Joe Raedle

Stanley Black & Decker (NYSE:SWK) engages in the tools & storage and industrial businesses globally. The firm’s primary products include, electric power tools and equipment, pneumatic tools and fasteners, home products, garden products, hydraulic tools and performance-driven heavy equipment attachment tools.

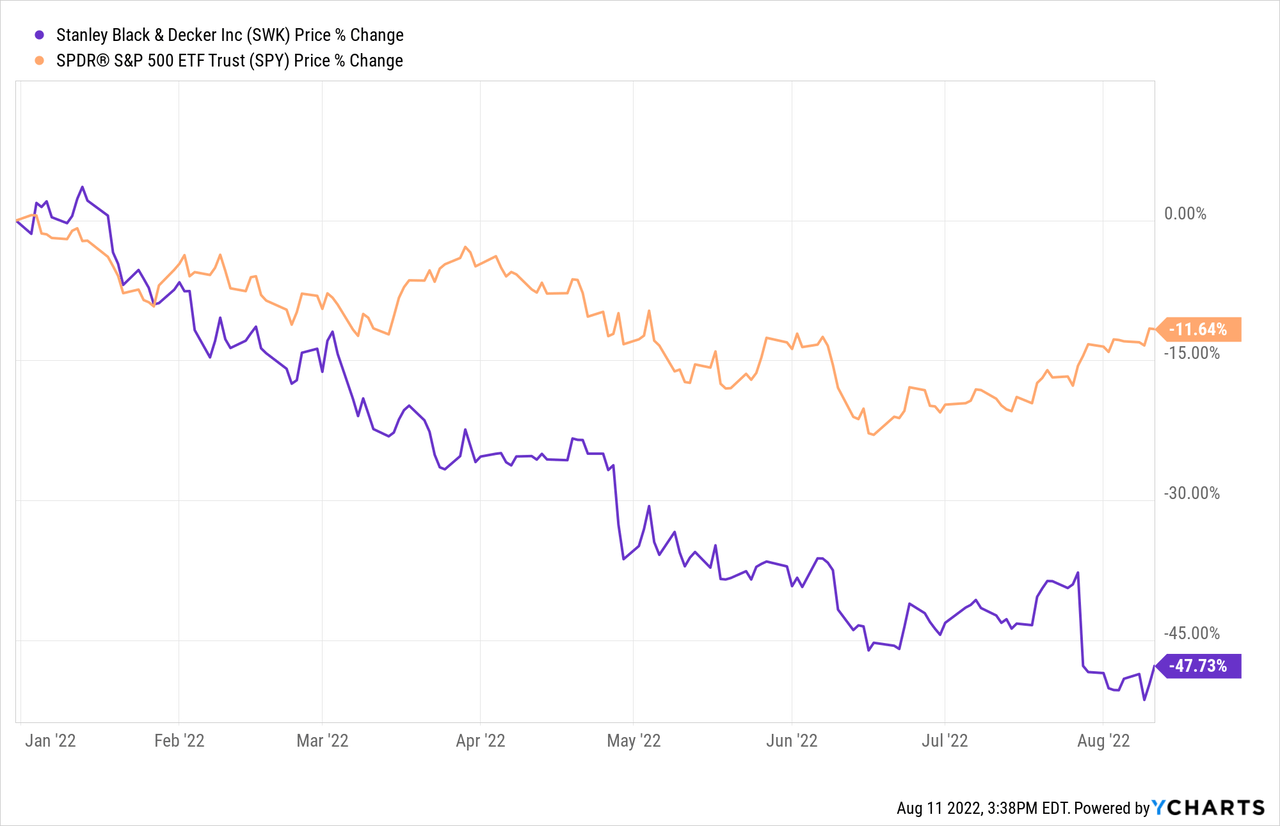

The company has lost almost half its market value year to date, while the S&P 500 (SPY) has only declined by 11% in the same time period.

In this article, we will elaborate on a number of factors that could be shaping SWK’s stock price in the near- and long-term, focusing on what the pros and cons of investing in SWK now could be.

Let us start with the cons.

Cons

1.) Consumer sentiment

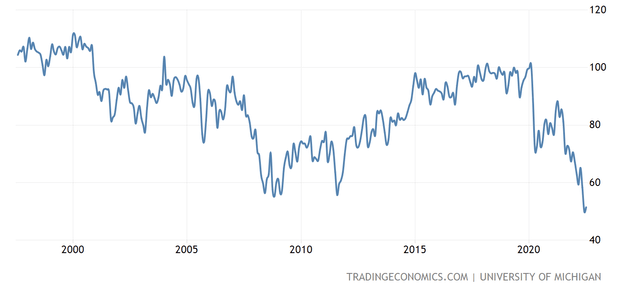

Consumer confidence is often used as a leading economic indicator, in order to gauge potential changes in the consumer spending trends. A low or declining consumer confidence is a signal that people are reluctant to spend larger sums of money and are more likely to save, as their financial outlook is worsening.

U.S. Consumer confidence (tradingeconomics.com)

This kind of a behaviour likely leads to reduced spending on durable, discretionary, non-essential goods. SWK’s products are mainly durables, therefore we believe that the demand for the firm’s products in the short term is likely to be materially impacted.

This negative impact on the demand is already visible in the second quarter financial results:

Net sales for the quarter were $4.4 billion, up 16% versus prior year driven by strategic outdoor power equipment acquisitions (+24%) and price realization (+7%), partially offset by lower volume (-13%) and currency (-2%). The Tools & Outdoor demand softened during the last portion of the quarter, compared to expectations in retail outdoor products and across the Tools businesses. Additionally, the Outdoor business experienced a very slow start to the core selling season due to poor weather.

The firm has also adjusted their guidance for the rest of 2022, to account for the slowing demand.

Not only the sales figures indicate the slowing demand, but inventory has been also growing at a faster than expected pace in the second quarter.

Inventory at the end of the 2Q’22 was $6.6 billion, up approximately $400 million compared to 1Q’22. Inventories remained elevated versus expectations and prior year due to the impact of softer demand and the dwindling effects of supply chain constraints.

In our opinion, the rising interest rates, the rising inflation, the geopolitical tension in the Eastern European region and the deteriorating U.S.-China relationship are all contributing to the low consumer confidence.

For the rest of 2022, we do not expect significant improvements in these areas, therefore we believe that the demand for SWK’s products is likely to remain depressed in the near future. On the other hand, we have to highlight that SWK is actively working on slowing the finished goods manufacturing in order to bring down inventory levels, which is expected already in the third quarter.

2.) Commodity prices

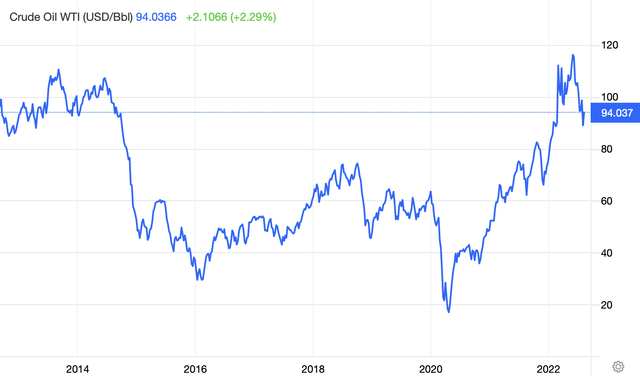

In February 2022, energy prices have skyrocketed as the tension between Ukraine and Russia has unfolded.

WTI prices (tradingeconomics.com)

While the price of WTI crude oil has come down significantly from its June highs, the price level remains elevated compared to the pre-pandemic levels.

The high prices combined with the supply chain disruptions resulted in a gross margin contraction in the second quarter.

Gross margin for the quarter was 27.5%. Excluding charges, gross margin* was 27.9%. Gross margin* was down 800 basis points from prior year, as price realisation was more than offset by commodity inflation, higher supply chain costs and lower volume.”

The declining oil price is likely to have a positive impact on the third quarter results, primarily on the margins and it is also expected to result in a slowing inflation, as already seen in the July CPI.

While we expect the oil price to remain elevated for the rest of 2022, we believe it has already peaked in June. Therefore, in our opinion this headwind is likely to be temporary.

3.) FX risk

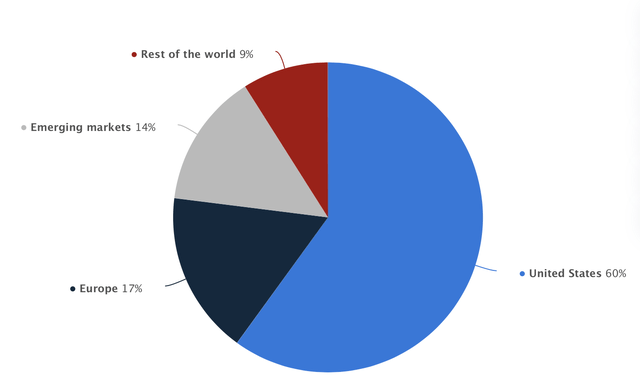

As much as 40% of SWK’s revenue is coming from abroad. Meaning that the strong USD has a material negative impact on the sales figures of the firm.

Revenue by region 2021 (statista.com)

The firm has reported in the second quarter that the currency exchange had a -2% impact on the sales, partially offsetting the net sales increase driven by strategic outdoor power equipment acquisitions.

Let us take a look at some of the factors that could make SWK’s stock attractive at this point.

Pros

1.) Dividend

Stanley Black & Decker has a long history of returning value to its shareholders in the form of dividend payment.

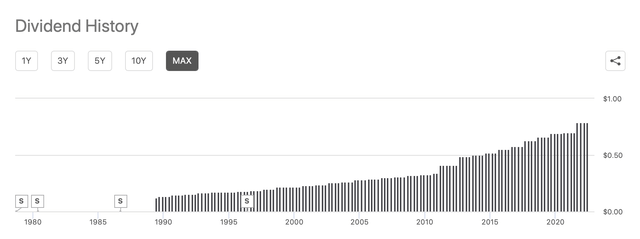

The company has been paying dividends each year in the last 53 years and even managed to increase these payments every single year.

Dividend history (Seekingalpha.com)

Currently, the firm pays a quarterly dividend of $0.79 per share, which corresponds to a yield of about 3.3% annually.

Important to note that dividend payment and dividend growth are not the only crucial factors to consider. The safety and sustainability of the payments also need to be accounted for.

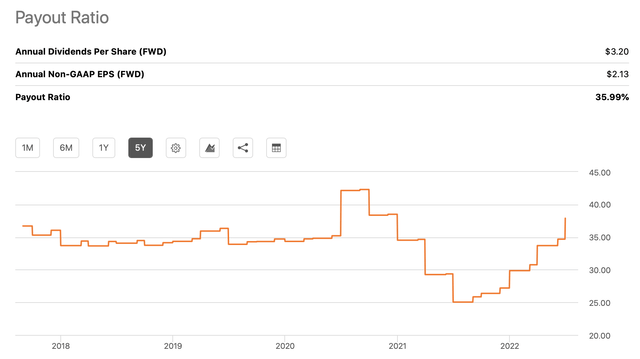

Payout ratio (seekingalpha.com)

While the dividend payout ratio (TTM) (Non GAAP) of 36% is above the firm’s own 5 year historical average and also above the industrials sector median, we believe that the payments are sustainable.

Although analysts are expecting EPS to decline in 2022 and 2023, the firm’s commitment to dividend payments in the last 50 years indicates that the dividends are not likely to be cut or paused.

For these reasons, in our view, SWK could be an attractive stock for dividend and dividend growth investors.

2.) Strategic initiatives

The firm is currently working on a number of initiatives, with the primary goal to save costs and become more efficient. These strategic initiatives are likely to show positive impacts in 2023.

The following initiatives are expected to reduce costs by as much as $1 billion through 2023:

- Accelerated supply chain transformation ($0.5 billion)

- Simplified corporate structure ($0.2 billion)

- Optimised organisational spans and layers and prioritised investments in the core businesses ($0.1 billion)

- Reduced indirect spend ($0.2 billion)

Further, the firm is aiming to achieve an adjusted gross margin of at least 35%. To improve the efficiency the firm is planning to introduce the following changes, resulting in an additional $1.5 billion cost reduction:

- Leveraging strategic sourcing and contract manufacturing ($0.5 billion)

- Consolidating facilities with a 30%+ reduction in manufacturing facilities from approximately 120 today ($0.3 billion)

- Executing our SBD Operating Model to deliver operational excellence through efficiency, simplified organizational design and inventory optimization ($0.4 billion)

- Platforming products and implementing initiatives to drive a 40%+ SKU reduction ($0.3 billion)

In our opinion, these strategic decisions are all likely to benefit SWK’s business in the long term. Once demand picks up again, SWK will likely be able to fulfil the demand of the customers in an agile and more efficient way.

We believe that for these reasons, SWK’s stock could be attractive for investors with a longer investment horizon.

Key takeaways

SWK’s business and its share price is likely to be negative impacted in the short term by the declining consumer confidence and the declining demand for their products. Elevated energy prices have also led to the contraction of the gross margins. On the other hand, we believe that these headwinds are temporary and are not likely to impact the firm in the long term.

The 53 years of dividend payment history makes the firm attractive for dividend and dividend growth investors.

The firm’s strategic initiatives aimed to reduce costs and improve efficiency are likely to positively impact SWK’s performance in 2023 and beyond.

For these reasons, we currently rate SWK’s stock as “hold”.

Be the first to comment