undefined undefined/iStock via Getty Images

The Fed is now openly courting larger rate hikes:

Federal Reserve officials, rattled by persistent inflation and criticism that they’re behind the curve, have pivoted toward an even more aggressive plan of interest-rate hikes than they signaled earlier this month to ensure price increases cool.

In the days after the March 15-16 Federal Open Market Committee meeting, Chair Jerome Powell and his colleagues shifted from a long-standing preference for slow and gradual interest-rate increases to front-loading policy with a half-point hike on the table in May and more to come.

…

In speech after speech since they raised rates, officials stress that they want the central bank’s lead role in cooling price pressures to occupy a much more prominent part in the national conversation.

Here’s what the Fed is worried about:

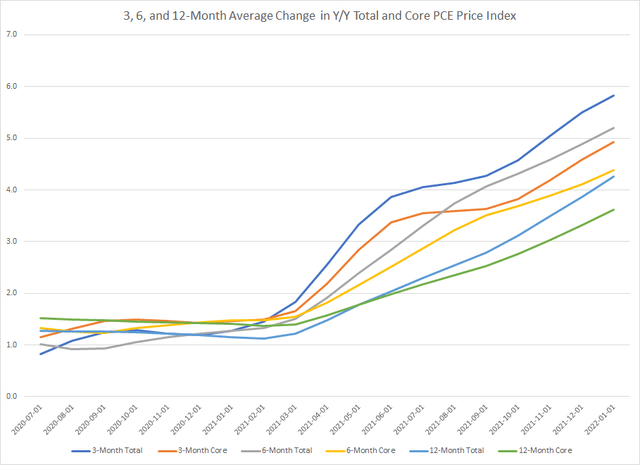

3, 6, and 12-month average percentage change in Y/Y PCE price indexes (FRED and author’s calculations)

The Fed uses averages for most economic data to remove month-to-month gyrations. The above data shows that the average rate of change in the Y/Y growth of both PCE price indexes continues to escalate. The shorter averages are also above the longer. At this point, price escalations are probably baked into the data for the next 3-6 months.

Shanghai is imposing lockdowns:

Then, on Sunday evening, the city’s officials signaled that doing both at once might no longer be feasible. The city declared a staggered lockdown that closed nonessential businesses, halted public transportation and confined the majority of the population to their homes.

The measures split the city in half, first closing the eastern section for a five-day quarantine starting Monday, before turning to a similar shutdown in the western portion. Shanghai’s caseload of 3,500 on Monday was tiny compared with much of the world, but it has been driven by the highly transmissible Omicron variant. Officials said the lockdown would enable the authorities to conduct mass testing.

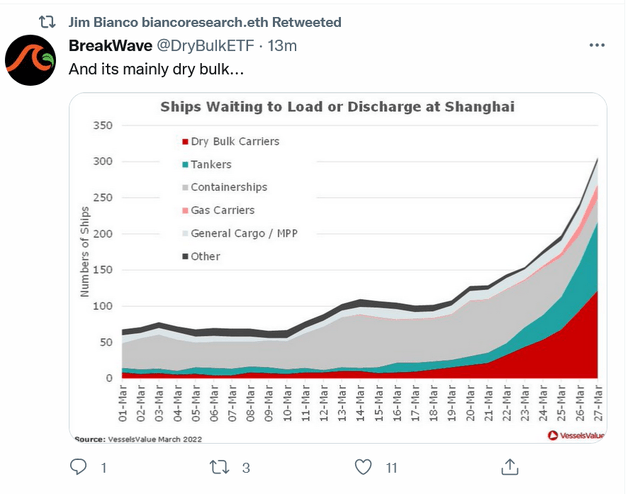

This couldn’t come at a worse time:

Ships waiting in Shanghai (Twitter )

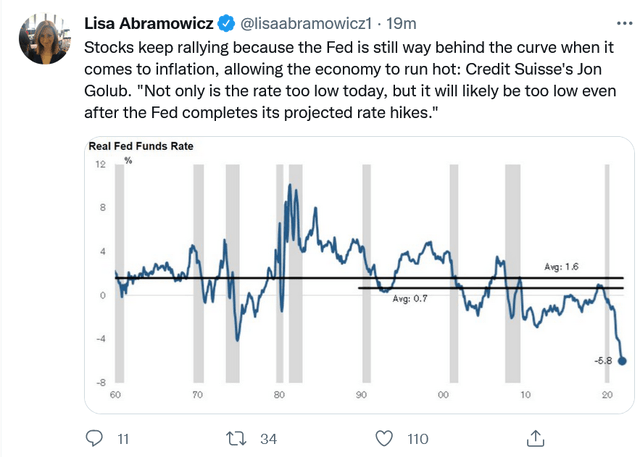

Real interest rates are very low:

Real interest rates (Twitter)

This is the lowest they’ve been in over 60 years. That’s significant. It theoretically means the Fed has plenty of room to hike.

Today, there’s some good news.

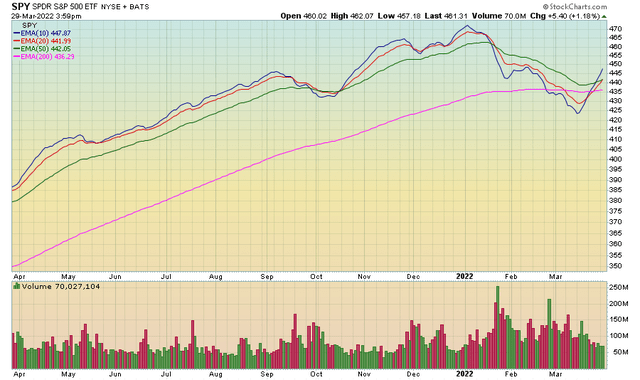

SPY EMAs only (Stockcharts)

The 20-day EMA (in red) crossed over the 50-day EMA, which now gives us a more bullish technical picture on the SPY:

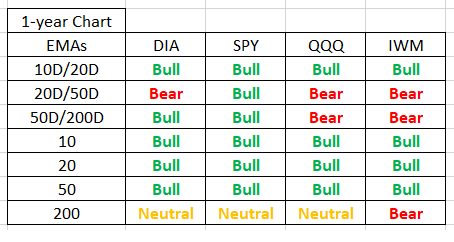

EMAs for major ETFs (Stockcharts)

Now the SPY has a solid bullish EMA picture.

Now, let’s turn to the 2-week charts:

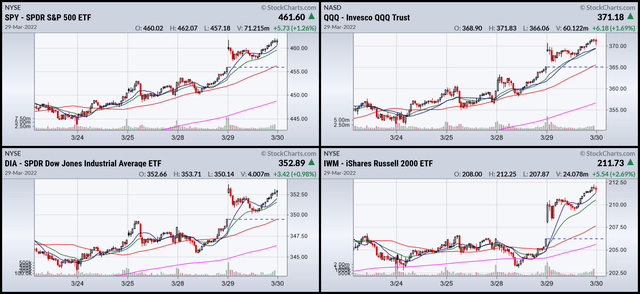

2-week SPY, QQQ, DIA, and IWM (Stockcharts)

The SPY and QQQ are in solid uptrends. The DIA and IWM have more of consolidation followed by a break-out look.

3-Month SPY, QQQ, DIA, and IWM (Stockcharts)

The three-month charts show continued improvement. The best part is the IWM, which is now just above the 200-day EMA.

Obviously, the idea of a peace settlement in Ukraine is bullish. Let’s hope the trend continues.

Be the first to comment