imaginima/E+ via Getty Images

The offshore industry is a “slow mover” in the oil sector. In other words, onshore drillers usually find it easier to raise and cut production. Offshore drilling, in contrast, requires heavy capital investments, whilst turning out to be profitable in the long term. This simply means that oil majors are willing to invest in offshore contracts when they are confident the oil prices are high and will stay so for years. This seems to be the case right now. In this article, I will discuss the advantages and disadvantages of both Transocean (NYSE:RIG) and Valaris (NYSE:VAL), explaining why the former is undervalued.

RIG and VAL comparison

Many other Seeking Alpha authors wrote about the advantages of the companies that have recently emerged from bankruptcy. Sure, the liabilities were wiped off as a result, whilst the servicing of the debt decreased significantly. This can definitely be said about Valaris.

However, Valaris is a company that is much smaller than Transocean by all means.

|

Company name |

Transocean |

Valaris |

|

Recently reported annual sales |

$2.556 billion |

$1.232 billion |

|

EPS per share |

$-0.93 |

-$22.82 |

|

Stock price (as of the time of writing) |

$2.70 |

$40 |

|

Outstanding shares |

$681 million |

$75 million |

|

Number of employees |

5,530 as of 2021 |

4,900 as of 2021 |

|

Total long-term debt |

$7.01 billion |

$545.3 million |

|

Total backlog |

$6.1 billion |

$2.95 billion |

|

Market capitalization (as of the time of writing) |

$1.82 billion |

$3.00 billion |

Source: Prepared by the author

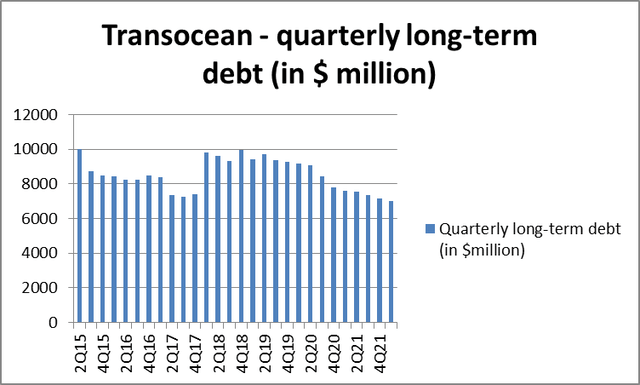

Both companies are loss-making right now. But Transocean has more employees, higher reported sales ($2.556 billion vs. $1.232 billion of Valaris) and, very importantly, a much higher backlog. The value of VAL’s long-term debt ($545.3 million) seems to be negligible compared to that of Transocean. At the same time, it is important to remember that Valaris re-emerged from bankruptcy in April 2021, slightly more than a year ago. Valaris eliminated $7.1 billion in debt. After its bankruptcy, the company issued new notes maturing in 2028, thus issuing $550 million in new debt. It was the only way to raise cash and allow the company to operate. Transocean, meanwhile, did not file for bankruptcy. That is why RIG’s debt was not wiped off and is still a risk for the company. But the company’s management also demonstrated its high level of creativity by restructuring RIG’s debt back in 2020. This really helped Transocean decrease its debt level over the two years’ time. This is impressive, given the last two years were challenging for RIG when the company did not make any profits.

On the diagram below, there is Transocean’s debt level history. After 2Q2020, the debt level started falling.

Transocean is a bigger company than Valaris, which can clearly be seen from its sales revenue and its backlog. At the same time, Transocean seems to be more efficient as far as its workforce is concerned. Transocean has 13% more employees, whereas its sales are 100% greater than these of Valaris. But at the same time RIG’s capitalization is sufficiently lower than that of Valaris. I will try to explain this in my other section.

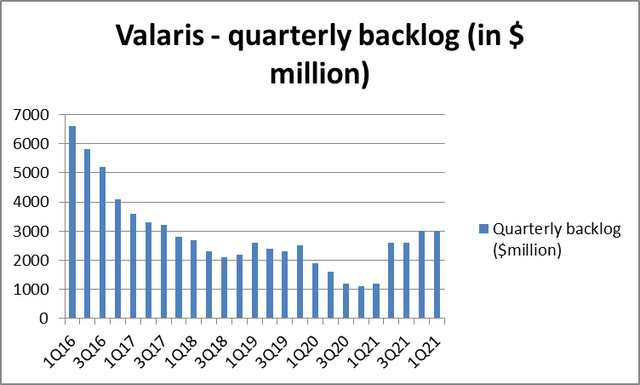

Backlog

The backlog of Valaris is much lower than that of Transocean. At the same time, after VAL’s bankruptcy, the company re-emerged on 30, April 2021. From the second quarter of 2021, its backlog started growing. This can very well be illustrated by the diagram below.

Backlog – Valaris

One of the reasons for this, in my opinion, was the fact the company started looking more financially stable for its potential customers than it used to be since the debt load of Valaris decreased substantially. But VAL’s fleet is not very large. The rigs that are not cold-stacked can easily find work.

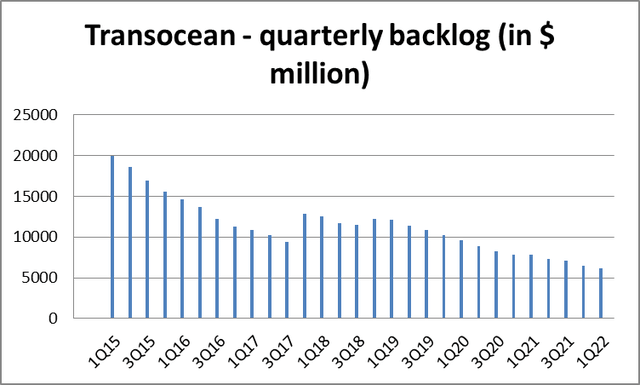

Backlog – Transocean

At the same time, Transocean’s backlog has been falling for some time. This, in my opinion, is a direct result of the fact that the offshore oil industry takes some time to recover, whilst RIG’s backlog consumption is quite fast. However, since the coronavirus crisis, none of Transocean’s contracts was cancelled, whilst some new ones were announced.

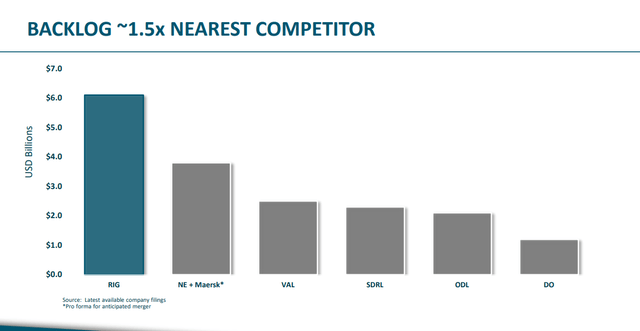

In my view, the fact VAL’s backlog is rising, whereas that of Transocean is not, is due to the fact that Valaris almost eliminated its debt load. But Transocean’s backlog is still sufficiently higher than that of Valaris.

In fact, RIG is the leading company in the industry in terms of its backlog.

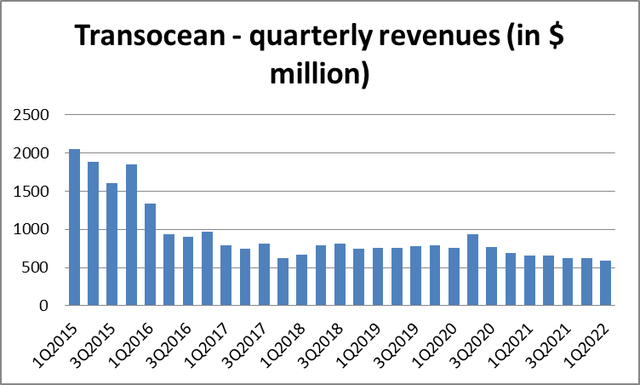

Revenues

Transocean’s Revenues

Transocean’s revenues have stayed more or less constant for many quarters already. However, just now, the company’s backlog is not translating into sales revenues. In my view, that requires time.

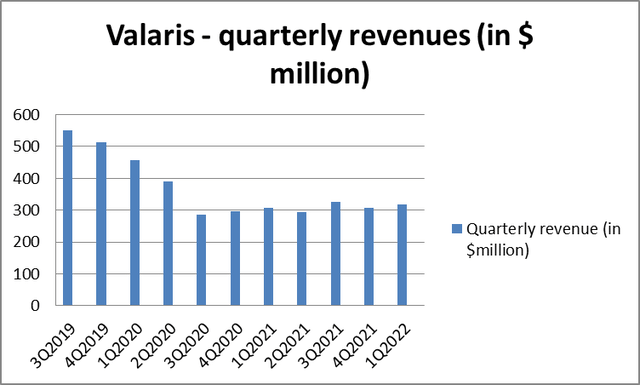

Sales – Valaris

VAL’s sales are not rising dramatically either. Instead, we can say they have stabilized somewhat. In my view, turning backlog into sales requires lots of time, which is also true for Valaris.

Recent news

Sembcorp Marine, a company based in Singapore, has delivered the world’s two eighth-generation ultra-deepwater drillships to Transocean. Both drillships are highly innovative and are able to contract very decent dayrates. But Transocean’s positive news does not end here – the dayrates have started rising substantially since there is a real shortage of drillships. I wrote about the offshore rig market recovery in more detail in my other article.

Risks

Due to the situation in Ukraine and the sanctions imposed against Russia by the West, it is likely the oil prices would stay high for a while. It is true that the Fed’s hawkish stance and the possibility of a recession in the near future might make the oil prices crash. The higher interest rates are also risky for companies with sufficient debt loads. However, in my view, the global economy is in a situation, similar to the 1970s. There was stagflation at the time. In other words, America’s economy suffered from inflation, negative economic growth and unemployment, whilst the oil prices stayed high for more than a decade. It is likely a situation like this will repeat itself this time as well. The main risk for Transocean is, in my view, the debt load. But given the company’s competent management, it is highly likely the company will manage it. Moreover, the oil prices would likely stay high. So, the banks would be willing to refinance the company. As concerns Valaris, in my view, the company is somewhat overvalued although its debt load is very low.

Valuation

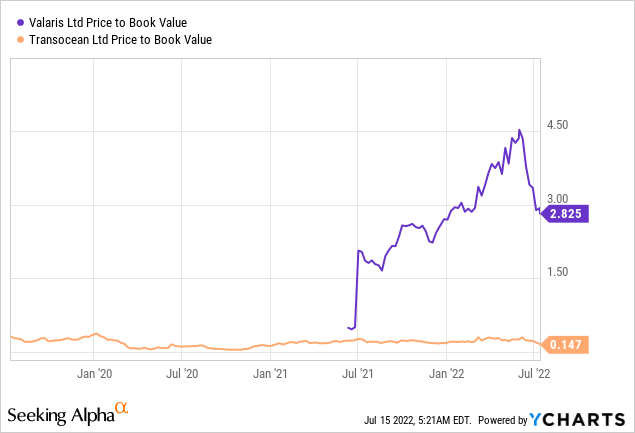

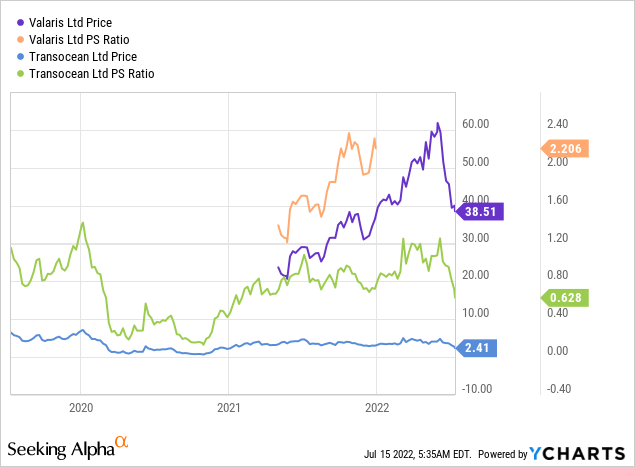

Since the two companies are not currently profitable, there is no price-to-earnings (P/E) ratio. So, I decided to use the price-to-sales (P/S) and the price-to-book (P/B) measures to judge how the two companies differ between each other in terms of valuation.

The P/B ratios of both VAL and RIG are presented below. The measure is not very accurate since book values on the balance sheet are always higher than the values of the net assets are in real life.

And yet, VAL seems to be much more overvalued than RIG in terms of its P/B ratio. The P/B ratio of Valaris is more than 19(!) times higher than that of Transocean. VAL’s debt level is surely lower than that of Transocean, but the latter has not stopped being the industry’s leader.

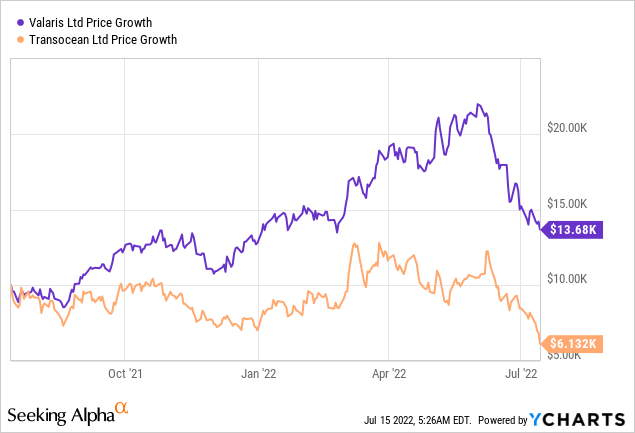

The same is true of the stock market’s perception of the two companies’ stock prices. Transocean is highly undervalued compared to Valaris. So, it would have been much more profitable for an investor to buy VAL’s stock in July 2021 than to buy Transocean’s shares at the time.

The P/S ratio situation is quite similar. Sure, VAL’s 2.2 is almost 3 times higher than that of Transocean.

Overall, Valaris stock is much more expensive than that of Transocean. From the valuation perspective, it means Transocean has much more upside potential than Valaris.

Conclusion

Valaris and Transocean are companies in the industry with a high recovery potential. Most certainly, it seems that oil companies are not good buys when the oil prices are near all-time highs, whilst many analysts predict recession. At the same time, Transocean is undervalued as opposed to Valaris. The latter has a much lower debt load. But Transocean is not losing its position as the company with the largest backlog in the offshore industry. The dayrates are rising, and it looks likely the banking industry would be more willing to fund Transocean on good conditions. I appreciate Valaris is less of a risk but Transocean shares have much more upside potential.

Be the first to comment