bjdlzx

(Note: This article was in the newsletter August 27, 2022.)

(Note: This article is about Canadian Companies Reporting In Canadian Dollars Unless Otherwise Stated.)

The current management of Cenovus Energy (NYSE:CVE) came after the acquisition of the ConocoPhillips interest in the partnership. Ever since this management has been in place, there has been a long-term process of whipping the company into shape primarily by cutting costs as well as a continuing growth strategy. This management shows no signs of slowing down anytime soon.

Even though this company is in a cyclical industry. The continuing pursuit of bargain acquisitions and growth is likely to continue to make this stock a good idea for long-term investors for years to come as long as they understand the volatility that comes with a cyclical industry. The continuing growth is likely to result in “higher highs and higher lows” throughout the business cycle.

Current Deals

Management just acquired a 50% interest in a refinery to now run it as the sole owner. This comes after the acquisition of another 50% interest in the Sunrise asset. Management did mention that there would be a delay in the startup of the completely rebuilt Superior Refinery. But that refinery represents still more refining capacity than was available at the time of the acquisition. It also represents additional refining capacity available at a time when the United States and Canada needs more refining capacity.

Note that the individual deals are small “add-on” deals that carry little risk because Cenovus already knows the assets very well. These are the kinds of deals that are typically low risk as well as high return deals. Generally, the market for such assets is very limited (usually to the other partner or partners). Any management that is patient enough can just wait for companies that “want out” to get a decent deal. That appears to be the case here.

Shareholder Benefits

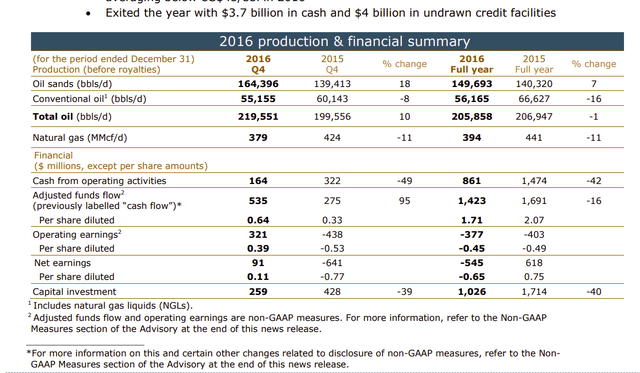

Before this management came into the picture, here was the company cash flow statement at the end of 2016 when management was completely tied up with partnerships:

Cenovus Energy Fourth Quarter 2016 Operating Results Comparison (Cenovus Energy Fourth Quarter 2016, Earnings Press Release)

In the annual report shown above, the large majority of production was due to the partnership with ConocoPhillips that management consolidated when reporting results to shareholders. The refining results came from still another partnership. That meant management was “hog-tied” when it came to projecting the future because it needed the approval of partners to do much of anything (that includes receiving cash to pay the bills). This was a relatively large operation to be so knotted up in a “necessary approval” process. Management did make it work. But it was far from a satisfactory way to operate.

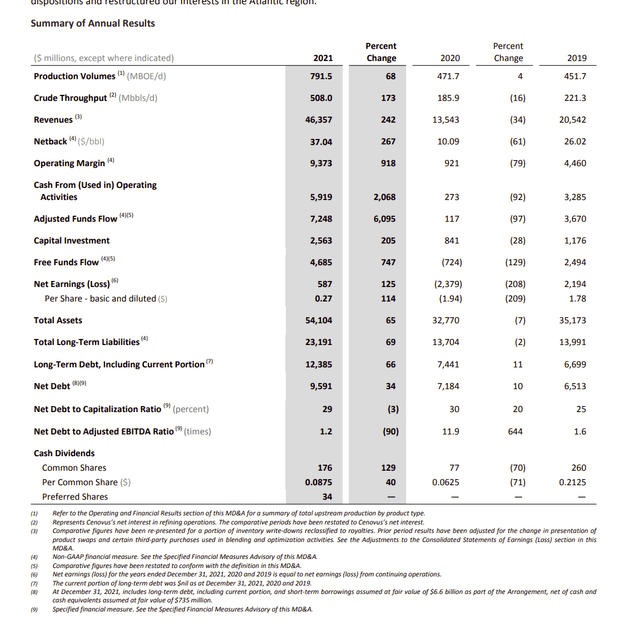

Cenovus Energy Fiscal Year 2021, Operating Comparison (Cenovus Energy Fiscal Year 2021, Management Discussion And Analysis)

By the end of fiscal year 2021, cash flow had increased far in excess of any perceived share dilution. The long-term project of increasing profitability through efficiency gains was clearly paying off.

Furthermore, the acquisition of additional refining capacity in fiscal year 2021 (when the market clearly was at or near a cyclical bottom) paid off handsomely beginning the current fiscal year. There is probably more good news to come as the fiscal year unfolds.

The biggest deal with thermal oil is that the product is discounted. Therefore, the considerable company exposure to the market resulted in abysmal cashflow figures in fiscal year 2021. That is far less likely to repeat with the Husky (OTCPK:HUSKF) acquisition complete. But Mr. Market wants to see how all the parts do now that they are in the same place. That demand should be easy to meet over time.

One of the catalysts that will propel this stock higher is a demonstration by management that this company that was “put together” through a combination of partnership buyouts, sales of non-core assets, and combinations or acquisitions, will work as designed. The track record of the company as now configured is not all that long. But it will not take an extraordinary effort by management to show the advantages of all the business moves taken the last few years.

Currently

Management has been literally “printing money” in the current commodity price situation.

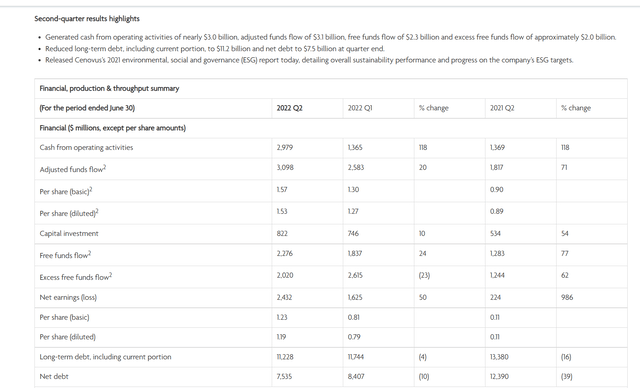

Second Quarter 2022, Operating And Financial Results (Cenovus Energy Second Quarter Fiscal Year 2022, Earnings Press Release)

Cash flow is now so far above where it was back in 2016, that one can just look and know that shareholders have benefited from the management strategy since the interest in the ConocoPhillips partnership was acquired.

If the second quarter cash flow was annualized, then the stock is trading at 3 times cash flow. That is an absurdly low number in a stock market that supposedly values free cash flow. Yet well run thermal companies generally generate a lot of free cash flow as is shown above.

This is a necessary advantage in the current robust pricing environment because earnings of upstream thermal companies tend to be very volatile. Thermal is generally a discounted product. That discount can widen during periods of weak pricing.

The difference in the future will be the additional refining capacity that will lessen the need for the upstream operations to sell product at unfavorable times. Now, much of the production (if not nearly all of it) will be upgraded to valuable products resulting in a better corporate performance during cyclical downturns.

The performance in the future is likely to mimic such integrated companies as Suncor (SU) and Imperial (IMO). Traditionally these two giants trade at a premium to much of the Canadian industry. As long as management runs the whole Cenovus operation in line with market expectations, that is likely to happen to the Cenovus common shares in the future because this company is now every bit as integrated as the other two companies.

Further Advantage

Cenovus Energy has a further advantage over the other two integrated companies in that it has lower upstream costs.

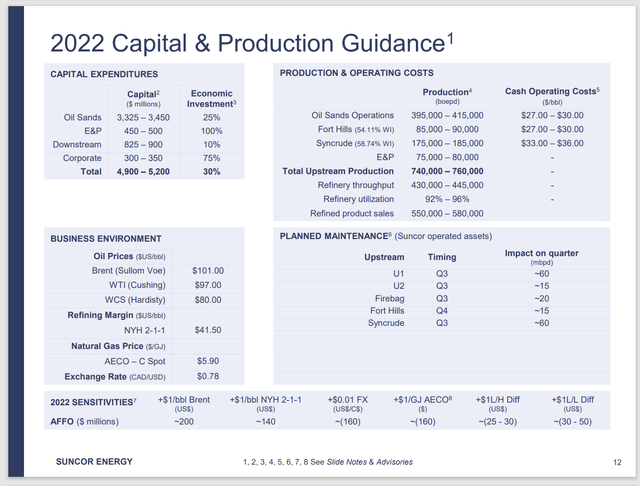

Here is the Suncor guidance given from the second quarter of fiscal year 2022:

Suncor Second Quarter 2022, Guidance, (Suncor Second Quarter 2022, Earnings Slide Presentation)

These higher upstream cost guidance by industry leaders should provide a catalyst for outperformance of the stock of a company like Cenovus Energy that has even better costs and now will report a full year of refining and upgrading capacity for the production.

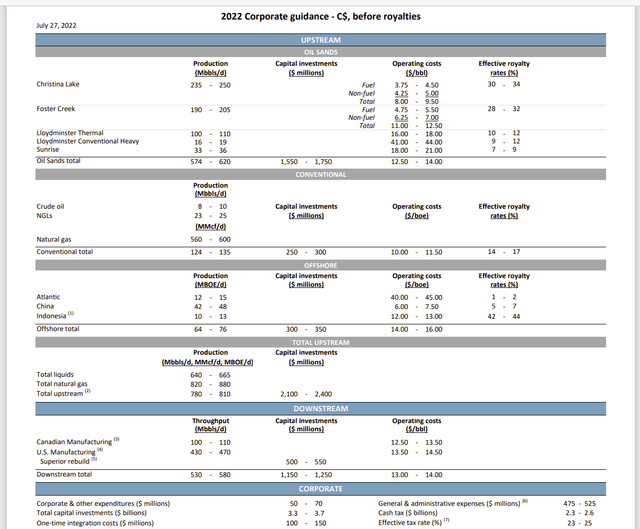

Here is the Cenovus upstream cost guidance for comparison purposes:

Cenovus Energy Fiscal Year 2022 Guidance From The Second Quarter 2022. (Cenovus Energy Second Quarter 2022, Earnings Conference Call Slides)

Most integrated companies report the majority of their profits from upstream operations. Therefore, costs of upstream operations tend to dominate the long-term performance of integrated companies.

The big deal here is that the market probably does not realize that Cenovus will be proportionately more profitable because it has far lower upstream costs than many of the established companies. As the Husky refineries replace either purchased product or Husky produced product with lower cost Cenovus upstream thermal product (and when the Superior Refinery comes online), the profitability of the company will improve to a greater extent than established integrated competitors like Suncor. This is likely to prove to be another catalyst that will propel the stock higher in the future.

The integration does benefit in that oftentimes, the integration provides necessary cash flow during periods of weak commodity prices. That was definitely true for Suncor and Imperial. In comparison, Cenovus Energy really had no cash flow before the completion of the Husky integration in 2021.

Right now, Mr. Market has some qualms about a large acquisition. Yet the company has had a refining partnership before it acquired the Husky assets. That partnership should be a good source of any needed information. In the meantime, the operations of the upstream have long been a company strength.

As the market realizes that the combined company should run well through no extraordinary effort of management, this stock will be revalued upwards. This company has far more valuable upstream assets and they constitute the majority of profits in a robust commodity price environment.

In addition to the value of the upstream assets is a robust growth strategy that is likely to continue into the future. This company has far more going for it than many in the industry. A company like this one would usually have a common market value of at least 8 times cash flow. That is more than double the current valuation.

Be the first to comment