choochart choochaikupt

Introduction

Opendoor’s (NASDAQ:OPEN) Q2 results were in line with expectations, but Q3 guidance portends a weak housing macro environment. In upcoming quarters, Opendoor’s financial performance could weaken significantly. However, the game-changing Opendoor-Zillow (Z) partnership announced along with the earnings release (from last week) has led to a strong post-ER rally in Opendoor’s stock. As a long-term investor in Opendoor, I am happy to see its stock doing well after an ER, but I know full well that a news-based rally could fade away just as quickly. In this note, we will assess Opendoor’s Q2 numbers and its Q3 guidance.

Furthermore, we will analyze some macro data points related to the housing market. Finally, I will share my thoughts on the Opendoor-Zillow partnership and re-evaluate Opendoor’s fair value using TQI’s Valuation Model. We have much to cover today, so let’s get started without further ado.

Understanding Opendoor’s Q2 Results And Forward Guidance

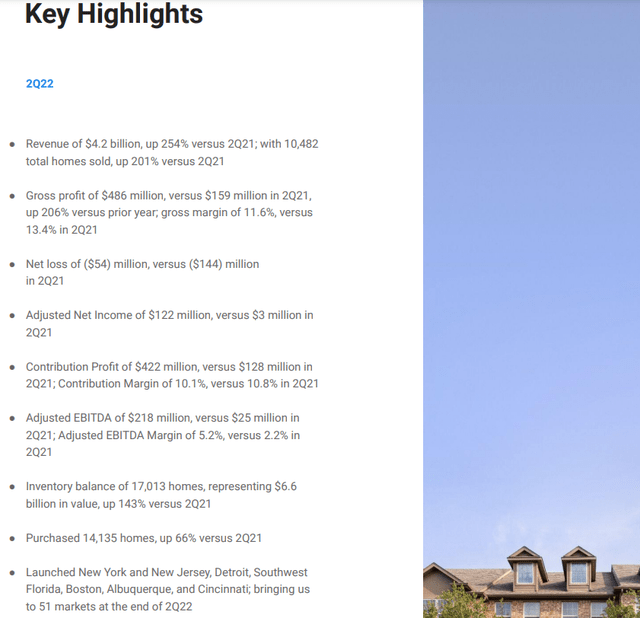

In Q2 2022, Opendoor’s revenue met management’s guidance of $4.2B (y/y growth of 254%) on home sales of 10.48K (up 201% y/y). Both revenue and home sales figures were down by more than 20% q/q; however, when we consider housing market seasonality trends, lower inventory levels going into Q2, and softening demand for housing (due to the rapid rise in mortgage rates), Opendoor’s Q2 performance is commendable.

Opendoor Q2 2022 Shareholder Letter

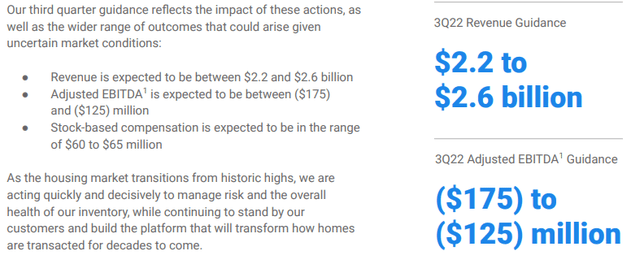

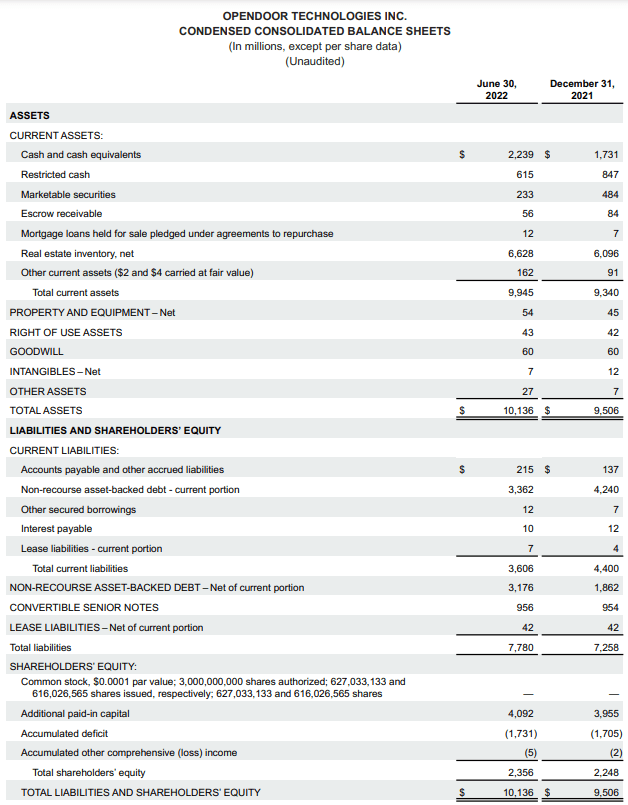

After showing a net profit in Q1 2022, Opendoor’s business has reverted back to losses. And a rapid downturn in housing prices could be set to turn Opendoor into a cash-burning company for the next few quarters. For Q3, Opendoor guided for sales of just $2.2-2.6B (a contraction of 43% q/q) despite its inventory growing to $6.6B at the end of Q2 (from $4.7B in Q1).

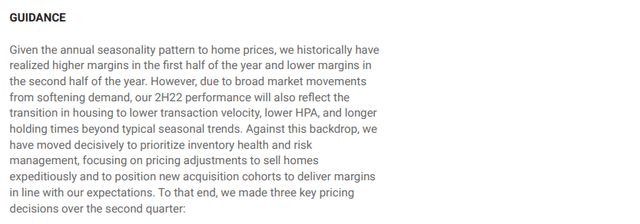

Here’s what the company had to say about this new guidance:

Opendoor Q2 2022 Shareholder Letter Opendoor Q2 2022 Shareholder Letter Opendoor Q2 2022 Shareholder Letter

Despite raising its transaction spreads rapidly, Opendoor is seeing similar conversion rates. This validates a big part of our investment thesis – Opendoor’s Seller offering becomes more valuable in a down market. While Opendoor has been increasing transaction spreads since Q3 2021, the housing market has shifted faster than expected, and Opendoor’s management acknowledged this fact in their earnings report. This failure is set to result in adj. EBITDA swinging from $218M (positive) in Q2 to -$150M (negative). If we extrapolate these numbers to adj. net income (proxy metric for operating cash flow price), Opendoor is set to burn through $250M in Q3 alone.

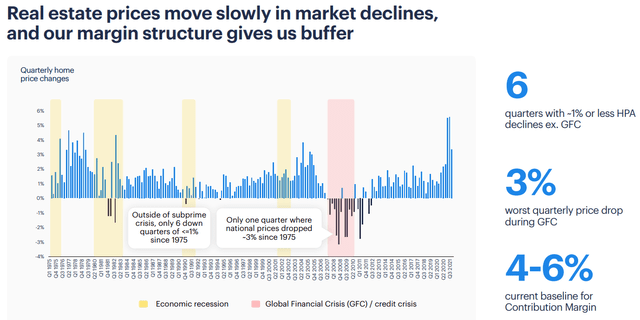

On a unit level, Opendoor’s Q3 guidance for contribution margin is around ~1.9%, which is well below management’s stated guard rails of 4-6% CM for operating their business. My initial reaction to these numbers was anger and sheer disappointment; however, when I reviewed additional data points, I realized that Opendoor is actually doing a brilliant job by maintaining positive contribution margins. Yes, that’s how bad it’s out there (a challenging macro environment is creating an unprecedented contraction in the housing market). Take a look for yourself:

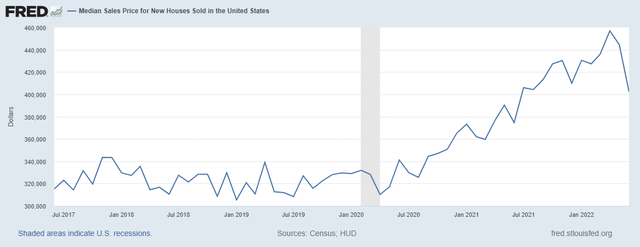

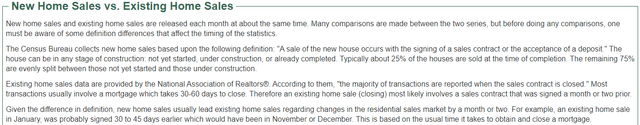

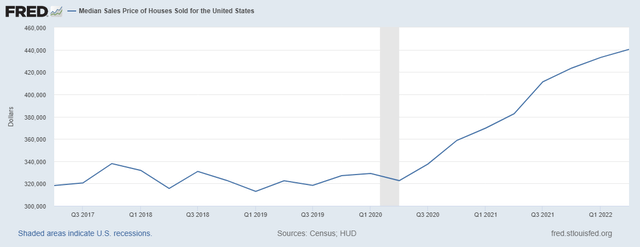

In June 2022, the Median Sales Price for New Houses Sold in the United States dropped to $402K. This figure was at $457K in April 2022 and $444K in May 2022. That’s a ~16% contraction in new home prices within 2 months. Are you wondering why this market weakness wasn’t evident in Opendoor’s Q2 report? Well, that is because of the fundamental difference in how New Homes Sales and Existing Home Sales are recorded. If you don’t know, this is how New Home Sales and Existing Home Sales are recorded:

Simply put, new home prices lead existing home prices by ~1-2 months (30-60 days), and Opendoor’s financial performance in Q3 will show this rapid contraction. Suddenly, Opendoor’s guidance for a positive contribution margin in Q3 looks amazing, right?

Now, as you can observe from the two charts above, existing home prices are less volatile compared to new home prices. Even then, Opendoor is probably going to experience a price contraction of 8-10% on the homes they purchased in recent months. In my view, Opendoor’s management is doing the right thing by moving quickly to re-sell inventory (even with noteworthy markdowns to adjust to current market prices), slowing new acquisitions, and focusing on risk management (& inventory health).

In my view, this rapid contraction in housing prices is indicative of a generational event. I say this because even during the Great Financial Crisis, the worst quarterly drop in US median home prices was 3%.

Opendoor Investor Presentation May 2022

Back in November 2021, the federal reserve pivoted to quantitative tightening after pumping tons of liquidity into the market in 2020 and 2021. A tighter monetary policy has led to a rapid rise in mortgage rates this year [the 30-yr fixed mortgage rate went up from ~3.8% to ~6.3% in a matter of months]. The shockingly fast move up in mortgage rates in 2022 is the most likely driver of this rapid contraction in home prices as affordability is worse than the housing bubble of 2006-09.

Naturally, the question on everyone’s lips is:

Has The FED Popped Yet Another Housing Bubble?

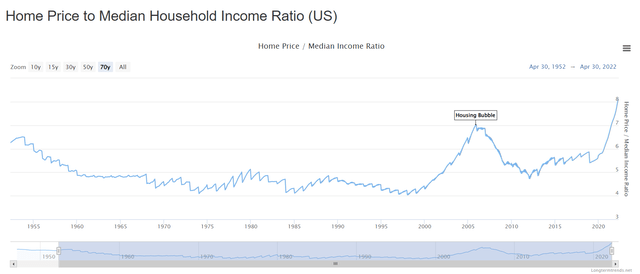

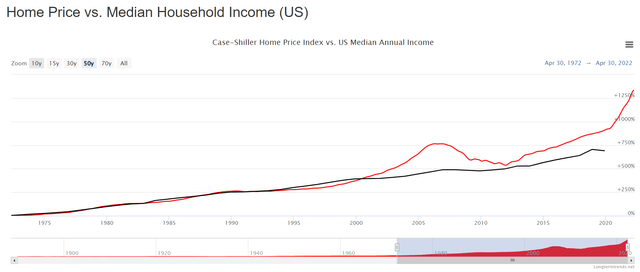

Looking at the violent ~16% drop in median new home sales prices, I am inclined to say yes. At the end of April, Home Price to Median Household Income ratio had reached ~8x (higher than the peak of ~7.2x in the housing bubble of 2006-09). Also, Case-Shiller Home Price Index has been outpacing US Median Annual Income quite spectacularly over the last three years or so. These data points are indicative of a bubble, and the contraction we are seeing could be the start of a burst.

Longtermtrends.net Longtermtrends.net

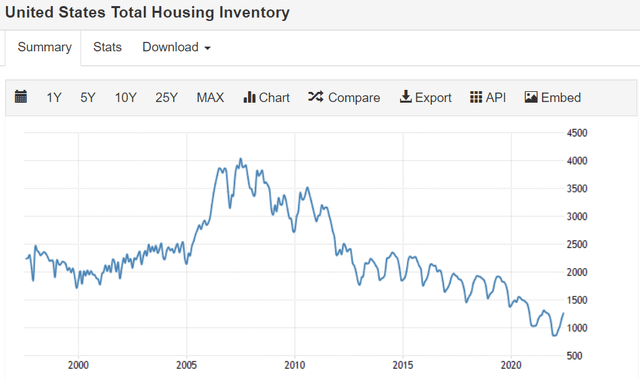

Unlike the housing bubble of 2006-09, the structural drivers of the housing market today are very, very different. Back in 2006, housing inventory was ~3.5-4M (much higher than all-time averages). And today, housing inventory is sitting near record low levels at ~1.4M. For the past decade, housing demand has outpaced supply, and we have an imbalance that won’t be resolved for years. With home builders cutting back on new supply due to higher interest rates, this structural driver (supply shortage) is unlikely to change anytime in the near future.

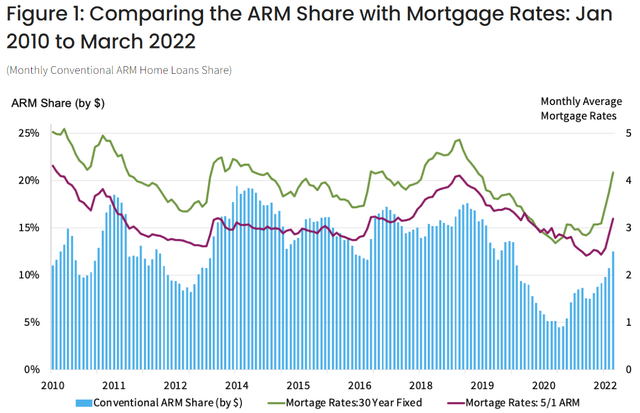

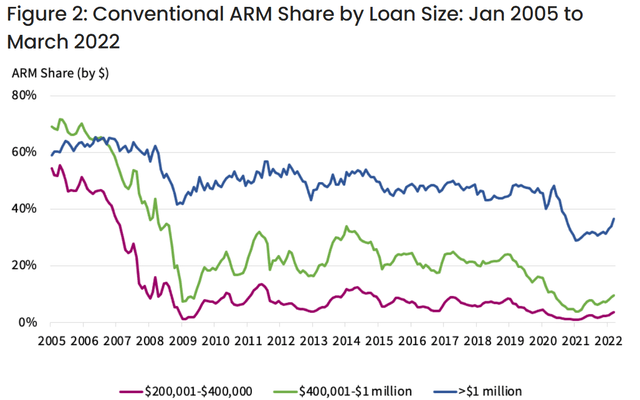

Another primary driver of the GFC (great financial crisis) was the widespread use of predatory mortgage lending practices that led to a big chunk of mortgages being ARM (adjustable-rate mortgages). When interest rates rose in 2008, millions of homeowners failed to afford higher payments. Furthermore, most of these loans were securitized and sold on the secondary markets. The derivatives market betting on this secondary was larger than the secondary market itself. When the underlying loans defaulted, these derivatives blew up and led to the great financial crisis. Fortunately, ARMs made up only 3% of all mortgages at the start of 2022.

However, the share of ARM loans is increasing rapidly in 2022 as home buyers try to tackle high prices and high mortgage rates. While this data is alarming, I don’t see any reason to panic about a housing market crash from here on out. During the last housing bubble burst, US median home prices declined by 25% from peak to trough over 4 years (2008-2012). Considering better fundamentals of the housing market in 2022, I don’t think we will see a rapid change in home prices from here (after the contraction of May and June). Yes, we could see a slow burn lower, but the worst for Opendoor’s business is probably over (however, we will only see this appear in Q3 & Q4 reports).

Opendoor Can Survive And Thrive

While I expect the next couple of quarters to bring massive business volatility at Opendoor, I think the company is well capitalized ($2.5B cash) to see it through any downturn in the housing market. As a market maker with the ability to raise transaction spreads during a bear market, Opendoor can continue to meet the financial goals set forward by its management team (even in these turbulent times). Most of Opendoor’s iBuying rivals are not as well capitalized, and this is why I see Opendoor emerging as a monopoly business on the other side of this downturn.

Opendoor Q2 2022 Shareholder Letter

The biggest fears around Opendoor are potential transaction losses and inventory writedowns. While these fears are justified to some extent due to the nascency of the iBuying model, Opendoor’s management guiding for positive contribution margins in the face of a violent contraction in home prices is a conviction booster. Some (mark-to-market) inventory writedowns may happen in Q3, and this figure could be as large as 8-10% of the $6.6B of housing inventory Opendoor is holding on its balance sheet. As a market-maker, Opendoor will continue to buy and sell homes in up or down markets.

Now, I do think that Opendoor could end up missing its Q3 guidance for sales and profitability (loss) if the macroeconomic conditions were to worsen further. However, mortgage rates have been moderating recently, the job numbers are coming in stronger than expected (record low unemployment of 3.5%), wage increases are looking robust, and the housing supply remains constrained.

Zillow-Opendoor: A Match Made In Heaven

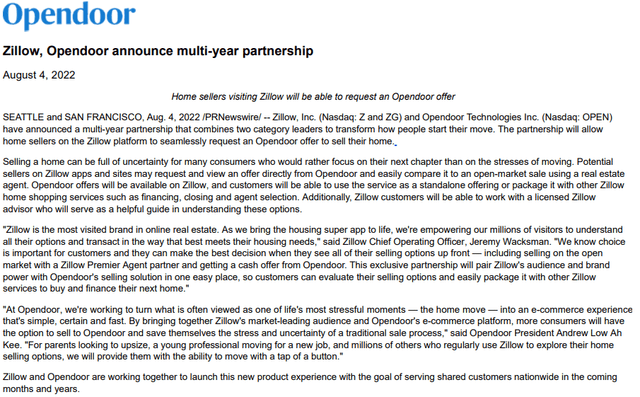

Opendoor and Zillow are category-leading businesses in their own rights within the burgeoning proptech industry. Technology has disrupted most markets, and real estate is one of the few remaining frontiers. While Zillow’s misadventure into iBuying blew up in 2021 (leading to a cumulative loss of ~$880M), the multi-year partnership with Opendoor is set to fill a hole in its housing super app vision. For Opendoor, this announcement is a game changer. Opendoor’s dominance in iBuying is clear as day; however, getting access to Zillow’s 200m MAUs will lead to a drastic reduction in CAC (marketing expenses) on the acquisition side of its marketplace.

“When you can’t beat them, join them” – and this is exactly what Zillow is doing here. As a former Zillow shareholder, I wish they never got into the iBuying business and took a partnership approach, to begin with. However, I think it’s “better late than never,” and Zillow’s housing super app approach could make it a big winner alongside Opendoor in the future.

Zillow users will be able to request an Opendoor offer and compare it to what a traditional real estate agent could get (on Zillow’s platform). All customers that sell their homes to Opendoor (via Zillow’s referral) will earn Zillow a referral fee from Opendoor (which I think will be lower than Opendoor’s typical CAC for the acquisition side of its platform). With this deal, Zillow is extending its housing super app vision (without the balance sheet risk of being an iBuyer), and Opendoor gets to reduce its CAC (marketing expenses) on the seller-side (acquisition-side) of its marketplace, increase brand recognition, divert resources to buyer side of the platform, and extend its vision of building a third-party marketplace in the future. This is a win-win-win for Opendoor, Zillow, and consumers.

From a very long-term perspective, this deal is likely to be a bad move for Zillow as Opendoor could cannibalize its business (and eliminate the need for real estate agents [Zillow’s primary customers (advertisers)]; however, both of these companies can grow together for the foreseeable future as transforming residential real estate transaction process with technology represents a humongous opportunity.

Back in 2021, I sold out of Zillow at ~$100 as its iBuying business was blowing up. However, I deployed that capital to buy more of Opendoor, and so far, this move hasn’t worked out too well. With that said, I remain convinced that iBuying is the future of real estate transactions, and this is how the next generation will buy and sell homes. After considering the potential impact of this game-changing Opendoor-Zillow partnership, I can now see a future where both Zillow and Opendoor thrive together. And this is why I plan to own both of them as complimentary positions in my portfolio going forward.

With this partnership, Opendoor has secured a spectacular win on the Seller (acquisition) side of its marketplace. The volumes it can generate via Zillow could propel Opendoor’s business to the next level. As we learned from Opendoor’s Q2 report, the company is now focused on building products for the buyer side of its platform, and Opendoor Exclusives is an amazing new product that allows customers to buy a new home at the tap of a few buttons (just like an e-commerce checkout). As I see it, Opendoor is shaping the future of residential real estate transactions, and that makes near-term business volatility acceptable. As a long-term investor, I am enamored by Opendoor’s vision and consistent execution. Also, I think Opendoor’s partnership with Zillow is game over for most of its iBuying rivals, and we are looking at an early-stage monopolistic platform in Opendoor.

Opendoor’s Fair Value And Expected Returns

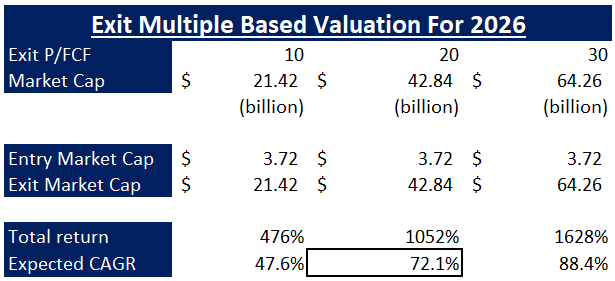

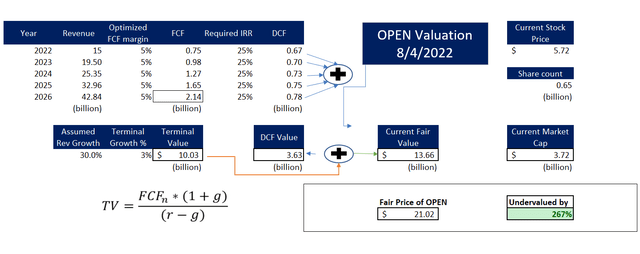

To find the fair value and expected return of Opendoor, we will use TQI’s Valuation model, which is a simplified discounted cash flow model, with the following assumptions:

| 2022E revenue (conservative estimate) | $15B |

| Forward 4.5-Yr CAGR Revenue Growth Rate (%) | 30% |

| Terminal Growth Rate (%) | 3% |

| Optimized FCF Margin (%) | 5% |

| Discount Rate / Required IRR (%) | 25% |

| Exit Multiple [P/FCF] | 10-30x |

Results:

Under TQI’s required IRR [discount rate] of 25% (for moonshot growth investments), Opendoor’s fair value came out to be ~$13.66B (i.e., $21 per share). With the stock trading at $5.72, it is currently trading at a significant discount to its fair value.

In a base case scenario, I expect Opendoor to trade at ~20x P/FCF (optimized FCF) at the end of 2026, which would be equivalent to ~1x 2026 P/S based on my forward revenue projections shared above.

TQI Valuation Model (Author)

With this assumption, I see Opendoor trading at ~$43B in market cap by the end of 2026 [1052% higher than current levels], which would translate to an expected CAGR return of 72.1% over the next 4.5 years.

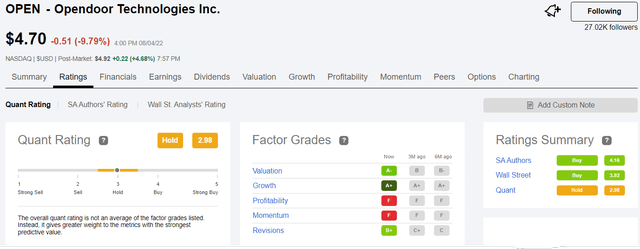

OPEN: Quantitative Factor Grades & Technicals

According to Seeking Alpha’s Quant Rating system, Opendoor is currently a “Hold” with strong factor grades for Valuation (“A-“), Growth (“A+”), and Revisions (“B+”) being offset by poor factor grades for Profitability (“F”) and Momentum (“F”). While these ratings are pretty straightforward and self-explanatory, I want to highlight that these factor grade ratings are headed towards “Sell” in the coming months because Opendoor’s growth rate is set to fall off a cliff (from 250% y/y in Q2 2022 to ~10-20% y/y in Q3 2022) and negative earnings revisions could start rolling in over coming weeks as a challenging macroeconomic environment hurts the housing market.

With that said, SA Authors and Wall Street analysts remain bullish on Opendoor. In my view, this bullishness is driven by the long-term potential on offer here, and I adhere to this chain of thought too.

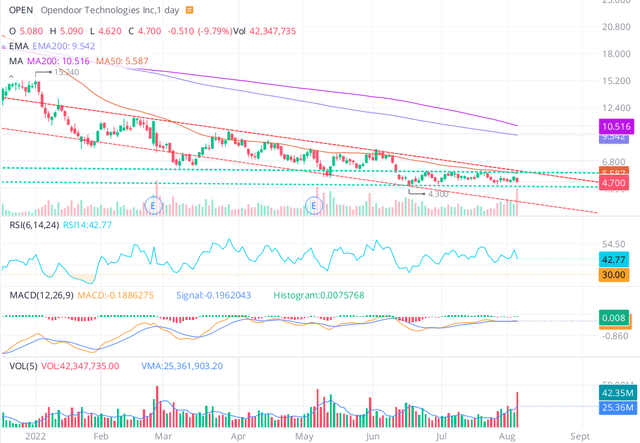

Technically, Opendoor’s chart is a dumpster fire, with the stock stuck in a downward wedge pattern for the last several months. Recent price-volume action is indicative of a base formation in the $4.3-$5.7 range, and the stock is sitting right at the top of this range after a +22% post-ER move on last Friday.

Opendoor’s technical setup is getting interesting – a breakout from the base here could take the stock up to $8-10 in a jiffy. While Opendoor’s Q2 results were good, the bounce is likely a result of the announcement of the Zillow partnership, and a news-based rally can fade off fast.

Twitter

Since Opendoor failed to get past resistance at $5.7-5.8 during Friday’s session, the breakout is not confirmed, and we may well break back into the base over the coming days. Hence, I am not convinced about a short-term trade here. However, I think the long-term risk/reward is simply fantastic, and investors should use the ongoing volatility in Opendoor to take/build long positions at these depressed levels.

Concluding Thoughts

Opendoor’s financial performance is set to bear the brunt of a challenging macroeconomic environment. While ultra-low housing affordability (as measured by median home price to income ratio) is leading to widespread fears of a GFC-like housing market crash (2008-12), housing inventory remains near record low levels (unlike 2005-08), and new housing supply is getting constrained further due to rising interest rates (builders pulling back).

In my view, the housing market needs some normalization, but that may not result in a big peak to trough crash in US home prices. A multi-year stagnation is a more likely outcome under current circumstances, but if we were to see a correction in home prices, it will be a slow burn lower. After the initial shock is navigated, Opendoor should be able to deliver solid unit economics and sales growth even during a buyers’ market in residential real estate. Opendoor’s partnership with Zillow is truly a game changer and a clear indication of Opendoor’s potential to be a generational company. While I think we are in for a couple of bumpy quarters, Opendoor has ample liquidity to get through this turbulent period (most of its rivals won’t). Opendoor is already the undisputed leader in iBuying, and a few quarters from now, it could be the only scaled player left standing. Hence, I am holding tight onto my Opendoor shares, and I will continue to add opportunistically in the near future.

Key Takeaway: I rate Opendoor a strong buy at current levels.

Housekeeping Note: I’ll soon launch a Marketplace service on Seeking Alpha focused on generating long-term outperformance through financial engineering. For a short period post-launch, “The Quantamental Investor” will be offered at a heavily discounted legacy price. Stay tuned for more updates!

Thanks for reading, and happy investing. Please share your thoughts, questions, or concerns in the comments section below.

Be the first to comment