OwenPrice/E+ via Getty Images

I haven’t gotten around to contributing to my Roth IRA for 2022, but I have been able to max out the contributions for the last couple years. I typically buy REITs in my Roth account because of the tax rules for REIT dividends, but I will look to add a couple new REITs to my Roth in the coming months. One of the REIT sectors I don’t have exposure to yet is the industrial sector. The first industrial REIT I intend to add to my portfolio is Terreno Realty (NYSE:TRNO).

Investment Thesis

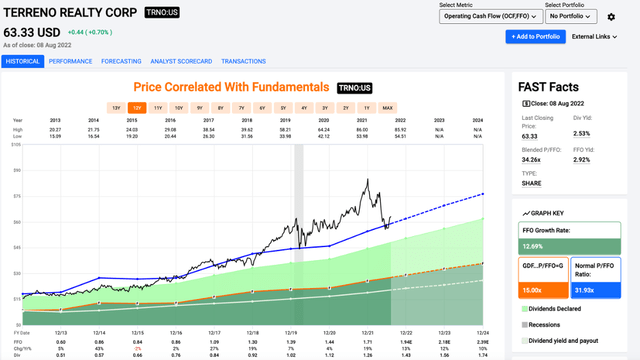

Terreno Realty is an industrial REIT that operates in six of the major coastal US markets with high barriers to entry. This leads to rapid rent increases along with significant real estate price increases as the supply of industrial real estate in these markets continues to shrink. The valuation isn’t cheap, but this is a REIT that is worth the premium in my mind. Shares currently trade at 34.3x price/FFO, which is a much higher multiple than I’m typically looking to pay for a REIT. One of the reasons I’m looking at Terreno is the impressive footprint and rapid dividend growth. The company recently hiked its dividend by another 17%, adding to its track record of impressive dividend increases.

Overview

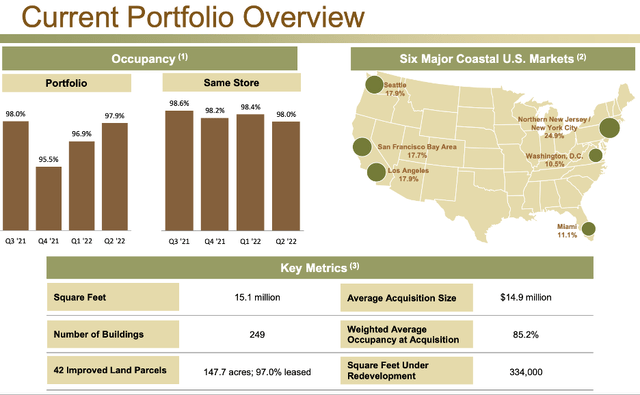

Terreno is one of the industrial REITs I have been watching for last year or so. The company has an impressive portfolio focused on six major coastal markets. This includes Seattle, the Bay Area, Los Angeles, New York/New Jersey, Washington, D.C., and Miami. They have grown the portfolio at an impressive clip in recent years, and they look poised to continue that well into the future.

Terreno Portfolio (terreno.com)

Their portfolio is located in areas with a much higher population density compared to peers. I would also recommend that readers take the time to read Colorado Wealth Management’s recent articles on Terreno. He talks about the estimates for 2024 and beyond and makes a very compelling case that the estimates are significantly under where they should be. I have looked at the recent quarterly reports, investor presentations, and other materials, and I tend to agree with his conclusion on the future estimates for Terreno.

When you consider the shrinking supply in Terreno’s submarkets, the rent growth should be impressive as the contracts are renewed. The company has also shown that they will work to redevelop properties and acquire new properties to create shareholder value. I will be watching the company in future quarterly reports, but with their operating history, I think the company will continue to create shareholder value with new acquisitions, redevelopments, and lease renewals.

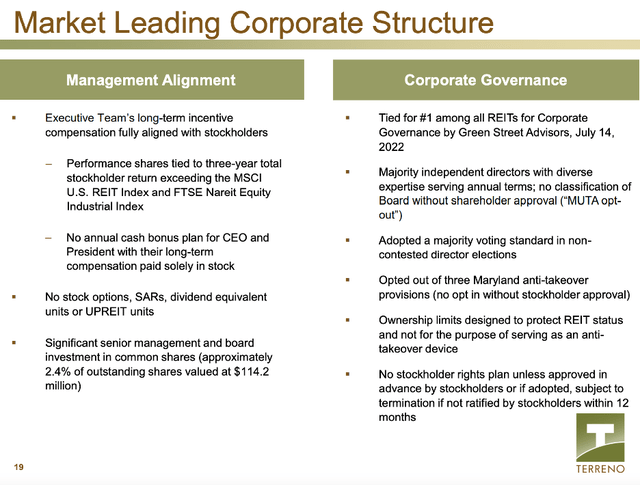

Terreno Corporate Structure (terreno.com)

One other piece worth noting is Terreno’s corporate structure. Management owns a significant stake in the REIT at 2.4%, and the incentives align management with investors for the long term. The CEO and President receive all their compensation in stock, and performance shares are tied with the stockholder return. When you combine the corporate structure with the impressive real estate portfolio, it shows why Terreno commands a well-deserved premium valuation.

Valuation

When I look at companies, I’m typically looking to buy good companies at a discount. In the case of Terreno, buying shares means buying a high-quality business at a fair valuation. Shares currently trade at 34.3x price/FFO, which is slightly above the average multiple of 31.9x. The valuation also allows the company to issue shares at good prices to buy new properties or redevelop existing properties.

While I don’t think we will see multiple expansion, I think Terreno will continue to command a premium multiple. Growth expectations show sustained double-digit increases in FFO/share, and that will lead to continued double-digit dividend growth.

The Dividend

While I would typically stay away from REITs trading above 30x price/FFO, the dividend growth is what puts me in the bullish camp on Terreno. The company has a long history of double-digit dividend growth, which continued with their most recent dividend hike. It was a 17% raise from $0.34 a quarter to $0.40 a quarter. That puts the forward yield at 2.5%, which isn’t as much as some REITs, but the real attraction with Terreno is the dividend growth. For long term investors, a rapidly rising dividend on the smaller starting yield will lead to impressive income growth.

Conclusion

Terreno is my favorite industrial REIT today, with an impressive real estate portfolio located in some of the most attractive markets in the US. They also have a corporate structure that aligns management with the long-term interests of shareholders, including significant insider ownership. While the valuation doesn’t show a huge discount now, the estimates could turn out to be too low as the portfolio contracts come up for renewal. The yield of 2.5% might not draw a ton of investors focused on current income, the dividend growth will likely outpace many other REITs. For investors looking for total return and rapid dividend growth, Terreno is a buy today. I intend to add shares as soon as possible, and once I do, I plan to hold onto them for a long time to come.

Be the first to comment