Bryan Bedder

Despite Pershing Square Holdings (OTCPK:PSHZF) outperforming the top 100 closed-ended funds and the broader market over the last five years, the stock price has not risen as much as the net asset value has. The stock will catch up to its intrinsic value over the next years. Paired with continuous active asset management, it offers a great investment opportunity for long-term investors.

Company Background

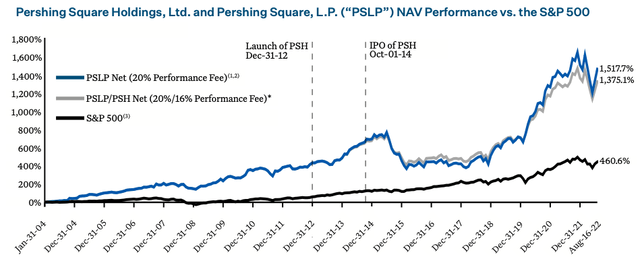

Pershing Square Holdings, Ltd. is an investment holding company engaged in acquiring and holding positions in a concentrated (8-12) number of publicly listed companies. The fund is structured as a closed-ended fund, meaning it issues a fixed number of shares in its initial public offering, which can then be bought and traded on a stock exchange, but no new money will flow into the fund. Bill Ackman founded Pershing Square Holdings on January 1st, 2004. He is in charge of final decision-making for all investment proposals and leads a small team of 8 investment professionals with little to no turnover over the last five years. Since its inception, Pershing Square Holdings has generated a 16.1% annualized net return, compared to a 9.7% return generated by the S&P 500 over the same period.

Pershing Square Investor Letter

Disproportional discount to Net Asset Value

In his most recent letter to shareholders, Bill Ackman raised the issue of Pershing Square Holdings trading at a significant discount to its net asset value (NAV), which as of July 31st, 2022, amounted to $ 46.51 while the stock closed at $32.58 the same day. As such, the stock closed the day trading at a discount of 30% compared to its net asset value. For clarification, if the fund were to liquidate and sell its assets to shareholders from one day to another, everything else equal, shareholders would receive compensation of the above referenced $ 46.51. Hence, the question must be raised about the reason for the said discount. Since 2015, when Pershing Square experienced inferior returns compared to the S&P for three consecutive years, the stock started trading at a discount to its net asset value. Since 2017 annualized performance has continuously outperformed the S&P 500 while the discount between NAV/per share to the share price has only widened. Particular emphasis must be put on the increasing discount that occurred despite various efforts by Pershing Square to reach NAV parity to market capitalization, which includes the best performance among the 100-largest closed-ended equity funds since 2017, new listings on the London Stock Exchange, and the FTSE 100 and an aggressive share repurchase program by which shares outstanding have been reduced by 22.5%.The discount of its share price to NAV cannot, at least to a high degree of certainty, be attributed to the fact that Pershing Square Holdings operates as a closed-ended fund. The median 5-year industry discount for closed-ended funds is 7.2%. Additionally, Scottish Mortgage Investment Trust (OTCPK:STMZF), a peer of similar size and fund structure, trades at only a 6% discount. Since both market characteristics and supply of the share can be eliminated as reasons for the disproportional discount to NAV, demand for PSH shares must logically explain the discount of market capitalization to NAV. Pershing Square Holdings choose an offshore closed-ended fund structure due to a favorable tax structure with no entity-level taxation. However, this has limited the company’s ability to market its fund, particularly in the most attractive market: The US market.

Steps to removing the discount

While there is no short-term solution to PSH’s demand problem, the outlook for the long-term and long-term investors is attractive in that assets trade at a 30% discount. Further, the company is fully aware of its demand problem, accelerating its marketing efforts most recently, and has undertaken several steps on its own to reduce supply by repurchasing shares. In addition, insiders of PSH own about 25.5% of the shares, ranking the fund among the top closed-ended funds in terms of insider ownership, which is so far relevant that Bill Ackman and his affiliates have “skin in the game,” a positive incentive to work for shareholders. The current discount at which PSH’s shares trade is akin to historical cases such as Berkshire Hathaway (BRK.B), which many investment managers would not own at first because it effectively meant giving up investment allocation decisions to a third party. This reluctance has faded over time, as Berkshire shares have been included in many prominent funds and ETFs. Another recent example of a company facing similar problems to PSH today is Blackstone (BX). Blackstone struggled to win over investors despite growing AUM, increasing dividend payout, and growing revenues substantially. Ultimately for both mentioned companies, it was the consistency of delivering superior returns compared to the broader market over an extended period to convince investors of the longevity of their respective business models. Pershing Square Holdings alike has offered superior returns compared to the market and will reward the patient investor when the broader realization of the market sets in.

Valuation

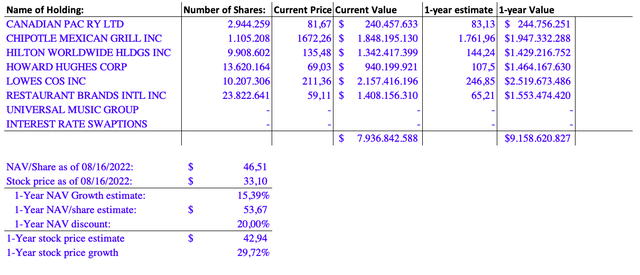

To obtain a reasonable 1-year target estimate for PSH stock, I assumed that with the continuous efforts by the company to close the discount gap between NAV and market capitalization, the discrepancy would narrow from 30% to 20%. Further, based on the positions listed in PSH’s most recent 13F filing, I estimated an approximate 1-year target growth rate for NAV by relying on average analyst 1-year price targets and weighted them appropriately as listed in the 13F filing. Please note that I left out Domino’s Pizza (DPZ) as the position has since been sold. Due to lack of information, I could not include Universal Music Group (OTCPK:UMGNF) and details on PSH’s interest rate swaptions into the NAV growth estimate. For more information on the relevant position, I recommend the article by John Vincent in his Q2 portfolio update. In doing so, one receives a 1-year growth estimate for NAV of 15.39%, or $ 53.67 per share. By applying a reasonable 20% discount to NAV, an improvement of 10% YoY, I end up with a 1-year price target for PSH stock of $ 42.94 or a 29,72% increase YoY.

Author; Yahoo Finance; Finscreener

Risk Factors

The valuation above rests upon two significant factors. First, the model assumes that 1-year analyst price targets can be reached. This assumption is probably most fragile in the current market environment of high inflation, the war in Ukraine, and supply chain constraints. However, I would argue that PSH flourishes particularly in uncertain market environments, as demonstrated by its active hedging during the beginning of the pandemic in 2020, ultimately generating 56.6% return compared to 18.4% by the S&P 500. In addition, the fund has protected its assets against high inflation in late 2021, with the purchase of interest rate swaptions contributing 10% in performance, thus limiting YTD performance to -9.9%. The second assumption materially impacting PSH’s share price is the company’s ability to promote the fund better and, as such, limit the NAV discount. The gap has slowly narrowed in the last couple of months, which appears promising. Still, these effects could be only temporary and must therefore be closely observed for PSH to reach above stated 1-year price estimate.

Conclusion

Pershing Square Holdings is an attractive investment opportunity at the current discount to the net asset value of 30%. Although past performance does not necessarily promise future returns, PSH has outperformed the market in 12 of its 17 years since inception, and its fund structure and investment decisions promise attractive returns in the future. Paired with active hedging of its portfolio, the downsides of investing in PSH are limited. An investor with a long-term investment horizon can neglect the NAV discount’s immediate impact and take advantage of it.

Be the first to comment