wildpixel/iStock via Getty Images

SPDR Series Trust – SPDR Portfolio S&P 500 ETF (NYSEARCA:SPLG) has been experiencing a bear market rally following stronger than expected earnings and smaller earnings misses from major companies. Additionally, investors’ optimism that inflation will plunge due to falling crude oil prices and rising rates contributed to the upside momentum. My view is that the rally looks unsustainable as the underlying fundamentals are softening across the majority of S&P 500 sectors while earnings revisions and low economic growth will further bolster valuations. It is very likely that investors will not pay a premium to buy stocks ahead of the recession, GDP contraction, and rising rates. Therefore, the timing is not right for going long on SPLG or any other related ETFs that track S&P 500.

Turmoil in the US and Global Economy

For SPLG’s portfolio holdings to generate year-over-year profit growth, global economic growth is essential, but it appears that central banks across key regions are trying to slow down overheating economies to keep inflation in a certain range through the largest interest rate hikes in the last two decades. Last month, the US Federal Reserve lifted rates by 75 basis points for the first time since 1994 with expectations for a series of a similar-sized rate hike in the coming months. US GDP contracted for the second quarter in a row in the second quarter of 2022, meeting the so-called technical criteria for a recession. Additionally, the European Commission, the executive arm of the EU, said a recession is on cards in the eurozone by the end of the year, while the British Monetary Policy Committee predicts that the U.K. will enter recession from the fourth quarter of 2022, and it will last five quarters. China, the world’s second-largest economy, missed first-half growth expectations, and analysts’ median forecasts of 3.5% hint China might miss its full-year growth target of 5.5%.

The key economic data clearly shows how quickly underlying economic fundamentals are softening, which is increasing challenges for corporations for the majority of S&P 500 sectors to maintain positive growth rates. Therefore, it is unlikely that the current rally will drive the S&P 500 back to its recent highs.

Earnings Could Weigh on Upside Trend

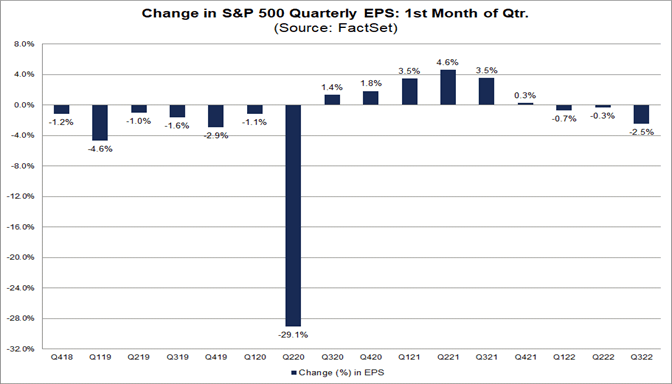

Earnings Estimates (Factset.com)

Many investors and market participants are calling second quarter earnings better than expected, but the data shows otherwise. As reported by FactSet, positive earnings surprises decreased below their five-year averages, and the growth of S&P 500 earnings on year-over-year basis slowed to its lowest level since December 2020. The data also shows that analysts have reduced earnings per share estimates for the September quarter of 2022, with estimates for the third quarter falling 2.5% from an earlier estimate of $59.44 to $57.98, the largest decline in earnings per share estimates in the last 40 quarters. Over the past 20 quarters, earnings per share estimates have dropped by an average of 1.3%, while they have dropped by an average of 1.8% over the past 40 quarters. For the full year, the earnings per share estimate declined by 0.8% to $227.77 from $229.63 from previous expectations. In addition, the earnings per share estimate for fiscal 2023 decreased by 2.0% to $245.61 from expectations of $250.59 in June.

Besides Tesla (TSLA), UnitedHealth Group (UNH), and Berkshire Hathaway (BRK.B), the data of the rest of the top 10 largest S&P companies indicates downward earnings revision for 2022 and 2023 due to economic headwinds, interest rates, and inflation. For instance, 27 analysts lowered Apple’s (AAPL) September quarter earnings expectations in the last 90 days while only two analysts raised them. Similarly, Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOG) (GOOGL), and Meta Platforms (META) all received low grades on earnings revision from Seeking Alpha’s quant system, reflecting heavy downside revisions.

Impact on Valuations

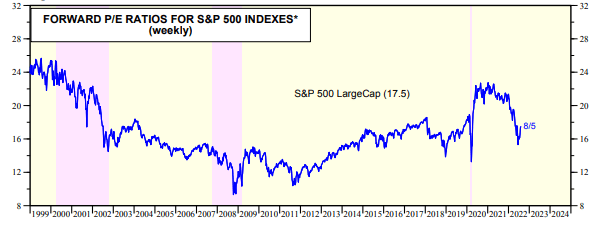

S&P 500 forward PE (Yardeni.com)

In addition, valuations don’t provide any support for the rally. A rally in the broader market index combined with a downward revision to earnings could further boost already elevated valuations. It’s hard for investors to pay a hefty premium on stocks when there is a huge risk of recession and earnings revisions. Moreover, the current market dynamics are significantly different from 2021 when the forward PE ratio of the S&P 500 index peaked at 24x at the end of the year. In 2021, companies were reporting record-breaking earnings, the economy was growing at a faster pace, and investors’ strategy of buying high-growth stocks to make easy money made it possible for the forward PE to hit the highest level since the early 2000.

The recent rally has already pushed the S&P 500’s forward PE ratio to around 17.4, which is standing at the high end of the last 10 years average of 16-18X range. With economic uncertainty and lower earnings forecasts and higher valuations, the upside surge of the S&P 500 is likely to face stiff resistance.

Historic Trends Suggest Going Against Long on SPLG

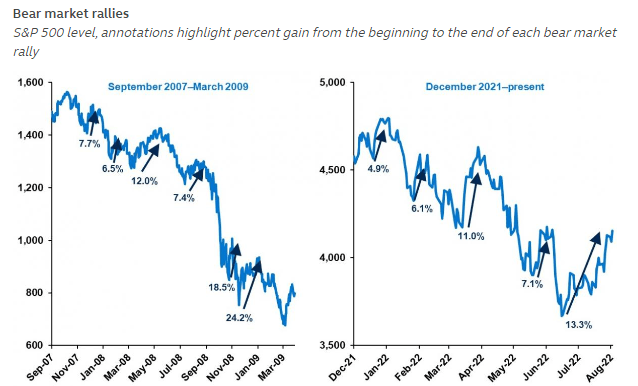

The past can teach us lessons about how markets behave, even though it’s never a good idea to make investment decisions based on historical trends. For instance, the S&P 500 has fallen into a bear market 21 times since 1929 with an average decline of 37%. In the event that history repeats itself, broader markets should fall dramatically from their current levels. Bear market rallies are another lesson that investors should learn from bear market price movements. These rallies occur when technical factors support buying, but worsening fundamentals undermine them again, resulting in new declines in the equity market.

Bear market rallies (principalglobal.com)

Besides from bear market rallies during the Great Financial Crisis, the same patterns were also seen during the Great Depression and the dot-com bubble. A bear market rally has always been followed by a sharp selloff, as shown in the chart above. Among the five rallies since December 2021, the latest surge is the longest, up almost 15% from mid-June lows. There is a possibility that the latest upside rally will prove to be a bear market rally.

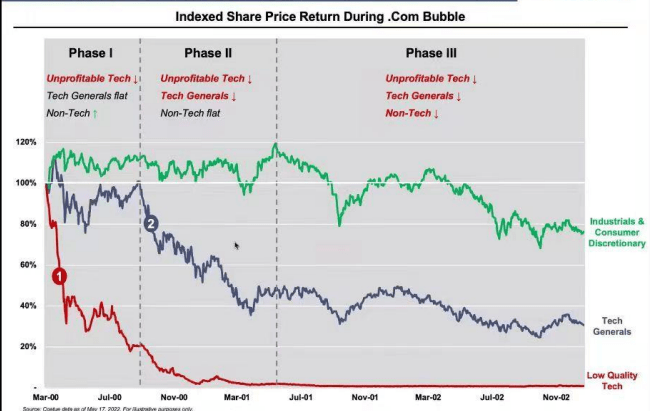

Similarities with Dot-Com burst (Coatue Management Presentation)

Moreover, the current market trends are similar to those of the dot-com bubble. Between March 2000 and the end of 2002, the market collapsed in three phases. Non-profitable tech stocks plunged during the first phase, while quality tech stocks also suffered losses during the second phase because of lofty valuations. And in the third phase, entire public companies saw a steep and longer selloff. It appears that the current bear market is in the middle of the cycle and weakening fundamentals and a longer economic downturn could push the markets into a capitulation phase.

In Conclusion

At the current levels, buying ETFs like SPLG that track the S&P 500 index doesn’t look like a prudent investment strategy. Since mid-June, stocks have already gained a lot of price appreciation, and valuations already stretched close to the high end of the 10-year average. The upside potential from here appears limited, whereas the downside potential is high due to the deteriorating fundamentals. It is possible that SPLG and the broader market will suffer a long and steep sell-off once markets begin pricing in weakening economic data and lower forecasts. Investors should therefore wait until underlying fundamentals improve before showing confidence in rallies.

Be the first to comment