MarsBars

Admittedly, I’m not a soccer fan, but as I watch the World Cup enter its final stages, I can’t help but admire the talent, grit, and tenacity of the teams that have made it this far. These athletes are most certainly competing at an uber-elite levels and that is definitely something good to feel about.

Drawing parallels to one’s portfolio, nearly everyone has favorite picks that form their core holdings in one’s portfolio. These are likely holdings that are of high quality in nature that can withstand adversity.

This brings me to Federal Realty Investment Trust (NYSE:FRT), which remains undervalued while yielding 4%. This article highlights why FRT is a top high quality pick at present for durable long-term returns, so let’s get started.

Why FRT?

Federal Realty Trust is a member of the S&P 500 (SPY) index, and is a shopping center REIT that was founded 60 years ago. It has a portfolio of high-quality shopping centers that are mostly located in densely populated areas with high average household incomes. These properties include Pike & Rose in North Bethesda, Maryland, Santana Row in San Jose, California, and Assembly Row in Somerville, Massachusetts.

Notably, FRT is part of an elite club of stocks that are Dividend Kings, given that it’s increased its dividend for 55 consecutive years, through many economic cycles. At present, it has 104 premium quality properties that are leased to around 3,200 commercial tenants.

FRT is also more than just a community center landlord, as its prime located properties make them ripe for mixed use cases. This is reflected by the fact that FRT also has 3,300 residential units on its properties, making it somewhat of a hybrid between traditional shopping center and multifamily REITs.

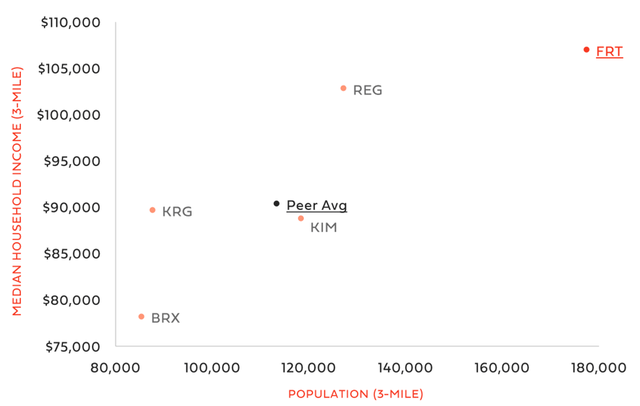

FRT’s properties are strategically located in Tier 1 cities across the U.S., with strong population demographics. As shown below, FRT leads the pack among its large shopping center peers in terms of population density and median household income within a 3-mile radius.

FRT Population Demographics (Investor Presentation)

Meanwhile, FRT continues to demonstrate respectable operating fundamentals, with FFO per share growing by 5.2% to $1.59 in the third quarter. Same property operating income grew by 3.7% YoY and 8.8% year to date, driven by rent escalations and positive lease spreads on new and renewal leases. Also encouraging, the portfolio is 94% leased, equating to a 150 basis point improvement over the prior year, as a reflection of strong demand. Remarkably, small shop leased rate is very strong at 90%.

Risks to FRT include higher interest rates and economic uncertainty. However, while higher rates increase FRT’s cost of debt, it also makes it more expensive for higher leveraged competitors, both public and private, to build competing assets. This makes FRT’s existing asset base more valuable, which should result in its ability to keep rental growth rates in line with inflation.

The valuable nature of FRT’s properties is reflected by the fact that FRT was able to dispose of $400 million worth of non-core assets at a cap rate below 5% so far this year. Management noted that these dispositions were immediately accretive to its pipeline and development opportunities, including the following noted during the recent conference call:

In terms of capital needed for our large development projects, we have less than an incremental $225 billion to go, about $100 million to complete the Choice Hotel, headquarters building at Pike & Rose. A $100 million largely for tenant build out commissions at Santana West and $20 million to complete Darien Commons.

Those products alone will be contributing an incremental $40 million in operating income in years to come. Investing in these and other projects, both large and small with fixed rate debt and equity before the recent rising rates will serve us well in the coming years as these state-of-the-art buildings begin cash flowing. Similar to development, our pro rata share of the acquisitions that we’ve made since the beginning of COVID through today totaled $850 million.

Meanwhile, FRT sports a strong BBB+ rated balance sheet. Fixed charge coverage ratio is strong at 4x, and while net debt to EBITDA is currently at 6x, as a reflection of the development pipeline, management targets a long-term ratio in the low to mid 5x range.

Importantly, FRT currently yields 4%, helping retirees and income investors achieve their 4% rule without having to sell shares. The dividend is well protected by a 68% payout ratio (based on Q3 FFO per share of $1.59), and as noted earlier, has been raised for 55 consecutive years.

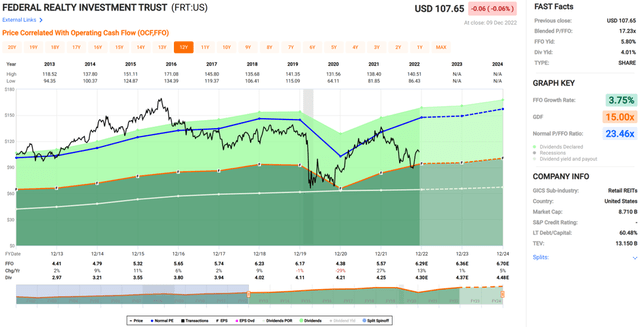

Lastly, I continue to see value in FRT at the current price of $107.65 with a forward P/FFO of 17.2, sitting well below its normal P/FFO of 23.5 over the past decade. Given the high quality nature of FRT’s property base, FFO growth, and strong balance sheet, I believe FRT deserves to trade at least at a P/FFO of 20x, which could be achieved after macroeconomic concerns subside.

FRT Valuation (FAST Graphs)

Investor Takeaway

In conclusion, Federal Realty Trust isn’t going to make you rich overnight, but it is an attractive stock for both retirees and income investors looking for steady and growing returns.

The portfolio consists of high-quality properties situated within desirable demographics in Tier 1 cities across the U.S., accompanied by a strong balance sheet, and strong operating fundamentals.

With the share price still trading below its normal valuation, now appears to be a good time to layer into this quality name before market uncertainty subsides.

Be the first to comment