Robert vt Hoenderdaal/iStock Editorial via Getty Images

Investment thesis

Ahold Delhaize (OTCQX:ADRNY) might be in one of the best sectors to hide in during a recession. Ahold Delhaize is a retail and wholesaling company with its claws in all sorts of stores. It mainly manages supermarkets under multiple names in the US, The Netherlands and Belgium, among others. The company has a competitive advantage in every industry and region it operates in. Ahold Delhaize is still slowly growing and this is exactly one of the reasons to buy this company. It is extremely solid and safe, pays a good dividend, and shows slow but steady growth. It is the perfect company under the current economic circumstances. In this article, I will tell you why.

(Because Ahold reports in euro, this will also be the currency I use throughout this article)

Ahold Delhaize

Ahold Delhaize is a multinational owning multiple supermarkets, convenience stores, online grocery, online non-food, drugstores, and liquor stores. The company was formed after the merger of Dutch Ahold and Belgian Delhaize. Ahold Delhaize consists of 21 brands which employ 375,000 people at approximately 6,500 stores divided over 11 countries. Most of these companies are located in the Netherlands and Belgium. Other countries, in which the company is active, are the Czech Republic, Greece, Luxembourg, Romania, Serbia, and the United States. Over the past 12 months, the company reported $83.32 billion in revenue and $36.17 billion in net income.

In the US, the company also manages 8 companies. These 8 companies accounted for about 61% of revenue in 2021 (in euros)

All companies under Ahold Delhaize (Ahold Delhaize)

Performance

As mentioned before, the company derived 61% of its revenue from the US. This year, of course, this was a huge tailwind because of the extremely strong dollar and the company reporting in euros. During H1 2022 the percentage of revenue from the US increased to over 62%. Since 2Q22 seems more representable for the current economy, I will dive a little deeper into those numbers.

The company did raise its guidance in the press release. At constant rates revenue increased by 6.4% YoY. With the currency tailwind, this increases to 15% YoY growth in revenue. The company reported an operating margin of 4.1%. EPS was €0.59, an increase of 11% YoY. This is what CEO Frans Muller had to say about their outlook during the latest earnings call:

Based on the strong half-year earnings as well as other macro-economic, foreign exchange and interest rate factors, the Group now expects mid-single-digit growth in underlying EPS compared to 2021 levels (originally expected decline of low- to mid-single digits vs. 2021 levels) and an increase in 2022 free cash flow guidance to a level of approximately €2.0 billion (originally €1.7 billion).

Cumulative Group free cash flow guidance increased to be around €7.5 billion from 2022 to 2025 (originally above €6 billion). Group capital expenditure now projected to average closer to 3% per annum from 2022 to 2025 (originally 3.5% per annum).

This is great news for every investor in Ahold Delhaize. H1 was great for the company and the outlook is only getting stronger, making the company even cheaper. The only little stain to be found in the Q2 press release was the decision to suspend its intention for the IPO of Bol.com. This is because of bad market conditions, and I think this is a fair reason. I cannot disagree with management’s decision to postpone. Yes, a lot of investors were excited for this IPO and so it was not the news that got investors really excited.

I think they made a good decision by postponing. Under current market conditions, the IPO would not raise the optimal amount of money. Growth stocks and E-commerce stocks are getting butchered and so would Bol.com.

Management remains confident in its full-year targets as shown by the slight increase in expectations, but also the repeating of their long-term targets is promising. The company also still expects its long-term margin to come in at at least 4.0%. This is very decent for a company in this industry proven by an A for profitability from Seeking Alpha Quant rating.

The company also remained committed to keep paying its dividend within a 40%-50% dividend payout ratio and keep buying back its shares. The company announced a €1 billion buyback for 2022 at the start of the year. As of today, there is still €300 million remaining of this buyback which has to be completed by the end of the year.

The average revenue growth over the last 3 years is 7.39%. 3-year EPS growth was 9.49% and is expected to be mid-single digits for FY22, which shows growth remains even under very difficult macroeconomic conditions and reduced consumer spending.

Returns

As shown in the previous chapter, the financial performance of Ahold was great. But how is the stock performance? Well, not that great, as shown below.

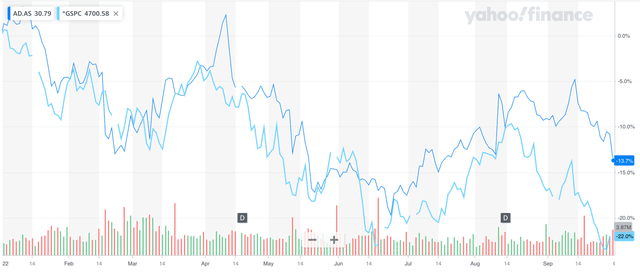

Ahold performance ytd vs S&P500 (Yahoo finance)

In contrast with the financial results the company reported, the stock is down by 13.7% YTD (at the time of writing). Yes, it is still way outperforming the S&P500 which is down 22%, but you would still expect more of a stock reporting great YoY growth of 15% and confirming their long-term goals. This does mean the stock got a lot cheaper, but more on this later.

It is also interesting to compare Ahold Delhaize to its peers in the retailing and supermarket industry:

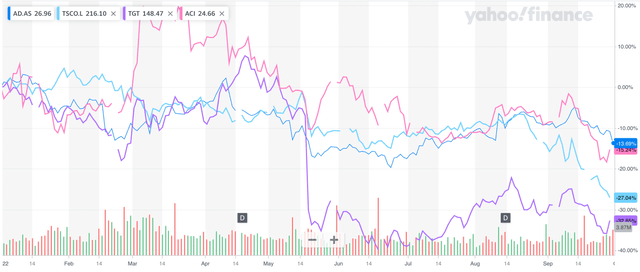

Ahold ytd compared to its peers (Yahoo Finance)

Above you can see I compare Ahold Delhaize to British Tesco (OTCQX:TSCDY) and American retailers Target Corp. (TGT) and Albertsons (ACI). This graph shows us that only Albertsons is getting close to the performance of Ahold this year, with a loss of 15.24% in share price. Target and Tesco took big hits, mostly because of profit warnings at these firms, which only confirms the performance of Ahold Delhaize is real class.

Finally, I want to check the historical performance of Ahold stock. What were the actual returns over the last few years?

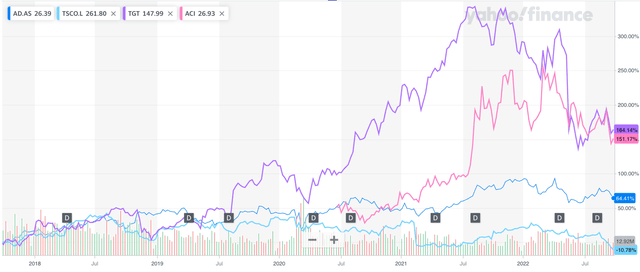

Ahold Delhaize performance last 5 years vs peers (Yahoo finance)

The graph above shows us Ahold Delhaize only managed to return a little more than 64% over the last 5 years. Of its peers, only Tesco did worse with negative returns. Its American peers did way better by posting more than 151% for Albertsons and 164% for Target. For comparison, over the last 5 years, the S&P500 returned 42.80%, so Ahold would have still given you an outperformance. That means Ahold Delhaize grew its stock price by little less than 11% CAGR. This made Ahold a strong outperforming investment over the last 5 years.

Moat

The retail and wholesale industry knows a lot about competition and price fighting. So, it takes a lot to pull customers towards your stores. This results in very low margins. Ahold had a margin of 4.0%, which is decent within the industry. The only way to grow is to outperform your competitors or through M&A, and Ahold did both. As shown in the previous sections, Ahold Delhaize is growing solid YoY over the last 5 years, and this is the result of a great moat it created over the years in multiple regions and sectors.

According to Morningstar, Ahold Delhaize holds the number one or number two spot in most of the markets it operates in, and this shows the great moat of the company. Albert Heijn, a Dutch supermarket, has the best moat of all 21 brands, with a 35% market share.

EcommerceDB states, Ahold is a frontrunner in technological investments showing with Bol.com being one of the largest E-commerce platforms in the Benelux with a 20-25% market share and growing.

Valuation and financials

According to Seeking Alpha, Ahold Delhaize is valued at a forward P/E ratio of 11.5. For comparison Target Corp. is valued at a forward P/E of 16.86, Albertsons at 8.87, and Tesco at 10.48. This makes Ahold not the cheapest nor the most expensive valued among its peers.

At the end of 2Q22 Ahold Delhaize had €3.46 billion in total cash & short-term investments and €4.56 billion in long-term debt. The company currently pays a 3.90% dividend yield and this receives an A- from the Seeking Alpha Quant system. Their yield is way above the sector median of 2.36%. The yield at Ahold Delhaize is very good, but for safety and growth, the Company receives a quant rating of D+ and C-, respectively.

The valuation of the company receives a Quant rating of B+. Mostly because on a forward P/E basis the company is undervalued compared to the sector by 36.16%. This is a criminal undervaluation. The company has been outperforming the whole sector over the last few years and has been one of the most steady forces so far this year, even under current macroeconomic volatility.

Threats

Company-specific, there are not many threats. Company management is dealing well with current macroeconomic headwinds as can be seen from H1 numbers. But there is a big chance of a recession by year’s end or the start of 2023, and then even Ahold Delhaize may start struggling. This will be mainly because of less consumer spending. Ahold Delhaize is in a relatively strong industry for economic downturns, but there is a threat of people looking for cheaper alternatives. For example, in The Netherlands Albert Heijn has a great market share, as mentioned before. But it is not the cheapest of supermarkets in The Netherlands. So, if consumers start saving money, they might go to cheaper options. All in all, I think the company will keep posting strong numbers even in the case of a recession, although growth may not be as high as now expected.

Another threat is the extremely high inflation all over the world, but most extreme in Europe. Ahold Delhaize does have some pricing power, which they used very well during H1. But for a company with very thin margins like Ahold Delhaize, higher energy bills and higher wages in combination with higher production and transport pricing, might put some pressure on its margins. I do not expect Ahold Delhaize to start posting negative margins any time soon, but it needs to be something management is looking out for.

Conclusion

We are currently experiencing a lot of uncertainty about where the economy is headed. We might be entering a recession by the end of the year. Under any circumstances, I think Ahold Delhaize is a good buy. It is currently undervalued compared to the sector, while it pays a higher yield in combination with share buybacks. The company posted great results for H1 and even raised its full-year guidance and confirmed its long-term targets. This means management is very committed to their targets. The company also operated in an industry that is resilient to downturns in the economy. Of course, it also carries some risk of extreme inflation, high energy prices, and less consumer spending, but I believe management is on top of this and the company should continue to post solid numbers. We could see some slight margin contraction over the coming months, but I think the long-term target of 4.0% margins is achievable. During these uncertain times, Ahold Delhaize remains a solid investment – a safe place to put your money.

Be the first to comment