue to grow as expected by analysts, Cimpress would look appealing to certain investors.

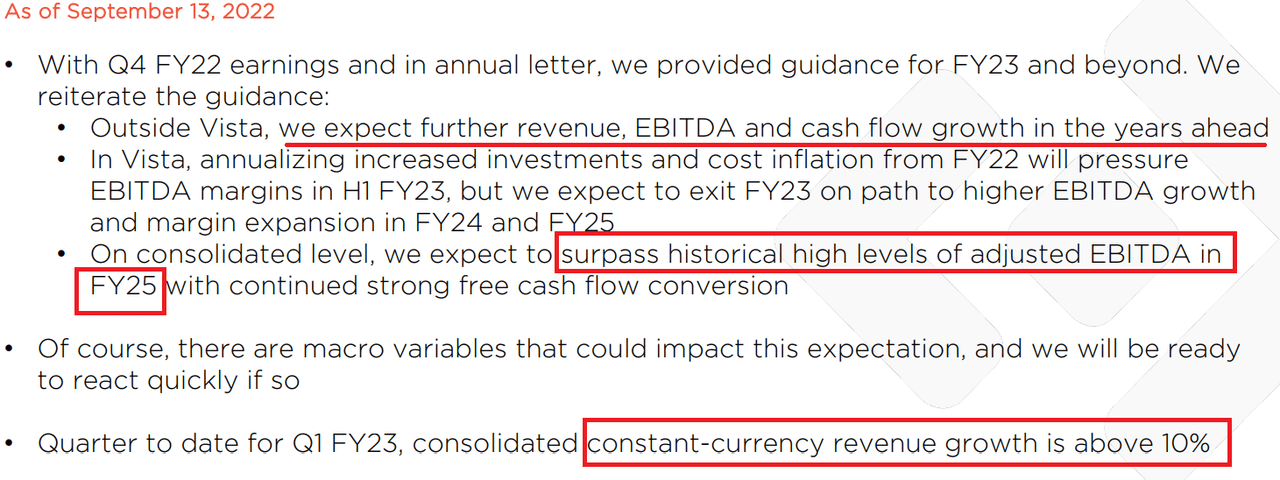

Expectations From Management Include Cash Flow Growth And EBITDA Margin Expansion

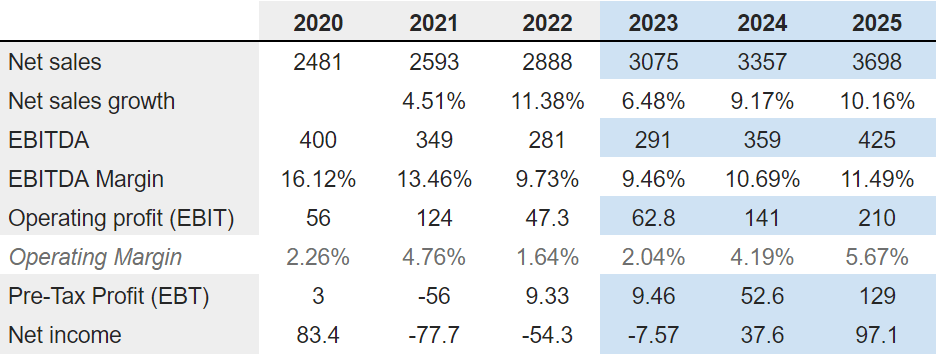

Further growth in revenues, EBITDA, and cash flow is expected in the coming years. Cimpress expects to break record levels in adjusted EBITDA in 2025 with continued strong free cash flow generation. For those readers who don’t want to go through all the slides of the recent quarterly report, the following slide is what matters the most.

Source: Investors Day

Expectations from analysts are also quite impressive. 2025 net sales is expected to be $3.698 billion. 2025 Net sales growth could stay close to 10.16% with an EBITDA of $425 million and an EBITDA margin of 11.49%. Operating profit would stand at $210 million with an operating margin of 5.67% and a net income of $97.1 million.

Source: Marketscreener.com

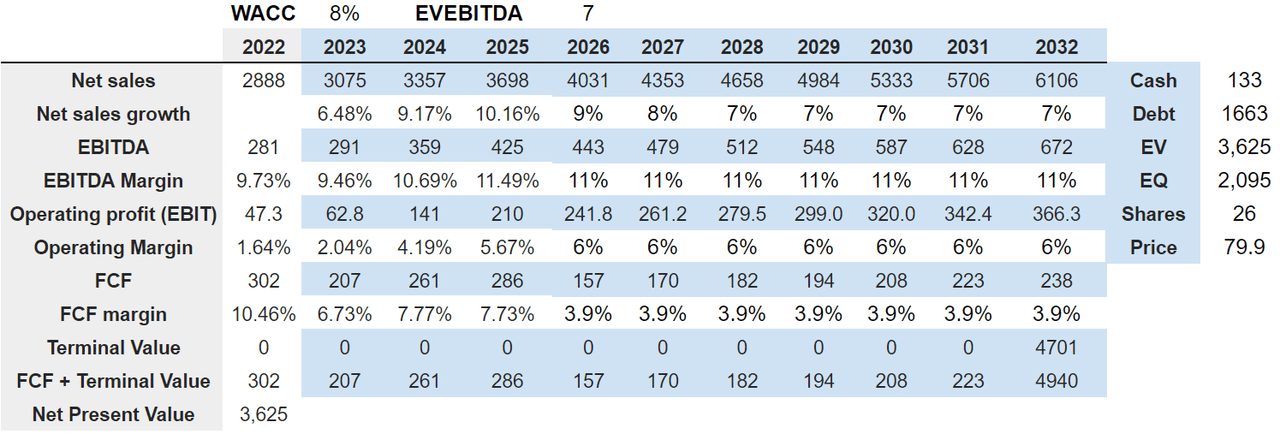

My DCF Model Implied A Valuation Of $79.9 Per Share

Under normal conditions, I expect an increase in online distribution, which will likely enhance the company’s FCF margin in the future. In 2022, Cimpress expects online signage to account for 34% of total signage revenue. Other product categories also expect a significant contribution to the company’s online business.

Source: Investors Day

I am optimistic about the new structure that was presented recently. It is a decentralized structure, which allows faster and more effective decision-making with a greater focus on customer needs. By having different action capacities available depending on the work area, they have been able to link the production of design objects with ease and determination, taking into account the restrictions of each geographical area, thus taking care of their employees. In my view, these initiatives will likely bring cost efficiencies and revenue growth.

Besides, I would expect an increase in Cimpress’s EBITDA margins thanks to the new centers outside the United States. Cimpress offers training courses and various in-house career development opportunities for its employees based in India.

We make it easy, low cost, and efficient for Cimpress businesses to set up and grow teams in India via a central infrastructure that provides all the local recruiting, onboarding, day-to-day administration, HR, and facilities management to support these teams, whether for technology, graphic services, or other business functions. Most of our businesses have established teams in India leveraging this central capability, with those teams working directly for the respective Cimpress business. Source: 10-k

Under the previous assumptions, I included 2032 net sales of $6.106 million with a net sales growth of 7%. I also assumed 2032 EBITDA of $672 million with an EBITDA margin of 11%, operating profit of $366.3 million, and an operating margin of 6%. The results would include 2032 FCF of $238 million with a FCF margin of 3.9%.

Source: Bersit’s DCF Model

If we use an EV/EBITDA multiple of 7x, the implied enterprise value would stand at $3.6 billion. Adding the cash in hand of $133 million, and subtracting the debt of $1.6 billion, the results include an equity valuation of $2.09 million and an implied price of $79 per share

Risks From The Transformation Of Vista, Failed Acquisitions, Failed JVs, Or Lack Of Innovation Could Lead To A Valuation Of $23 Per Share

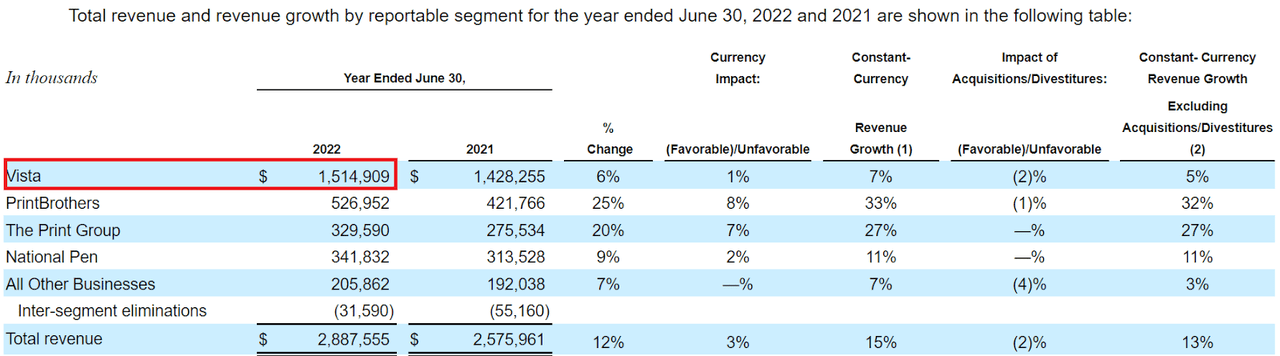

Cimpress is currently undertaking a reorganization of the Vista business segment, which grows at only 7% per year. Let’s note that Vista is one of the largest business segments. In my view, if Vista’s transformation fails, revenue growth may decline, which will likely lead to a decrease in future revenue growth and perhaps increase in costs.

Source: 10-Q

The Vista business is undertaking a multi-year transformation, and we are investing heavily to rebuild Vista’s technology infrastructure, Source: 10-k

If our investments do not have the effects we expect, the new technology infrastructure does not perform well or is not as transformational as we expect, we fail to execute well on the evolution of our customer value proposition and brand, or the transformation is otherwise unsuccessful, then the number of new and repeat customers we attract may not grow or could decline, Vista’s reputation and brand could be damaged, and our revenue and earnings could fail to grow or could decline. Source: 10-k

Cimpress may also suffer from failed acquisitions attempts, or may sign joint ventures with partners that don’t offer innovative technological solutions. The company’s total amount of goodwill is not small. If management decreases its expectations about the future of businesses acquired, the book value per share may decline. In sum, the company may see a decline in free cash flow expectations, and the fair value would diminish.

An important way in which we pursue our strategy is to selectively acquire businesses, technologies, and services and make minority investments in businesses and joint ventures. The time and expense associated with finding suitable businesses, technologies, or services to acquire or invest in can be disruptive to our ongoing business and divert our management’s attention. Source: 10-k

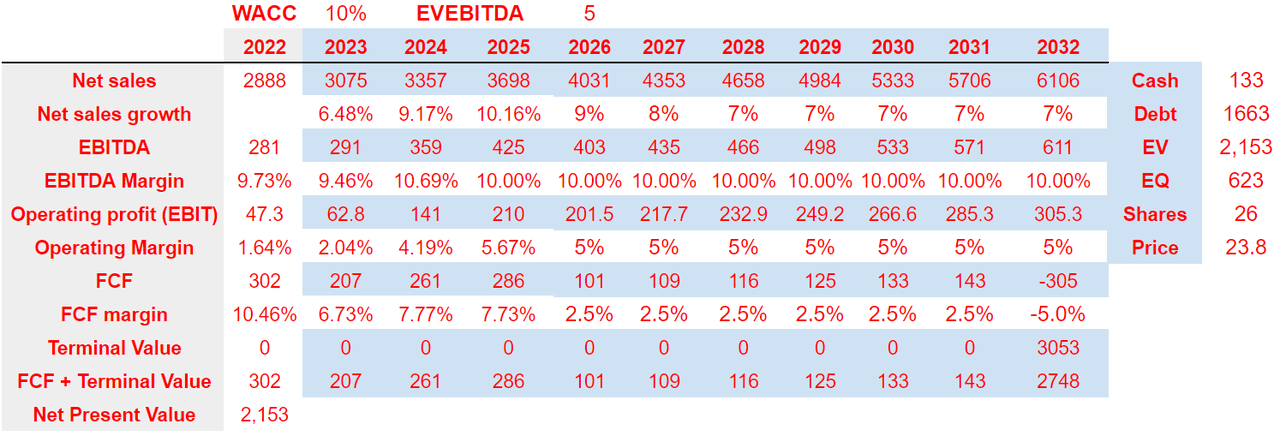

Under the previous conditions, I included 2032 net sales of $6 billion with net sales growth of 7%. Also, with 2032 EBITDA of $611.5 billion and an EBITDA margin of 10%, the operating profit would stand at $305 million. Finally, 2032 FCF would stand at close to -$305 million with a FCF margin of -5%.

Source: Bersit’s DCF Model

Putting everything together, Cimpress’ enterprise value would stand at $2.15 million, and the equity valuation would be around $623.5 million. Finally, with a share count of 26 million, the implied price would be $23.8 per share.

My Takeaway

Currently trading with a market capitalization of $751-851 million, Cimpress plc will likely benefit from the ongoing transformation of Vista, and more online activities. Considering the company’s cash flow, the guidance of management, and expectations of analysts, debt may not represent such a problem. Even considering risks from failed acquisitions, joint ventures, or lack of innovation, in my view, the fair valuation is higher than the current market valuation.

Be the first to comment