David Ramos

Shares of Verizon (NYSE:VZ) dropped 4.5% on Friday after the telecom submitted its third-quarter earnings sheet, despite the company seeing robust momentum in its broadband business. Verizon, like AT&T, also reported strong free cash flow for the third-quarter which should remove any doubt about the telecom’s dividend sustainability. However, shares dropped to their lowest price in more than a decade after the telecom also reported an unexpected decline of phone subscribers in Q3’22. I believe, given the low valuation, high yield and good dividend coverage, that shares of Verizon could revalue higher!

Verizon’s Q3’22 earnings sheet

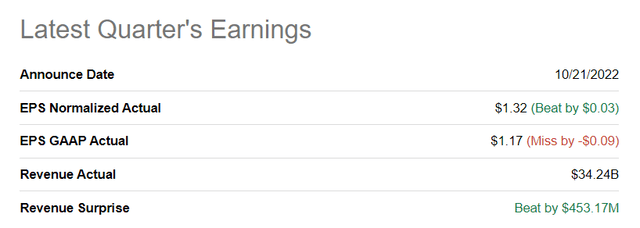

Verizon delivered a strong earnings sheet for the third-quarter with earnings of $1.32 per-share, which beat analysts’ projections of $1.29 per-share. Third-quarter revenues hit $34.2B, beating the average projection as well.

Seeking Alpha: Q3’22 Earnings Results

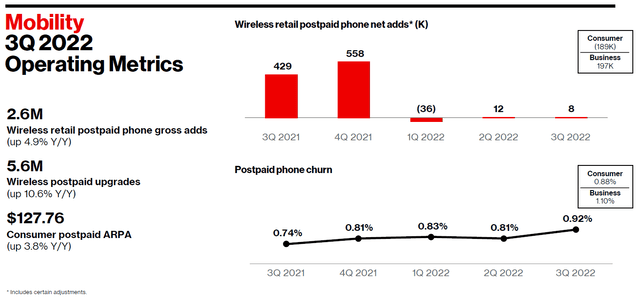

Verizon lost nearly 200 thousand post-paid phone adds in Q3’22

Weakening performance in Verizon’s consumer post-paid phone business explains the market’s reaction on Friday, although I still believe that the market overreacted to the telecom’s results. Verizon posted a 189 thousand subscriber net loss in its post-paid phone business in the third-quarter. AT&T reported 708 thousand net adds in its post-paid phone business. The reason: Verizon increased prices in the third-quarter which drove at least some customers over to AT&T.

Source: Verizon

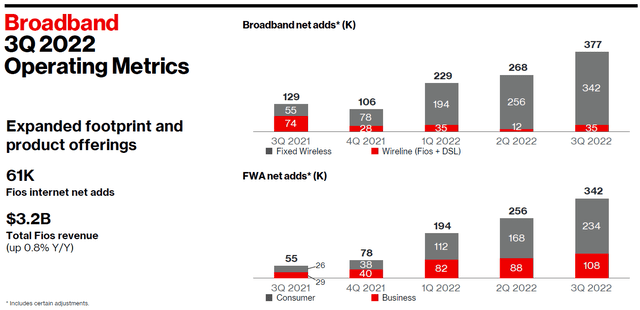

Broadband momentum

Verizon, like AT&T, benefited from strong broadband momentum in the third-quarter, especially in its consumer business.

Verizon added 377 thousand new broadband customers in the third-quarter, after adding 268 thousand in the prior quarter and 229 thousand before that. Broadband momentum continued to be driven chiefly by the fixed wireless consumer business which saw another 234 thousand customers signing up with Verizon in the last quarter. Verizon’s fixed wireless net adds in the third-quarter exceeded the firm’s Q2’22 net adds by 66 thousand. Verizon is rolling out broadband access aggressively and is covering more locations as part of its broadband growth strategy.

Source: Verizon

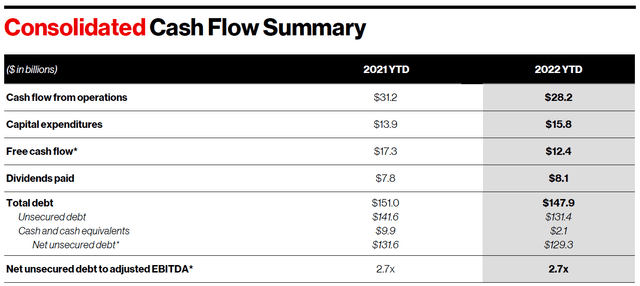

Free cash flow and dividend coverage

Verizon reported free cash flow for the first nine months of FY 2022 of $12.4B. From January through September, Verizon paid $8.1B in dividends which calculates to a dividend payout ratio, based off of free cash flow, of 65%. Verizon generated $5.2B in free cash flow in the third-quarter and paid about $2.7B in dividends which means the Q3’22 payout ratio was just 52%… which should serve as proof that the telecom is under no pressure to adjust its dividend payment any time soon.

Source: Verizon

In my last case study about Verizon, I predicted that the telecom could achieve at least $13.5B of free cash flow in FY 2023, implying a 30% year over year drop due to bill collection challenges. With $12.4B in year to date free cash flow, Verizon is already 92% there.

Therefore, after Verizon’s better than expected third-quarter results, I am reverting back to my base case assumption of $17.6-18.7B in free cash flow for FY 2022… which would require Verizon to add between $5.2B and $6.3B in free cash flow in the fourth-quarter. Additionally, Verizon did not make any comments about its FY 2023 free cash flow guidance — which currently still stands at $22B — meaning the telecom likely stands by its earlier FCF forecast.

Valuation of Verizon

Assuming $17.6-$18.7B in free cash flow in FY 2022, Verizon has a P-FCF ratio of 7.9-8.4 X. Verizon’s chief rival in the telecom business was trading at a P-FCF ratio of 8.5 X as of Friday.

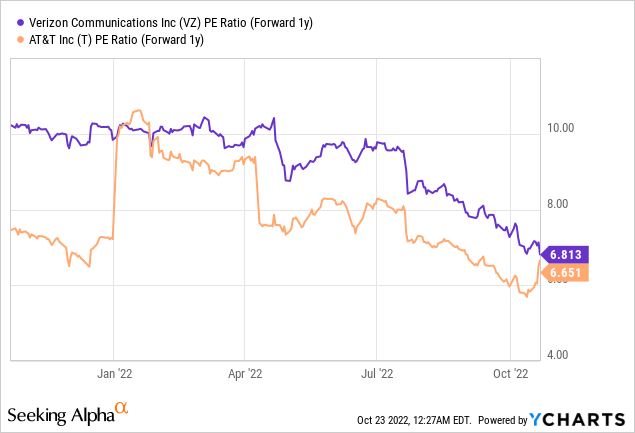

Verizon’s earnings valuation factor based on FY 2023 earnings is 6.8 X which makes the telecom’s shares slightly more expensive than AT&T’s shares which have a multiplier factor of 6.6 X.

Risks with Verizon

Risks for Verizon’s dividend have decreased post-earnings release since the telecom easily covered its payout with free cash flow. What I see as a risk for Verizon is the large decline in post-paid phone subscribers and muted overall revenue growth. Verizon’s top line is expected to grow just 2% this year and 1% next year. I still believe that Verizon’s stock represents deep value, however, but I would be prepared to change my opinion on the telecom if the company lowered its free cash flow forecast for FY 2023.

Final thoughts

The market massively overreacted to Verizon’s earnings sheet. While the loss in post-paid phone subscribers was a disappointment, the company doesn’t get enough credit for its excellent execution in the broadband business which just in the last quarter welcomed 377 thousand new customers. Verizon also covered its dividend with free cash flow which is effectively reducing dividend risk. Based off of valuation and dividend, Verizon’s stock is very attractive for dividend investors and I believe the risk profile remains skewed to the upside!

Be the first to comment