f11photo Swedbank logo (Swedbank home page)

Investment thesis

In my last article on Swedbank (OTCPK:SWDBF) on the 9th of February this year, I kept my buy stance based on good results for FY 2021 and a promising outlook for an improved interest rate environment.

Since then, an ongoing war, high inflation, and a deteriorating climate all intertwined have created a backdrop of a stagnating economy.

All stock markets have taken a turn for the worse and as such, Swedbank followed the OMX Stockholm 30 index down.

Swedbank versus OMX Stockholm 30 index YTD (Yahoo Finance)

Swedbank has just published its 2nd quarter 2022 financial results.

We shall take a closer look into how they have done during the first half of this year and whether it still deserves a buy stance or if we should downgrade it.

Second quarter and FH 2022 financial results

We shall focus on the last six months in comparison to the same period of last year.

I would like to remind the readers that Swedbank’s net profit of SEK 20.9 billion for FY2021 was the second-best result in its 200-year history. Therefore, we need to keep this in mind.

Total net income after taxes over the six months declined by 11% from SEK 10.5 billion to SEK 9.3 billion. If we look at Q-o-Q it rose just slightly from Q1 to Q2 by just SEK 93 million.

EPS for the FH was SEK 8.29 with SEK 4.18 in the last quarter. This is in line with last year’s earnings per share. It also gives us some guidance as to what kind of dividend shareholders might get for the year as their policy is to distribute 50% of annual EPS.

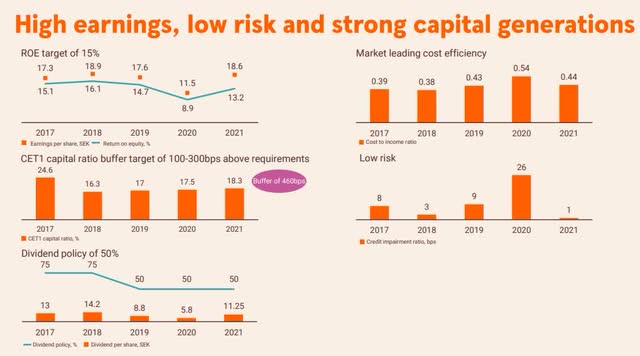

Swedbank earnings and other performance metrics (Swedbank Q2 presentation)

It does seem rather ambitious of Swedbank to have a target of getting back to an ROE of 15% but much of this depends on interest rate development and how much capital they need to retain.

Based on a share price of SEK 135 and if we estimate that EPS for FY 2022 will be SEK 16.50, the P/E is only 8.2

This is very attractive as the average P/E for the 30 companies that constitute Stockholm’s stock index OMXS 30 is now 16.

Credit impairments are kept at very low levels, which is presently what helps its stability. Over the last six months, they recorded just SEK 198 million over the last six months. More importantly, it went from SEK 158 million in Q1 to just SEK 40 million in Q2.

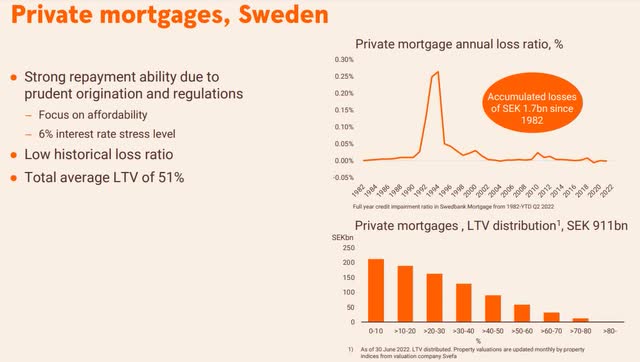

According to Swedbank’s last conference call with analysts, the Swedish residential property prices have fallen 2% from March to May this year. This is a small correction only. Their average loan to value for their Swedish mortgage book is only 51%, which is quite conservative.

Swedish mortgage book (Swedbank Q2 presentation)

During the bank’s own stress test which is used in assessing the loans, they set an interest rate of 6% to test the customer’s ability to service their mortgages.

- Interest Rate income and Fee income

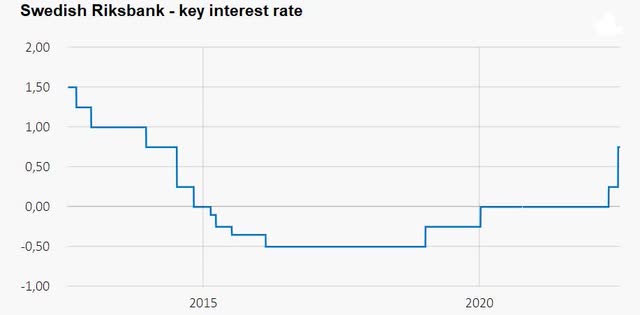

I was expecting good news to come from a slightly higher interest rate environment in Sweden. The Swedish Riksbank has come off its negative policy interest rates.

Swedish Riksbank – Policy rate (Swedish Riksbank)

The Swedish Riksbank has forecasted that the policy rate may go to 2% and is expected to hike the rate another 0.25% later in July.

As expected, the net interest income in the last quarter did receive a good boost of 5%. We can also expect this to increase further, although there are limitations to how much net interest rate margin they can achieve. Therefore, higher net interest income will come from higher volume rather than the increases in the margin.

Swedbank NII – last 5 quarters (Swedbank Q2 presentation)

With regards to the fee income, Swedbank had lower income from asset management as a result of the downturn in the capital markets. Income from payment services also decreased and they also recorded price adjustments of endowment insurance policies of about SEK 30 million.

This was offset by higher income from credit cards, as more people took to traveling.

Net gains and losses in Q2 saw a positive contribution of SEK 419 million from clients trading and SEK 92 million from Group Treasury bond buy-backs. However, this was pulled down by losses of SEK 237 million in their bond inventory and SEK 277 million in the treasury liquidity portfolio.

They also took a loss of SEK 54 million from selling their Danish bond portfolio. All in all, the total NGL was only SEK 57 million and it is not a pretty picture when we look at the trend over the last five quarters.

Swedbank NGL – last 5 quarters (Swedbank Q2 presentation)

Management had been criticized earlier that they were losing market share in the domestic market for mortgages. Fortunately, Swedbank has now regained the number one position in Sweden and the Baltic region with good growth in lending.

Mortgages grew by SEK 15 billion in the second quarter.

Like so many other large banks, Swedbank also talks about focusing on controlling its costs, but evidence shows that it is easier said than done.

For the full year of 2021, Swedbank had SEK 20.5 billion in expenses and they estimate that it will remain similar this year.

In their defense, it is hard to reduce expenses when we are facing inflationary pressure. A large part of a bank’s expense is the cost of staff. This is 4%, or SEK 230 million, higher in FH this year compared to the same period last year.

At the end of last year, the Swedish parliament voted in favor of a new bank tax. The size of the tax is 0.05% of the tax base for the 2022 fiscal year and 0.06% for the 2023 fiscal year.

This came out to be SEK 926 million for the FH of 2022 and only SEK 401 million in the corresponding period last year. That explains some of the difference in net profits, and will obviously increase somewhat the next year too.

The ongoing costs of litigation expenses are still quite annoying as I would have liked to see this AML investigation being settled and paid.

Swedbank spent SEK 92 million on litigation costs in Q2 of the year and is guiding that it will be less than SEK 500 million for the year. That is still a lot of money that goes out year after year until it gets settled.

Conclusion

In my earlier Buy stance, I had stated that it was not too farfetched to believe that Swedbank’s share price could revert to its pre-Covid level which was well above SEK 200. I still believe this is possible. I just don’t know how long time it will take.

In the meantime, I am invested in a solid bank that pays me roughly 5% to 6% a year. I am happy with that.

I maintain a Buy and have added shares in this temporary market weakness period.

Be the first to comment