Black_Kira/iStock via Getty Images

If you have been following Li-Cycle (NYSE:LICY) for some time like I have, there has never been a more exciting time to own the company. I think that their recent Q2 earnings results show evidence that they are progressing well in their journey to be a preferred recycling partner in North America and Europe. Furthermore, the management provided better clarifications on some issues raised in Blue Orca’s short report on the company, which gave me further confidence in Li-Cycle’s fundamental business and its prospects.

I have written several articles on Li-Cycle, namely an initiation article that does more of an introductory deep dive into the company, and a subsequent article on achievements and progress made in subsequent quarters.

This article goes into Li-Cycle’s Q2 earnings as well as significant recent developments for the company that continues to validate my investment thesis for the company.

Investment thesis

Li-Cycle could be a leader in lithium ion battery recycling sector, an early stage but fast-growing industry for the next few decades to come. Li-Cycle’s technology advantage and patented business model is underappreciated by the market.

This original investment thesis from my initiation article continues to hold and I am increasingly convinced that Li-Cycle is well positioned to be the leader in lithium ion battery recycling, which will be further explained below.

Sufficient liquidity for capital and operating needs

There has been some concerns raised by one sell side analyst and also by Blue Orca’s short report that the company may need to raise more than $1 billion through dilutive equity issuances or debt for currently proposed capital investments. However, these concerns were well addressed by management and should provide further confidence to Li-Cycle investors that the company has sufficient liquidity for its capital and operating needs.

Management reiterated and further emphasized the fact that Li-Cycle has the necessary liquidity for its capital and operating needs to fund its current pipeline of projects that are in development. With more than $509 million in cash as at the end of April, along with the $250 million investment from LG and Glencore, the total cash balance adds up to $761 million. According to CFO Debbie Simpson and CEO and co-founder Ajay Kochhar, this total cash amount of $761 million can bring the company through its current pipeline of projects under development. This, in my view, provides the much needed clarity the market needs to think about how the company will meet the growing capital and operating costs as Li-Cycle scales up in 2023 and beyond.

As such, this means that for the projects that have been announced like the 5 spokes in North America and 2 spokes in Europe (Germany and Norway), as well as its first hub in North America, are all fully funded. Furthermore, given how the business model works, the commissioning of the Rochester Hub in 2023 is expected to lead positive and sustainable cash flows for these currently proposed projects.

Li-Cycle will use a modular approach for the capital investments needed in the next phase of projects. This next phase of projects which will provide Li-Cycle with the next growth phase will require financing that will be done in a modular fashion.

To me, this means that each incremental new project will thus need to utilize the range of financing alternatives available to the company and at the same time ensure that the cost of capital is optimized. I think management is clear in saying that this next phase of growth is optional, meaning that they will only take on new projects and capital investments if they are accretive and financing terms are favorable.

All in all, I think Li-Cycle is executing well on the financial front to be able to meet the capital and operating needs of its current project pipeline and this gives investors much more confidence in the company’s ability to execute and stay for the long term as it balances between growth and the health of the balance sheet. Per the Q2 earnings call:

We have sufficient liquidity for our capital and operating needs to fund the current pipeline of projects and development incentive costs. And finally, our Spoke & Hub technologies integrated network is uniquely positioned to capitalize on accelerating electrification trends that will deliver significant earnings and cash flow in the years to come.

Significant operation progress made

I say this with much excitement as Li-Cycle begins operations in its Arizona spoke. This is significant as the Arizona spoke is the first of its kind and what management considers next generation spoke innovation as discussed in prior earnings calls, in terms of its scale and operating capabilities. On scale, the Arizona scale is double the capacity of Li-Cycle’s earlier Ontario and New York spoke with a total processing capacity of 10,000 tonnes. In addition, besides being battery and chemistry agnostic, the new Arizona spoke is capable of processing “full electric vehicle battery packs without having to discharge or dismantle“, as highlighted by management in the call.

On the Rochester Hub, management continues to expect it to commission as planned in 2023, with focus on securing the necessary equipment and materials needed to ensure that the construction and project development goes smoothly. With Li-Cycle obtaining the key environmental comment for the Rochester Hub in 1Q22, this means that the company can now move forward to the next phase, which is project development and construction. During 2Q22, management has managed to lock in the price for most of its equipment and the construction materials are being purchased as management continues to monitor and manage both material as well as labor costs.

For its European spokes in Germany and Norway, these spokes have the same spoke technology as that built in Arizona. These spoke locations in Europe are located close to battery and electric vehicle manufacturers like Freyr (FREY), Tesla (TSLA), Volkswagen (OTCPK:VWAGY), as well as its partner LG Energy. These spokes are also expected to come online in 2023 and they have a total capacity of 20,000 tonnes per year.

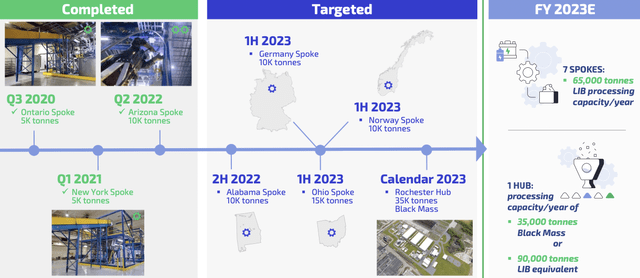

In the near term, for 2022, most of the growth in production volumes will come in 2H22 as Arizona ramps up and Alabama, a similar capacity spoke, comes online. As highlighted below, these are the 7 spokes and 1 hub that are expected to bring processing capacity from 5,000 tonnes of spoke capacity in 2020 to 65,000 tonnes of spoke capacity as well as 35,000 tonnes of black mass capacity in 2023.

Operational milestones and targets for Li-Cycle (Li-Cycle 2Q22)

“Strategically, we are positioning Li-Cycle’s Spoke & Hub integrated network as a long-term preferred recycling partner and supplier of lithium-ion battery materials, particularly in North America and Europe.” – Q2 earnings call.

Improving battery recycling industry trends

I think that awareness for the need for recycling of batteries in the market is still rather lacking. The secular tailwinds that drive Li-Cycle’s growth come from the increasing need for energy security, the growing emphasis on climate change and the speeding up of electrification trends in the transport sector. I think it is clear that the world is in a transition towards electric vehicles as the solution to tackle the increasing greenhouse gas emissions and the problem of climate change, and that we are only in the early stages of this transition.

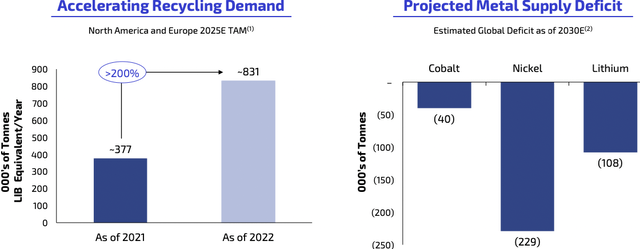

As evident from the graph below, the recycling demand in Li-Cycle’s core markets of North America and Europe have since doubled in the span of 1 year as more battery producers announce new investments for new battery manufacturing capacity and as vehicle manufacturers pivot towards the electric vehicle trend. Furthermore, as we are in the early stages of this electric vehicle transition, it is forecasted that there will be a deficit of key materials needed for the production of the electric vehicle batteries, as evident in the graph below as well. As such, industry players are realizing the need and importance of battery recycling to provide additional supply of materials and ensure resilient battery production

Growing trends for battery recycling (Li-Cycle 2Q22)

In line with these, Li-Cycle’s total addressable market for lithium ion batteries that are available for recycling grew by 170% since 2021 year end and in Europe, this figure grew by 330% since 2021 year end. As highlighted before, this increase in the total addressable market comes as there is increased demand for electric vehicles, driving both electric vehicle manufacturers and battery producers to scale up for this demand.

Success underpinned by commercial agreements

With the completion of long term commercial contracts with Glencore and LG Energy Solution, these 2 new partners bring multiple benefits to Li-cycle. First, they helped strengthen the balance sheet by providing investment proceeds of $250 million. Second, both Glencore and LG Energy Solution are global leaders in their own respective space and provide significant credibility and a vote of confidence on the business and management of Li-Cycle’s business given the huge due diligence usually done by such established companies. Third, both companies have also designated Li-Cycle as their preferred recycling partner which speaks volumes about their expectations for Li-Cycle’s execution for their long term needs.

Specifically, Glencore is the top producer of cobalt and the top 3 producer of class 1 nickel, both of which are used in lithium ion battery production. Management shared that its agreement with Glencore is a long term 10 year contract and gives the company opportunities to jointly develop more spokes or to expand their market opportunity in the future. LG Chem, on the other hand, is one of the largest battery producers in the world with production sites in the U.S., South Korea and China.

I think that it is increasingly clear that Li-Cycle is able to help its customers close the loop and provide a vertical integration solution to customers wanting a battery recycling capability. For example, Li-Cycle is helping LG recycle their manufacturing scrap and in turn, they will receive the end-product which is nickel, which will then be once again utilized in their battery production process.

In conclusion, I think that Li-Cycle’s new partners could help demonstrate to others in the industry how Li-Cycle can add value by providing a closed loop, vertically integrated battery recycling option to ensure resilient supply of battery materials for the energy transition ahead. Furthermore, this gives further validation to Li-Cycle’s hub and spoke network strategy to reach multiple customers and serve their individual needs.

Valuation

Li-Cycle remains an interesting one to value. I have based my target multiple based on peers in the waste and recycling sectors. These peers trade at 13x EV/EBITDA, and I assume Li-Cycle to have a 40% discount to these established players for conservatism. As such, my terminal 2025F EV/EBITDA multiple for Li-Cycle is 7x. Based on my 2025F EBITDA of $551 million, this implies an enterprise value of $2.7 billion.

Hence, discounting this by the WACC of 9.1%, I derived my target price of $16.30, with 118% upside potential.

Conclusion

I think that Li-Cycle is starting to demonstrate its competitive advantage as it goes into long term commercial agreements with large, established customers, and continues to execute well operationally, riding on the improving industry trends for battery recycling. Furthermore, the management further assured investors that their current cash pile is ample for its current growth trajectory that its pipeline will bring. My price target for Li-Cycle is $16.30, implying an upside potential of 118% from current levels.

Be the first to comment