Jan-Otto/E+ via Getty Images

Overview – Despite Heavy Losses, Myovant Stock Surged On Acquisition Bid

Myovant (NYSE:MYOV) stock jumped in value last week after the company that owns 52% of the biotech – Sumitovant Biopharma and Sumitovant Pharma, collectively referred to as Sumitomo – offered to acquire its remaining shares for $22.75 per share.

The equity value of the deal would be ~$2.4bn, or a 27% premium to Myovant’s share price immediately prior to the offer being made. Myovant’s Board of Directors, however, refused the offer, stating that it “significantly undervalues the Company and, therefore, is not in the best interests of the Company or its minority shareholders.”

Management also hinted that it is open to negotiation, however, commenting in a press release:

The Special Committee remains open to considering any improved proposal that reflects the full and fair value of the Company and is otherwise in the best interests of the Company and its shareholders, and is prepared to engage further with Sumitomo regarding any such proposal.

In my last (bearish) note on Myovant in late July this year, I described Myovant as follows:

Myovant markets and sells two FDA approved products, both derived from the drug Relugolix – an oral, once-daily, small molecule that acts as a gonadotropin-releasing hormone (“GnRH”) receptor antagonist that binds to and inhibits GnRH receptors in the anterior pituitary gland.

Relugolix decreases the production of estrogen and progesterone in women, and testosterone in men, and is approved as a 120mg dose to treat prostate cancer under the brand name ORGOVYX, and also approved as a 40mg dose, plus estradiol 1mg and norethindrone acetate 0.5mg, to treat heavy menstrual bleeding associated with uterine fibroids under the brand name MYFEMBREE.

In August, Myovant won a second approval for MYFEMBREE, for management of moderate to severe pain associated with endometriosis in pre-menopausal women. The win came 3 months behind schedule, due to the FDA postponing its decision after identifying some deficiencies in the original marketing application.

Myovant splits revenues earned from ORGOVYX and MYFEMBREE 50/50 with the Pharma giant Pfizer (PFE), thanks to deal agreed in December 2020. It was worth $650m upfront, plus $100m on the approval of MYFEMBREE in both menstrual bleeding and endometriosis. There also are as much as $3.8bn more in milestone payments on the table, should certain sales targets be met.

In fiscal year 2021, Myovant reported product revenues of $94.3m. $83m came from Orgovyx revenues, and $6.4m from MYFEMBREE, plus there was $105m of collaboration revenues from Pfizer. The company still made a net loss of $206m, however, following a loss in 2020 of $255m.

In Q122 (the 3-month period ended June 30th) Myovant earned product revenues of $41.4m – up from $11.6m in the prior year period – $25m of license revenue from Pfizer, and a $50m up front payment from its new European marketing partner (for ORGOVYX) Accord Healthcare. Net losses were $21.2m, versus $61.7m in Q121. Current cash position is $325.

In my last note on Myovant for Seeking Alpha, I argued that Myovant struggled to justify its $1bn (at the time) market cap valuation, being heavily loss making, and with product revenue generation looking somewhat shaky, but a combination of the MYFEMBREE label expansion, which led to analyst upgrades, and the Sumitomo bid has lifted the share price by >100% since August, and the market cap valuation >$2.4bn.

Background To Sumitomo’s Bid

In my view its hard to justify Sumitomo’s desire to spend ~$1.2bn on the remaining shares of a company that has declined to provide any financial guidance for 2021, and one that seems likely to be unprofitable again this year based on Q122 performance. But, there is a little more to this deal than meets the eye.

Myovant Sciences was created by Roivant Sciences – the biotech vehicle of ex-hedge fund manager Vivek Ramaswamy. Roivant has spawned a number of companies.

Axovant, for example, raised $360m via its 2015 IPO (the largest biotech IPO of the year), on the promise of an Alzheimer’s drug acquired for $5m from GSK plc (GSK), which failed. The company is now known as Sio Gene Therapies and has a share price of $0.3, and a market cap of $23m.

Myovant has clearly been more successful, currently trading at a 52% premium to its 2016 IPO price of $15 (the IPO raised $218m and was the largest biotech IPO that year). After the Axovant debacle, none of the other “Vant” companies – Urovant, Enzyvant, Spirovant and Altavant – have gone public.

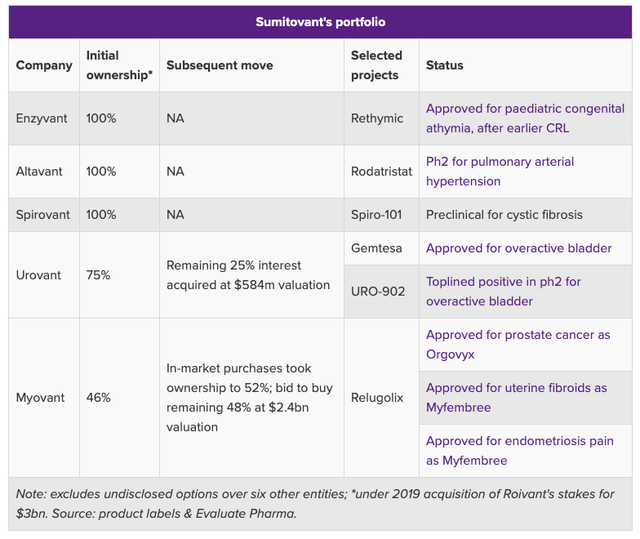

Back in 2019, Sumitomo paid $3bn to gain 100% ownership of Enzyvant, Spirovant, and Altavant, and a 75% stake in Urovant and 46% stake in Myovant. Evaluate Pharma has broken down each company’s assets as follows:

Sumitomo’s “Vant” Portfolio. (Evaluate Pharma)

Sumitomo markets and sells Latuda – a Schizophrenia drug that earned $1.7bn in 2019 – but sales are in decline and the drug will go off patents in 2023, so Sumitomo needs to find another drug with blockbuster potential to replace it.

Peak Revenue Expectations For MYFEMBREE and ORGOVYX

Could MYFEMBREE or ORGOVYX revenues exceed $1bn one day? As impressive as the jump in product revenues in Q122 was – and perhaps there is more to come across the next 3 quarters given the latest approval – MYFEMBREE earned revenues of just $4m.

In its Q122 earnings press release, Myovant states that MYFEMBREE is “now the number one prescribed GnRH antagonist therapy for uterine fibroids with 51% total prescription (TRX) share in June 2022,” and also that:

Approximately 2,400 new patients started treatment on MYFEMBREE in first fiscal quarter 2022, resulting in 71% sequential quarterly growth in the number of patients treated since launch.

The scary thing here is that if MYFEMBREE has 51% of the uterine fibroid market, and is generating revenues for Myovant of $4m, the logical peak sales expectation would be $8m!

Presumably, we will see a substantial increase in sales in Q222, as MYFEMBREE begins selling into its new market of endometriosis, and new patient revenues kick in, although, as I commented in my last note:

On the Women’s Health side, however, the market opportunity is more uncertain, given AbbVie’s (ABBV) Orilissa and Oriahnn, both formulations of Elagolix and indicated for endometriosis and heavy menstrual bleeding respectively, brought in revenues of just $145m last year combined, and the endometriosis market as a whole has an estimated value of ~$1bn presently.

Myovant is confident that studies show MYFEMBREE is a superior product to Orilissa and Oriahnn, but even so, the chances of the drug becoming a blockbuster drug – meaning sales >$1bn per annum – seem remote at best, and inconceivable at worst. There doesn’t seem to be any justification for blockbuster sales, and Women’s Health is a notoriously tough market. AbbVie and Merck (MRK) have both tried and failed to make their Women’s Health divisions work, but AbbVie no longer breaks down division sales, and Merck has spun its division out into a new company, Organon (OGN).

On the prostate cancer side, again analysts have suggested that ORGOVYX has peak sales potential of ~$1bn per annum. Research suggests the Prostate cancer market is worth ~$18bn in 2022, and Orgovyx has a potential competitive advantage over injectable drugs, being orally administered, and has outperformed standard of care leuprolide in clinical studies.

With that said, however, the drug is intended for patients with advanced prostate cancer, and AbbVie’s Lupron – an injectable formulation of leuprolide – earned only $604m of revenues in 2021. Johnson & Johnson’s (JNJ) Zytiga earned $2.3bn, and Pfizer’s Xtandi $1.2bn. Novartis (NVS) recently won approval for Pluvicto, aimed at later-stage patients, which could achieve peak sales ~$750m, the Pharma believes, whilst Bayer’s Nubeqa earned ~$105m of sales in Q222.

Considering the above, I struggle to compute a $1bn peak sales opportunity for ORGOVYX in a crowded market, even if, as has been predicted in some quarters, the market for Prostate cancer reaches $30bn per annum by 2030.

Conclusion: Sumitomo Deal Seems To Defy Logic – But Who Needs Logic When Your ROI is >100%

Although I called the share price performance of Myovant wrong back in July, I believe my logic was reasonably sound. There is a huge gap between the peak sales expectations being quoted for MYFEMBREE and ORGOVYX and the reality of their current sales performance, and market dynamics.

To justify the $2.4bn market cap valuation that Myovant enjoys today, the 2 drugs will likely need to generate total revenues of ~$1bn each, to drive a price to sales ratio of ~2.5x, let’s say, bearing in mind the 50/50 profit share with Pfizer.

It’s difficult to get to those kinds of figures when we consider the market opportunity and competition. Clearly, however, Myovant management are confident enough in their products to demand a higher fee from Sumitomo than $22.75 per share.

It doesn’t seem conceivable to me that Pfizer would wish to make an offer to buy Myovant, because surely Sumitomo has enough influence as a majority shareholder to block any such deal (although if I were Sumitomo management I would be looking to sell my Myovant holding, not buy the rest of the business!).

Perhaps Sumitomo’s interest speaks more to the desperation of that company – with its key revenue driver about to lose patent protection, which will likely decrease sale by ~20% per annum – than it does to the potential of MYFEMBREE and ORGOVYX.

Having already paid $3bn to Roivant Sciences, with apparently little tangible return to date, it seems strange that Sumitomo would want to make another deal. In fairness, Myovant is arguably the biggest Vant success story, and the pick of the bunch.

In terms of the investment opportunity, as stated above, logic tells us that Myovant management must be very confident that Sumitomo will make a higher offer, or that it can drive the value of the business up under its own steam.

That implies that there ought to be further upside potential in Myovant stock, and that if Sumitomo does come back with another offer the upside will arrive very soon, but since my research suggests MYFEMBREE and ORGOVYX lack blockbuster potential, I will be staying on the sidelines.

The current scenario strikes me as a classic example of how the biotech markets are often driven by sentiment and deal making amongst an elite group of investors, rather than by the cold logic of income and profits. If Myovant doesn’t make this deal, I cannot see the share price doing anything but falling.

Personally, if I were an investor with funds to invest in biotech, I would choose to buy a dividend paying Pharma with a large and diverse pipeline rather than a single asset biotech that is part of a group of companies that have achieved little of note to date, with a strategy of acquiring assets discarded by Big Pharma. Then again, if I had invested in Myovant back in July, I would have doubled my money. It will be very interesting to see what move Sumitomo makes next.

Be the first to comment