Ultima_Gaina/iStock via Getty Images

Dear readers,

In this article, we’ll take a look at the Algonquin Power & Utilities Corporation (NYSE:AQN), an interesting utility company to consider as an investment. We’ll go through why I view that at the right price, you could buy AQN, but also some of the risks and considerations that you should make prior to investing your hard-earned money in the company.

Let’s get going and see what we have here.

Algonquin Power & Utilities – Canadian Power

It’s no secret that I like investing in utilities and companies that provide fundamental services such as heat, water, power, communication, food, and transport. In times of trouble such as the times we are currently in, many people’s perspectives narrow back to “the basics”, and they no longer consider certain things or investments to be as meaningful.

Algonquin Power & Utilities is a former income fund, founded in 1998 and established formally in 1997 and listed on the TSE at the end of that year. The company used its raised $75M to buy 14 hydro facilities in Ontario, Quebec, and New Hampshire. The trust distributed a portion of the profit from these to the unit holders. The company’s preferential tax treatment was changed in 2009, and the company responded by incorporating.

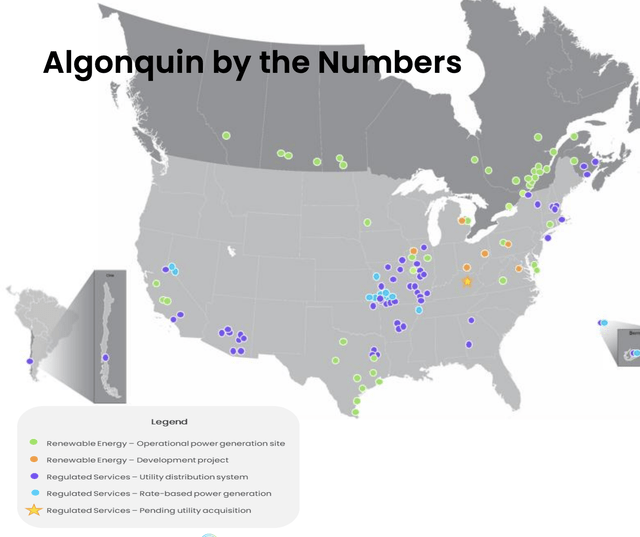

Today, AQN operates with $9.8B in market cap of around $17.7. The company has an investment-grade BBB credit rating, employs 3,400 people, and manages around 4.2GW in renewable assets, to name parts of their current geographical exposure.

The company has managed impressive returns of 350% over a 10-year period, and 101% over a 5-year period, making it a very good historical investment. The company has also been able to grow the dividend at a rate of 10% per year between 2010 to 2021. EPS has grown 11.1% CAGR over time, so the company has not been irresponsibly raising its dividend without seeing the corresponding rise in earnings over the time period.

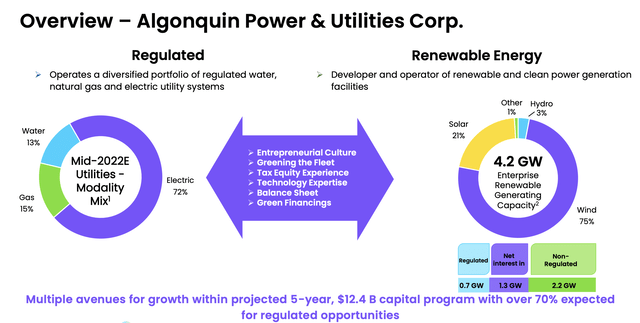

AQN manages a resilient, future-proof business with 70% of the business being water, electric, and gas utilities across 16 electric jurisdictions. The company can be considered an ESG leader with significant renewable exposure, and a leading Co2 per revenue dollar. The company has the goal of being net-zero in terms of emissions by 2050.

The business mix for AQN is part-regulated and part renewable energy generation and development.

The company has been able to de-carbonize the business at a rate of 31% over a 4-year timeframe, and there are still plenty of levers the company can operate or pull to deliver more growth. This includes both organic investments in the company’s current assets as well as performance optimization, but also further M&As and growth investments. This last part is not a problem for AQN, given that it has a 100% success rate in terms of closing announced M&As for regulated utilities.

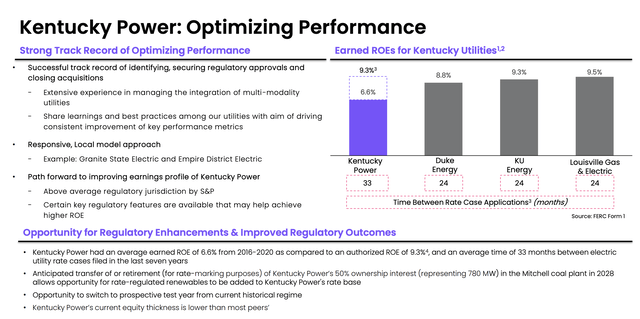

The fact that this is a regulated utility means that earnings visibility and forecasts are fairly accurate and comparatively easy to make compared to non-regulated companies. $11.4B of the company’s assets are regulated, and AQN serves over 1.2M customers with another 230k expected due to a pending M&A of Kentucky Power, which will be another feather in AQN’s cap.

This M&A is already ongoing, and there are plenty of levers the company can pull to improve operating performance and RoE here.

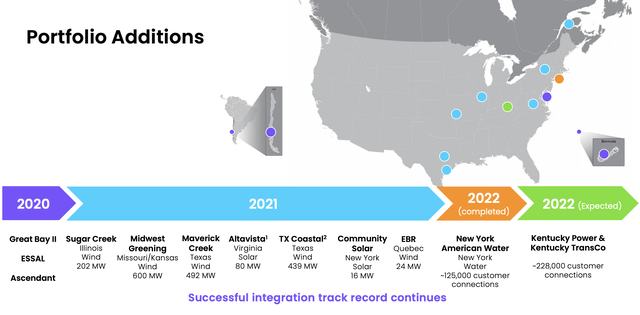

When looking at AQN, the focus should be on two things. The company’s strong fundamentals and earnings, and its expansion and growth in renewables, which is still growing. AQN is a major player in this field, and investors should be aware of this going in – you’re investing in a renewable player – and one that’s used to growing. Take a look at the company’s portfolio additions over time.

These fundamentals of successful M&A’s, operations in attractive areas and overall safety have resulted in a few things that we want to drill down on – and that we need to establish that the company does have:

- A long-term record of positive growth in the double digits over the past 5-6 years.

- A long-term record of positive, double-digit dividend growth since the financial crisis

- A long-term positive dividend outlook, with a targeted payout of up to 90% of normalized EPS.

- A well-diversified balance sheet consisting of 57% equity, 30% long-term debt (senior, unsecured), and 13% hybrid securities with prefs in Canada and subordinated notes in both the USA and Canada.

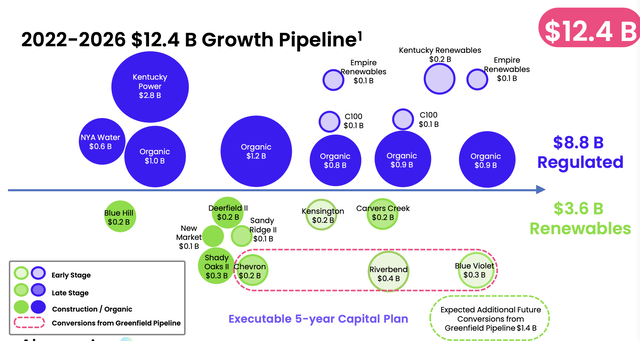

The company already has $12.4B of targeted CapEx in the next 5 years. These investments will be financed through a mix of cash, hybrid debt, asset recycling, debt, tax equity, and ATM/DRIP. There is an impressive growth pipeline expected in the company’s future, with many smaller projects in renewables, but also plenty of projects coming online in the regulated part of the business.

Strengths in this company seem clear – and the business is also well-led, with the co-founder and CEO retiring in 2020 and the current leader coming from Amazon Web Services, with a global growth perspective. The company has evident skillful handling in M&As, JV’s, and other partnerships, based on its ability to generate positive earnings growth over time. The company’s Kentucky M&A is a natural part of “greening” its overall approach and fleet, replacing older plants with cleaner fuels and creating renewable assets where possible.

Risks for the company concern the company’s M&A strategy which has put a higher-than-usual strain on its balance sheet. Its leverage means that the company is considered to be BBB – it could likely be higher if this was done more conservatively.

There is also the simple fact that renewable companies like AQN come at a premium. This company is not exactly cheap – and I will state this clearly even before going into valuation in this article. Viewed through a traditional P/E-metric, AQN is one of the more expensive operators out there, and this also needs to be taken into consideration. There are reasons for this valuation, but the margin for error if the company were to miscalculate is small, because the company has quite some distance to fall, if this should happen.

So, while a great company, this is all about the valuation – and this brings us to exactly that portion of the article.

Algonquin Power – The valuation

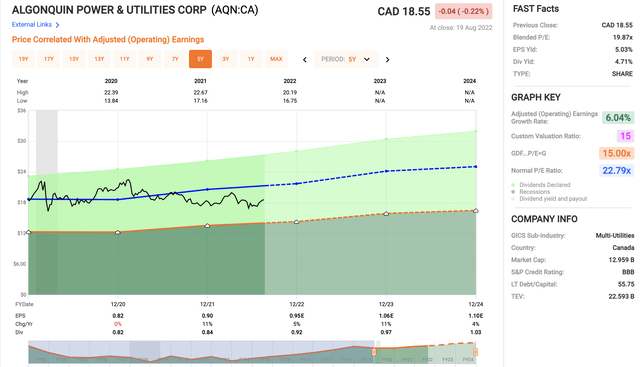

AQN is at a relatively complex valuation. As I said, it’s expensive usually, and what we do see when we look at AQN is an average multiple of just south of 20x P/E, and a 5-year average of not far from 23x P/E. On the basis of its premium, AQN is therefore somewhat cheaper than it was in 2020 when it traded close to 25x P/E – but it’s not exactly “cheap” on the basis of overall utilities as a whole.

AQN valuation (F.A.S.T. Graphs)

The company has a good track record of delivering growth – and it’s a mostly-regulated utility. That means I consider the EPS forecasts here to be somewhat accurate, and I expect analysts to be right more often than they are wrong – and this expectation is fulfilled. FactSet analysts are wrong about 15% of the time negatively with a 10% margin of error. However, the company also has the un-like utility trend of actually beating estimates, and not seldom. On a 1-year basis, AQN beats estimates by more than 10% as high as 46% of the time in the last 10 years.

This goes beyond coincidence and implies a general underestimation by the market with regard to AQN, which is very interesting when looking at a utility. It’s also not as though the yield is “bad”, despite it being expensive. The current yield is 4.71% for the native, and I would generally consider a company that’s consistently underestimated closer to its premium than to a normalized valuation.

Don’t get me wrong, I would love to be able to buy AQN at 15x P/E or below – but based on looking at where the company has been trading historically, such an opportunity seems very unlikely.

The company has, in fact, never really traded at that valuation, but usually carried that sort of interesting premium since essentially the financial crisis. The future for the company, based on its asset base and the way the world seems to be moving vis-a-vis the generation and renewables, seems very positive. That’s also why I’m actually willing to grant the company a 20x P/E premium, despite being a utility, and some utilities I invest in being traded below 8x P/E here.

Even based on only a 20-20.5x P/E range, the upside for AQN is 13% per year – or 35% in 3 years, thereabouts. This is not a return to sneeze at. Remember, we’re talking utilities. Those are some of the most highly regulated, safe cashflows in existence.

That in itself is attractive, especially in this situation, which can best be described as volatile.

Conclusively, based on the company’s history, its performance, its forecasts, and its fundamentals, I consider it quite likely that the company will be able to deliver what is forecasted. For 2022, I expect at least a modest increase in EPS – 3-5%, with more when Kentucky power comes online and starts becoming more integrated into the business. AQN has done this before, and successfully. Kentucky isn’t easy geography to get into – the amount of legacy generation assets that need retrofitting or replacing is monumental. We’re talking coal country – but this brings positive aspects to the table as well, such as the comparative impact of even a slight renewable introduction will completely shift the mix over time. It’s very easy to tell the population you’re improving the mix when the comp starts at 0%.

In short, there is a lot to like about AQN. Other analysts agree with this. For the US ticker, the company trades at $14.27, with an average PT of $16.25, implying an upside of 14% or so, with 6 out of 10 analysts either at a “BUY” or “Outperform” rating for the company.

Based on these trends, i consider it likely that AQN can perform and deliver double-digit market-beating alpha over the next few years.

That is why I recently started a small position.

AQN is a “BUY” – I’ll start at a PT of $16/share for the US ticker AQN.

Thesis

My thesis for AQN is as follows:

- The company is a great renewable player with a good asset base and an impressive track record of integration, optimization and market leadership. Its regulated base gives good cash flow visibility, and the dividend is good.

- The future calls for similar, positive performance over time, and I expect the company to continue to do well.

- Based on the current valuation and prospects, I assign AQN a price target of $16/share and consider the company a “BUY” here.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized.

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment