shutter_m

Why Invest In Global Stocks?

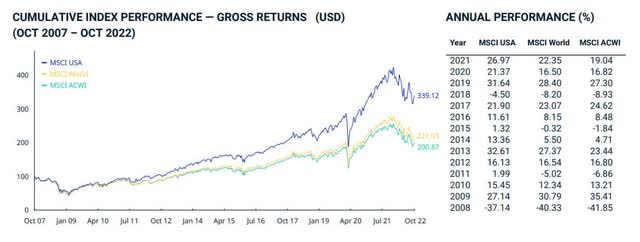

With a strong dollar posing headwinds for many U.S.-based companies operating abroad as the world grapples with inflation, energy crises, rising interest rates, and geopolitical issues, why not diversify into international stocks? Although the markets continue to be volatile, and the MSCI USA is outperforming both the MSCI World and MSCI ACWI as shown below, there’s an opportunity for those investors wanting to diversify their portfolios in hopes of greater upside for international stocks going forward.

MSCI Cumulative Indexes Performance

MSCI Cumulative Indexes Performance (MSCI.COM)

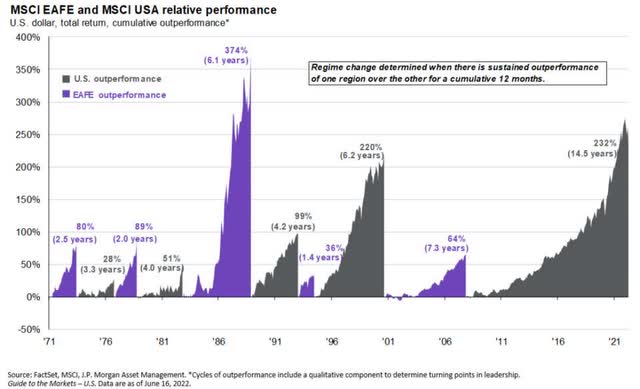

Accounting for nearly 60% of the global equity market, the United States dominates stock markets. And although the chart above seems to indicate that money is best invested in U.S. stocks, the U.S. stock market doesn’t always dominate. As showcased in the FactSet chart below, there’s a long history of international stocks outperforming U.S. stocks.

MSCI EAFE and MSCI USA Relative Performance (FactSet, MSCI, J.P. Morgan Asset Management, Forbes)

Headwinds can challenge U.S. stocks, and international stocks have occasionally outperformed the U.S. indexes. From 2000-2009, the S&P 500 total return was -9.1% vs. 30.7% for the MSCI ACWI ex-U.S. Geopolitical concerns and headwinds facing global economies like the war in Ukraine, uncertainty in the UK, and slowing in China are factors that can affect the markets. As recently experienced on Nov. 10, better-than-expected inflation numbers prompted a surge in equity markets around the globe, particularly in the US, which resulted in the US dollar falling significantly. It was one of the worst days for the U.S. dollar since the financial crisis, dropping more than 2.1%. One would expect that such news and a persisting rally in U.S. equities would cause the USD to fall as international markets rise, further boosting returns on global securities. If Santa has already come, what better time to consider investing.

5 Best International Stocks Under $10

Bear market territory is how the U.S. markets have been trading, and non-U.S. stocks are even riskier. Considered more volatile, largely due to currency risk and smaller economies, international stocks can have whipsawing price swings, as evidenced this year, especially amid rising rates that can affect the outlook of individual stocks. As we’ve seen with the post-pandemic fall in tech, the U.S. technology sector (XLK) is -24.25% YTD, and is concentrated as a significant portion of the U.S. indexes, hence their declines this year. Compared to other nations who tend to spread out their holding into various sectors, including financials and commodities, adding ex-U.S. stocks, especially in the current environment, may offer the appropriate exposure needed to help minimize the loss in the long run.

My Top 5 International Stocks Under $10

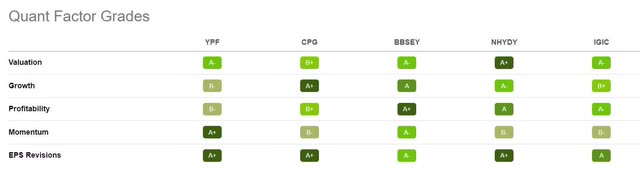

My Top 5 International Stocks Under $10 (Seeking Alpha Premium)

My top five international stocks highlighted above possess the best combination of collective metrics: Valuation, growth, profitability, momentum, and EPS revisions. Each stock was selected using the quant-rating system, which offers an objective, unemotional evaluation of each stock based on data that includes a company’s financials and analyst estimates. Consider these five stocks in diversifying your portfolio.

5. YPF Sociedad Anónima (YPF)

-

Market Capitalization: $5.39B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 11/11): 1 out of 246

-

Quant Industry Ranking (as of 11/11): 1 out of 18

Headquartered in Buenos Aires, Argentina, YPF Sociedad Anónima engages in up- and downstream integrated oil and gas activities. With some of the world’s largest fuel resources situated in 30,000 km² of Late Jurassic geological formations known as Vaca Muerta, YPF offers some of the largest shale oil and gas reserves. Given the importance of energy and hydrocarbons for food production, transportation, technology, heating, and electricity, YPF has experienced bullish momentum and is ranked a Top Energy Stock in the only positive-performing sector this year.

Argentina delivers more than 1,800 million liters of diesel. Although YPF has experienced some pricing fluctuations amid market volatility, the stock has been on a longer-term uptrend, trading under $8 per share. Year-to-date, YPF is +77%, and over the last year, +63%, with extremely low valuation levels, indicating room for future growth.

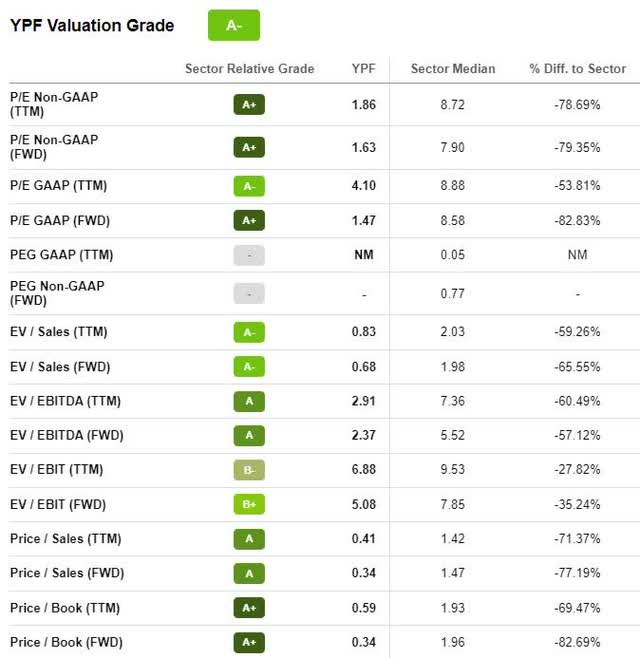

YPF Valuation (Seeking Alpha Premium)

YPF’s forward P/E ratio is 1.47x compared to the sector median of 8.58x, trading 82% below the sector median. The additional underlying valuation metrics showcased above indicate this stock is extremely discounted. As we look to YPF’s future and factors enabling its growth, including the surge in oil and gas prices, debt reduction, and EBITDA growth, 2022 could be a turning point for the company. Despite a Q3 Earnings miss (EPS of $0.59 misses by $0.61 and revenue of $3.62B missing by $760M), as SA Author Ricardo Fernandez writes:

“YPF is recuperating pricing power and margins, spending US$4bn in CAPEX and targeting to double oil and gas production by 2026 while exports could be on the horizon. The equity market seems enthused with shares tripling since July 2022 as production grew, and 2Q22 results came in with surprising strength on domestic pricing.”

YPF is maintaining its guidance for the year and will continue to play a crucial role in increasing production while meeting the sustainability challenge. The desire to meet the energy needs of its nation coupled with the resources available helps provide this stock a solid moat and substantiates its Strong Buy rating.

4. Crescent Point Energy Corp. (CPG)

-

Market Capitalization: $4.34B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 11/11): 3 out of 246

-

Quant Industry Ranking (as of 11/11): 1 out of 71

Offering tremendous growth and cash flow, Crescent Point Energy is a Canadian-based energy company that produces crude oil and natural gas in western Canada and the U.S. Focused on the development of high-return resources, CPG’s strategy and operational performance have rewarded shareholders by delivering value, and reaching its near-term debt target with plans to return up to 50% discretionary excess cash flow in addition to base dividends.

After generating substantial excess cash flow of $1.1B to $1.5B at $75 to $85 per barrel WTI pricing for Q3, CPG announced a special dividend of CAD 0.035 (USD $.026) per share in addition to its regular CAD 0.08 dividend and raised its full-year CAPEX outlook. Although CPG’s revenue of $715.64M missed by $213.77M, EPS of $0.60 beat by $0.26.

Seeking Alpha contributor Michael Wiggins De Oliveira wrote, “Crescent Point Energy is one of the first companies in the oil sector to shift investors’ conversations firmly into 2023… At the low end of its guidance, CPG is priced at 5x free cash flow. I continue to believe that CPG is extremely attractive and worthwhile considering.”

With a B+ valuation grade, CPG is trading more than 65% below its sector, with a forward P/E ratio of 2.82x. Its tremendous valuation framework is showcased by its underlying value metrics, including strong forward EV/EBITDA. I chose this stock because it has great potential and strong factor grades, which rate investment characteristics on a sector-relative basis. Below, the Growth and Revisions Grades indicate that CPG has excellent potential and is fundamentally sound compared to the sector. With A+ Growth and A+ Earnings Revision, CPG is one of the fast-growing companies in its sector.

CPG Factor Grades

CPG Factor Grades (Seeking Alpha Premium)

With energy prices remaining elevated and CPG sitting on $1.52B in cash with A+ EBIT and EBITDA Margins, we are riding the momentum of this stock. Its gradual quarterly price performance is on an uptrend and outperforming its sector peers, with a six-month price performance offering an 80% difference to the sector and its one-year price-performance offering a +158% difference. As trading volume has increased over the last year and year-to-date fluctuations show positive signs, consider this energy stock pick for a portfolio.

3. BB Seguridade Participações S.A.Par. (OTCPK:BBSEY)

-

Market Capitalization: $11.60B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 10/24): 5 out of 664

-

Quant Industry Ranking (as of 10/24): 1 out of 10

I recently wrote about Brazilian-based BB Seguridade Participações S.A.Par. in an article titled My Top 3 Insurance Stocks for a Financial Rebound. BBSEY is a multi-line insurance carrier operating in two segments, Insurance, and Brokerage. A subsidiary of Brazil’s largest bank, Banco do Brasil S.A. (OTCPK:BDORY), BBSEY is a leading insurance company in Brazil, an under-penetrated insurance market as showcased in the below OECD charts, making it a prime opportunity for growth.

Insurance Spending by Nation, Total % of GDP (OECD Charts)

BBSEY offers stellar Quant Ratings & Factor Grades across the board with straight ‘A’ grades on all core factor grades and trades at a discount. Its A- Valuation grade includes a forward PEG of 0.48x, a -57.89% difference to the sector median, and a forward EV/EBIT of 7.59x, a more than -35% difference to the sector, an indication of its undervaluation.

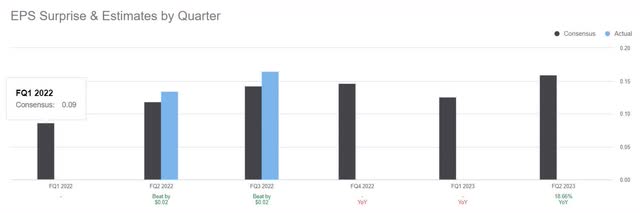

BBSEY EPS Surprise (Seeking Alpha Premium)

In addition to bullish momentum that offers a YTD share price increase of +57% and a one-year price increase of +34%, BBSEY has consecutively beaten earnings. Rising above the 200-day moving average and significantly outperforming the S&P 500, BBSEY recently reported another top-and-bottom-line beat with Q3 results. EPS of $0.16 beat by $0.02, and revenue of $386.90M beat by $69.04M, a vast improvement from Q2 results. With rising insurance premiums and lower loss ratios as highlighted in Q2 earnings, BBSEY’s Strong Buy quant rating highlights the stock’s growth and profitability, with big contributions coming from rural insurance, home insurance, and pensions, which grew YoY in Q2 by 42%, 27%, and 346% respectively.

“We have had a strong collection of pension plans. So, in the second quarter, we had almost BRL12 billion (USD 2.26B) in contributions and very strong growth in premium bonds. We are again leaders in terms of collection, 27% higher than the same quarter last year. All of this will enable us to pay out BRL2.1 billion (~ USD 400M), which is a payout ratio of 80%, as we had announced before.” –Ullisses Assis, BBSEY Chief Executive Officer.

Offering a 7.10% forward dividend yield and solid financial performance, BBSEY has paid four years of consecutive dividends as a result of increases to its net income growth via premium collection and capitalizing on rising prices. Insurance stocks can be a profitable business model and inflationary hedge because they generate cash at a low cost of capital for other revenue-producing activities. In addition, people and businesses will likely always need insurance. Consider diversifying your portfolio by adding a unique international insurance company. Not only is BBSEY adding new partnerships while ranking in the dough with current customers, but the company also offers value and growth that can benefit investors looking for a financial rebound.

2. Norsk Hydro ASA (OTCQX:NHYDY)

-

Market Capitalization: $14.16B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 11/11): 1 out of 280

-

Quant Industry Ranking (as of 11/11): 1 out of 6

Headquartered in Oslo, Norway, aluminum material company Norsk Hydro ASA (OTCQX:NHYDY) is in the power production business and primarily engages in the mining and sale of aluminum through five divisions: Bauxite & Alumina, Aluminum Metal, Metal Markets, Extrusions, and Energy segments. Rated a Strong Buy according to our quant ratings, NHYDY possesses fundamentals that highlight its strongly bullish momentum, which has resulted in investors actively purchasing shares to drive the stock price higher. Over the last year, the stock is up nearly 10%.

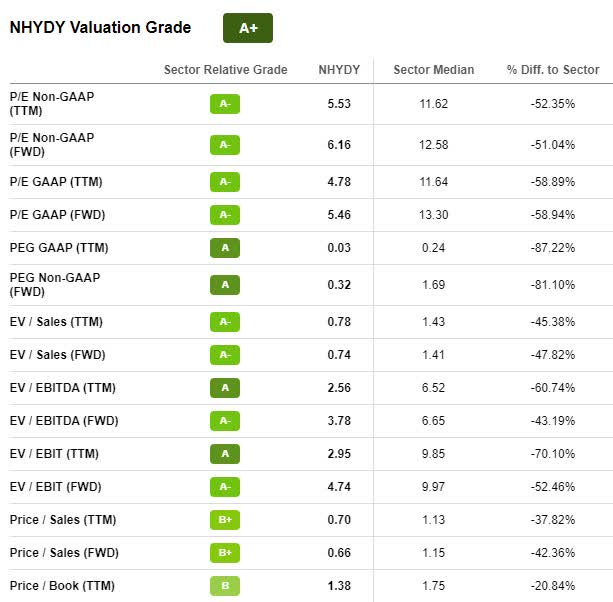

Norsk Hydro Valuation (Seeking Alpha Premium)

Norsk Hydro offers an extremely discounted A+ valuation with a forward P/E ratio of 5.46x versus the sector median of 13.30x, a forward PEG of 0.32x vs. the sector median of 1.69x, and given its stellar growth and profitability grades, NHYDY is a stock to consider for portfolios. As fellow Seeking Alpha author Wolf Report writes:

“[Norsk] Hydro is in the enviable position of being among the world’s foremost Aluminum businesses with exposure to renewables, and recycling, while being part-owned by the Norwegian state and paying out a pretty good dividend.”

While Europe’s energy crisis is affecting companies like Norsk, which shut down some of its facilities due to “high electricity prices” and Chinese exports, Norsk Hydro urged for sanctions on Russian aluminum. Despite this request, Norsk and aluminum continue to gain amid fears of shortages.

Third quarter earnings resulted in consecutive top-and-bottom-line beats. EPS of $0.32 beat by $0.17, and revenue of $4.99B beat by nearly 14% YoY. On the heels of higher aluminum prices. CO2 compensation for doing their part in the battle against carbon emissions; and positive currency fluctuations positively contributed to Q3 earnings.

Renewable energy continues to drive demand for aluminum, and Norsk is focused on doing its part in addressing long-term strategic initiatives that include innovative ways for sustainability. Norsk was diversifying to grow in new energy and focused on delivering strong financial results. In the Q3 Earnings call, Hilde Merete Aasheim, President and CEO of Norsk Hydro, said,

“Hydro made the decision to invest in 12,000 tonnes of additional capacity at our Extrusion plant in Rackwitz in Germany…we have finalized the acquisition of 30% of the shares in Vianode, a joint venture together with Elkem and Altor. Following this, Vianode announced that we will invest in NOK 2 million to produce low-carbon synthetic graphite for about 20,000 electrical vehicles per year by 2024 at the pilot plant — first pilot plant at Herøya in Norway.

With a solid balance sheet and, forward guidance, an attractive 7.94% forward dividend yield, if you’re looking for a cheap materials stock to buy, consider NHYDY for a portfolio.

1. International General Insurance Holdings Ltd. (IGIC)

-

Market Capitalization: $374.18M

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 11/11): 22 out of 664

-

Quant Industry Ranking (as of 11/11): 1 out of 46

Strongly bullish International General Insurance Holdings Ltd. is prompting to pay higher prices for shares of this sleeper stock, with positive momentum. In a merger with Tiberius Acquisition Corporation that went public in 2020 to form IGIC, the companies combined to provide specialty insurance and reinsurance globally. The stock has been pretty steady this year, and investors are enjoying a 4.83% yield on the current share price.

IGIC Valuation Grade (Seeking Alpha Premium)

IGIC underwrites a diversified portfolio of energy, property, marine cargo, financial institutions, and more. With a forward Price to Book value of 0.82x, nearly -40% below the sector median, a forward P/E ratio of -58.10%, and a trailing PEG of -91.46%, IGIC comes at an extreme discount.

Despite foreign currency re-evaluation losses of $10.4M compared to $4.9M in Q3 2021, it’s clear why IGIC is quant-rated a Strong Buy. Amid market volatility, rising inflation and interest rates, and geopolitical uncertainty around the globe, gross written premiums increased by +11% YTD. Profits for Q3 jumped from $16.1M to $18.6M, with core operating income improving to $15.9M. In addition, IGIC managed an EPS of $0.56 and net premiums of $96.3M versus $91.2M YoY. In addition to solid results, IGIC experienced improved net claims and claims expense ratios.

“We expect to see further opportunities to continue on our profitable growth trajectory, particularly after the headline events of the third quarter, which we expect will positively impact rates in some of our markets. While we were less impacted than others in our industry by these catastrophic events – in particular, the devastation of Hurricane Ian – they once again provide a reminder of why we do what we do – to provide peace of mind in times of uncertainty. That is our purpose and our commitment at IGI, and it is what enhances the value that we provide to our customers and our shareholders”-IGI Chairman and CEO Wasef Jabsheh.

With continued financial strength and tremendous fundamentals, IGIC, like the other stock picks shared throughout this article, are excellent consideration in diversifying a portfolio.

Consider 5 International Stocks Under $10

Finding value stocks under $10 with strong growth and overall fundamentals can offer portfolios upside. Although the markets have been volatile, risk can bring rewards. The key is to make well-informed investment decisions, using tools that help take the emotion and fear out of investing.

Investing in international stocks can have more risks due to currency fluctuations, limited liquidity, government regulations, and other geopolitical factors. The stock picks mentioned here were selected by identifying low-cost stocks with strong fundamentals using our Quant System. YPF, CPG, BBSEY, NHYDY, and IGIC are fundamentally strong stocks with excellent profitability, solid valuation frameworks, and above-average growth prospects. Quant-rated strong buys, if you consider these stocks, may help to diversify your portfolio. We have many more Top Stocks Under $10 for you to choose from and offer the best resources to make informed investment decisions.

Be the first to comment