M. Suhail

One of the core investment theses that got me into the stock market originally was the overblown assessment of Amazon’s (NYSE:AMZN) impact on any consumer-facing retailer. I am a huge fan of Amazon, and have been a Prime member for over a decade, but 5 or 6 years ago, the sky was falling across all of retail and I thought it was lazy investment analysis to assume Amazon would crush the entire industry.

That seems easy to say now. Amazon put plenty of retailers into bankruptcy. However, The Home Depot (NYSE:HD) was never going to be one of them. The best retailers were either insulated from the pressure, or shifted with the times and the consumer was better for it.

The home improvement industry in some ways facilitates the American dream. When I bought my first house, it was the ultimate symbol that I had arrived in adulthood and for many, their home is their number one asset and part of their retirement plan. Either through contractors or DIY (vastly better these days thanks to YouTube), most suburbanites have tackled a major home project and are very familiar with HD and it’s blue-themed competitor, Lowe’s (NYSE:LOW). I’m a fan of Lowe’s as a shopper when given the choice, but these days I tend to look at both to find the right brand or price point.

The power of HD’s brand and the loyalty it maintains among its DIY and Pro customers makes it among the bluest of the blue chip stocks. I read a book once by one of the founders of HD, and the commitment the company has to its customers has created a culture that is difficult to replicate. The company transformed the hardware and home improvement space nearly half a century ago, and continues to set the standard today.

Recent Results

Looking at the company’s most recent quarter, it’s tough to find a flaw. Sales were up 6.5%, comparable store sales grew 5.8% on the back of difficult comps last year post-COVID. Average tickets grew 9.1%, and all other key metrics are pointed in the right direction. Earnings were up 11.5% on the back of a fantastic year last year.

Retail lives and dies by the consumer, so recessionary pressures are real. However, none of that has reached HD based on the results. With rising interest rates, it’s apparent the housing market has slowed down, home prices have stalled and fallen in many places, and many are calling for a decline in the housing market as a whole. The CEO Ted Decker had this to say on the call:

[W]e’re seeing overall in the business the questions about housing and the economy, all very real questions. Again, things we’re following closely but, I mean, we just couldn’t feel better about our business. We just reported record quarterly sales and profits and re-affirmed our guidance, and that’s on top of the $40 billion in growth in the past two years. We see a very engaged customer, each DIY and Pro. And as Richard said though, we are operating in a unique environment with many crosscurrents, inflation and interest rates and supply chain disruptions and the like.

But given all that, our customer in our markets has been incredibly resilient. As Jeff said, project demand is incredibly strong. Our Pro in particular is very strong, and their backlog remains healthy. In DIY, we did see some seasonal weakness. But as we parse through that, it’s difficult to say is that weakness in the seasonal businesses the overlap of the two prior incredibly strong years? Is it the weather where we had a really bad and late spring and then it turned incredibly hot across the country? Or are they fundamental demand pressures? Again, we have not seen a broad-based fundamental demand pressure in the business.

-Ted Decker, Home Depot CEO, Q2 Earnings Call

HD survived the housing bubble collapse in 2007-2009, so I’m not concerned about the company’s long-term viability, but this is definitely a risk to consider as you choose whether to invest in the company.

On a side note, it cracks me up that there are basically product advertisements in the middle of the earnings call. If you haven’t listened to one, check it out. I’ll cite my favorite one below:

One example in building materials where we launched nationally Henry’s Tropi-Cool Roof coatings. This new formula offers maximum reflectivity, helping reduce cooling costs. Henry’s Tropi-Cool can be applied in any season, is 100% waterproof, and rain-safe within 15 minutes of application. And this product is exclusive to The Home Depot in the big box channel.

-Jeff Kinnaird, EVP Merchandising

I’m impressed by Mr. Kinnaird’s commitment to merchandising. Who knows, maybe there’s a sales bump just from all of us listening.

Growth

HD currently operates 2,316 stores for a total retail square footage of 240M. Home improvement is a mature industry, and HD is a mature company. Don’t expect sales growth to set the world on fire here. However, management sees the total addressable market at $900B in a fragmented market environment, leaving room for the company to continue its sales growth over the long-term.

Additionally, the company’s acquisition of Interline and HD Supply have pushed the company into the MRO (Maintenance, Repair, and Operations) space, for a likely $100B market opportunity. This is important as the industry is not nearly as cyclical as housing based on maintenance needs for companies. Integration of this offering into the company’s ecosystem is something I trust management to handle well based on past initiatives and metrics I will discuss below, and it’s important to see the company continuing to invest in growth.

As I mentioned above, the best retailers have shifted with the times, and HD’s embrace of the omnichannel concept has taken form nicely. I’ve purchased several items online for both delivery and in-store, and unlike in years past, the experience was seamless and didn’t feel clunky when compared to the likes of Amazon and other online-native retailers. Most recently, over 50% of online orders were fulfilled in-store, and online sales grew over 10%.

Lastly, improvements in the supply chain were driven by $750M in capex in the most recent quarter as the company rolls out new fulfillment centers and improves timeliness in merchandising. The ultimate goal here is to improve how quickly the company is able to deliver products into the hands of its Pro’s, and this will continue to build out the company’s moat and overall brand loyalty.

Important Metrics

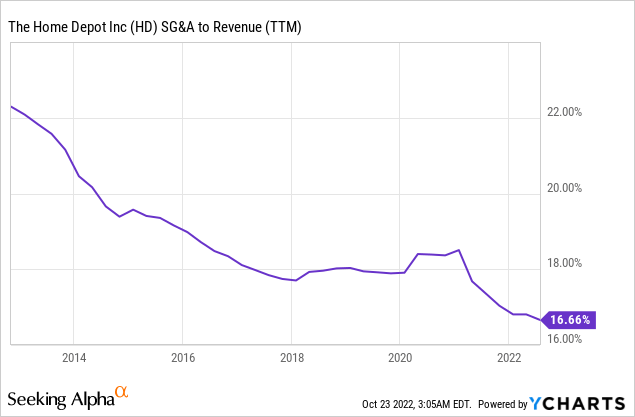

No retailer analysis would be complete without looking at Selling, General, and Administrative expenses. The graph above depicts these expenses as a percent of sales volume, which shows whether a retailer is sacrificing efficiency for sales gains. Notice the downward trajectory over the last 10 years as the company has driven improvements in omnichannel and merchandising. Nothing to add here, this is exactly what you want to see.

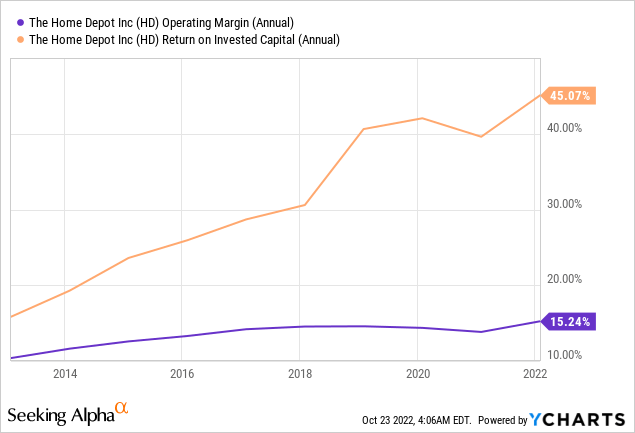

For profitability, both of these metrics are pointed in the right direction, as well. Management’s initiatives continue to drive margin improvements, and the returns on invested capital compared to Morningstar’s weighted average cost of capital at 8.4% show excellent shareholder value creation. Whenever management teams are talking about exciting new initiatives and how they intend to improve the business, the metrics above will show you whether that is being born out.

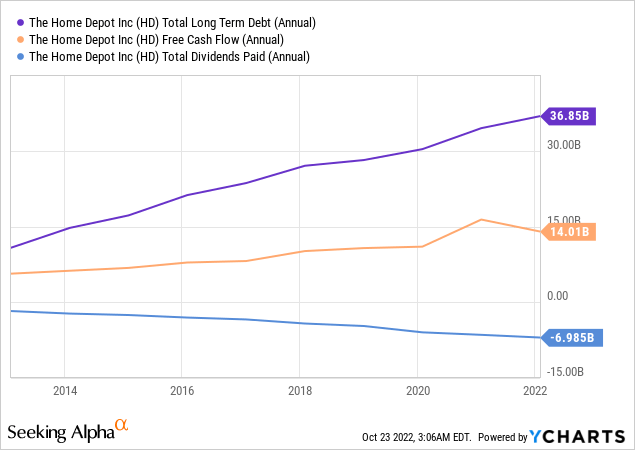

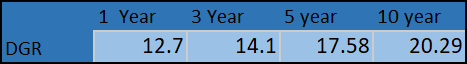

As for the dividend, HD has increased the dividend every year for 13 years after freezing it during the housing crisis. Growth is solid, as shown below, and well covered by free cash flow. Long-term debt is growing, but not outside the box compared to the company’s profitability. Most recently, interest and other expense stood at $379M, so not moving the needle for a company of this size.

DRIP Investing Dividend Champions Spreadsheet

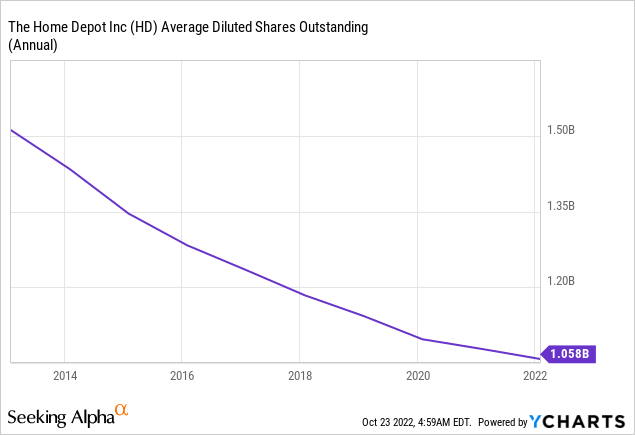

After the dividend is paid, the company has been a serial acquirer of itself. This is a breath of fresh air after spending my time looking at high-flying tech companies where share-based compensation is a plague on the balance sheet. Over the past ten years, management has cannibalized nearly a third of the entire share count, making each shareholder own just that much more of the company year after year.

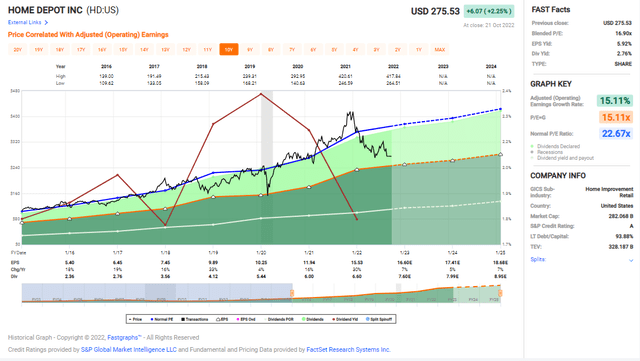

On the shorter-term valuation graph, the company is trading a little above COVID lows from March 2020. Earnings are pointed in the right direction, and the company is well below its average valuation.

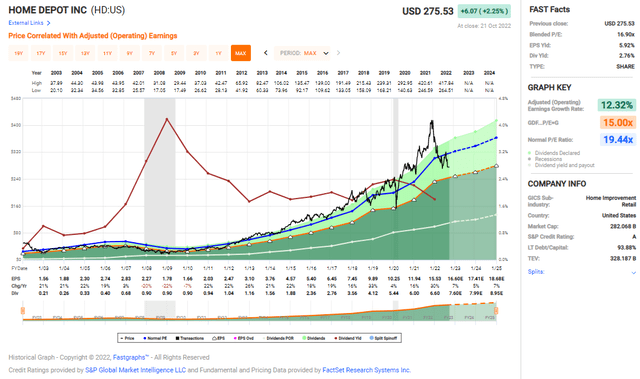

Zooming out, earnings are as expected and on an excellent trajectory from housing market lows in 2009. The stock price is below its long-term average valuation, as well.

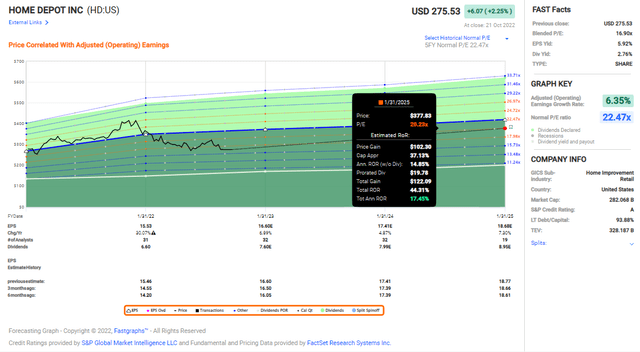

The normal P/E ratio over the long-term, including the housing crisis, is around 20X, so I’ll use that here. If the company were to return to those levels while factoring in analyst estimates for earnings growth over the next few years, investors could see upwards of a 17% annualized total return. This is strictly an exercise in showing what could happen, obviously your mileage may vary.

My conclusion is that HD is a solid buy here. I own shares of HD, and the dividends continue to reinvest and compound away in my IRA. I’m likely not adding here, considering some of the other deals in the market that I hope to continue to write about in the coming weeks, but investors could do much worse. HD is a stalwart blue chip, firing on all cylinders, and trading below its average valuation. Enjoy the nearly 3% dividend yield while it lasts.

Disclaimer: This article is for informational purposes only and represents the author’s own opinions. It is not a formal recommendation to buy or sell any stock, as the author is not a registered investment advisor. Please do your own due diligence and/or consult a financial professional prior to making investment decisions. All investments carry risk, including loss of principal.

Be the first to comment