phaisarn2517

The trucking and logistics industry is pivotal for the recovering economy. It plays a more crucial role amidst the slow improvement in the supply chains. Personally, Daseke, Inc. (NASDAQ:DSKE) is one of the most striking companies. It has unique but stable revenue streams. Also, it remains one of the largest owners and consolidators of specialized transportation and flatbeds in North America.

But what makes it more interesting is its top-line growth, which appears to be more visible this year. Margin expansion persists, showing its efficient asset management amidst the larger operating capacity. It is bouncing back and coping with the disruptive impact of the pandemic. Its robust core operations and strong liquidity position make it both viable and sustainable. Its solid and intact fundamentals are an integral aspect to cushion the blow of inflation and supply chain disruption. Moreover, the stock price is only about half of its most recent all-time high. Given its strong core operations and cheap stock price, it appears to be an attractive investment.

Company Performance

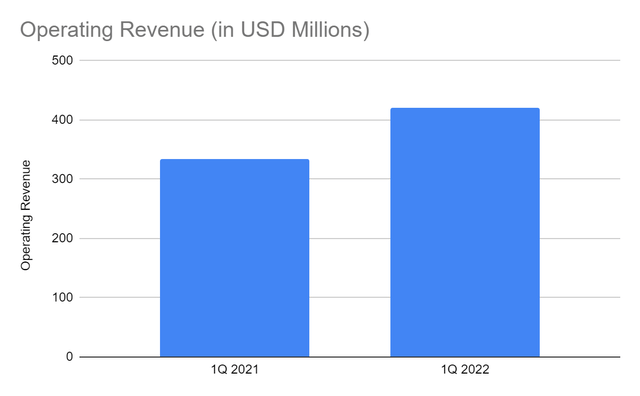

Daseke, Inc. is not exempted from the impact of supply chain disruptions. Inflationary pressures are another challenge that affects the price of fuel. Even so, this year appears to have more enticing growth prospects than 2021. The operating revenue amounts to $420 million, a 26% year-over-year growth. All its segments have higher revenues, showing an increased demand for its services. Its specialized solutions are enjoying the increased demand and freight rates. The same goes for its flatbed solutions. Also, its fuel surcharge allows it to offset the rising costs of fuel. It becomes a more important factor due to its contractually and industrially-based business model.

Operating Revenue (MarketWatch)

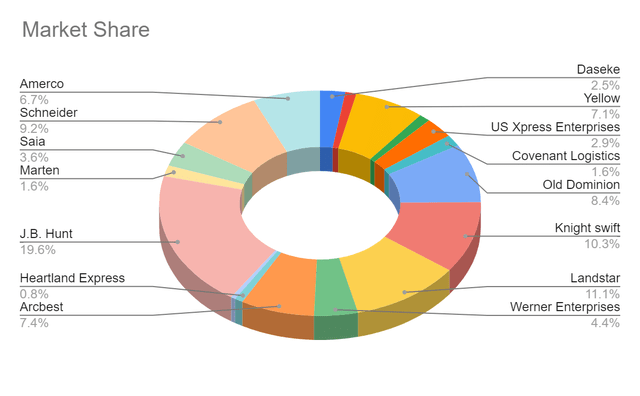

The company also feels the impact of supply chain disruptions. It faces capacity constraints as asset availability remains lower than the pre-pandemic levels. The demand for its flatbeds and specialized segments. But the strong freight rates and the uniqueness of its model continue to help it offset the decrease in volumes. Also, this business model leverages brokerage networks and owner operators to take advantage of the improved freight rates. Revenues could have been higher if not for its still limited capacity. If we compare it to other companies in the industry, DSKE is within the average revenue growth. Its market share of 2.5% is quite higher than the 2.4% market share in the comparative quarter.

Even better, it doesn’t have a similar spot rate or dry van retail exposure to many of its peers. Its operations are geared toward contractual and industrial, so revenues are more stable and secure. It also allows it to focus on a niche where it excels most amidst the demand and supply imbalance. Also, it has a strong domestic presence, given its size, concentration, and distribution in the region.

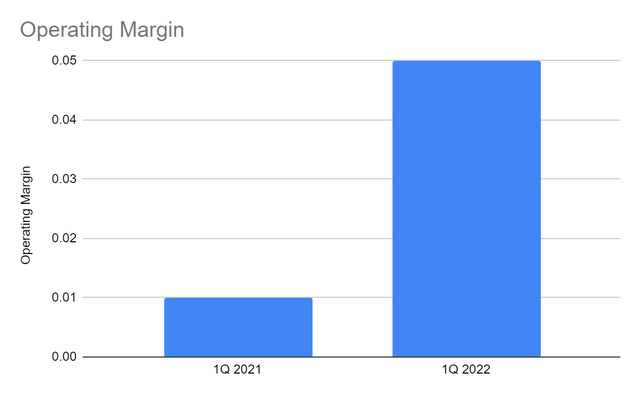

Of course, driver shortages are also a problem. Drivers are crucial not only to the timeliness of deliveries but also to their capacity to cater to customers. That is why the improved freight-rate environment and fuel surcharge are vital to offset the foregone revenue opportunities. Also, decreasing its tractors and trailers in both segments is a wise move to keep the costs and expenses low. With its unique end-market target, it has unique positioning, carrying high entry barriers and attractive growth prospects. Its ongoing transformation initiatives may pay off, especially when the full reopening of borders begins. With the relatively high increase in revenues, the operating margin is also higher at 0.05 vs 0.007. With its unique business model and continued transformation, its operations remain robust.

Operating Margin (MarketWatch)

External Pressures

In most of my previous articles, I always look into the financial conditions of the companies. But now, the external factors are more vital, especially for the trucking and logistics industry. The pandemic disruptions had been a pothole along the industry journey in the last two years. Despite the reopening of borders, market challenges are still visible. The easing of border restrictions must speed up to improve supply chains. More recent problems include inflation and geopolitical disturbance in Eastern Europe. Today, the industry is still hammered by these external pressures, especially by the rising fuel prices. Even so, I am optimistic about its performance. Many opportunities may come in the following years.

The industry is just on its way to recovery, and these external factors appear to hamper it. For instance, backlogs are still high as port congestion improvement remains slow. Also, the geopolitical disturbance drives the rise in fuel and oil prices. It is a likely outcome since Russia is one of the primary providers of energy commodities. As such, retailers and manufacturers are adjusting their production levels to keep their costs and expenses manageable.

With the still high inventory levels and lower spending, freight demand may take a toll from the recent macroeconomic changes. It is more applicable to larger retailers and manufacturers who can rethink their orders. They have responsive supply chains that allow them to cancel or change their orders quickly. It may be more challenging now, given that the inflation rate is now 9.1%. Given the rise in prices, they may decrease or stop their orders to improve their inventory management.

It is also true according to a recent update by SONAR’s Container Atlas. Data show that the global shipments and container bookings have taken a nosedive by 8% and 36%, respectively. Again, retailers and manufacturing giants have larger networks, so they have more responsive supply chains. It is easy for them to cancel or decrease their orders. So while they improve their inventory management, the trucking and logistics companies are affected. That is why they are vulnerable to port congestion and lower shipments. But the sustained emergence of e-commerce is a ray of sunshine as more opportunities are present today.

Why Daseke, Inc. May Stay Afloat

We can see how DSKE keeps its robust performance in a challenging market landscape. Its strong domestic presence and adequate capital levels are some of its best attributes. Its stellar Balance Sheet allows it to sustain its size in changing economic conditions. It has an impressive liquidity position with stable cash levels and financial leverage.

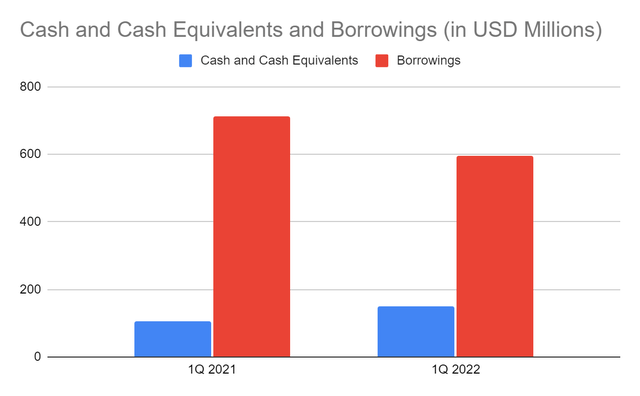

Its cash and cash equivalents of $150 million are 41% higher than in the comparative time series. Likewise, borrowings dropped by almost 20%. Given this, we can see that as it generates more returns, it keeps its financial leverage low. Cash inflows are both for strengthening its operations and deleveraging, making its financial position better. Also, cash may not be as high as borrowings, but its percentage relative to borrowings is higher today at 25% vs 15% in 1Q 2021.

Cash and Cash Equivalents and Borrowings (MarketWatch)

We must keep in mind that companies like Daseke, Inc. use more capital. That is why it is typical for them to have high borrowings. Fortunately, its cash levels are stable allowing it to sustain its operations and cover its financial leverage. If we check its Net Debt/EBITDA, the value is 2.4x. It is even lower than the ideal range of 3-4x. It means that the company is earning more than enough to suffice its financial leverage. Its stable viability and liquidity are important features for capital-intensive companies.

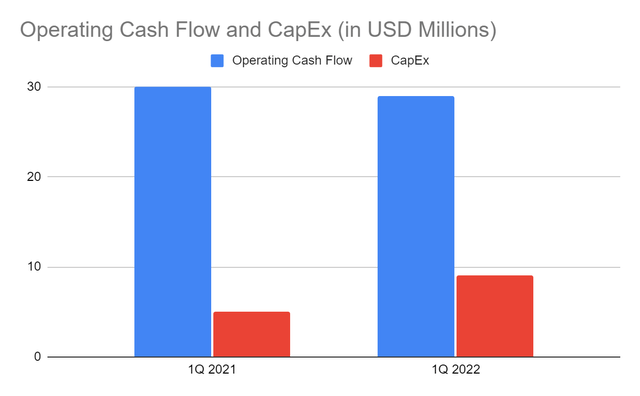

The same thing is evident in its Cash Flow Statement. Its cash inflows from operations are adequate to suffice its CapEx. Only 31% of cash inflows are for CapEx, so FCF is stable at $20-25 million. Even if we compare the two accounts using the five-year average, FCF remains high. This year, it plans to decrease its CapEx, given the challenges in finding new equipment.

Operating Cash Flow and CapEx (MarketWatch)

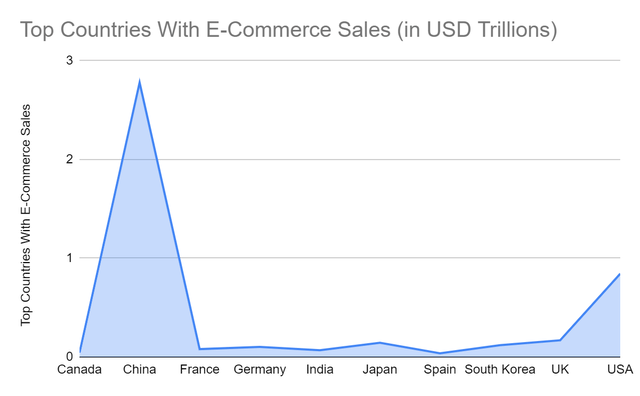

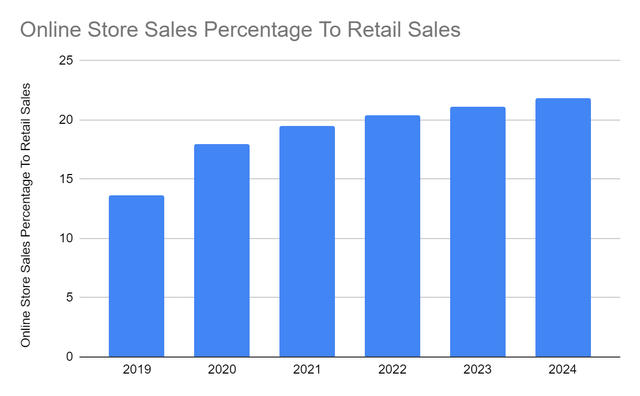

Aside from its well-positioned fundamentals, other spillovers are coming from e-commerce. That is why it is a good thing that DSKE keeps its domestic visibility strong. We must understand that e-commerce is composed of many SMEs. Their supply chain networks are fewer and less responsive, which is more favorable for the company. They cannot retract or halt their orders for their inventory since their access to distribution networks is limited. They are different from big box and established e-commerce companies. SMEs prefer third-party transportation service providers, creating more market demand. Currently, the US and Canada are among the top ten countries when it comes to global e-commerce sales. In the following years, expansion may continue as the market comprises 20.4% of the total retail sales. It may increase further to 24% as e-commerce sales amount to $5-6 trillion in 2022-2024.

Top Countries With E-Commerce Sales (shopify)

Online Store Sales Percentage To Retail Sales (Statista)

Stock Price Analysis

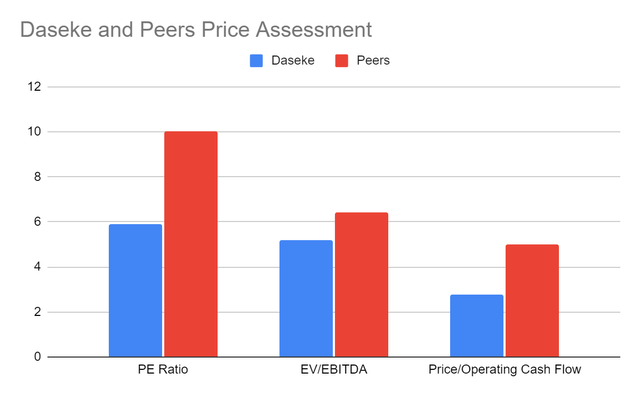

The stock price of Daseke, Inc. has been moving sideways with a slice uptrend in the last month. But it is way lower than its highs in 1Q 2022. At $6.58. It has already been cut by 36% from the starting price. It appears to be more attractive, making it cheaper and undervalued. The P/E Ratio shows that it’s only trading at 5.9x, which is lower than the peer average of 10x. Other valuations using the EV/EBITDA of 5.2 and the Price/Operating Cash Flow of 2.8 also show potential undervaluation. All of them have lower valuations than the average of their close peers. To assess the price better, we can use the discounted cash flow (“DCF”) Model and EV/EBITDA.

Daseke And Peers Price Assessment (NASDAQ)

DCF Model

FCFF $136,000,000

Cash and Cash Equivalents $153,000,000

Borrowings $595,000,000

Perpetual Growth Rate 4.2%

WACC 9%

Common Shares Outstanding 63,442,000

Stock Price $6.58

Derived Value $10.96

EV/EBITDA

EV $1,020,000,000

Net Debt $442,000,000

Common Shares Outstanding 63,442,000

Stock Price $6.58

Derived Value $9.15.

Both models show that the stock price is cheap and undervalued. There may be an upside of 39-56% in the next 12-24 months. More growth prospects may drive the increase in the price.

Bottom Line

Daseke, Inc. also observes the disruptive impact of inflation, supply chain disruptions, and geopolitical tensions. But its robust performance and solid fundamentals may make it rise above these external pressures. Also, the stock price is low and reasonable. The potential undervaluation may lead to more gains. The recommendation is that Daseke, Inc. is a buy.

Be the first to comment