bjdlzx

(Note: This article was in the newsletter on June 14, 2022 and has been updated as needed.)

There is a general feeling that smaller companies are riskier than larger companies when investors try to determine the relative risks of an investment. While that is generally true, there are smaller companies such as Magnolia Oil & Gas (NYSE:MGY) that mitigate those small company risks effectively enough to compare very well with far larger companies that supposedly have more diversification and deeper management in their favor. Sometimes, those supposedly “riskier” smaller companies are a better bet on an upside that far outweighs the downside potential.

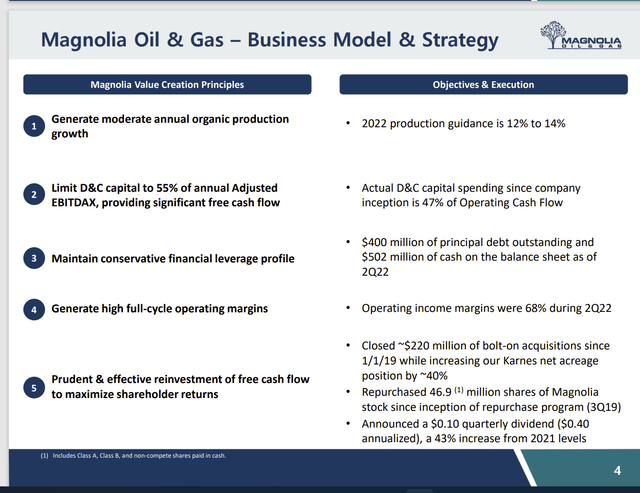

Magnolia Oil & Gas Strategies To Minimize Risk (Magnolia Oil & Gas August 2022, Investor Presentation)

For many potential (and actual) investors in the company, managing downside risk in a particularly volatile industry is a paramount consideration. This company tends to keep the financial leverage ratio well under 1. That is one of the most conservative ratios of all the companies I follow. It allows management to go shopping for deals during downturns when there are few buyers and lots of distressed sellers. That conservative ratio allows management to expand production at a time when it is particularly cost-effective to expand production. All of this allows for profitable growth to offset the normal downside pressure when commodity prices weaken.

This company also has had the means to repurchase shares whenever management felt that was the thing to do. A share repurchase program adds to demand for the company stock. Therefore, a share repurchase program aids in reducing the downside risk of an investment. So many times, share repurchase programs are conducted at market tops. Those same companies have too much debt (and sometimes too much high-cost production) to repurchase shares when the stock price is very low.

The organic growth combined with the bolt-on acquisitions and the share repurchase program have allowed this company to report some impressive per share growth rates. Mr. Market loves a growth story, and this company has posted one almost from the start.

Those bolt-on acquisitions also minimize acquisition risk. The company buys small acquisitions which have a far better success rate, and it sticks to areas it knows best. This strategy when combined with the other management strategy makes this company a far lower risk investment than is normally the case for growing companies. Yet, the emphasis on low-cost production also allows for above-average profitability to ensure an above-average track record to add to potential purchasing interest in the stock.

Probably the most obvious way to demonstrate faith in the future of the company was an unusually large purchase by the company of 2 million shares of stock from the recent offering by EnerVest of some of its shares to the public. Financially strong companies can do this, and it shows that management believes that the shares are cheap. That is in addition to open market purchases of stock in the program underway. This can also be interpreted as an attempt to bypass the period of stock price weakness that often follows a public offering of stock. It may well work too since it is the company repurchasing a significant number of shares of its own stock.

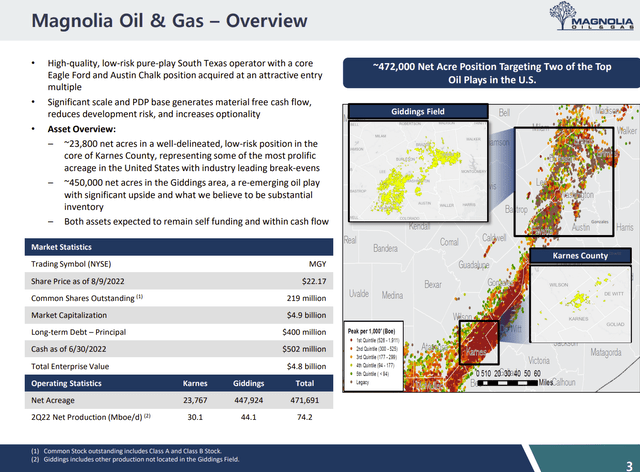

Magnolia Oil & Gas Acreage Performance And Advantages (Magnolia Oil & Gas August 2022, Investor Presentation)

Anytime an investor sees a breakeven point as low as what is shown above, then the company will be very profitable. This company is also likely to adequately cash flow during industry downturns.

The Eagle Ford has a couple of advantages over the more sought-after Permian acreage. The takeaway capacity has long been adequate, and future takeaway issues are unlikely because there is no emphasis on this profitable basin. Therefore, growth is relatively tame, and midstream volume increases have so far been easily handled by the existing operators.

The lack of attention has also (in the past) allowed the Eagle Ford production to sell at a premium to the benchmark. That has turned out to be a significant advantage to the Permian. Takeaway issues would develop to result in operators discounting the production while paying for expensive trucking to get the product to market. Given the continued attention to the Permian acreage and the production growth, it would not be out-of-line to predict that additional takeaway issues are likely to develop in the current upswing that results in more product discounting.

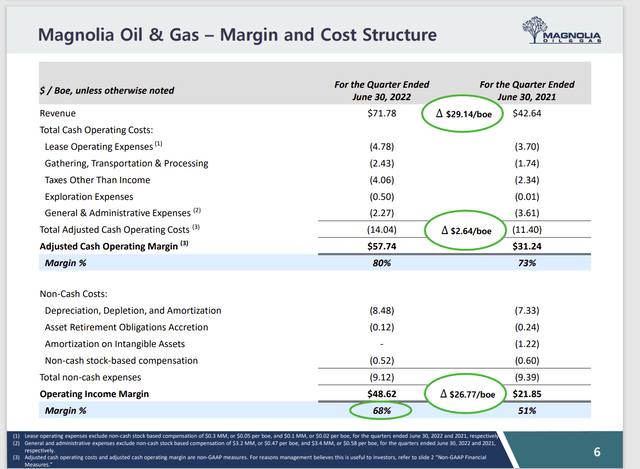

Magnolia Oil & Gas Key Operating Costs And Margin (Magnolia Oil & Gas August 2022, Corporate Presentation)

The first thing to note is that the low costs shown above back up the low breakeven price management states very well. Most breakeven costs imply a certain profit percentage (that is likely but does cover some expected complications). As the costs above demonstrate, the actual breakeven point on these wells without accounting for any risk is considerably lower.

Furthermore, the single largest increase in costs was the royalties. Those costs go back down with the prices. Some of the other costs may also decline during periods of weak pricing. But the royalties are the most noticeable cost to vary with industry pricing.

Another cost that is declining with company growth is the general and administrative costs. This is usually a sign of tight-fisted management. Along with this is another slide (not shown here) that shows a considerable increase in cash flow from the margin increase.

There are a lot of companies that tout a great margin while mitigating a lack of production to lead to sufficient cash flow even with a great margin. This is a notorious practice among secondary recovery experts. As a result, I followed several of them to bankruptcy even with those great margins.

This company, on the other hand, appears to balance costs with expected profits in a way that results in above-average profitability. Therefore, the margins noted above have more credibility because those margins are backed up with a generous cash flow. That cash flow also gives the reserve report a credibility it can lack when there is insufficient cash flow.

The Future

Management will likely continue to make small bolt-on acquisitions. That often leads to accretive transactions because small positions are hard to sell. Oftentimes, management can piece together smaller bolt-on transactions into a valuable, larger and far more marketable holding which creates value for shareholders before the first well is drilled on the property. This process often involves extra work for management that many managements cannot be bothered with.

The organic growth is likely to be above average due to the low breakeven price cited for wells drilled. The Eagle Ford will continue to be a superior place to do business as long as there are no future takeaway issues as there have been in the Permian for many midsized and smaller operators.

Investors pay management to make profits where many cannot see profits to be made. Yet that seldom happens when it comes to actual execution. This company is likely to be an important exception for a lot of reasons noted above. That also means that investors are investing in darn good management.

Good management often surprises to the upside. Therefore, it is not a bad idea to consider a long-term holding in a growing company like this one. The results are often far better than some of the more obvious proposals. Good management is often the most valuable asset, and it is not on the balance sheet. This management could easily be one of the best that I follow.

Be the first to comment