MediaProduction

Article Thesis

Blackstone Inc. (NYSE:BX) is one of the largest alternative asset managers in the world and continues to grow its business at an attractive pace. Shares have pulled back quite a lot over the last year, which has made its valuation decline and which has boosted its dividend yield. I do believe that recent worries about fund withdrawal limitations are overblown — Blackstone should do well in the long run, and investors now have an opportunity to enter or expand a position at an attractive valuation.

Recent Performance Has Been Strong

Blackstone’s profitability can experience some swings due to uneven contributions from performance fees and similar items. One of the best ways to evaluate the company’s business growth is thus its assets under management performance, I believe. In that regard, the last couple of years have been excellent for Blackstone.

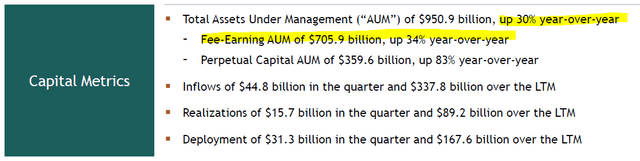

During the most recent quarter, Q3, Blackstone managed to generate $45 billion of inflows, which is equal to around 5% — for a single quarter. Most asset managers can only dream of that, as this pencils out to a ~20% annual AuM growth rate just from new inflows, without accounting for the rising value of assets that are being managed. There will be some ups and downs there, but Blackstone’s excellent performance history suggests that AuM growth will be meaningful even in a zero-inflow scenario in the long run thanks to appreciation.

Q3 was not an outlier, either, as Blackstone also showed strong results for the previous quarters. During 2022 so far, Blackstone has generated inflows of a little more than $180 billion — Q3 thus was below-average compared to what Blackstone did in H1. Due to market troubles in the third quarter and due to high inflation, which hurt the savings rate of many consumers, lower inflows in Q3, relative to Q1 and Q2, are not surprising. Overall, 2022 has been great so far inflow-wise, which boosted Blackstone’s AuM significantly:

30% AuM growth will not be possible forever, of course, even though the company also managed to generate very attractive AuM growth in 2021 (~25%). Still, investors should expect that this number will be meaningfully lower in the long run, on average, but that’s not a disaster at all, as assets under management growth should still be positive due to several drivers I’ll delve into later.

Blackstone has managed to grow its fee-earning AuM and its Perpetual Capital AuM significantly faster than overall AuM, partly due to the fact that it’s been focused on getting its clients to invest in these vehicles. Perpetual Capital is a relatively new type of fund structure that is more long-term oriented and that avoids some issues with other private market entities, such as exit deadlines and capital calls. The Perpetual Capital structure allows Blackstone to be more focused on creating long-term value appreciation for investors, and seemingly, investors enjoy this approach quite a lot, showcased by the massive 80%+ increase in Perpetual Capital AuM over the last year alone.

As stated earlier, Blackstone’s reported earnings per share and distributable earnings can see considerable ups and downs due to swings in its realized performance revenue. Fee-related earnings, which primarily consist of management and advisory fees adjusted for fee-related compensation, are a better way to understand the company’s long-term growth. Fee-related earnings were up a massive 50% so far this year, relative to the Q1-Q3 2021 number. During the most recent quarter, Q3, fee-related earnings were up by an even better 51% year over year. This was mostly driven by the hefty increase in fee-earning AuM over the same period. When AuM growth slows down in the long run, fee-related earnings growth will slow down with it, but even if future growth averages just one-fifth of the 2022 run rate, or around 10%, that would be quite compelling for long-term oriented investors that want to own BX as an income and total return play.

Long-Term Growth Drivers

There will be stronger years and weaker years for Blackstone’s assets under management growth rate, but in the long run, the average should be easily positive, I believe, due to several reasons. First, Blackstone’s expertise should allow the company to grow the value of the assets it manages, even without any inflows. There will be some ups and downs, due to interest rate movements, market sentiment, and so on. But over many years, underlying values should climb, on average.

Second, Blackstone should be able to generate meaningfully positive net inflows in the long run. Investors want exposure to assets that provide protection against inflation, such as real estate, which should be positive for BREIT. Other strategies can be attractive for investors as well, such as Blackstone’s private equity and credit and insurance offerings — both have seen meaningful inflows in the recent past.

Geographic expansion should also allow Blackstone to add more clients. The company has, for example, opened offices in Zurich, Switzerland, and Paris, France, not too long ago. Further expansion into Europe is possible, but Blackstone could also grow its exposure to emerging and developing markets. As people become wealthier in fast-growing countries in Asia, for example, more and more people will be looking for asset management solutions, and Blackstone, with its strong brand, has the ability to capitalize on that over time.

Between these factors, I believe that it is highly likely that Blackstone’s assets under management, and thus also its fee-related earnings, will continue to grow meaningfully in the long run. A 30%+ growth rate such as in 2022 will not be maintained, but a 5% organic appreciation rate and a 5% inflow rate would allow for 10% annual growth, on average, which would be quite attractive already, I believe, considering Blackstone is not trading at a high valuation, meaning implied growth is not very high.

BREIT Worries Seem Overblown

Blackstone has seen its shares drop more than 40% over the last year. To some degree, this can be tied to the overall equity market pullback, while one can also argue that BX’s valuation was too high a year ago.

More recently, shares also came under pressure due to worries about Blackstone’s private REIT, BREIT. The company has recently limited withdrawals from BREIT, which has made some investors worry that the REIT was having difficulties. But underlying asset performance is pretty strong, which is not too surprising when we look at the properties BREIT has primarily invested in — warehouses and apartments. People will always need a place to live, and with rising mortgage rates making houses even less affordable, there will be massive demand from renters. Warehouses will also remain in demand by companies such as Amazon (AMZN), as they are still growing, after all, even though AMZN’s growth in 2022 and 2023 will be lower than in 2020 and 2021 when the pandemic provided a one-time boost.

BREIT also has a clear geographic focus on the Sunbelt region in the United States, where population growth is way higher than the country-wide average. This should have a positive impact on lease demand for BREIT’s assets, all else equal. BREIT’s average return over the last five years was 13%, so the REIT’s management must know what they are doing in my view.

Blackstone’s CEO Steven Schwarzman also explains that he sees other factors at play when it comes to the above-average withdrawals from BREIT in the last couple of weeks, such as market pullbacks in Asia that made Asian investors look for additional funds.

Between these items, I believe worries concerning BREIT are overblown. The REIT invests in strong assets with high and growing demand, the historic performance is compelling, and it seems unlikely that major withdrawals will be a longer-term issue.

Blackstone As An Income And Total Return Play

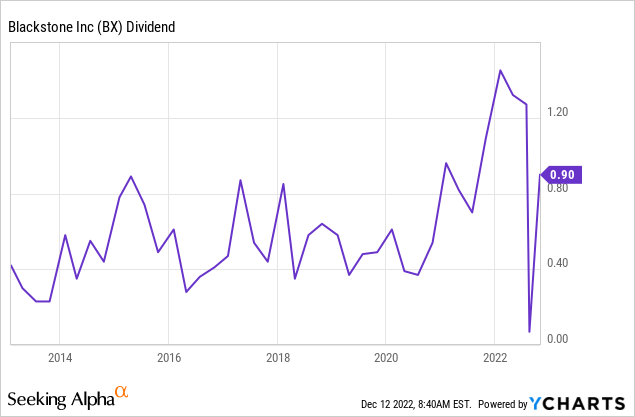

Blackstone’s dividend is uneven, which is an issue for some investors that want a more consistent dividend payout. But I personally do not see this as a serious problem, as I want a compelling average distribution, while it does not matter too much to me whether payouts are a little higher or lower in specific years.

Overall, dividends have moved upwards meaningfully over the last decade — the current payout of $0.90 per quarter is more than twice as high as it was 10 years ago. The dividend yield, based on an annualized payout of $3.60, is 4.6% right now. If that dividend doubles again over the next decade, investors could be looking at a 9%+ dividend yield even before dividend reinvestment is considered. That’s not guaranteed, of course, but shows what Blackstone could be capable of when its future performance is more or less in line with what the company has done over the last decade.

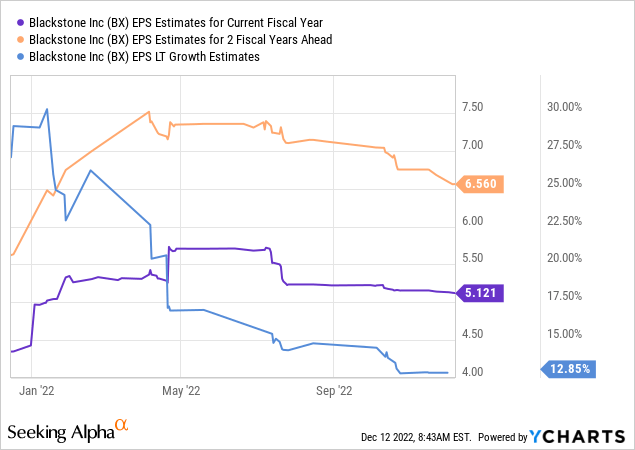

In the above chart, we see that analysts are forecasting EPS of a little above $5 this year. That’s forecasted to grow by almost 30% through 2024, and analysts are predicting that EPS growth will be 13% a year in the long run. That would be extremely attractive, but it’s not necessary for BX to be a solid investment.

In fact, if EPS growth is just half as high as expected going forward, BX would earn $5.84 in 2024 and $8.52 in 2030. Put a 15x earnings multiple on that, and Blackstone would trade at $128 in eight years, or 64% higher than today (6.3% per year). Add a dividend yield of 4.6%, and Blackstone would still generate total returns of around 11% a year. This shows that Blackstone could be a very solid performer even if it massively underperforms current analyst expectations and its own past growth rate — one could argue that there is a considerable margin of safety built into the current stock price.

Takeaway

Blackstone is a great asset manager that should see significantly positive net inflows in the long run, while BREIT issues seem overblown. The current stock price slump allows for an attractive entry point, and I do believe that there is a good chance that investors will generate 10%+ annual returns from the current level, even if Blackstone were to significantly underperform current analyst forecasts.

Be the first to comment