shapecharge/E+ via Getty Images

Even the best can fall. Zscaler (NASDAQ:ZS), a top tier operator in cybersecurity, has high quality fundamentals in a high quality sector. Its main issue has been valuation and for many months, it appeared that its premium multiple would remain resilient in spite of the ongoing tech crash. That resilience has faded, as the stock has now fallen 60% from the peak and now trades at highly buyable valuations. The tech crash has led even the highest quality stocks to come on sale – though, one must have the resolve to stomach the inevitable volatility.

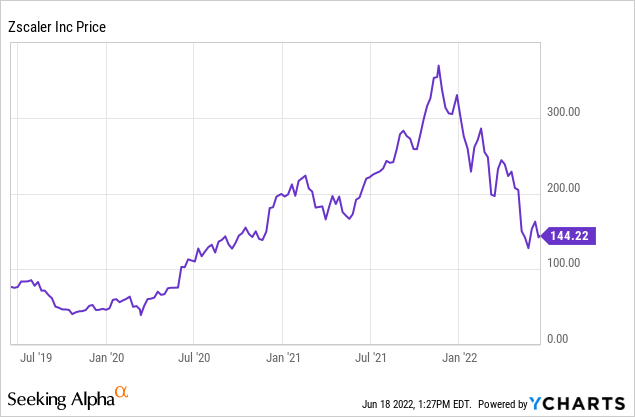

ZS Stock Price

I last covered ZS in March, when I stated that in spite of the 40% drop, the stock was still too expensive to buy. The stock has since fallen another 40% and now trades around $144 per share.

At the wrong price, even the highest quality stocks aren’t attractive buying opportunities. ZS is an example of the right company at the right price.

ZS Stock Key Metrics

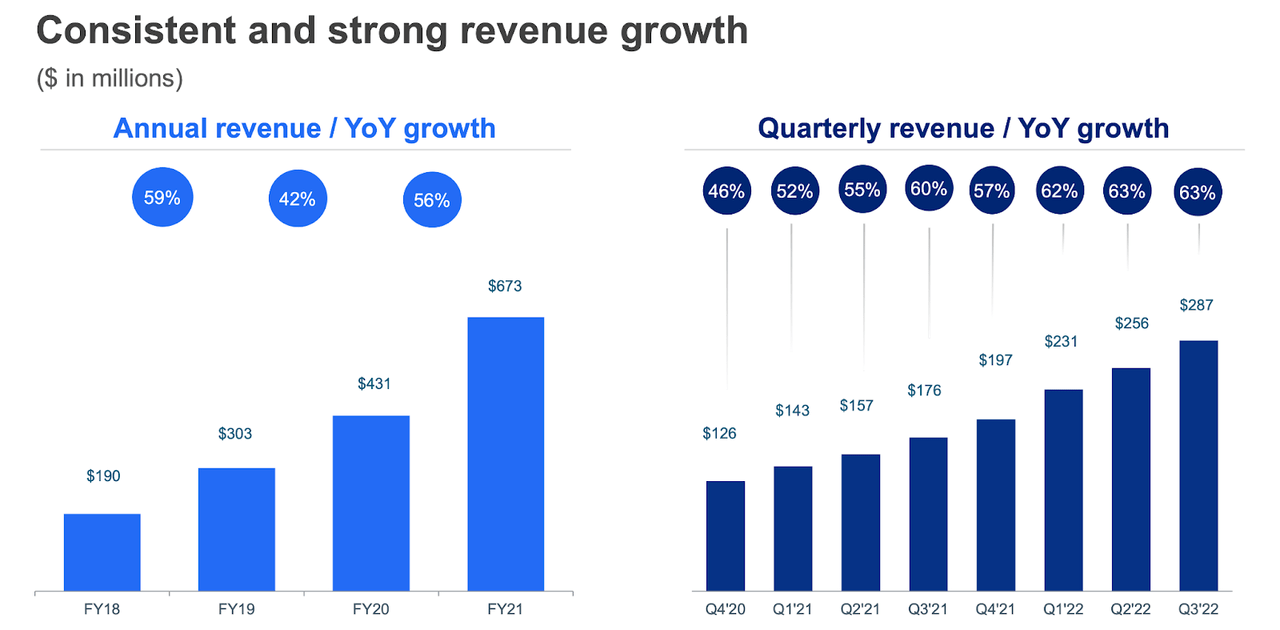

ZS has shown incredible financial numbers that seem to defy the laws of physics. 63% revenue growth in the latest quarter was its highest over the past 8 quarters – typically one would be expecting decelerating growth rates.

FY22 Q3 Presentation

ZS had previously guided for only $272 million in quarterly revenues – this is a company with a long track record of “beating and raising” guidance. ZS has guided for $306 million in quarterly revenues in the next quarter, representing growth of 55%.

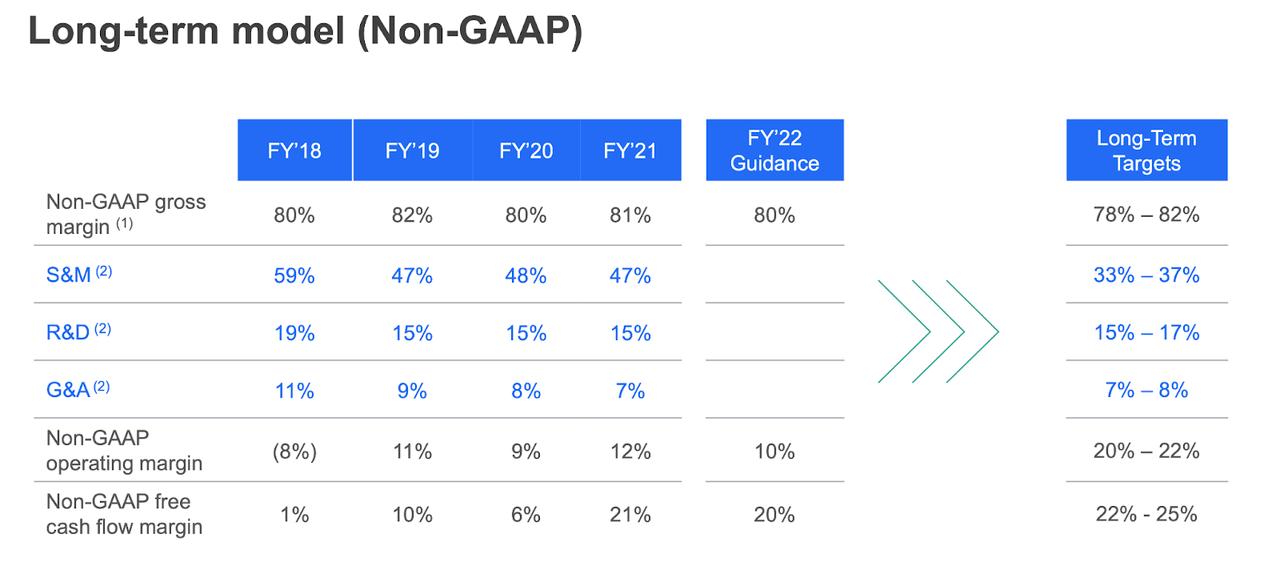

ZS is still not profitable on a GAAP basis, but did generate non-GAAP net income of $24.7 million and $43.7 million in free cash flow. Free cash flow is greater than net income because its customers often pre-pay many years of fees.

Over the long term, ZS has guided for up to 22% non-GAAP operating margins.

FY22 Q3 Presentation

I expect that target to prove overly conservative. ZS ended the quarter with $1.7 billion of cash versus $1 billion of convertible notes. The convertible notes carry a 0.125% interest rate with a conversion price of $246.76 per share through 2025.

Is ZS Stock A Buy, Sell, or Hold?

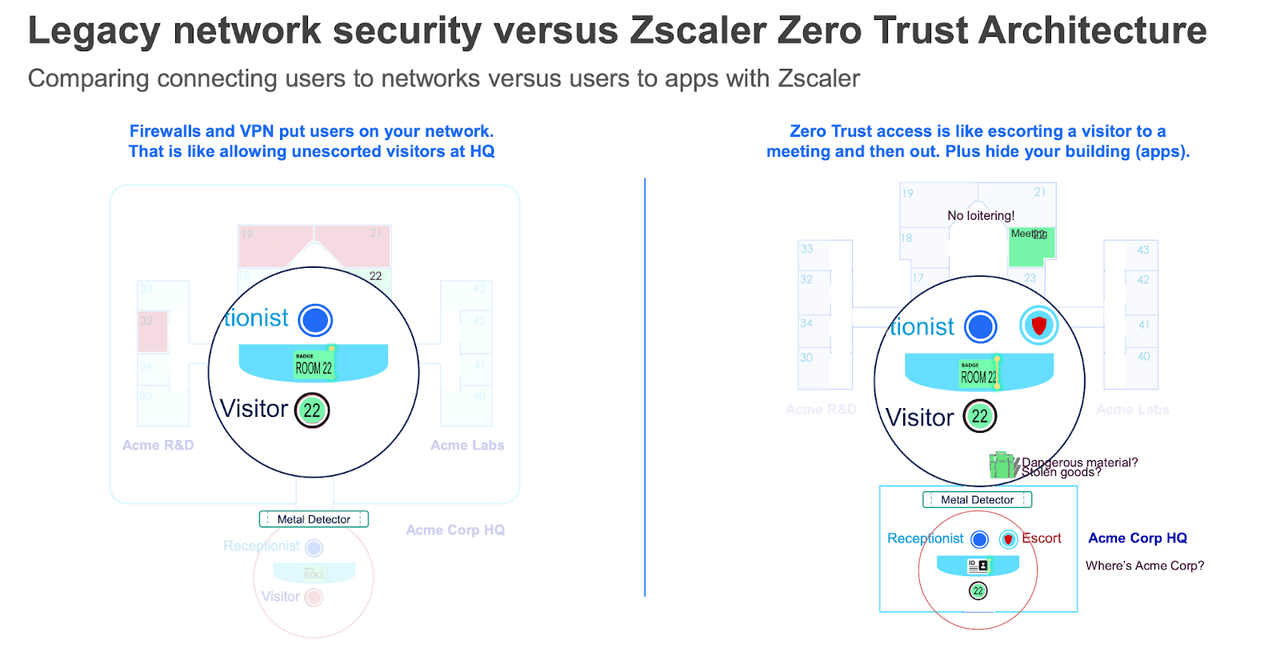

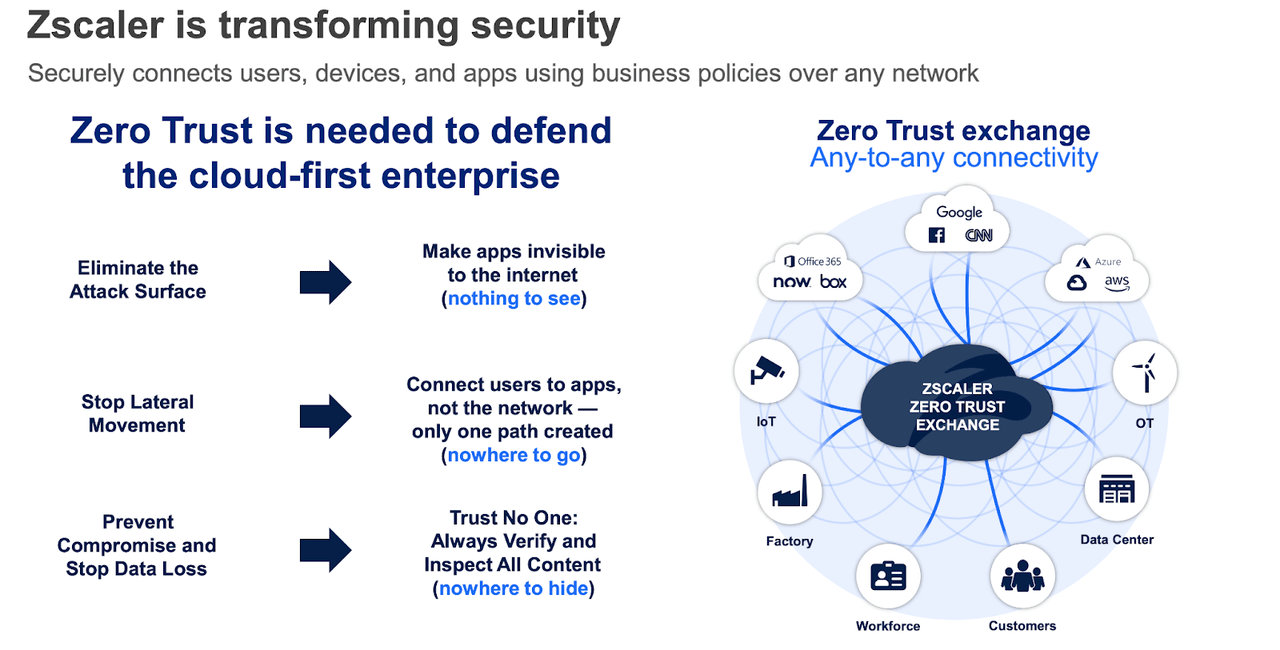

Before I discuss valuation, let’s recall why ZS deserves a premium valuation in the first place (though perhaps not a premium to its previous extent). The old form of network security restricted who was allowed on an internet network, but did not restrict what those users did while they were on the network.

FY22 Q3 Presentation

ZS powers what it calls the “zero trust exchange.” In simple terms – whereas Okta (OKTA) helps companies verify which users are their own employees, ZS then helps verify which employees have access to which applications.

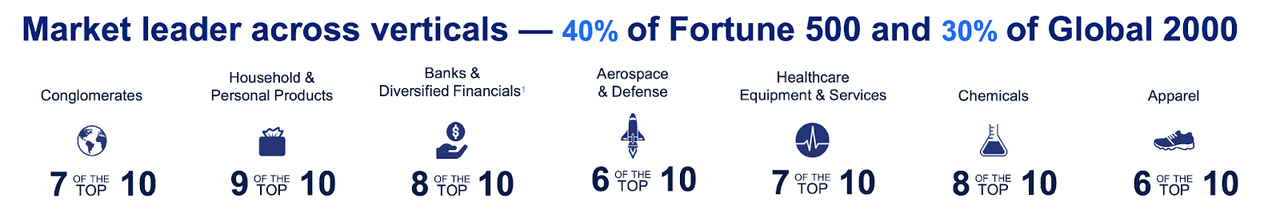

FY22 Q3 Presentation

ZS is a clear market leader with 40% of the Fortune 500 including clear market dominance across various industries.

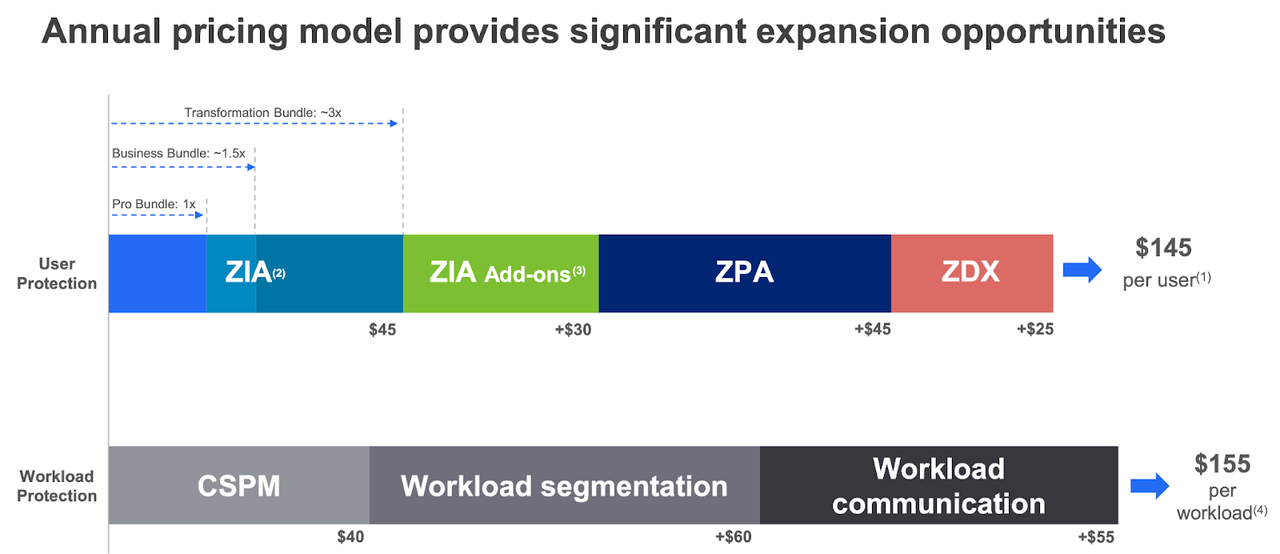

FY22 Q3 Presentation

ZS has historically realized strong net retention rates which have exceeded 125% over the last several quarters. Looking forward, ZS expects continued organic growth as it can add further growth on a per user basis.

FY22 Q3 Presentation

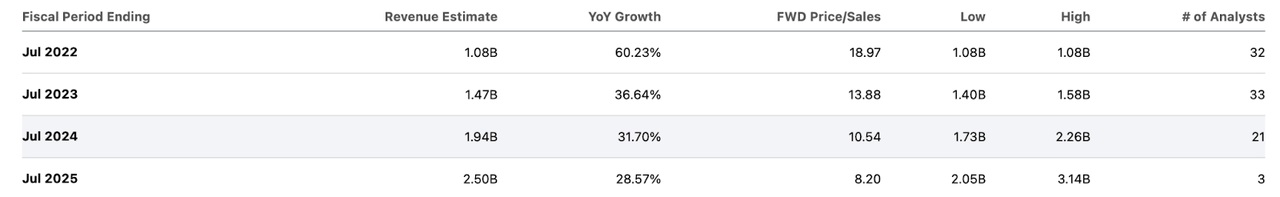

Wall Street consensus estimates call for growth to slow down to 37% next year.

Seeking Alpha

Consensus estimates look too conservative, especially considering the ever-growing relevance of cybersecurity. Nonetheless, the stock looks cheap even based on consensus estimates. If we assume 28% growth exiting the fiscal year ended in July 2025, 30% long term net margins, and a 1.5x price to earnings growth ratio (‘PEG ratio’), then ZS might trade at 12.6x sales in 3 years, representing a stock price of $221 per share or 16% annual upside over the next 3 years. Those assumptions are arguably too conservative considering that ZS is likely to sustain a premium multiple due to being in the cybersecurity sector. If we instead assume a 2x PEG ratio, then ZS might trade at 16.8x sales or a stock price of $295 per share, representing 27% annualized upside over the next 3 years. Key risks here are if growth decelerates faster than expected, which would likely lead to multiple compression. In such a scenario, the stock would still present substantial downside – perhaps it could trade down to as low as 9x sales, representing 35% downside. This is not a case of deep undervaluation as is becoming quite common in the tech sector. Yet ZS represents one of the more undervalued high quality ideas in the market right now – I rate shares a buy for long term minded investors.

Be the first to comment