ipopba

A Quick Take On Guidewire Software

Guidewire (NYSE:GWRE) recently reported its FQ3 2022 financial results on June 7, 2022, slightly beating expected revenue estimates.

The company provides a suite of software solutions to property and casualty insurers worldwide.

Until management makes progress in meaningfully reducing its operating losses as the firm transitions to a subscription-based revenue model, I’m on Hold for GWRE.

Guidewire Overview

San Mateo, California-based Guidewire was founded in 2001 to develop a range of property and casualty insurance software products for self-managed and cloud environments.

The firm is headed by Chief Executive Officer Michael Rosenbaum, who was previously head of product management and go-to-market strategy for core CRM products at Salesforce.

The company’s primary offerings include:

-

InsuranceSuite

-

InsuranceNow

-

Guidewire Live

-

Cyence

-

Guidewire Cloud

-

Guidewire for Salesforce

-

HazardHub

The firm acquires customers through direct sales methods as well as through various partners and its marketplace.

GWRE counts customers in the Americas, the EMEA and in the Asia-Pacific regions.

Guidewire’s Market

According to a 2022 market research report by Allied Market Research, the market for claims processing software was an estimated $33.9 billion in 2020 and is forecast to reach $73 billion by 2030.

This represents a forecast CAGR of 8.3% from 2021 to 2030.

The main drivers for this expected growth are a desire for insurance companies to automate its claims processing approach and manage the entire claim lifecycle from first filing until closure.

Also, N. America represented the greatest revenue by region in 2020. However, the Asia-Pacific region is expected to grow markedly through 2030.

By company type, large enterprises account for the highest market share.

Guidewire operates in other insurance software markets, so the claims market is just one aspect of the firm’s total addressable market.

Guidewire’s Recent Financial Performance

-

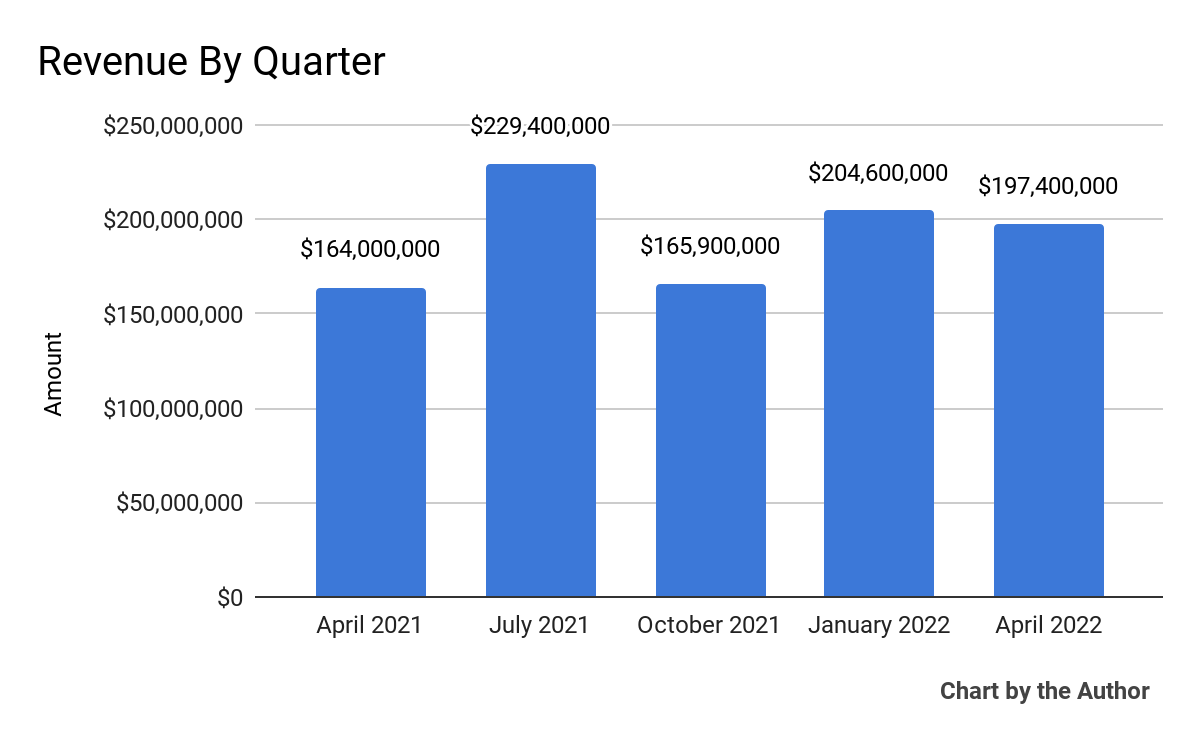

Total revenue by quarter has grown unevenly over the past 5 quarters, although that may be due to seasonality variation:

5 Quarter Total Revenue (Seeking Alpha)

-

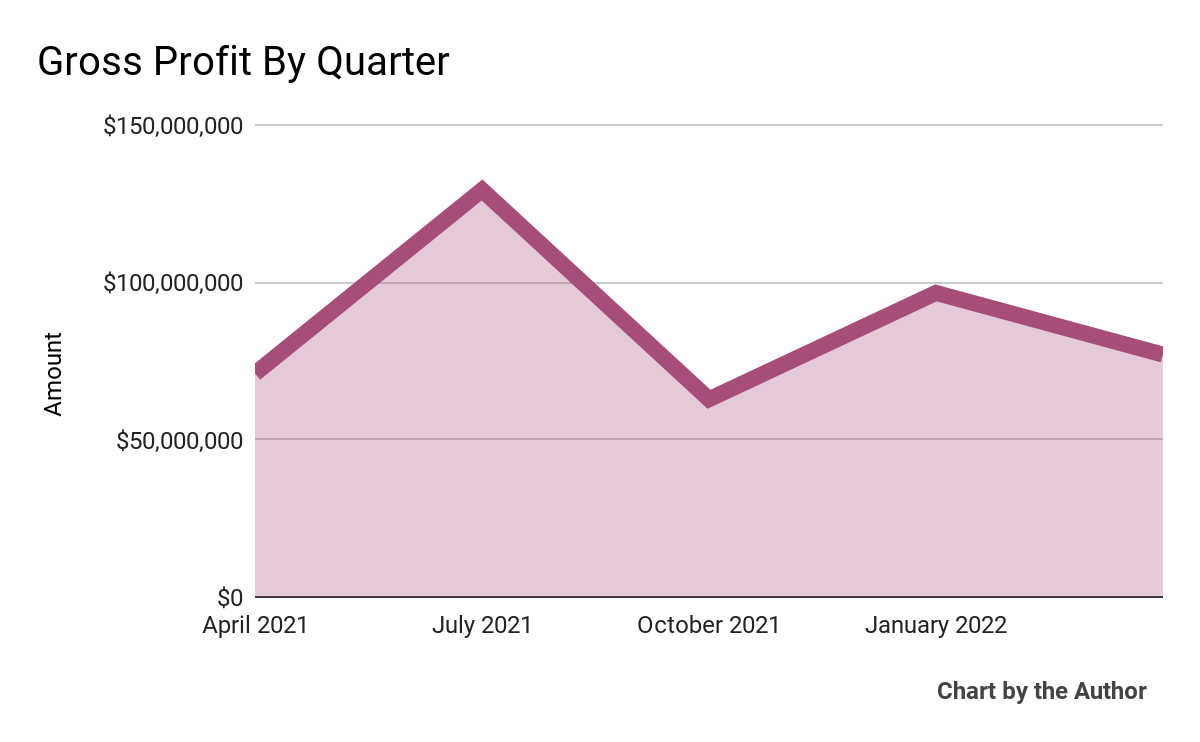

Gross profit by quarter has followed approximately the same trajectory as total revenue:

5 Quarter Gross Profit (Seeking Alpha)

-

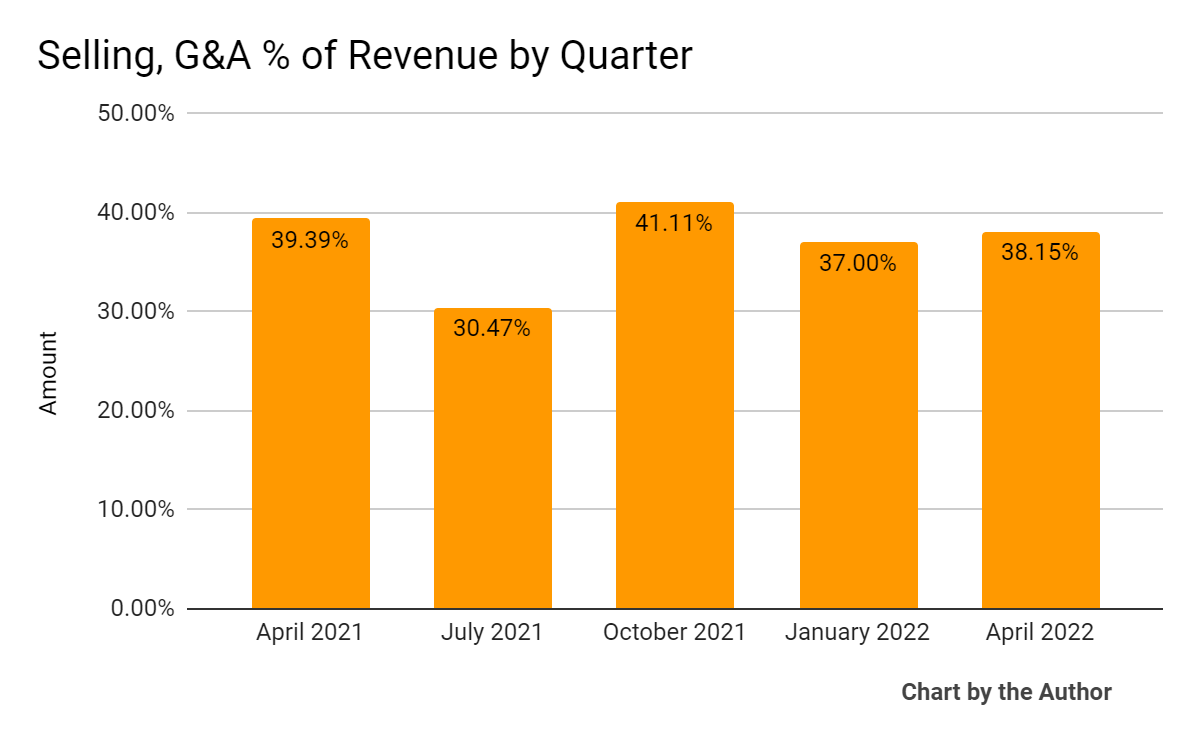

Selling, G&A expenses as a percentage of total revenue by quarter have remained within a largely narrow range over the past 5 quarters:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

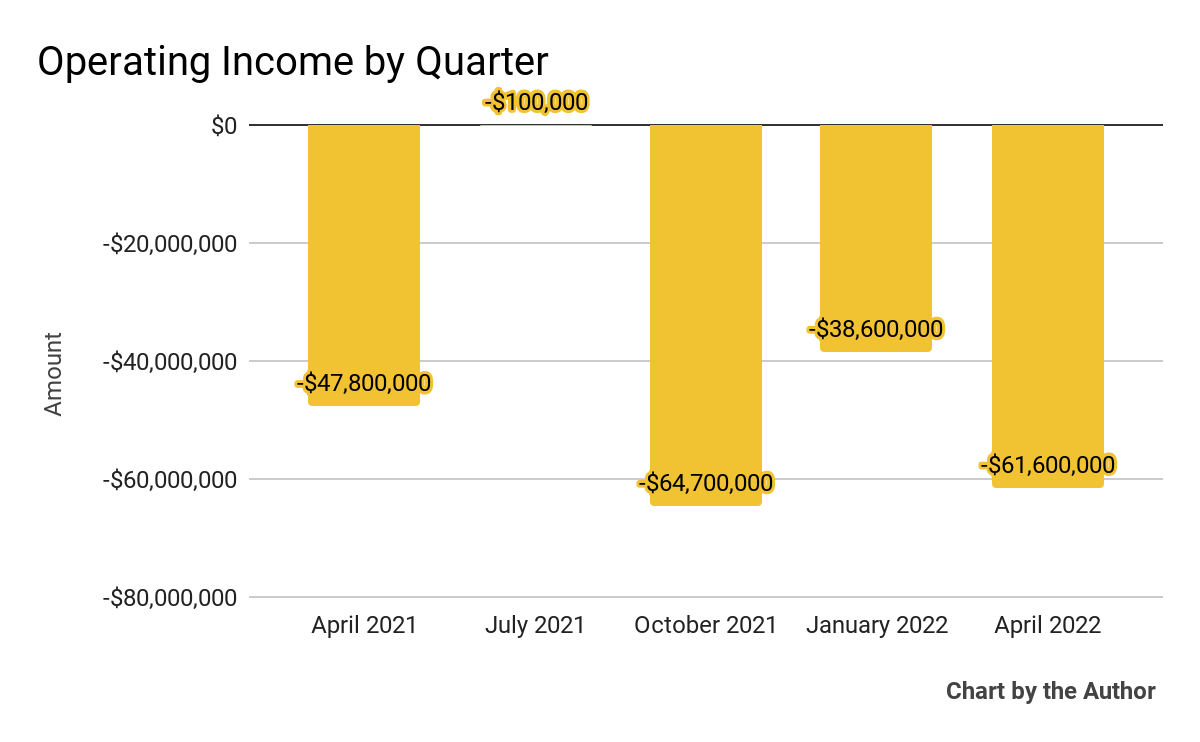

Operating income by quarter has remained heavily negative with the exception of one quarter in 2021, as the 5-quarter chart shows below:

5 Quarter Operating Income (Seeking Alpha)

-

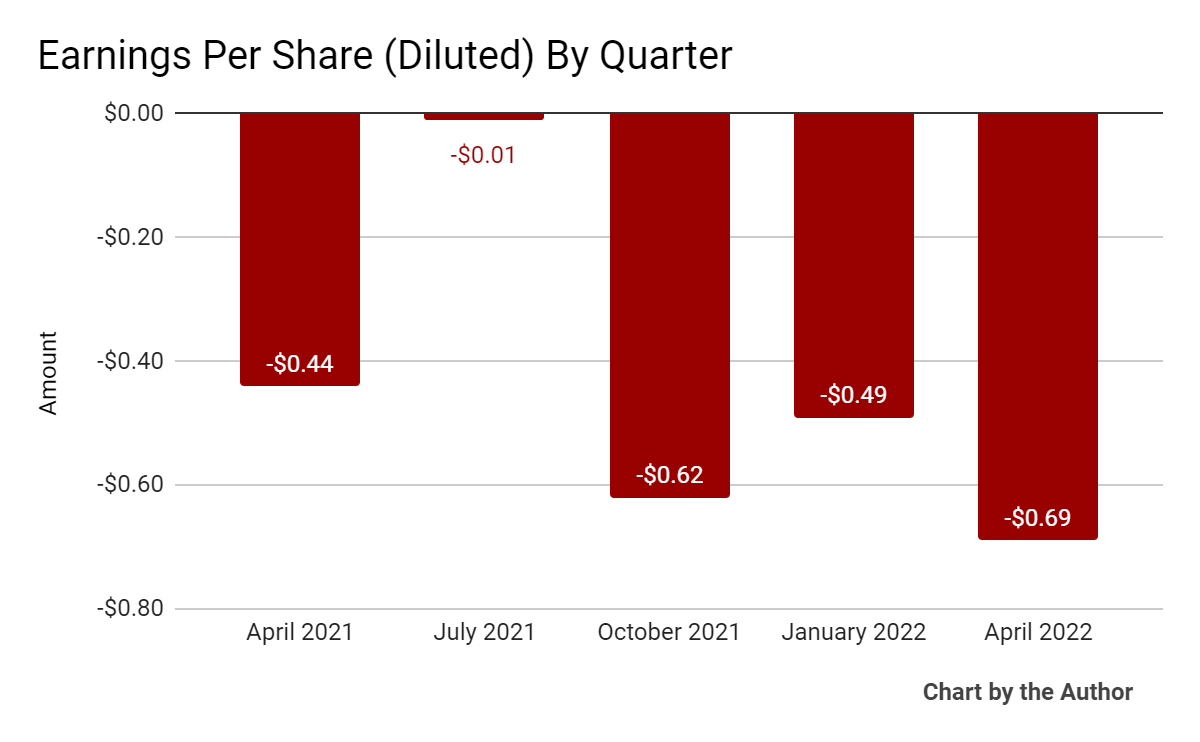

Earnings per share (Diluted) have also remained heavily negative:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

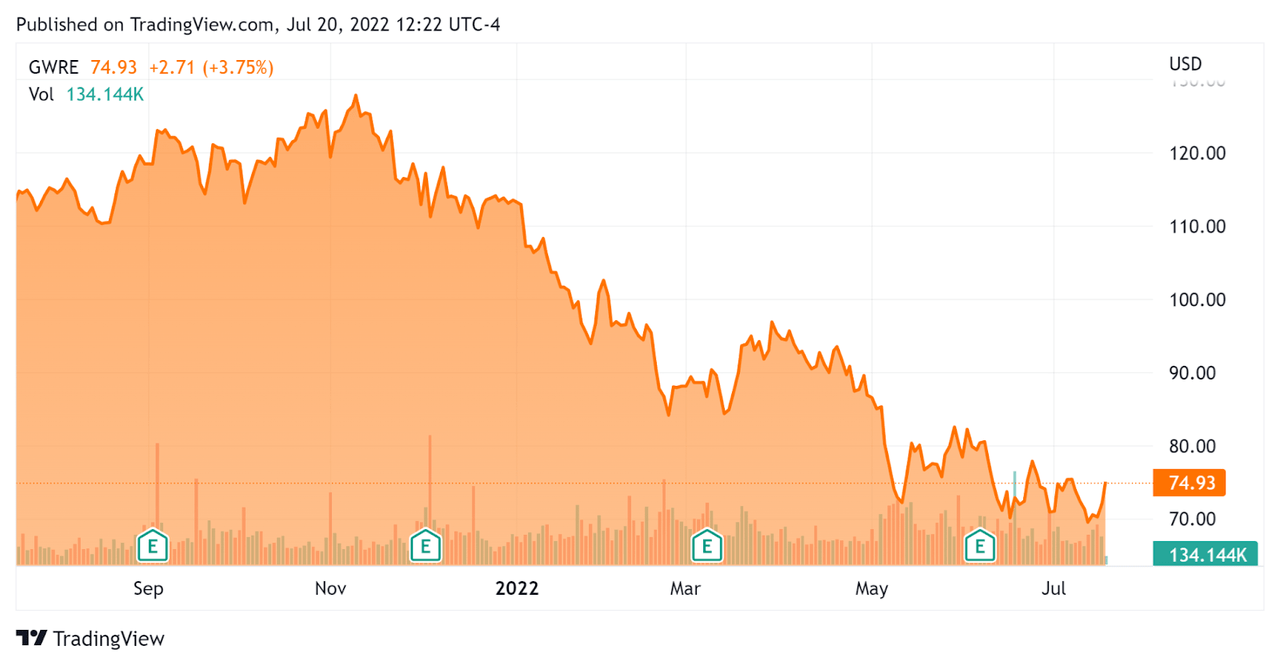

In the past 12 months, GWRE’s stock price has fallen 33.9 percent vs. the U.S. S&P 500 index’s drop of around 8.1 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Guidewire

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

$5,710,000,000 |

|

Market Capitalization |

$6,050,000,000 |

|

Enterprise Value / Sales [TTM] |

7.15 |

|

Price / Sales [TTM] |

7.55 |

|

Revenue Growth Rate [TTM] |

5.27% |

|

Operating Cash Flow [TTM] |

-$13,180,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.81 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

GWRE’s most recent GAAP Rule of 40 calculation was negative (12%) as of Q1 2022, so the firm needs significant improvement in this regard, per the table below:

|

GAAP Rule of 40 |

Calculation |

|

Recent Rev. Growth % |

5% |

|

GAAP EBITDA % |

-17% |

|

Total |

-12% |

(Source – Seeking Alpha)

Commentary On Guidewire

In its last earnings call covering FQ3 2022’s results, management highlighted continued progress on its Guidewire Cloud product offering as it sees ‘demand from existing and new insurers all over the world.’

The company is seeing existing customers move their on-premises systems to its cloud system.

GWRE also closed ‘20 deals in data and analytics’ during the quarter, with most of those signing up for its HazardHub product.

Additionally, CEO Rosenbaum also noted the growth of its partner community, with certified Cloud consultants growing to 4,400 out of a total of 18,000 from various partners.

As to its financial results, ARR (Annual Recurring Revenue) grew by 18% year-over-year from new sales as well as increasing customer ramps.

However, the company is experiencing a reduction in gross margin due to revenue shifting toward subscription and support, which is more even and less ‘upfront’ than term license revenue.

This is flowing down to the bottom line, which has produced worsening results as the firm makes the transition to a cloud-based revenue model.

For the balance sheet, GWRE finished the quarter with $1.1 billion in cash, equivalents and investments, plenty to cover its relatively small trailing free cash flow use.

Looking ahead, management slightly revised upward its revenue guidance for 2022 and expects ‘mid-teens’ subscription revenue growth for fiscal 2023, with total revenue growth estimated at around 11%.

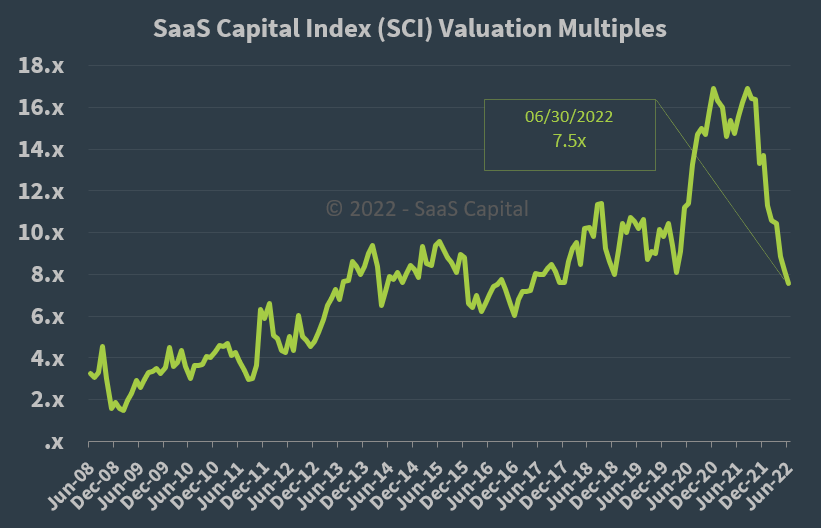

Regarding valuation, the market is valuing GWRE at an EV/Sales multiple of around 7.15x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 7.5x at June 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, GWRE is currently valued by the market at a slight discount to the SaaS Capital Index, at least as of June 30, 2022.

The primary risk to the company’s outlook is a potential macroeconomic slowdown or recession, which may slow sales cycles and reduce its revenue growth estimates.

Guidewire is seeking to make a turn toward a cloud-centric approach and appears to be making good progress in that regard.

However, its legacy business may continue to slow its growth rates while the subscription revenue model also represents a slower revenue recognition ramp while expenses remain high.

While the firm looks to have ample resources to fund its transition, it could take a significant amount of time to convert the bulk of its operations to a subscription model.

Until then, the stock may continue to disappoint as long as the firm continues to generate significant operating losses.

When management makes progress in meaningfully reducing its operating losses, the stock may be worth a closer look.

I’m on Hold for GWRE until that time.

Be the first to comment