Andreas Rentz

Palantir (NYSE:PLTR) sank after releasing earnings results that showed it was not immune to macro headwinds. While the company’s growth rate and free cash flow were still solid, investors may have been spooked by near term guidance and the implicit retraction of long term guidance. The stock price weakness is a buying opportunity for long term investors, as PLTR remains a compelling investment on the use of artificial intelligence to maximize the value of data. Trading at just 9x forward sales, PLTR is a strong buy.

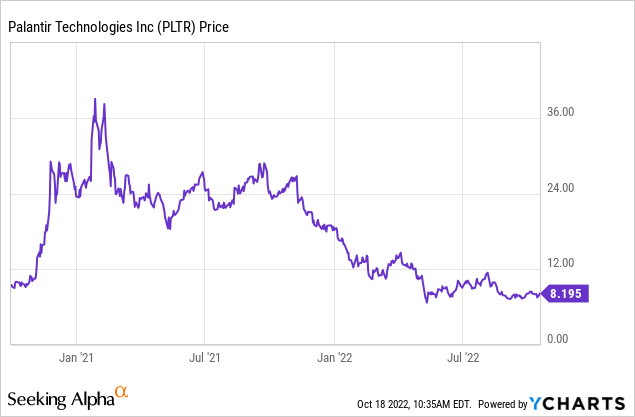

PLTR Stock Price

PLTR, once a tech stock favorite, traded as high as $39 per share in early 2021 but has since fallen below the price it traded at on its first day of trading two years ago.

I last covered PLTR in June where I discussed the stock as an investment proposition on the growth of data. The stock has since fallen 9%, as it has struggled to catch a bid amidst the pessimistic environment in the tech sector.

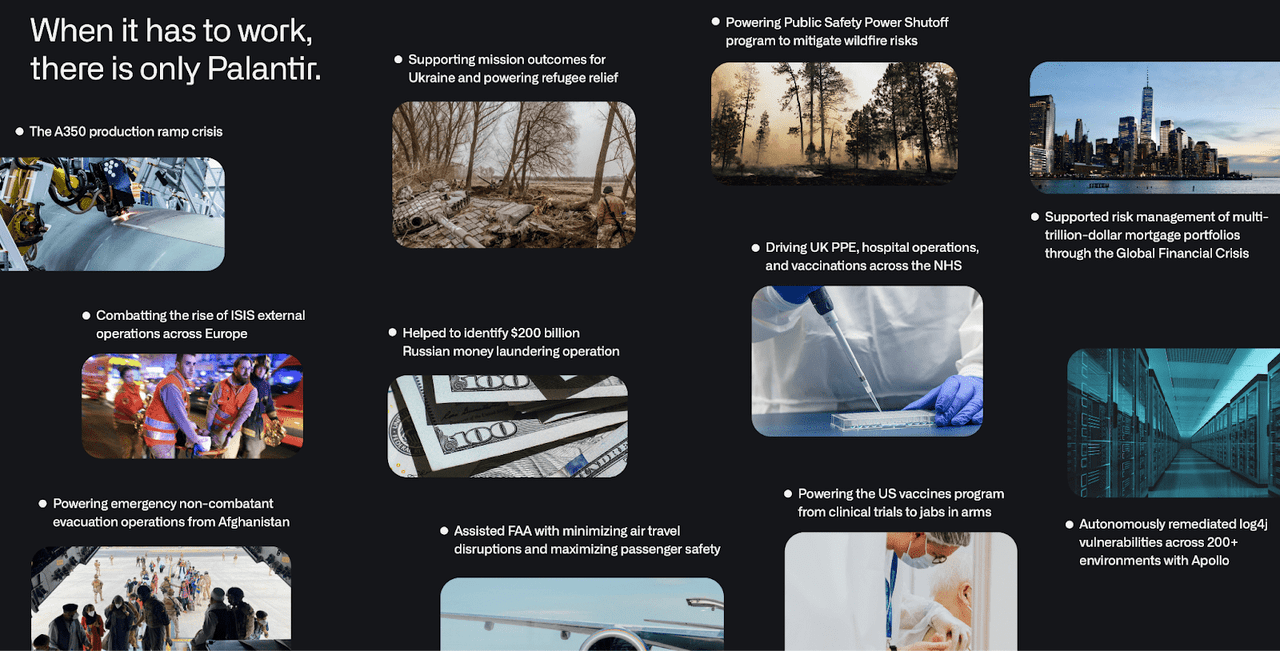

What Is Palantir?

PLTR serves enterprise and government customers and helps them harness the value in data. The idea is that its software helps predict future events by analyzing the past. Some of its use cases can be seen below – for example PLTR has been used to identify money laundering operations, mitigate wildfire risks, and much more.

2022 Q2 Slides

While PLTR was and is probably still at some level overhyped, I still consider it to be the most likely company to drive innovation in artificial intelligence.

PLTR Stock Key Metrics

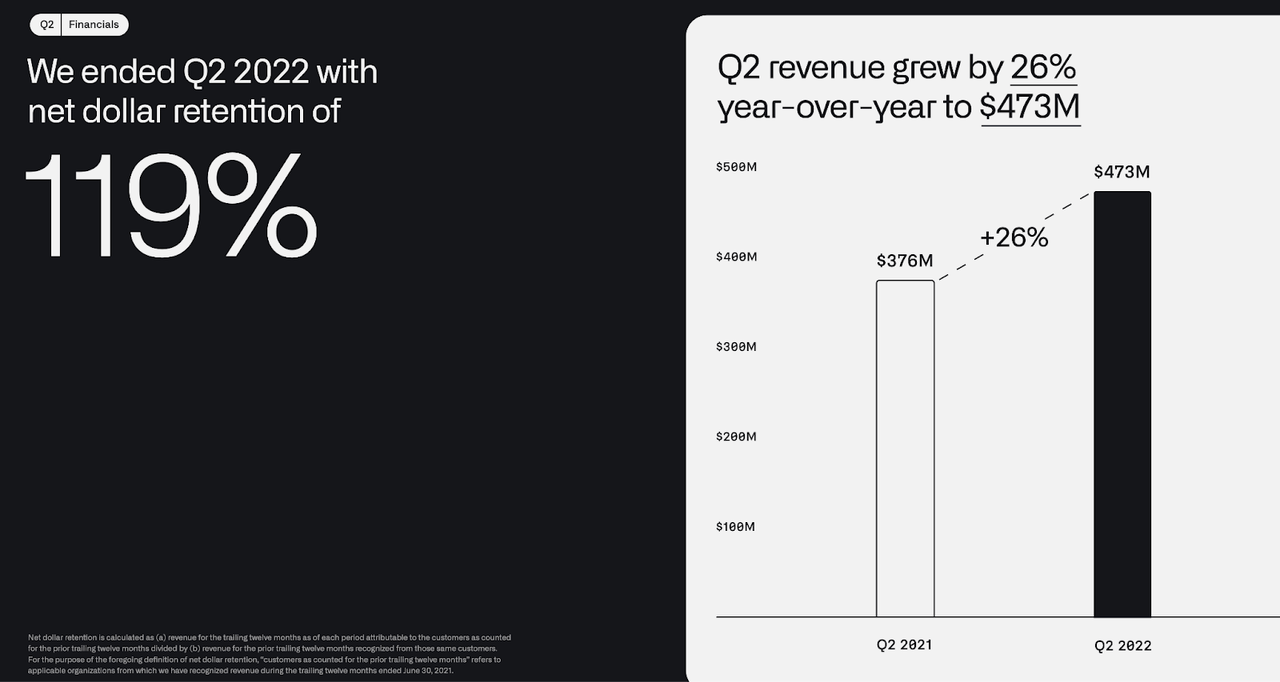

The latest quarter saw PLTR post 119% net dollar retention and 26% revenue growth. That represented a small beat over the $470 million in guidance provided in the prior quarter.

2022 Q2 Slides

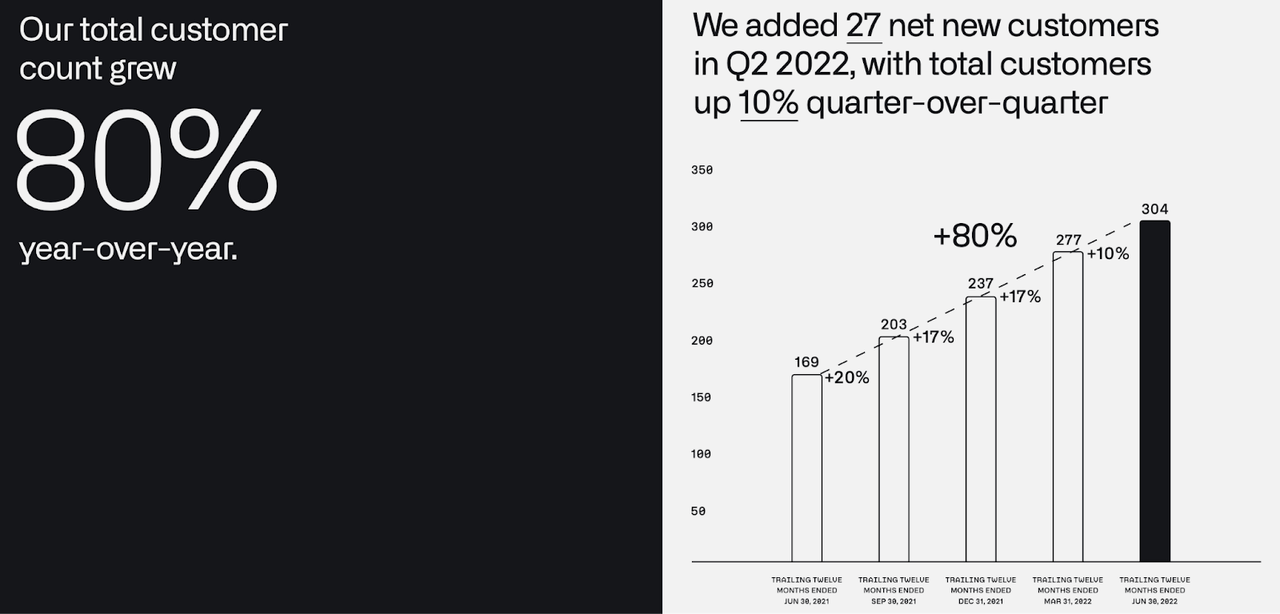

Customer growth significantly outpaced revenue growth, growing 80% year over year. Due to the high amount of customization required for each customer, revenue growth often lags customer growth. The high customer growth now may foreshadow high revenue growth later, as its customers ease into using the platform.

2022 Q2 Slides

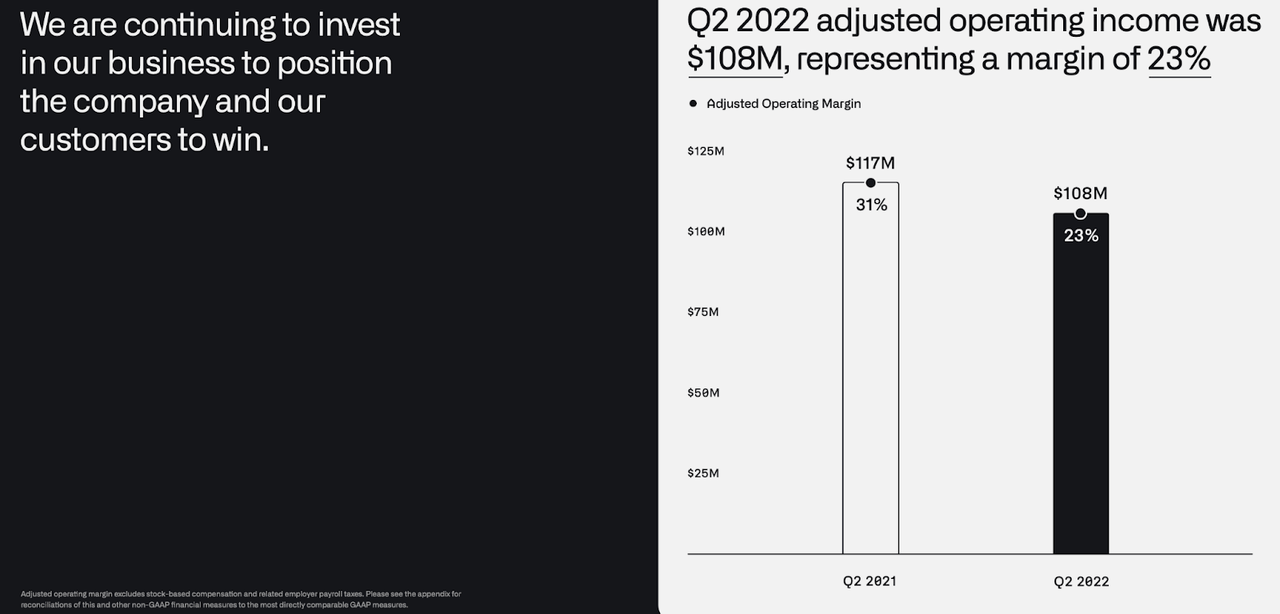

PLTR continued to drive strong non-GAAP margins, posting a 23% operating margin in the quarter.

2022 Q2 Slides

The company is still not yet profitable on a GAAP basis (the main difference between GAAP and non-GAAP profits is equity-based compensation), but the 8.8% GAAP operating loss margin was a sizable improvement from the 38.9% GAAP operating loss margin of the prior year’s quarter.

PLTR ended the quarter with $2.4 billion of net cash, making up around 15% of the current market cap.

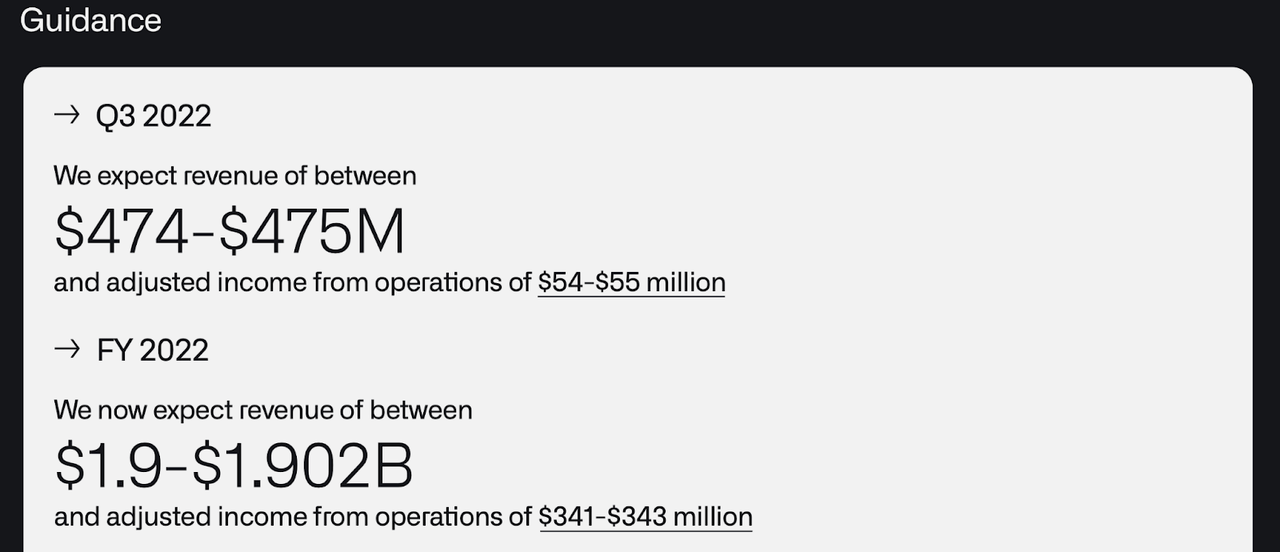

Looking forward, PLTR guided for up to $475 million in revenue in the next quarter and $1.902 billion of revenue for the full year.

2022 Q2 Slides

The 18% projected adjusted operating margin for the full year represents a decline from the previous 27% guidance. I am not concerned with the declining margin because it is mainly driven by aggressive investment in growth. For tech companies like PLTR, investment in growth means ramping up headcount which inherently increases operating expenses and pressures margins. Assuming that PLTR can achieve high ROI on such investment, investors arguably should be hoping for the company to post as minimal profits as possible in the near term because that implies a greater payoff later.

Instead, investors are more likely spooked by the fact that the guidance implies only 23.5% revenue growth for the full year, and $507.6 million of revenues in the fourth quarter, or 17.2% growth. PLTR’s results have always been lumpy (due to the aforementioned high amount of customization) but this is an environment which has been unforgiving on near term deceleration in growth and profit margins.

Is PLTR Stock A Buy, Sell, Or Hold?

PLTR had previously guided for at least 30% revenue growth over the next three years. That guidance was missing in its latest earnings deck. Consensus estimates call for mid-20’s growth through 2024.

Seeking Alpha

Management was asked about this on the earnings call. There, CEO Alex Karp implied new guidance of $4.5 billion by 2025. Assuming PLTR reaches its $1.902 billion of revenue this year, $4.5 billion of 2025 revenue implies 33% growth in the three years after this year – somewhat consistent with prior guidance if you forgive this year’s miss. That said, PLTR’s guidance miss this year and apparent moving of the goalposts is not a great sign. I remain confident in the company’s long term prospects largely due to my confidence in the company’s products, but I would be unlikely to retain such conviction if this were any other company. It would be telling if the next year did not see revenue growth of at least 30%, as that would increase the risk that management simply does not know how to give guidance for this business.

Assuming that the company achieves $4.5 billion of revenue by 2025, has a 25% exit growth rate, achieves 30% long term net margins, and trades at a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see the stock trading at 11.3x sales by 2025, implying a stock price of $25 per share by 2025. That implies 45% potential annual returns over the next three years. I have assumed the net cash position offsets any ongoing shareholder dilution.

Let’s now discuss key risks. The cash-rich balance sheet and high amount of free cash flow generation help to reduce financial solvency risk. That said, the longer it takes for PLTR to reach GAAP profitability, that would lead to a greater amount of dilution. PLTR’s 8.8% operating margin loss this past quarter was not too large, implying that most of the dilution is also being offset by cash flowing to the balance sheet, but that benefit should not be overstated because PLTR is not currently buying back stock. The more concerning risk is that of competition and decelerating growth. PLTR needs to sustain high growth rates in order to eventually achieve operating leverage, GAAP profits, and attractive long term returns for shareholders. If it turns out that PLTR’s products are not materially better than competitors, then the company might not be able to sustain high growth rates for as long as projected, which may prevent the company from ever producing enough profits to justify an investment at present day. Further, while the 9x forward sales valuation is as attractive as the stock has ever been in its limited time as a public company, it is not necessarily more attractive than other tech stocks, which should not be surprising considering that many tech stocks are down 80% or more from all-time highs. PLTR would make a great addition to a diversified basket of beaten-down growth stocks – a strategy I have discussed with subscribers of Best of Breed Growth Stocks. I remain bullish on the long term prospects for PLTR and continue to rate the stock a strong buy.

Be the first to comment