Chris Hondros/Getty Images News

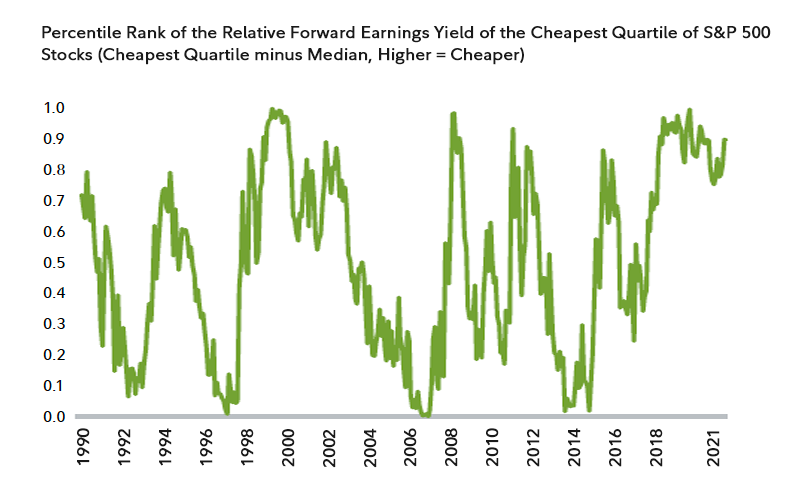

From a market strategy standpoint, I continue to favor value over growth because lower multiple stocks remain extraordinarily inexpensive compared to their very pricey counterparts on a historical basis. The chart below shows that the least expensive quartile of the S&P 500 is at a near record high discount to the median stock on the basis of earnings yield. The earnings yield is the reciprocal of the price-to-earnings ratio, which means it is calculated by dividing expected earnings (forward) by the stock price. The higher the yield, the cheaper the stock.

fidelity

Focusing on value does not necessarily mean one must confine holdings to specific sectors, as value can be found in every sector of the S&P 500 to varying degrees. My goal is to find those values in a way that allows me to diversify my stock holdings across all sectors of the market.

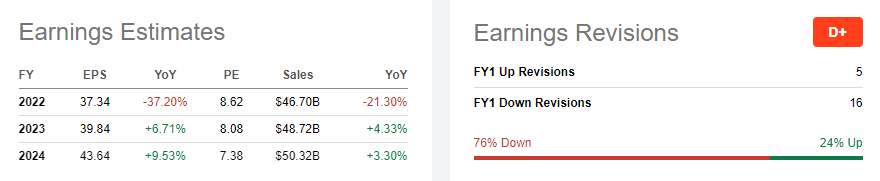

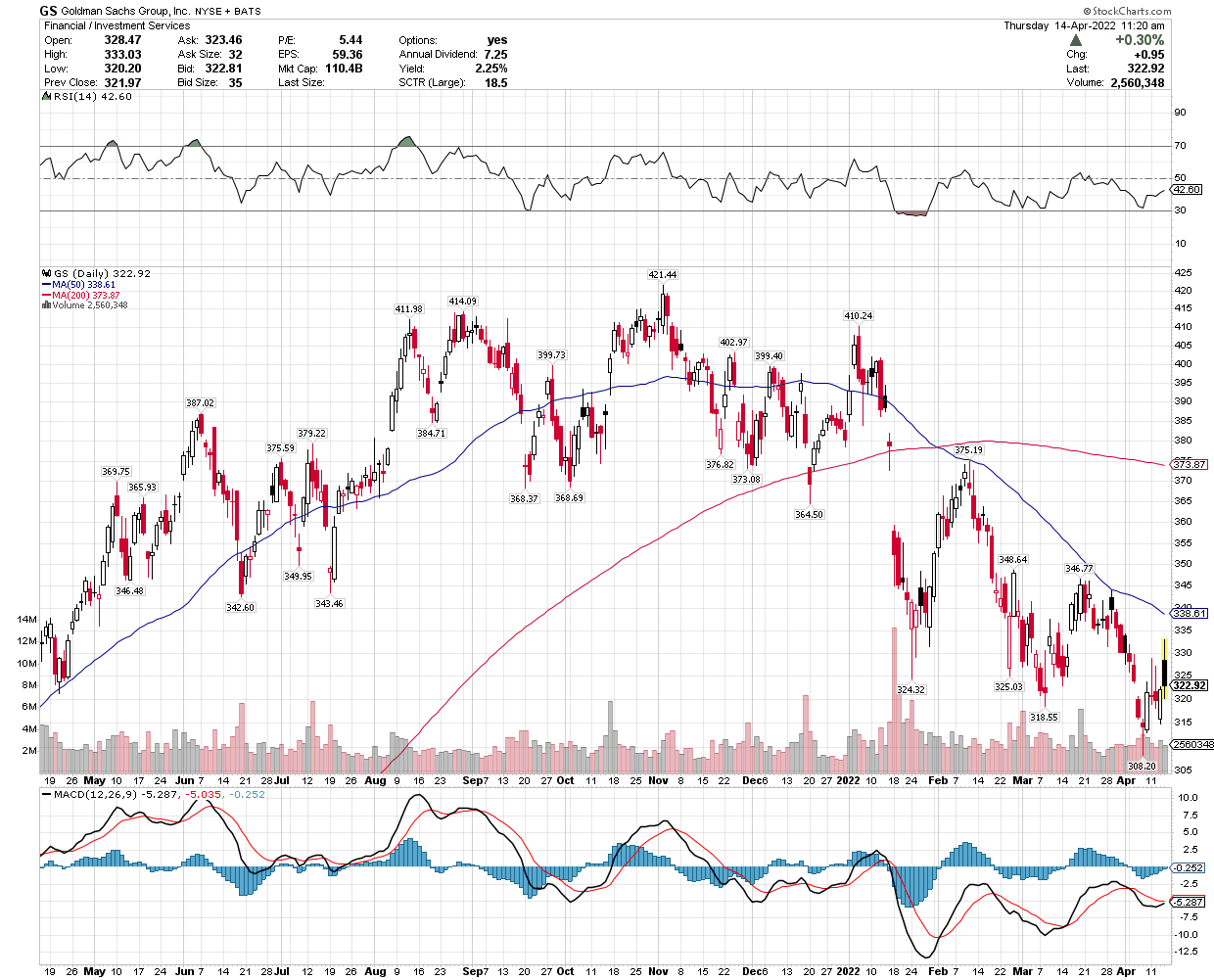

With respect to the financial sector, I view Goldman Sachs (NYSE:GS) as a prime example of a value-oriented name that still has plenty of growth potential in a very difficult macroeconomic environment. This is one of the most inexpensive and high quality ways to invest in financials, as Goldman trades at less than nine times profit expectations for 2022. In fact, this morning’s first quarter earnings report shows that estimates are likely still too low, as the bank handily beat the $8.98 number with profits of $10.81. Revenues of $12.9 billion also exceeded the consensus estimate by more than $1 billion.

Recognize that these numbers came in light of one of the most volatile and difficult quarters since the pandemic struck in 2020. Perhaps that is why there were far more downward earnings revisions than upward ones going into the quarter’s end. Assuming we do not have a recession this year, I am confident that Goldman can earn better than $40 this year and trade at north of $400 again, which implies upside of more than 20%. The stock also boasts a yield of 2.5%.

Seeking Alpha

That would still have it trading at just 10x earnings when JPMorgan, Bank of America, Wells Fargo, and Morgan Stanley are all trading at 11x earnings today. I think Goldman should be trading at a premium to these competitors after today’s first quarter earnings performance. Goldman’s book value at 1.1 times is also at a steep discount to the likes of JPMorgan at 1.5x.

Stockcharts

There is no way that Goldman will be able to repeat its performance in 2021 when the bank earned nearly $60/share on record investment banking and trading revenues, but that does not substantiate today’s depressed valuation. After today’s earnings report I think we will see a slew of Wall Street upgrades that recognize the improved diversification of the business and its acumen to capitalize through trading on what is likely to be an extremely volatile year in markets.

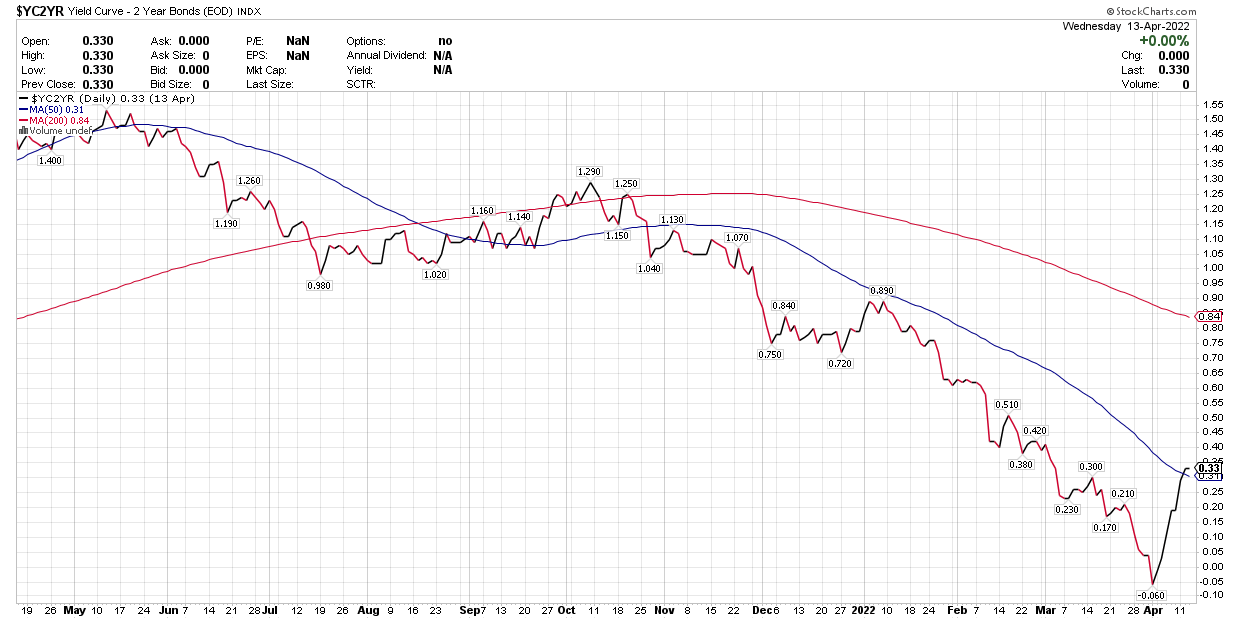

One additional tailwind would be to see the yield curve steepen after its brief inversion last week. I think 2-year rates have peaked and that 10-year yields should continue to climb, albeit more slowly, improving the banking sector’s profitability. Now that Goldman has a consumer banking platform, this would be another positive development.

Stockcharts

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment