RobsonPL

Introduction

Intesa Sanpaolo (OTCPK:ISNPY) has exceeded my expectations as it currently is in bull territory since it is up 25% since I initiated my coverage on the largest Italian bank in July. Counting dividends, the total return is almost 30%, which is quite a result if we consider that we are talking about a bank that operates in Europe and, within Europe, in countries that are not usually among investor favorites. However, this solid performance is not happening by chance and in this article I would like to go over a few points from the bank’s last earnings report that I think are worth looking at. In fact, even though the stock has reached my initial target price, I think it is reasonable to revise the target price upwards.

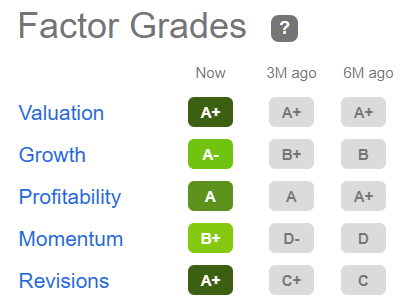

One last note before we start. Intesa currently sports some very good factor grades that have all been revised upwards in the last six months. According to Seeking Alpha Quant Ratings, Intesa is currently the number one stock among the 59 diversified banks that are rated.

Seeking Alpha

Summary of previous coverage

Let’s start from the end and move backwards. In my first article (“Intesa Provides a 14% Returns And Is Now a Zero NPL Bank“) my valuation was that Intesa had a 25% possible upside.

I tried to show how the Italian banking system is much better than what it was prior to the Great Recession. All major Italian banks have undertaken a massive de-risking action, while monitoring to be well above the CET1 ratio of 10%. In addition, a thing that is not often considered when we think about Italy is that Italians are very good savers and every month, they deposit around €30-40 billion per month in their accounts. This leads to country whose banking deposits are worth €2.1 trillion, which is equal to Italy’s expected GDP for 2022. Italian household wealth is at €11 trillion, of which €5 trillion is in financial assets, coupled with low household debt. With inflation at 10% in Europe, many people will start thinking about new ways of using their cash in their banking accounts and here is where big asset management companies, such as Intesa Sanpaolo, can find a new tailwind. Intesa Sanpaolo has taken a unique position in the European landscape because it can call wealth management products today also its retail deposits. This is even more important when we consider Italy and its huge amount of cash stacked up in the banks without being invested.

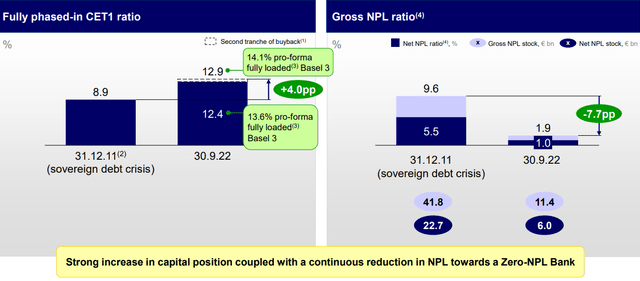

Intesa Sanpaolo has also gotten rid of almost its nonperforming-loan (NPL) through a well-executed deleveraging process that has reduced Intesa’ NPLs by €54 billion from 2015 to 2021. NPL stock reduction was €4 billion in the first nine months of the year and €53 billion since the peak of September 2015. Now, net NPL stock is at €6 billion after 28 quarters of continuous reduction. This makes the company much stronger than what it was as the sovereign debt crisis hit European banks, with a fully phased-in CET1 ratio well above the 2011 one and a gross NPL ratio that has been reduced by 7.7 percentage points. The CET1 ratio is quite important to know because Intesa has committed itself to a cash dividend payout that will be equal to 70% of total income in each year until 2025, as long as the common equity ratio is higher than 12%.

Intesa Sanpaolo Q3 Results Presentation

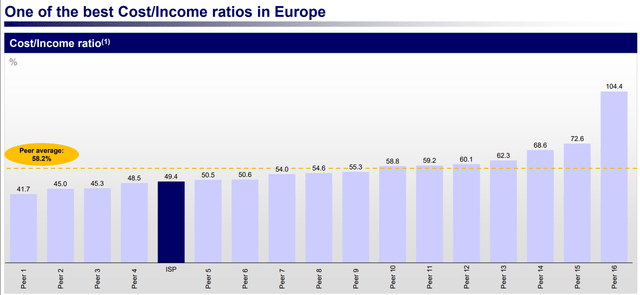

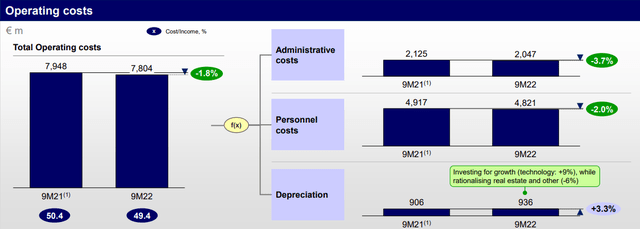

Readers who are unfamiliar with the bank can take a look at this new presentation of six slides “The Intesa Sanpaolo Group at a glance” where some useful information can be found about the bank. For example, we know that of its 20.6 million customers, 13.6 are in Italy and 7 are abroad. We can also see that the company operates with a return on capital which, depending on how it is calculated, is approximately between 8 and 10%. We also see that the company is becoming more and more efficient, with a cost/income ratio below 50%, as we can see here.

Intesa Sanpaolo Q3 Results Presentation

The fact that the company is becoming more efficient, together with the fact that for every 50 basis points rate rise, the bank’s net interest income can increase by more than €900 million made me think Intesa was set to achieve very good results in the upcoming quarters.

Q3 Results

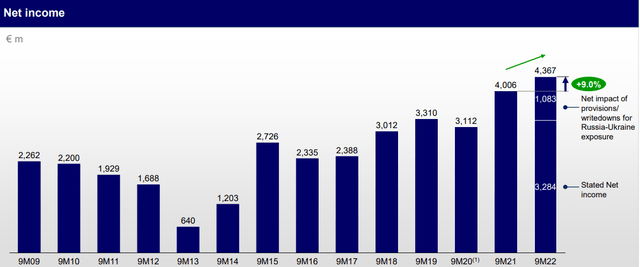

This time, let’s start from the bottom line. For the first nine months of the year, the banks’ net income – driven by net interest income – reached €4.4 billion, when excluding Russia de-risking. In the meantime, during the last quarter, Intesa Sanpaolo reduced its exposure to Russia by around 65% (around €2.3 billion) bringing Russia down to 0.3% of the Group’s total loans to customers. This makes Intesa a zero Russia exposure bank which goes along with the other achievement Intesa was focused on: becoming a zero-NPL bank. The Italian bank has reached one of the lowest NPL stock and ratios in Europe. And ISP Zero-NPL Bank status is driving a very low underlying cost of risk.

Now, when we look at the chart below, we see that since the end of the sovereign debt crisis, Intesa Sanpaolo has been driving its net income steadily upwards even though we were in a low interest rate environment. Rate increases will be a strong upside for the bank and it is supposed to grow by €2 billion, assuming one-month Euribor reaching an average of 2% (it is now at 1.54%).

Intesa Sanpaolo Q3 Results Presentation

This is fully in line with the 2022 business plan net income target of more than €5 billion. I also think it is now evident that the €6.5 billion net income target in 2025 will be exceeded and could come in around €7 billion.

And here we have to understand that the bank has always tried to have multiple sources of revenues which is what Carlo Messina, the bank’s CEO, explained in the last earnings call

In light of the strong core revenue performance, we didn’t push on profit from financial assets and at the same time, reducing the total amount of government bonds that we have in our portfolio. We have reduced the size of the goods portfolio to avoid an impact from volatility and that action impacted trading profits in the quarter. As I have always said, we manage revenues in an integrated manner. […]

Intesa Sanpaolo 3Q Results Presentation

Shareholder return

The fact that Intesa is becoming more and more efficient and that its net income is expected to grow quite rapidly as interest rates rise make me consider it one of the best plays in the industry.

The company is also becoming a very committed cash dividend provider, with a yield that is currently around 70%. Intesa pays its dividend twice a year, in November and in May. Since it has just paid its interim dividend, it could also be a good moment to pick up some shares as they have dropped a bit in price.

This year, Intesa has already accrued €3.7 billion in dividends and it has also just concluded the first tranche of its share buyback, repurchasing around 5% of shares. I really liked this buyback as it took advantage of a depressed stock price during the summer that enabled the bank to decrease the total shares outstanding by a greater extent than what was originally expected.

Next year, Intesa expects net interest income to come in above $11 billion, versus the $8.5-$8.8 billion forecasted for this year, this will provide a big boost to the bottom line making it reasonable to expect that Intesa will have a net income growth Y0Y above its past average. As a consequence, the dividend should grow, too.

There is another way Intesa returns cash to its shareholder because the bank decided to make a €3.4 billion of share buyback. So far, the company has executed, as we have seen, a buyback of €1.7 billion. Once the results of the full year are in and 2023 becomes a bit clearer in terms of economic outlook, the company will tell investors when it will execute the second tranche of its buyback.

Conclusion

Although there is a country risk that I think partially explains why Intesa trades at such a low valuation, I still think investors are not yet pricing the bank accordingly to what it can reasonably deliver in the upcoming years. This is why I recently increased my stake in Intesa and I stick to my target price of $16 which, in the Italian stock exchange, would be equivalent to €2.5 per share.

Be the first to comment