Sundry Photography/iStock Editorial via Getty Images

Introduction

Ryder System (NYSE:R) is a very interesting stock. This Florida-based company operating in the rental & leasing services industry offers investors a dividend yield of more than 3%, which is more than almost all of its high-quality transportation peers. Yet, total returns have been lagging behind as the company has failed to generate “value” comparable to various transportation peers who have a history of turning accelerating free cash flow into ever-increasing shareholder distributions. However, Ryder isn’t dead money. The company rejected a takeover offer this year and is spending billions on its business, which explains why free cash flow is so low. The company is offering increasingly capable services and I have little doubt that the company will get more acquisition offers in the future. In this article, we will cover all of this and discuss what to make of this company from a dividend growth point of view.

So, bear with me!

What’s Ryder System?

Ryder System is a $4.2 billion market cap company operating in the rental & leasing services industry. The company was founded in 1933 and is located in Miami, Florida.

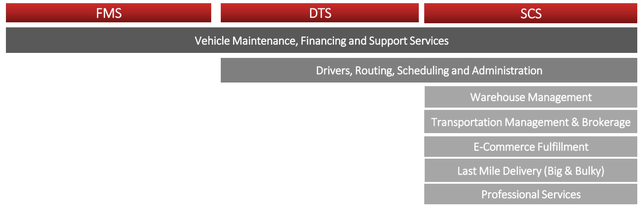

The company engages in Fleet Management Solutions (58.8% of total sales), which…

… provides full service leasing and leasing with flexible maintenance options, commercial rental and maintenance services of trucks, tractors and trailers to customers principally in the United States (U.S.), Canada and the United Kingdom (U.K.).

Its second segment is Supply Chain Solutions (32.6%), which…

… provides integrated logistics solutions, including distribution management, dedicated transportation, transportation management, e-commerce and last mile, and professional services in North America.

Last but not least, the company has Dedicated Transportation Solutions (15.1%), which…

…provides turnkey transportation solutions in the U.S., including dedicated vehicles, drivers, management, and administrative support. Dedicated transportation services provided as part of an operationally integrated, multi-service, supply chain solution to SCS customers are primarily reported in the SCS business segment.

What this means is that Ryder is a major beneficiary of the ongoing outsourcing trend where companies focus on core operations instead of capital-intensive transportation. For example, Fleet Management Solutions offers a full-service leasing service and flexible maintenance options, shorter-term commercial vehicle rental, contract or transactional maintenance, and digital and technology-supported services that optimize asset performance.

FMS also provides vehicles and maintenance, fuel, and other services used in its SCS and DTS segments.

As a result of Ryder being a leasing company, it owns roughly 260 thousand vehicles and 80 million square feet of warehouse space with 750 maintenance locations to service customers and its own fleet.

Essentially, the demand for Ryder’s services has accelerated because of the pandemic. While outsourcing and e-commerce are trends that started before I knew what the internet was all about, it is now seeing accelerating demand for advanced supply chain solutions. Especially when it comes to inventory management as I discussed in a recent GXO Logistics (GXO) article.

In the case of Ryder, the company provides e-commerce distribution to 100% of the US population within 2 days. It provides last-mile transportation to every citizen in the continental USA as well as data analytics that help customers improve supply chains and better understand where and how to improve profitability.

What’s important to mention is that Ryder isn’t as short-term as your local car rental service. Ryder is working with long-term contracts. 86% of operating revenue comes from contractual revenue with contracts between 3 and 7 years.

Before I go into the numbers, Ryder got a takeover offer, which the company rejected.

In May of this year, the company got an unsolicited takeover offer from HG Vora Capital Management, which wanted to acquire the shares it did not already own for $86 per share.

HG Vora currently owns 9.9% of the company.

In June, Ryder rejected the offer. This is what Ryder CEO Robert Sanchez said according to FreightWaves:

I spoke to Mr. Vora late yesterday and I informed that the board had reviewed his letter and had determined that the price indicated in his letter was not indicative of the value of our company. So our board remains committed to maximizing shareholder value and believes that the plan that we have going forward would result in a much higher value for our shareholders.

I am not a Ryder shareholder, but I believe rejecting the takeover offer was a smart move by management as I will explain in this article. Vertical Partners also shares that view as it believes that Ryder is worth at least $150 per share (currently $83), when looking at the value the different business segments bring to the table:

In its note to investors, Vertical Partners said its valuation of Ryder on a “sum of the parts” basis puts Ryder stock at $150 per share. Vertical Partners bases its view in part on the valuations of the Dedicated Transportation Services and Supply Chain Solutions divisions, which together constitute a little less than 50% of the total business, with the better-known leasing business constituting the balance. Some analysts have said the sum of the parts valuation of Ryder puts correct numbers on DTS and SCS, which the street value of the company’s stock is missing.

“While [the $150 price] feels excessive in the current environment, that is where the peer group multiples go for the DTS and SCS divisions,” Vertical Partners said in its note. “We believe we may have to get to the other side of a pending economic slowdown to get investors to pay attention to that kind of valuation work.”

Vertical Partners has reduced its valuation a bit to a 4-5x multiple, which warrants a valuation of no less than $100 given this year’s EBITDA. That’s based on the current economy and it delays a $150 valuation in my opinion. It’s not off the table.

With that said, let’s look at the numbers from a dividend-growth point of view.

Ryder’s Dividend Growth & Value

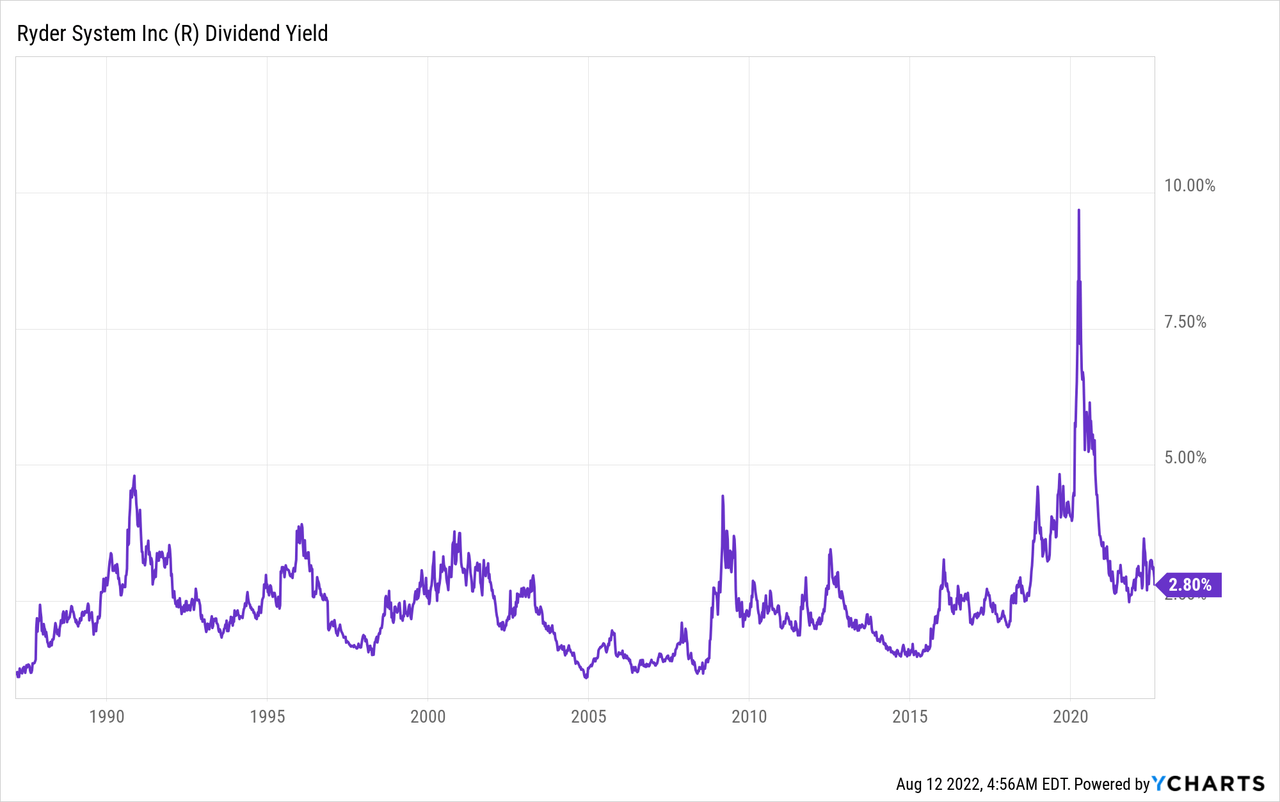

I own a lot of transportation stocks – mainly railroads. In my discussions with investors and readers, I almost never encounter people who own Ryder shares. And I believe that has a fundamental reason. Historically speaking, Ryder hasn’t been a great place to put one’s money. Going back to 1986, the company has returned 6.44% per year including dividends. While that’s not a terrible number, it underperforms the S&P 500 by quite a wide margin given the 10.8% total return of the index. Meanwhile, the standard deviation of Ryder was above 30%, which gave the stock a rather bad volatility-adjusted return (Sharpe/Sortino ratios).

Looking at the blue line in the chart above, we see that Ryder has prolonged sideways trends with regular steep drawdowns. These drawdowns occur whenever economic growth slows as Ryder depends on high utilization rates to make money from its huge fleet – to put it bluntly.

There’s nothing wrong with these drawdowns. A lot of stocks have drawdowns like that. Even highly successful stocks like one of my largest holdings, Union Pacific (UNP). However, the difference is that Ryder hasn’t been the best source of shareholder value.

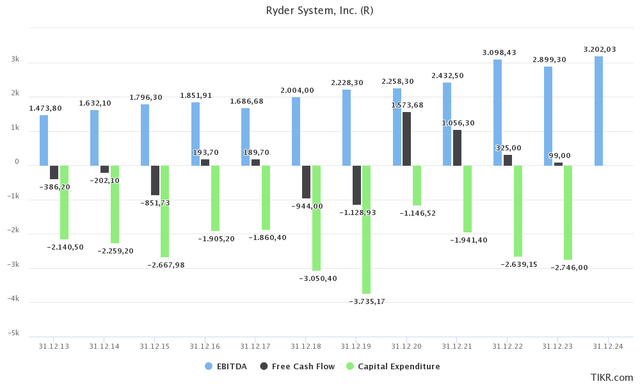

As the graph below shows, the company does not have a history of high free cash flow generation due to high investments in its business. In most years prior to the pandemic, free cash flow was negative, which prevented the company from engaging in net buybacks (a huge driver of outperformance for many stocks), and high dividend growth.

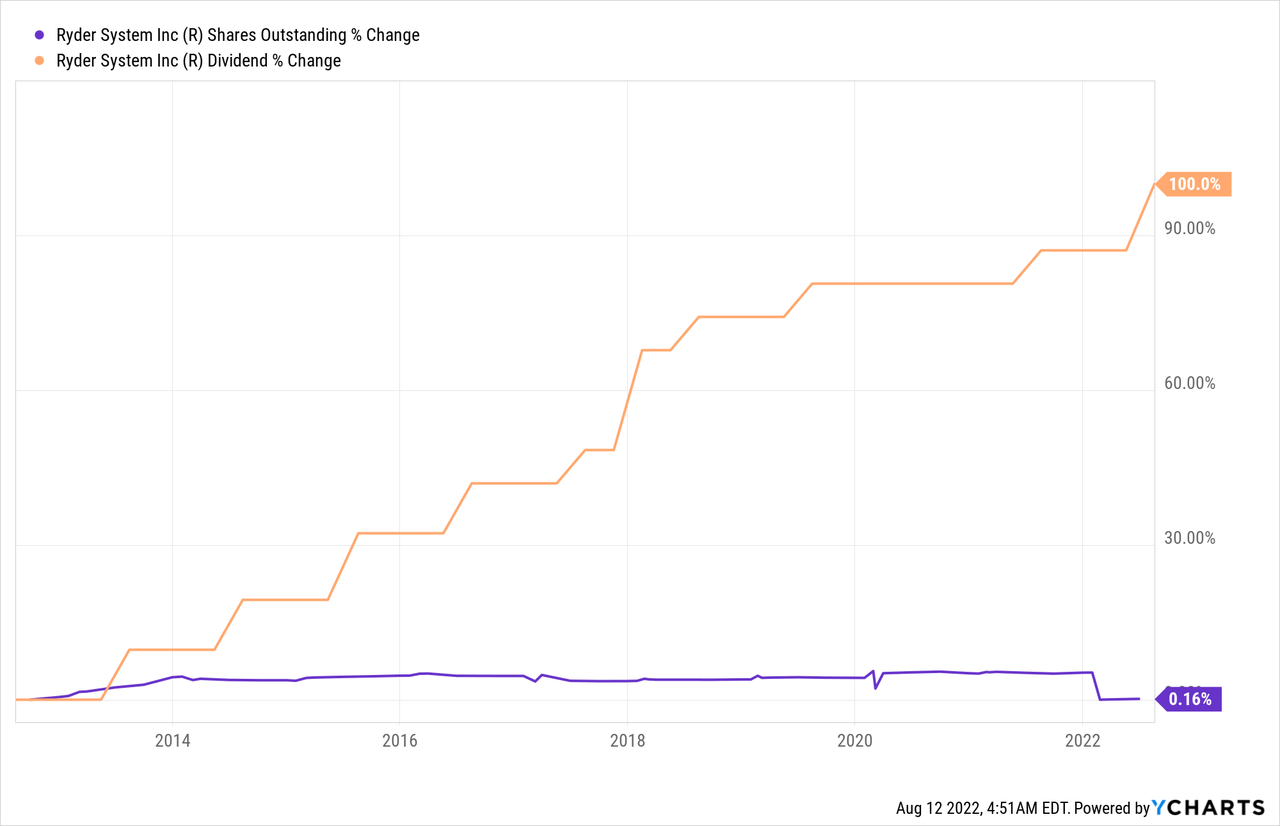

Over the past 10 years, the average annual dividend growth rate was 7.2% according to Seeking Alpha. Also note the unchanged number of shares outstanding in the chart below.

These are the most “recent” hikes:

- July 2022: 6.9%

- July 2021: 3.6%

- July 2018: 3.8%

As you can see, dividend growth was well below the longer-term average in recent years due to high investments in the company’s business.

Because dividend growth has outpaced capital gains over the past 10 years, Ryder has a decent dividend yield. The company is paying $0.62 per share per quarter, which translates to a 3.0% yield on an annual basis. The YCharts chart has not been updated, but a 3% yield is one of the highest in the past 30 years, ignoring recession sell-offs.

It is no surprise that shareholder distributions have been lagging as that’s not a company priority. That’s not a bad thing, it’s just something investors need to be aware of.

Priority number one is investing in organic growth. In order to achieve moderate fleet growth, the company needs between $200 and $500 million in annual growth capital. Base fleet replacement capital is roughly $1.8 to $2.1 billion. On top of that investments in technology are needed to boost its footprint in an industry that has gone well beyond “just” trucking.

The second use of capital is M&A as the company looks for growth in e-commerce fulfillment, last mile, and new SCS verticals. This includes RyderVentures, which invests in startups.

Free cash flow is not expected to increase in the years ahead as the TIKR chart shows. Year-to-date free cash flow is $551 million, which is the result of the sale of vehicles and properties in the UK as part of the exit of the UK business.

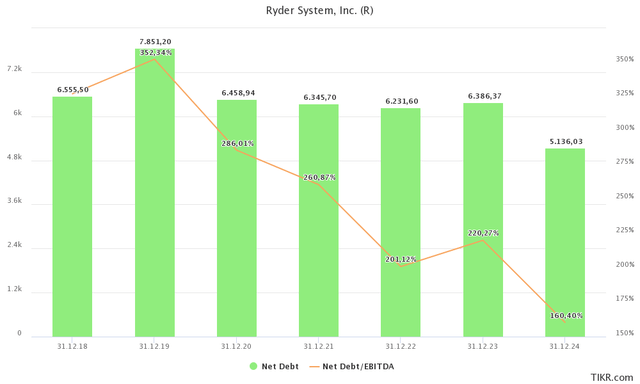

And with regard to the company’s debt, it’s expected that the company can maintain a 2.2x net leverage ratio in the fiscal year 2023 followed by a decline to 1.6x in 2024 as EBITDA is improving thanks to business investments. This could also come with net debt close to $5.0 billion. Hence, in 2-3 years, I believe Ryder will be able to boost shareholder returns.

With that said, the company is truly undervalued.

We’re dealing with a company that will likely do roughly $3.0 billion in annual EBITDA in the 2-3 years ahead. Ryder has a $4.2 billion market cap and roughly $6.3 billion in net debt. Pension-related liabilities are $190 million.

This gives the company an EV/EBITDA multiple of 3.6x.

While a subdued valuation versus fast-growing peers does make sense, we’re dealing with a valuation that is too low. Hence, I do agree with market participants who call for a gradual move to $150.

I believe the company should trade at no less than 4.5x expected EBITDA, which would imply a $7.0 billion market cap before debt reduction. That’s roughly 67% upside from current levels. That would imply a $140 stock price.

In other words, I do expect the company to get more offers from buyers.

Takeaway

Ryder is a fascinating company. From a dividend-growth point of view, it has disappointed. The company has underperformed the market by a wide margin while dividend growth has become slow and inconsistent. While the yield is 3.0%, investors are unlikely to benefit from higher distributions (including buybacks) anytime soon as the company’s priorities are its business expansion.

In order to capture growth in a rapidly evolving transportation/warehousing industry, Ryder is investing aggressively in its existing and new capabilities. This is growing EBITDA but not yet providing the basis for high shareholder returns.

With that said, there is tremendous value in Ryder. The company is trading at a very attractive valuation as the market isn’t willing to price in higher expected growth. That’s good news for companies trying to buy the entire Ryder company and investors who want to bet on high capital gains and a return of aggressive shareholder distributions 2-3 years from now.

While I agree with the company’s decision to reject the HG Vora takeover offer, I believe that new potential buyers will try to make a move. Buying Ryder’s massive transportation footprint at a discount is a no-brainer for companies looking to gain influence in major economic supply chains.

So, long story short, Ryder is a good dividend growth investment, but it’s different from companies that are already generating high free cash flow and aggressively boosting dividends and buybacks. Ryder investors need more patience and what I like to call an “ownership” mentality.

(Dis)agree? Let me know in the comments!

Be the first to comment