HeliRy

Although it may not seem like it at all times, it is undeniable that we live in a truly globalized world. Very few countries, if any, produce all that they need in order to meet consumption. That is especially true of the largest countries that have the largest economies. Even the energy sector is highly globalized. As such, it should be no surprise that a significant amount of oil and related products are often transported by sea, with a tremendous amount of infrastructure required in order to facilitate said activities. One company dedicated to offering these types of services is a firm called Frontline (NYSE:FRO). Because of the nature of the company and how it operates, it is a truly volatile enterprise. But considering current economic conditions, it’s not unreasonable to think that this volatility should continue to work in a positive way for shareholders for the foreseeable future. Because of its very nature and historical track record, I do think that any investors who buy into the firm or any of its competitors should be prepared for a volatile road ahead. But because of the industry dynamics and the specifics regarding this particular firm, I do think that it makes for a decent ‘buy’ prospect at this time.

A niche energy business

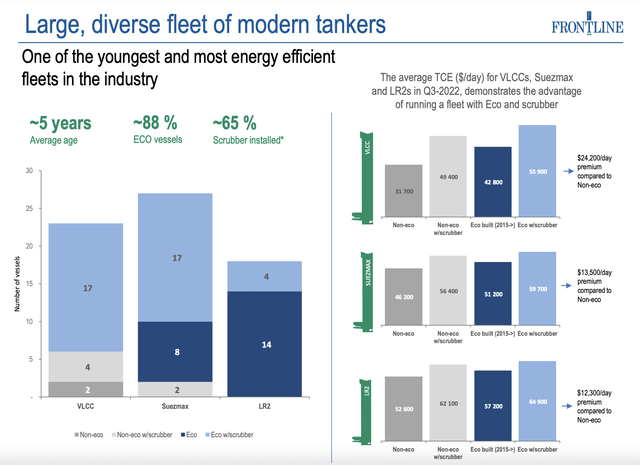

According to the management team at Frontline, the company and its subsidiaries operate a portfolio of oil tankers and other related assets. As of the end of the latest quarter, the company owned no fewer than 67 vessels. Which really interesting about its fleet is that it is very young. The average age in its fleet currently stands at around five years. In total, the company has 22 VLCC (very large crude carriers) that can handle between 200,000 and 320,000 dwt (deadweight tons). Of these, 17 are classified as Eco vessels with scrubbers. This is noteworthy because, according to the most recent data available, this classification should result in around $24,200 per day above what non-Eco VLCCs should generate.

In addition to this, the company also has 27 Suezmax vessels, all but two of which are Eco vessels. 17 of these, in turn, are also equipped with scrubbers. In this case, the average per day premium compared to their non-Eco counterparts should be as much as $13,500. These particular vessels, it is worth mentioning, have capacity of between 120,000 and 170,000 dwts. And finally, the company has 18 LR2/Aframax tankers. Whereas the VLCC and Suezmax tankers are classified as focusing on crude, these assets focus on clean products (transporting refined cargoes). They are also slightly smaller with a capacity of between 111,000 and 115,000 dwts. Only four of these 18 have scrubbers, but all 18 are of the Eco variety, with an average expected premium per day compared to their non-Eco counterparts of $12,300.

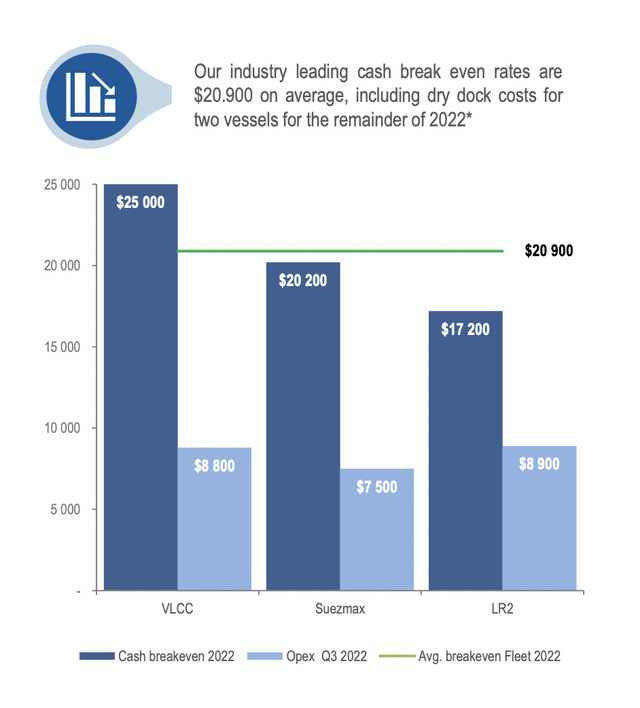

The fact that these vessels are new and efficient, not to mention that they should generate more revenue compared to older vessels, means that their break-even points should be lower than what the break-even points would be for older vessels. As an example, the company’s cash break-even point for its Suezmax ships should be around $20,200 per day. That compares to the $20,900 industry average. The LR2/Aframax break-even is even lower at $17,200. Of course, this picture could change rather rapidly. I say this because, while it is common for companies in the shipping industry to enter into long-term contracts to guarantee attractive day rates, Frontline specializes in taking the spot rate. This is basically the current market rate from day to day that shippers can capture. When times are good, this can result in tremendous upside potential. But when times are bad, the pain can be incredibly significant. To put in context exactly how dedicated the company is to the spot rate strategy, consider that, as of the end of its latest annual report, all but five of its vessels were entered into contracts under the spot rate.

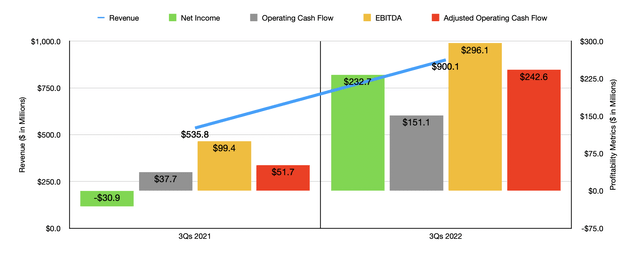

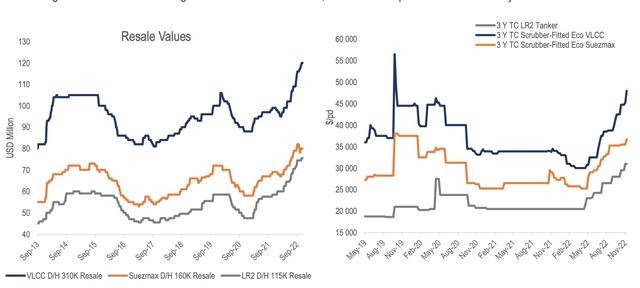

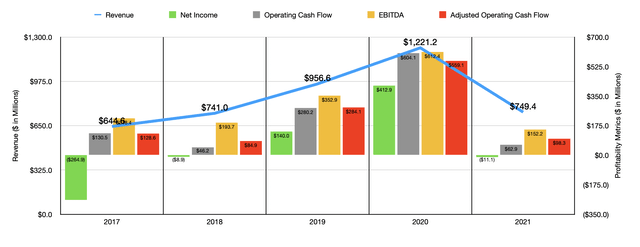

The volatility that comes with a spot rate strategy can be seen by looking at the chart above. This particular chart covers the historical financial performance of the company for the five years ending in 2021. In the chart below, meanwhile, you can see financial data covering the first nine months of 2022 compared to the same nine months one year earlier. The disparity between last year and this year is particularly noteworthy, with revenue skyrocketing from $535.8 million to $900.1 million. An aging fleet, a dwindling tanker order book market, and both geopolitical and economic conditions that have made the energy sector highly uncertain and expensive, have all coalesced to cause not only vessel resale values, but also day rates, to shoot higher.

Author – SEC EDGAR Data Frontline

This surge in revenue has also brought with it improved profitability. Net income of $232.7 million for the first nine months of 2022 dwarfed the $30.9 million loss achieved the same time last year. Other profitability metrics also came in strong. Operating cash flow, for instance, jumped from $37.7 million to $151.1 million. Even if we adjust for changes in working capital, the metric would have nearly doubled from $51.7 million to $242.6 million. And over that same window of time, EBITDA nearly tripled from $99.4 million to $296.1 million. We don’t really know what to expect for the rest of 2022. But taking the simple approach, annualizing results experienced so far for the year would yield adjusted operating cash flow of $461.3 million and EBITDA of $453.4 million.

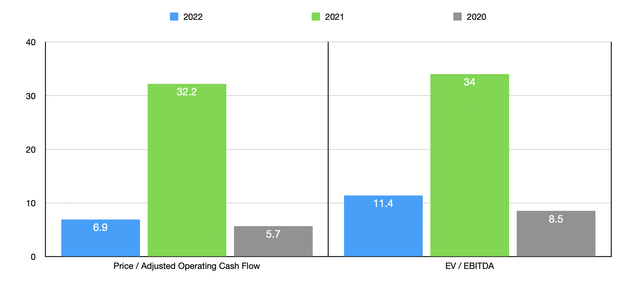

Based on these figures, the company would be trading at a forward price to adjusted operating cash flow multiple of 6.9 and at a forward EV to EBITDA multiple of 11.4. But as I stated earlier in this article, the downside to a spot rate strategy for any business in any volatile market is that this picture could change rather rapidly. If we use the data from 2021, as an example, these multiples would be 32.4 and 34, respectively. By comparison, reverting back to what we saw in 2020 would result in multiples of 5.7 and 8.5, respectively. To keep things simple, I did decide to compare the company with five similar firms. On a price to operating cash flow basis, four of the five companies had positive results, with a range of between 3.6 and 25. In this case, two of the five companies were cheaper than Frontline. Using the EV to EBITDA approach, the range for the five companies was from 9.6 to 10.5. In this case, Frontline was the most expensive of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Frontline | 6.9 | 11.4 |

| Scorpio Tankers (STNG) | 6.7 | 4.6 |

| Navigator Holdings (NVGS) | 7.1 | 10.5 |

| SFL Corp. (SFL) | 3.6 | 6.6 |

| Teekay Tankers (TNK) | N/A | 6.0 |

| International Seaways (INSW) | 25.0 | 9.3 |

Another important consideration for investors looking to buy in is that Frontline has already agreed to merge with rival Euronav (EURN) in what was touted as a $4.2 billion combination. This deal should generate at least $60 million in run-rate synergies. But right now, the deal is taking longer than expected. According to the original agreement, shareholders in Euronav are expected to receive 1.45 shares of Frontline for each share they own. The nature of this transaction is incredibly complex, including the laws of multiple areas. It’s unclear exactly what the end result will be. But we do know that Frontline wound up with control of the combined entity, with ownership of as much as 75% or even more over Euronav. Due to regulatory issues though, this deal has been pushed from an expected completion date of sometime this quarter to sometime in the first quarter of next year.

Takeaway

Based on what data we have today, I will say that Frontline it’s not exactly my cup of tea. While I can appreciate the industry in which it operates and I definitely find it an interesting player, the spot rate of anything related to shipping, particularly when it comes to the transportation of oil and related products, subjects investors to tremendous amounts of uncertainty. Given how cheap shares are at the moment and the expectation that current market conditions will persist because of issues like Russia, I could definitely understand why investors should be drawn to the enterprise. Add on top of this the pending merger And the overall quality of the enterprise, and I can understand why a soft ‘buy’ rating would be appropriate for this firm.

Be the first to comment