tdub303

Author’s note: This article was released to CEF/ETF Income Laboratory members on November 9, 2022. Please check latest data before investing.

The Weekly Closed-End Fund Roundup will be put out at the start of each week to summarize recent price movements in closed-end fund (CEF) sectors in the last week, as well as to highlight recently concluded or upcoming corporate actions on CEFs, such as tender offers. Data is taken from the close of Friday, November 4th, 2022.

Weekly performance roundup

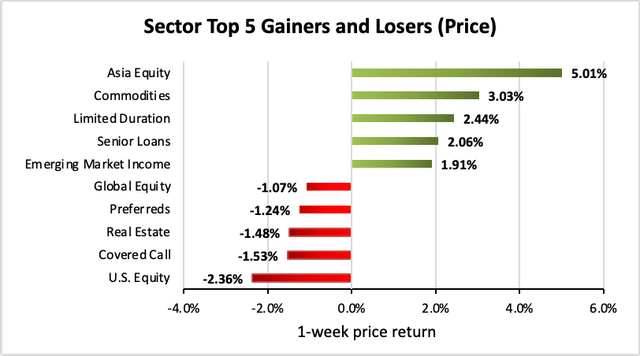

12 out of 23 sectors were positive on price (down from 18 last week) and the average price return was +0.45% (down from +2.73% last week). The lead gainer was Asia Equity (+5.01%) while U.S. Equity lagged (-2.36%).

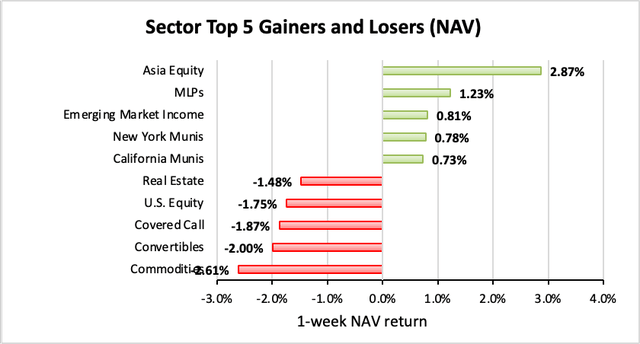

6 out of 23 sectors were positive on NAV (down from 18 last week), while the average NAV return was -0.52% (down from +2.14% last week). The top sector by NAV was Asia Equity (+2.87%) while the weakest sector by NAV was Commodities (-2.61%).

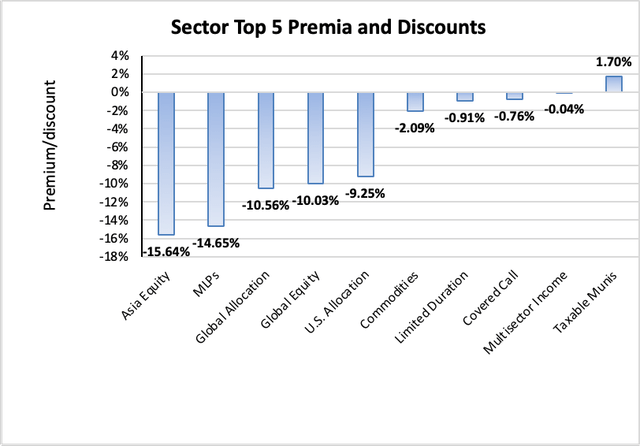

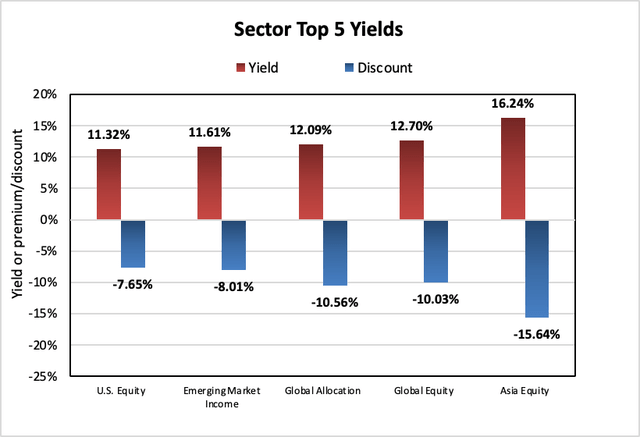

The sector with the highest premium was Taxable Munis (+1.70%), while the sector with the widest discount is Asia Equity (-15.64%). The average sector discount is -6.06% (up from -6.64% last week).

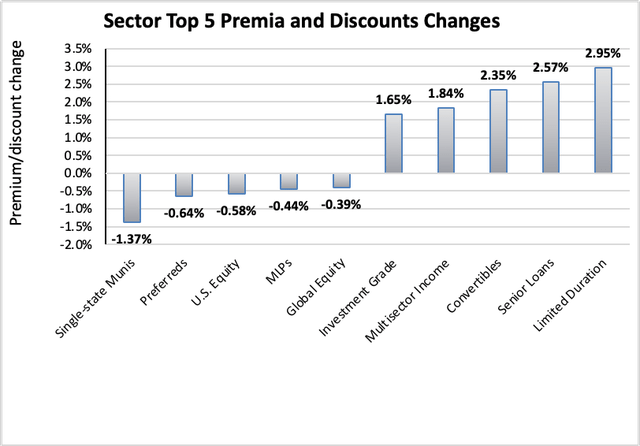

The sector with the highest premium/discount increase was Limited Duration (+2.95%), while Single-state Munis (-1.37%) showed the lowest premium/discount decline. The average change in premium/discount was +0.60% (down from +0.65% last week).

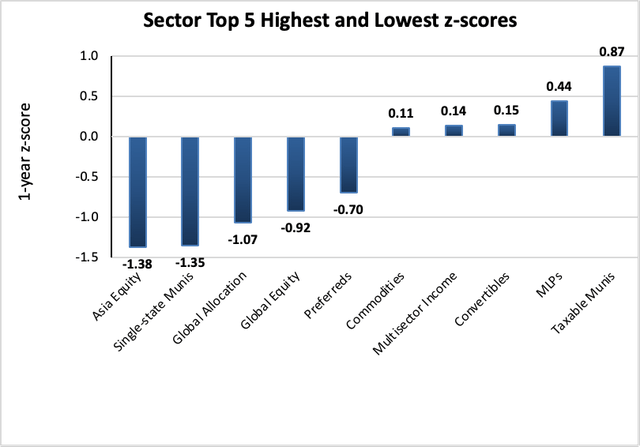

The sector with the highest average 1-year z-score is Taxable Munis (+0.87), while the sector with the lowest average 1-year z-score is Asia Equity (-1.38). The average z-score is -0.34 (up from -0.54 last week).

The sectors with the highest yields are Asia Equity (16.24%), Global Equity (12.70%), and Global Allocation (12.09%). Discounts are included for comparison. The average sector yield is 9.06% (down from 9.19% last week).

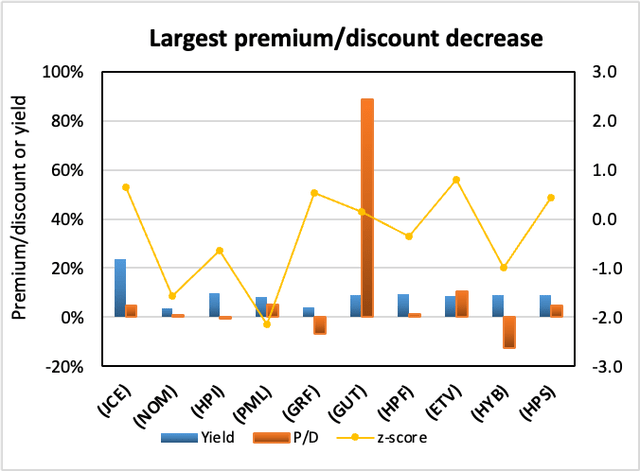

Individual CEFs that have undergone a significant decrease in premium/discount value over the past week, coupled optionally with an increasing NAV trend, a negative z-score, and/or are trading at a discount, are potential buy candidates.

| Fund | Ticker | P/D decrease | Yield | P/D | z-score | Price change | NAV change |

| Nuveen Core Equity Alpha | (JCE) | -13.39% | 23.82% | 4.83% | 0.7 | -14.81% | -3.92% |

| Nuveen MO Quality Muni Inc | (NOM) | -8.52% | 3.58% | 1.03% | -1.6 | -7.17% | 0.66% |

| John Hancock Preferred Income | (HPI) | -5.95% | 9.62% | -0.64% | -0.6 | -7.11% | -1.52% |

| PIMCO Municipal Income II | (PML) | -5.59% | 8.25% | 5.02% | -2.1 | -4.24% | 0.86% |

| Eagle Capital Growth | (GRF) | -5.47% | 4.08% | -6.61% | 0.5 | 0.33% | 3.86% |

| Gabelli Utility Trust | (GUT) | -4.81% | 8.93% | 88.76% | 0.2 | -3.03% | -0.56% |

| John Hancock Preferred Income II | (HPF) | -4.76% | 9.51% | 1.37% | -0.4 | -5.97% | -1.54% |

| Eaton Vance Tax-Managed Buy-Write Opp | (ETV) | -4.70% | 8.55% | 10.54% | 0.8 | -6.26% | -2.27% |

| New America High Income | (HYB) | -4.40% | 8.96% | -12.60% | -1.0 | -1.09% | 3.41% |

| John Hancock Preferred Income III | (HPS) | -4.21% | 9.13% | 4.94% | 0.4 | -5.25% |

-1.43% |

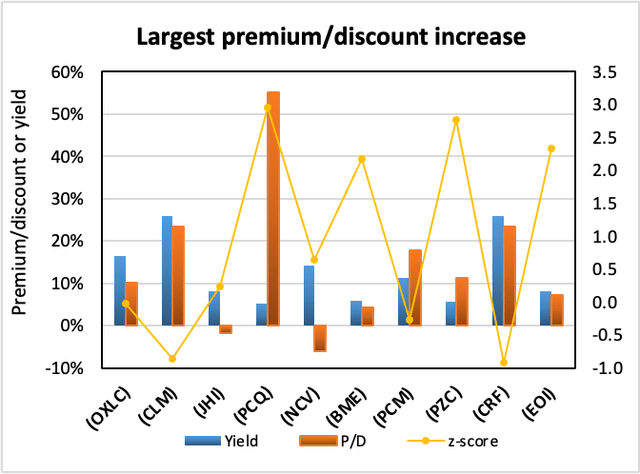

Conversely, individual CEFs that have undergone a significant increase in premium/discount value in the past week, coupled optionally with a decreasing NAV trend, a positive z-score, and/or are trading at a premium, are potential sell candidates.

| Fund | Ticker | P/D increase | Yield | P/D | z-score | Price change | NAV change |

| Oxford Lane Capital Corp. | (OXLC) | 24.07% | 16.57% | 10.20% | 0.0 | 0.74% | -25.19% |

| Cornerstone Strategic Value | (CLM) | 6.58% | 25.86% | 23.38% | -0.9 | 1.45% | -3.95% |

| John Hancock Investors | (JHI) | 5.73% | 8.09% | -1.67% | 0.2 | 4.43% | -1.64% |

| PIMCO CA Municipal Income | (PCQ) | 5.72% | 5.26% | 55.13% | 3.0 | 4.81% | 0.95% |

| Virtus Convertible & Income Fund | (NCV) | 5.43% | 14.13% | -5.99% | 0.6 | 3.44% | -2.54% |

| BlackRock Health Sciences | (BME) | 5.37% | 5.84% | 4.36% | 2.2 | 4.14% | -1.18% |

| PCM Fund | (PCM) | 5.36% | 11.32% | 17.78% | -0.3 | 3.04% | -1.64% |

| PIMCO CA Municipal Income III | (PZC) | 5.35% | 5.75% | 11.22% | 2.8 | 5.94% | 0.85% |

| Cornerstone Total Return Fund | (CRF) | 4.99% | 25.91% | 23.35% | -0.9 | 0.50% | -3.56% |

| Eaton Vance Enhanced Equity Income | (EOI) | 4.96% | 8.18% | 7.28% | 2.3 | 1.90% | -2.79% |

Recent corporate actions

These are from the past month. Any new news in the past week has a bolded date:

November 7, 2022 | Tortoise Announces Final Results of Tender Offers for its Closed-End Funds. Tortoise announced today the final results of cash tender offers for each of the following Funds that expired at 5:00 P.M., Eastern Time on November 1, 2022.

Fund Tender Offer Amount

TYG Up to 5% or 596,395 of its outstanding common shares NTG Up to 5% or 282,149 of its outstanding common shares TTP Up to 5% or 111,388 of its outstanding common shares NDP Up to 5% or 92,299 of its outstanding common shares TPZ Up to 5% or 326,324 of its outstanding common shares

The table below shows the final results for each Fund. The final results are based on a count by Computershare, the depositary for each tender offer.

Fund Shares Properly Tendered

Shares to be Purchased

Pro-Ration Factor*

Purchase Price **

Outstanding Shares after Giving Effect to Tender Offer

TYG 5,215,915

596,395

0.1144880

$38.96

11,331,508

NTG 2,774,144

282,149

0.1018340

$43.88

5,360,842

TTP 1,054,174

111,388

0.1058825

$32.91

2,116,385

NDP 1,030,052

92,299

0.0898095

$38.72

1,753,698

TPZ 3,138,234

326,324

0.1040280

$15.24

6,200,175

*The number of shares to be purchased divided by the number of shares properly tendered. The factor is subject to rounding adjustment to avoid the purchase of fractional shares.

** Equal to 98% of the relevant Fund’s net asset value per share as of the close of regular trading on the New York Stock Exchange (NYSE) on November 1, 2022 (the date the Tender Offer expired).

November 3, 2022 | Virtus Convertible & Income Fund, Virtus Convertible & Income Fund II Announce Final Results of ARPS Tender Offers. Virtus Convertible & Income Fund (NCV) and Virtus Convertible & Income Fund II (NCZ) (each, a “Fund” and, together, the “Funds”), today announced final results for each Fund’s voluntary tender offer (each, a “Tender Offer” and, together, the “Tender Offers”) for up to 100% of its outstanding auction rate preferred shares (“ARPS”). The Tender Offers expired at 5:00 p.m., New York City time, on November 1, 2022. Based upon current information, 8,902 shares (approximately 99.7% of outstanding ARPS) were tendered for NCV and 6,452 shares (approximately 99.2% of outstanding ARPS) were tendered for NCZ. Payment for such shares will be made on or about November 2, 2022. All of the ARPS of each of NCV and NCZ that were not tendered remain outstanding. The purchase price of properly tendered shares is equal to 97.95% of the ARPS per share liquidation preference of $25,000 per share (or $24,487.50 per share), plus any unpaid ARPS dividends accrued through the expiration date of each Tender Offer. As a result of the tender offer, NCZ has reached the minimum asset coverage ratio for total leverage required under its organizational documents for the declaration and payment of dividends. The Fund therefore will begin to process its monthly distribution of $0.0375 per common share that was previously scheduled to be paid on October 3, 2022 to shareholders of record as of September 12, 2022, with a new pay date of November 4, 2022. In addition, the monthly distribution of $0.0375 per common share, which was originally scheduled to be declared on October 3, will be paid on December 1, 2022 to shareholders of record as of November 15, 2022 (ex-dividend date of November 14, 2022).

October 14, 2022 | BlackRock Corporate High Yield Fund, Inc. Announces Results of Its Rights Offering. BlackRock Corporate High Yield Fund, Inc. (HYT) (the “Fund”) today announced the successful completion of its transferable rights offer (“the Offer”). The Offer commenced on September 20, 2022, and expired on October 13, 2022. The Offer entitled rights holders to subscribe for up to an aggregate of 24,463,440 shares of the Fund’s common stock, par value of $0.10 per share (“Common Share”). The final subscription price of $8.23 per Common Share was determined based upon the formula equal to 90% of the Fund’s net asset value per share of Common Shares at the close of trading on the NYSE on the expiration date. The Common Shares subscribed for will be issued promptly after completion and receipt of all shareholder payments. The Offer is expected to result in the issuance of more than 20.3 million Common Shares (including notices of guaranteed delivery), resulting in anticipated gross proceeds to the Fund of approximately $168 million. The Fund will receive the entire proceeds of the Offer since BlackRock Advisors, LLC, the Fund’s investment adviser, has agreed to pay all expenses related to the Offer. (Original rights offering press release)

September 27, 2022 | RiverNorth/DoubleLine Strategic Opportunity Fund, Inc. Announces Final Results of Rights Offering. RiverNorth/DoubleLine Strategic Opportunity Fund, Inc. (the “Fund”) (OPP) today announced the final results of its transferable rights offering (the “Offering”). The Fund will issue a total of 3,508,633 new shares of common stock as a result of the Offering, which closed on September 23, 2022 (the “Expiration Date”). The subscription price of $9.70 per share in the Offering was established on the Expiration Date based on a formula equal to 92.5% of the reported net asset value. Gross proceeds received by the Fund, before any expenses of the Offering, are expected to total approximately $34.0 million.

September 26, 2022 | RiverNorth/DoubleLine Strategic Opportunity Fund, Inc. Announces Preliminary Results of Rights Offering. RiverNorth/DoubleLine Strategic Opportunity Fund, Inc. (the “Fund”) today announced the preliminary results of its transferable rights offering (the “Offering”) that expired on September 23, 2022 (the “Expiration Date”). In the Offering, the Fund received subscription requests for 3,508,633 shares of common stock from rights holders. Accordingly, the Fund expects to issue 3,508,633 new shares of common stock for these subscriptions, pending the receipt of payment for “delivery-guaranteed” subscriptions, on or about September 29, 2022. Gross proceeds from the Offering are expected to total approximately $34.0 million, before expenses. The foregoing numbers are estimates only. The Offering’s final subscription price per share was determined to be $9.70. The subscription price was established pursuant to the terms of the Offering and based on a formula equal to 92.5% of the reported net asset value (“NAV”). Using the formula described above, the NAV per share was $10.49. The final subscription price is lower than the original estimated subscription price of $10.89 per share. Accordingly, any excess payments will be returned to subscribing rights holders as soon as practicable, in accordance with the prospectus supplement and accompanying prospectus, filed with the Securities and Exchange Commission on August 17, 2022. The shares of common stock issued as a result of the rights offering will not be record date shares for the Fund’s monthly distributions paid in August or September 2022.

September 19, 2022 | Virtus Total Return Fund Inc. Completes Rights Offering. Virtus Total Return Fund Inc. (ZTR) announced the completion of its non-transferable rights offering that expired on September 16, 2022. In accordance with the Prospectus, the subscription price was determined to be $6.96 per share, which was equal to 95% of the lower of [i] the net asset value per share of the Fund’s common stock at the close of business on September 16, 2022 (the “Pricing Date”), or [ii] the average of the last reported sales price of a share of the Fund’s common stock on the New York Stock Exchange on such date and the four preceding business days. The net asset value per share of the Fund’s common stock on the Pricing Date was $7.88. The average of the last reported sales prices of the Fund’s shares on the Pricing Date and the four preceding business days was $7.33. The subscription price is lower than the original estimated subscription price of $8.50. In accordance with the Prospectus, any excess subscription payment which would otherwise be refunded to a Record Date Shareholder who has exercised his or her right to acquire shares pursuant to the Over-Subscription Privilege will first be applied by the Fund toward payment for the additional shares to be so acquired. Information regarding the Over-Subscription Privilege is set forth in the Prospectus. Any excess payments otherwise to be refunded by the Fund to Record Date Shareholders will be mailed by the Subscription Agent to them as promptly as possible. It is anticipated that confirmations will be issued on or shortly after September 23, 2022. Newly issued shares will not be entitled to the Fund’s September distribution. Under the terms of the rights offering, shareholders as of the Record Date were entitled to acquire one share of common stock for each three shares held, up to an aggregate of 16.5 million shares of common stock of the Fund, plus up to an additional 25% if the offering was oversubscribed. Based on preliminary results provided by the Fund’s Subscription Agent, the Fund received requests for approximately 20.3 million shares. The Fund expects to announce the aggregate number of shares subscribed for and the total net proceeds to the Fund on or about September 21, 2022.

Upcoming corporate actions

These are from the past month. Any new news in the past week has a bolded date:

October 4, 2022 | RiverNorth Opportunities Fund, Inc. Announces Transferable Rights Offering. RiverNorth Opportunities Fund, Inc.(RIV) (the “Fund”) announces that its Board of Directors (the “Board”) has authorized and set the terms of an offering to the Fund’s stockholders of rights to purchase additional shares of common stock of the Fund. In this offering, the Fund will issue transferable subscription rights (“Rights”) to its stockholders of record as of October 14, 2022 (the “Record Date” and such stockholders, “Record Date Stockholders”) allowing the holder to subscribe for new shares of common stock of the Fund (the “Primary Subscription”). Record Date Stockholders will receive one Right for each share of common stock held on the Record Date. For every three Rights held, a holder of Rights may buy one new share of common stock of the Fund. Record Date Stockholders who exercise their Rights will not be entitled to distributions payable during October 2022 on shares issued in connection with the Rights Offering, but they will be entitled to distributions payable during November 2022 on these shares. The Rights are expected to be listed and tradable on the New York Stock Exchange (“NYSE”) under the ticker: RIV.RT. Record Date Stockholders who fully exercise all Rights initially issued to them in the Primary Subscription will be entitled to buy those shares of common stock that are not purchased by other Record Date Stockholders. The subscription price per share of common stock will be determined based upon a formula equal to 95% of the reported net asset value or 95% of the market price per share of common stock, whichever is higher on the Expiration Date (as defined below). Market price per share of common stock will be determined based on the average of the last reported sales price of a share of common stock on the NYSE for the five trading days preceding (and not including) the Expiration Date. The subscription period will expire on November 8, 2022, unless extended by the Board (the “Expiration Date”).

October 3, 2022 | Tortoise Announces Tender Offers for its Closed-End Funds. Tortoise announced today the commencement of cash tender offers for each of the following Funds.

Fund Tender Offer Amount (TYG) Up to 5% or 596,395 of its outstanding common shares (NTG) Up to 5% or 282,149 of its outstanding common shares (TTP) Up to 5% or 111,388 of its outstanding common shares (NDP) Up to 5% or 92,299 of its outstanding common shares (TPZ) Up to 5% or 326,324 of its outstanding common shares

Each tender offer will be conducted at a price equal to 98% of each Fund’s net asset value (‘NAV’) per share as of the close of regular trading on the New York Stock Exchange (NYSE) on the date the tender offer expires. Each tender offer will expire at 5:00 P.M., Eastern Time on November 1, 2022 or on such later date to which the offer is extended. The pricing date will also be November 1, 2022, unless extended. If the number of shares tendered exceeds the maximum amount of a tender offer, the Fund will purchase shares from tendering shareholders on a pro-rata basis (disregarding fractional shares). Accordingly, there is no assurance that a Fund will purchase all of a shareholder’s tendered common shares in connection with the relevant tender offer. Each Fund may sell portfolio instruments during the pendency of its tender offer to raise cash for the purchase of common shares. Thus, it is likely that during the pendency of each tender offer, and possibly for a short time thereafter, each Fund will hold a greater than normal percentage of its net assets in cash and cash equivalents. This larger cash position may interfere with a Fund’s ability to meet its investment objectives and invest consistently with its investment strategy.

September 20, 2022 | First Trust/abrdn Emerging Opportunity Fund Announces Approval of Liquidation. First Trust/Aberdeen Emerging Opportunity Fund (FEO) (the “Fund”) announced today that it intends to liquidate and distribute its net assets to shareholders. Based upon the recommendation of First Trust Advisors L.P., the Fund’s investment advisor (“FTA”), the Board of Trustees of the Fund determined that it was in the best interests of the Fund and its shareholders to liquidate the Fund. Accordingly, the Board of Trustees of the Fund approved the liquidation of the Fund pursuant to a plan of liquidation and termination. The Fund intends to terminate on or around December 7, 2022 (the “Termination Date”). As the Fund liquidates its assets, it may deviate from its investment objective and policies. The Fund’s common shares of beneficial interest (the “Common Shares”) are expected to cease trading on the New York Stock Exchange on or about December 1, 2022 and will be suspended from trading before the open of trading on or about December 2, 2022. The Fund anticipates making a liquidating distribution of cash, after paying or making reasonable provisions for the payment of all of its charges, taxes, expenses and liabilities, on or about the Termination Date (the “Liquidating Distribution”). The Fund has designated the close of business on December 5, 2022 as the effective date for determining the shareholders entitled to receive the Liquidating Distribution. If the Fund is not able to liquidate all of its assets by the Termination Date, for example, certain Russian securities currently not available for sale, it will transfer such remaining assets to a liquidating trust (the “Liquidating Trust”) and, in such case, the Liquidating Distribution would be comprised of cash plus, for every one Common Share held by a Fund shareholder, one share of the Liquidating Trust. Shareholders would not have the right to sell, transfer or otherwise dispose of or in any way encumber the interests they receive in the Liquidating Trust, except by operation of law or upon the death of the shareholder, or as required by law or order of a court of competent jurisdiction. The interests in the Liquidating Trust would not be offered to the public and would not be traded on an exchange. The trustee of the Liquidating Trust would use its reasonable best efforts to reduce the assets held in the Liquidating Trust to cash and, from time to time, pay the proceeds, if any (after accounting for amounts retained in reserve for the payment of applicable expenses and liabilities, if any), from the sale of such assets to shareholders of the Liquidating Trust.

August 11, 2022 | Abrdn’s U.S. Closed-End Funds Announce Special Shareholder Meetings Relating to Proposed Acquisition of Assets of Four Delaware Management Company-Advised Closed-End Funds. The Board of Trustees of each of the Acquiring Funds, listed below, announces the proposed reorganization of several closed-end investment companies advised by one or more affiliates of Delaware Management Company into the respective Acquiring Funds (“Reorganizations”). The proposed Reorganizations are subject to the receipt of necessary shareholder approvals by each Fund:

Acquired Fund Acquiring Fund Delaware Ivy High Income Opportunities Fund (“IVH“) Aberdeen Income Credit Strategies Fund (“ACP“) Delaware Enhanced Global Dividend and Income Fund (“DEX“) Aberdeen Global Dynamic Dividend Fund (“AGD“) Delaware Investments Dividend and Income Fund, Inc. (“DDF“) Macquarie Global Infrastructure Total Return Fund Inc. (“MGU“) Aberdeen Global Infrastructure Income Fund (“ASGI“)

The combination of the merging funds will help ensure the viability of the Funds, increasing scale, liquidity and marketability changes that may lead to a tighter discount or a premium to NAV over time. Following the Reorganizations, shareholders of each Acquiring Fund will experience an increase in the assets under management and a reduction in their Fund’s total expense ratios. There are no proposed changes to the current objectives or policies of the Acquiring Funds as a result of these Reorganizations, including the Funds’ monthly distribution policies. Individually, each Board believes that the Reorganizations are in the best interest of their Fund’s shareholders recognizing the strategic objective of creating scale for the benefit of shareholders. Shareholders of the Acquiring Funds will be asked to approve the issuance of shares at a special virtual shareholder meeting tentatively scheduled for November 9, 2022 (the “Meeting”). Each Acquiring Fund Board has fixed the close of business on August 11, 2022 as the record date for the determination of shareholders entitled to vote at the Meeting and at any adjournment of the Meeting. Each approval of the special resolution of the shareholders authorizing the issuance of new shares will require the affirmative vote of a majority of shares present in person or represented by proxy and entitled to vote. It is currently expected that each Reorganization will be completed in the first quarter of 2023 subject to [i] approval of the Reorganization by the respective Acquired Fund shareholders, [ii] approval by the respective Acquiring Fund shareholders of the issuance of shares of the Acquiring Funds, and [iii] the satisfaction of customary closing conditions. No Reorganization is contingent upon any other Reorganization. The Board of Trustees to each Acquired Fund and the Board of Trustees of each Acquiring Fund believe that the proposed Reorganization is in the best interests of the shareholders of that Fund.

Recent activist or other CEF news

These are from the past month. Any new news in the past week has a bolded date:

October 21, 2022 | The Cushing® NextGen Infrastructure Income Fund Announces Name Change. The Cushing® NextGen Infrastructure Income Fund (SZC, the “Fund”) announced a change to the Fund’s name. Effective as of November 1, 2022, the Fund’s name will be NXG NextGen Infrastructure Income Fund. In connection with its name change, the New York Stock Exchange ticker symbol of the Fund’s common shares will change from “SZC” to “NXG.” The CUSIP for the Fund’s common shares will remain 231647207 following the name and ticker change.

Current Name

Current NYSE Symbol

New Name

New NYSE Symbol

The Cushing®NextGenInfrastructure Income Fund

SZC

NXG NextGen InfrastructureIncome Fund

NXG

In connection with the name change, there will be no change to the Fund’s investment adviser, the portfolio management personnel primarily responsible for the day-to-day management of the Fund’s portfolio, or the Fund’s investment objective and investment strategies.

October 5, 2022 | BlackRock Closed-End Fund Share Repurchase Program Update. BlackRock Advisors, LLC released today share repurchase activity for certain BlackRock closed-end funds (the “Funds”) during the quarter ended September 30, 2022. The Funds have authorized open market share repurchase programs (the “Repurchase Programs”) pursuant to which each Fund may repurchase, through November 30, 2022, up to 5% of its outstanding common shares in open market transactions. In September, BlackRock announced that the Boards of Directors/Trustees of the Funds have authorized the renewal of the Repurchase Programs through November 30, 2023. The Repurchase Programs seek to enhance shareholder value by purchasing Fund shares trading at a discount from their net asset value (“NAV”) per share, which could result in incremental accretion to a Fund’s NAV. Below is a summary of share repurchase activity over this past quarter and since the inception of each Fund’s Repurchase Program:

Summary of share repurchase activity during the most recent calendar quarter ended September 30, 2022:

Fund Name

Ticker

Number of

Shares

Purchased

Total Amount

of Shares

Repurchased

Total

Amount of

NAV

Accretion

BGR

361,269

$4,051,879

$566,015

BFZ

210,872

$2,375,882

$328,714

BOE

207,535

$1,866,674

$255,735

BCX

246,758

$2,165,475

$267,434

BIGZ

1,975,283

$14,811,781

$3,204,019

BGY

384,492

$1,762,933

$217,088

BMEZ

524,542

$7,967,859

$1,451,496

BCAT

703,504

$10,393,473

$1,916,063

ECAT

538,782

$7,739,237

$1,483,448

October 3, 2022 | Virtus Convertible & Income Fund II Postpones Monthly Distribution on Common Shares. Virtus Convertible & Income Fund II (NYSE: NCZ), a closed-end fund, today announced that it has postponed payment of its monthly distribution of $0.0375 per common share that was scheduled to be paid on October 3, 2022 to shareholders of record as of September 12, 2022, and has postponed declaration of its monthly distribution of $0.0375 per common share that was scheduled to be declared on October 3, 2022 for payment on November 1, 2022. Recent market dislocations have caused the values of the Fund’s portfolio securities to decline and, as a result, the Fund’s asset coverage ratio for total leverage as of September 30, as calculated in accordance with the Investment Company Act of 1940, was below the 200% minimum asset coverage guideline. Compliance with the asset coverage ratio is required by the Fund’s governing documents for declaration or payment of the monthly distribution. As a result, the Fund is not authorized to declare or pay its monthly distribution until the coverage ratio is in compliance. The Fund intends to pay the October 3 common share distribution and resume declaration and payment of its monthly common share distributions once its coverage ratio is in compliance.

————————————

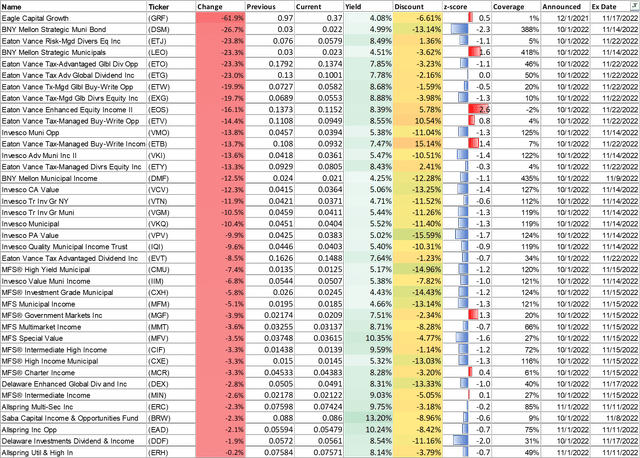

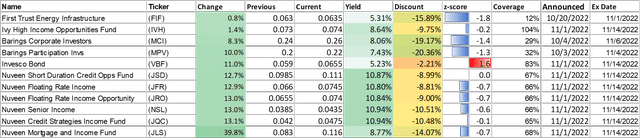

Distribution changes announced this month

These are sorted in ascending order of distribution change percentage. Funds with distribution changes announced this month are included. Any distribution declarations made this week are in bold. I’ve also added monthly/quarterly information as well as yield, coverage (after the boost/cut), discount and 1-year z-score information. I’ve separated the funds into two sub-categories, cutters and boosters.

Cutters

Boosters

Commentary

1. Tortoise tender offers completed

The Tortoise CEF tender offers are completed! The tender offer, which expired on November 1, 2022, was to repurchase 5% of outstanding shares at 98% of NAV. We discussed these offers when they were first announced in a previous CEF Weekly Roundup, and again when they were about to expire here. Nick also presented a standalone analysis of the tender offers here.

The results for the tender offers are presented again below:

|

Fund |

Shares Properly Tendered |

Shares to be Purchased |

Pro-Ration Factor* |

Purchase Price ** |

Outstanding Shares after Giving Effect to Tender Offer |

|

TYG |

5,215,915 |

596,395 |

0.1144880 |

$38.96 |

11,331,508 |

|

NTG |

2,774,144 |

282,149 |

0.1018340 |

$43.88 |

5,360,842 |

|

TTP |

1,054,174 |

111,388 |

0.1058825 |

$32.91 |

2,116,385 |

|

NDP |

1,030,052 |

92,299 |

0.0898095 |

$38.72 |

1,753,698 |

|

TPZ |

3,138,234 |

326,324 |

0.1040280 |

$15.24 |

6,200,175 |

Given that the funds all traded at wide discounts, the ability to tender your shares back to the fund at 98% NAV, i.e. a -2% discount, is a no-brainer as you get an instant gain on the tendered shares. Yet, for some reason or another, only around half of shareholders tendered their shares. The other half of shareholders who did not tender, simply left money on the table. I’m not complaining though, as the fewer the shareholders who tender, the better the results for everyone else! This is because the fewer the proportion of shareholders that tender, the higher the proration factor for everyone else.

For example, for TYG which we own in our Tactical Income-100 portfolio, only around 43% of shareholders tendered their shares. This means that even though TYG only repurchased 5% of their total shares, each investor who tendered all of their shares would have had 11.45% of their shares repurchased by the fund. We fully took advantage of this in our Tactical Income-100 portfolio, rebuying that portion of shares tendered the next day on the open market, thus making an instant gain of +$5.66 or +14.53% per share on those portions of shares. On an overall position basis, the cost basis of the position was decreased by -$0.66 or -2.58%.

As I’ve previously written, the Tortoise tender offers were proactively instituted by management as part of a discount management program, rather than something that the managers were strong-armed into as a reaction to activist pressure. Thus, this is a sign of management alignment with shareholders, in my opinion. For more background information on tender offers, see this guide from Beer Money Arb: Tender Offers: How To Guide + Notes On Invesco And EIM Tenders.

Be the first to comment