Justin Sullivan

Article Thesis

Oracle (NYSE:ORCL) will report its first-quarter (fiscal 2023) earnings results on Monday, September 12. We’ll take a look at what investors can expect and will evaluate whether Oracle looks like an attractive investment at current prices.

Oracle Is A Serial Earnings Beat Producer

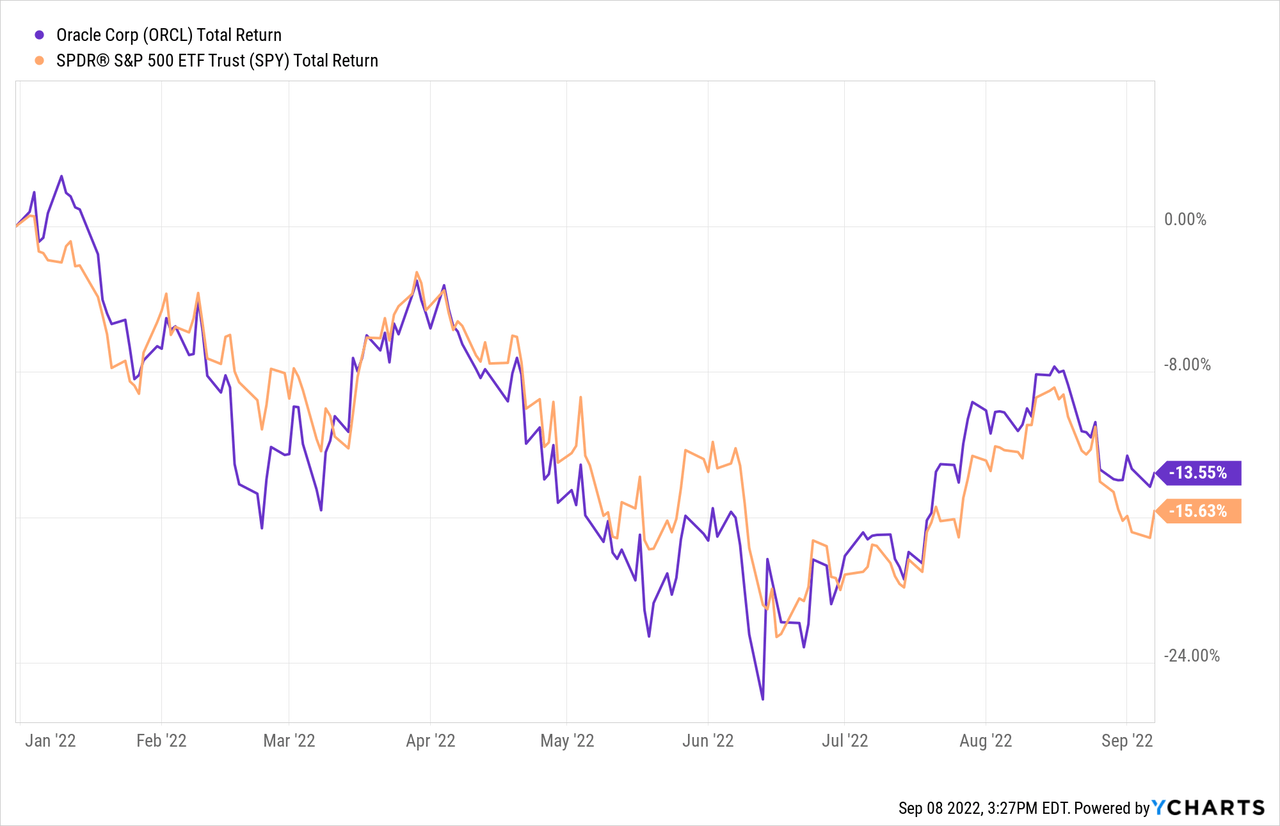

Oracle has a pretty clear history of beating Wall Street’s expectations, as we can see in the following screencap:

As we can see, Oracle has beaten earnings per share estimates in 9 out of the last 10 quarters, while revenue estimates have been beaten in 8 out of the last 10 quarters. The average earnings per share beat were in the 10% range, which is quite meaningful – it’s not like Oracle has beaten estimates by $0.01, on average. Revenue beats were less meaningful, on average. But that means that Wall Street is relatively good at forecasting Oracle’s sales, while analysts seem to perpetually underestimate its profitability.

Despite its history of beating estimates, the market reaction was varied, on average. In some quarters, Oracle’s share price declined following the earnings release even as estimates were beaten, with the most likely reason for that being that the market was not happy with Oracle’s forward guidance. That happened in September 2021, for example, when a 6% EPS beat was greeted by a meaningful stock price decline.

Oracle’s Recent Performance

Oracle’s sales performance was solid but not spectacular in recent quarters, as revenues rose at a mid-single digits pace over the last year. Profits rose faster, as Oracle kept cost controls tight, while the impact of share repurchases also played a role in the faster earnings per share growth rate, relative to the sales performance.

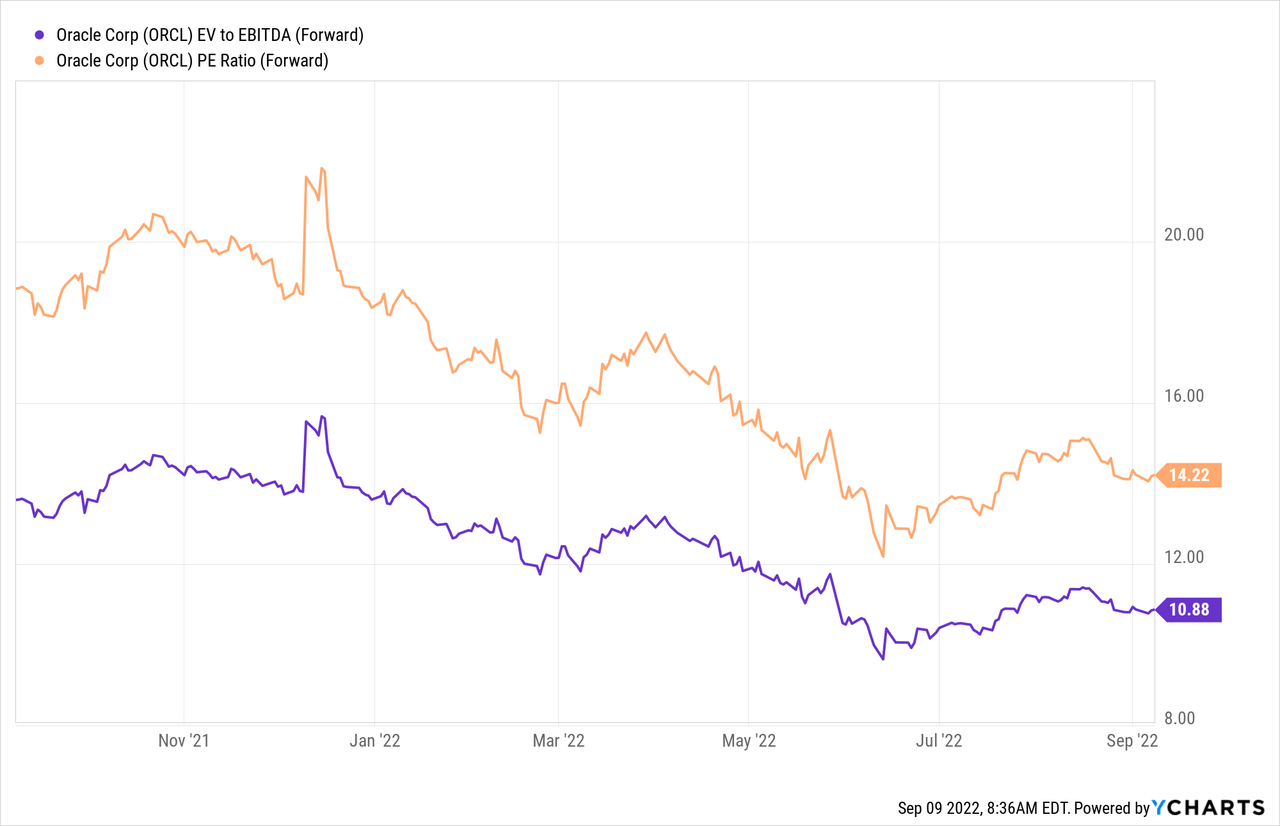

When it comes to Oracle’s share price, the performance isn’t great, however:

This year, Oracle is down 14% to date. But when one does not look at the share price performance in a vacuum, that’s still pretty reasonable, as the broad market has pulled back slightly more so far in 2022. Generally, Oracle has moved relatively in line with the broad market, as can be seen in the above chart. During sell-offs, Oracle dropped as well, while it also took part in market recoveries. That’s not too surprising, as Oracle’s beta of 0.9 suggests that there is a strong correlation between the stock’s moves and the broad market’s moves, at least in the recent past. Looking at a longer time frame of five years, Oracle has underperformed the broad market, as it rose by 40% while the S&P 500 climbed by 60% in the same period.

What To Expect From Oracle’s Q1

Since Oracle’s fiscal year is shifted versus the calendar year, the upcoming report is for Oracle’s fiscal Q1 2023, which ended August 31, 2022.

Forecasting Oracle’s results for the period is more complicated this time due to the impact of the Cerner acquisition that closed in June. Q1 is the first quarter that will include Cerner’s results, and there likely are considerable one-time items in the report, such as additional expenses for integrating the company or letting go of former Cerner employees or managers that were not needed any longer once Cerner was integrated into Oracle.

The sales increase should be higher than it was, on average, in the recent past. Cerner generated sales of $6 billion in 2021, thus quarterly sales of around $1.5 billion will be added to Oracle’s results going forward. Adding in some organic growth at Oracle, it seems likely that revenues will come in around $1.5 billion to $2 billion higher than during the previous year’s period, which translates into a growth rate of 15%-20%. That aligns with the analyst consensus, which forecasts an 18% revenue increase on a year-over-year basis.

Of course, once the closing of the Cerner acquisition has been lapped, revenue growth will slow down again, thus investors should not assume that this takeover has resulted in a permanently higher revenue growth rate for Oracle.

Analysts expect that earnings per share will come in at $1.08 for the first quarter, which would be up slightly versus the previous year’s period. Since most of the synergies will not be captured yet, and since integrating a company comes with some one-time upfront expenses, it’s not too surprising that Oracle’s profits will likely have grown less than the company’s revenue. Over time that should change, as cost synergies are captured, while upfront closing costs will not appear in future earnings reports beyond Q1.

The Cerner acquisition was an all-cash deal, thus there was no dilutive impact when it comes to Oracle’s share count. On the other hand, less cash on hand and a larger debt load lead to higher net interest expenses, which has a (small) negative impact on Oracle’s net profits. The cash outlay also means that share repurchases might be subdued for a while, as Oracle will likely focus on deleveraging for some time, which would mean a lower buyback pace for the foreseeable future.

That being said, Oracle’s balance sheet isn’t weak, thus investors don’t have to worry about the debt impact of the Cerner acquisition too much. At the end of the previous quarter, Oracle had $39 billion in cash on its balance sheet, while its debt load totaled $83 billion. That made for a $44 billion net debt position. Adding the $28 billion for the Cerner deal gets us to a net debt estimate of $72 billion. In reality, the number is likely a little smaller, as Oracle has generated some cash during Q1 to offset the debt increase, so net debt should be in the $70 billion range. That is equal to around 3x this year’s expected EBITDA of $23 billion, which is not a low leverage ratio, but which isn’t dramatic, either. Over time, Oracle should be able to deleverage meaningfully, as its free cash flows can be used to pay down some debt, while EBITDA growth will result in a declining leverage ratio as well due to the denominator increasing.

Is Oracle Stock A Good Investment Today?

Oracle is not the fastest-growing major tech company at all. Microsoft (MSFT) and many others have more consistent business and profit growth. That being said, Oracle has still delivered solid shareholder value over the years. Over the last ten years, earnings per share have roughly doubled, which pencils out to a high-single-digits annual growth rate. Combined with the dividend payments that Oracle has made, this provides very solid returns in theory.

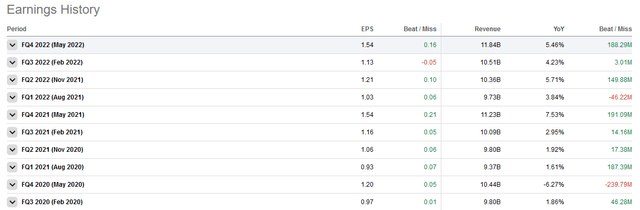

And before investors neglect Oracle versus faster-growing software players, they should also consider valuations:

Oracle is relatively inexpensive, trading at an 11x EBITDA multiple, while its net profit multiple is 14 today. That’s on the lower end of the range Oracle has traded at over the last year, and it also represents a discount versus how Oracle was valued over the last decade, as the 10-year median earnings multiple is 18, or around 30% higher than the current valuation. We can thus say that Oracle might be a better value today, relative to how the company was valued in the past. On the other side, its balance sheet employs more leverage than it used to, following the closing of the Cerner acquisition, which arguably warrants a bit of a discount versus the historic valuation norm. No matter what, Oracle to me seems like an equally good investment today, relative to the last couple of years.

Oracle’s dividend yield is 1.7% right now, which is more or less in line with the broad market’s yield. The dividend growth rate has been compelling, as it averaged 13% over the last five years. If Oracle was able to keep that dividend growth rate in place for a longer period of time, investors would see their yield on cost rise very meaningfully over the years. Since analysts are forecasting a long-term earnings per share growth rate of 9% for Oracle, and since the payout ratio is pretty low at just 24%, there is a lot of potential for further dividend increases, I believe.

Oracle is not the highest-quality or highest-growth software player. But it generates solid business growth and its cloud business is performing well. With an undemanding valuation, potential for synergies following the Cerner acquisition, and steady dividend growth, Oracle could be a solid pick at the current price, although it does not seem like a must-own stock.

Be the first to comment