matsilvan/iStock via Getty Images

P.A.M. Transportation Services, Inc. (NASDAQ:PTSI) is an Arkansas-based truckload transportation and logistics company. It operates through its subsidiaries across the US, Mexico, and Canada. It transports general commodities in dry van carriers. These include consumer goods, general retail goods, manufactured goods, and automotive parts. Since its foundation, it has expanded to over 2,000 trucks.

Today, it already rebounded and even exceeded pre-pandemic levels. Headwinds intensify amidst sustained inflation and slow improvement in port congestion. Yet, its market positioning allows it to cushion the impact and sustain its rebound. It has the adequate financial capacity to expand and cover its financial leverage. Likewise, the stock price stays reasonable and adheres to its fundamentals as the uptrend continues.

Company Performance

The lifting of restrictions eases the domestic movement of goods. For P.A.M. Transportation Services, Inc., it is an opportunity to rebound and expand. It may still be tough since it also operates in some neighboring countries like Canada and Mexico. Disruptions are still evident in the changes in the trucking market. Customer downtime and labor shortages pose more challenges. Even so, it appears to be bouncing back to pre-pandemic levels. Its fundamentals are more stable amidst these market headwinds.

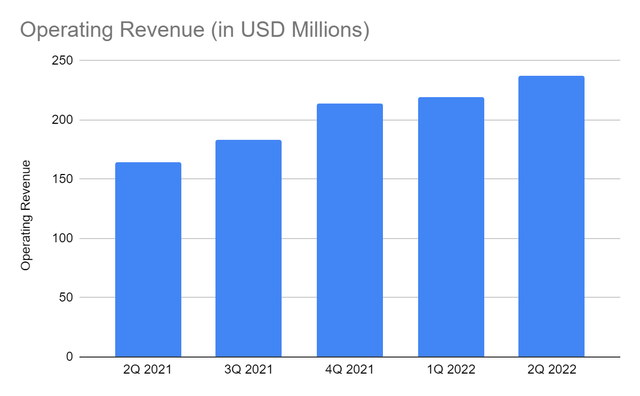

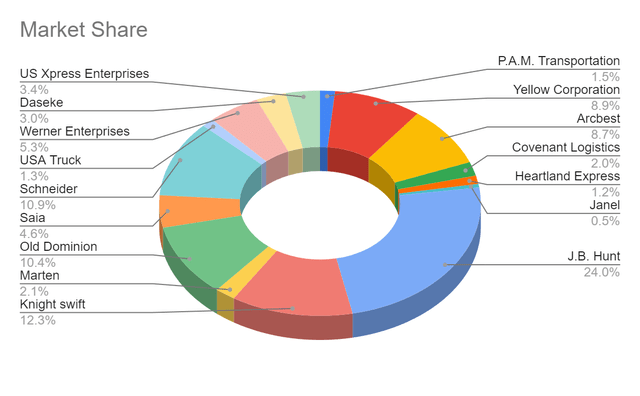

Its operating revenue amounts to $237.17 million, a 44% year-over-year growth. Note that it has already been recovering since 2021. So, we can see that the company sustained its rebound amidst market challenges. Also, it is even higher than pre-pandemic levels. The rising price of goods and energy does not stop its growth and expansion. Despite the overwhelming inflation, the company knows how to balance the trade-offs. Its fuel surcharges are more than twice as much as the value in 2Q 2021. It is a nice move to offset the impact of fuel price increases. Even better, the demand for its transport services continues to increase thanks to the increased domestic movement. There are market opportunities as the pent-up demand and the rise in e-commerce continues. Its growth is also above the market average of 36%. Also, its market share increased from 1.3% to 1.5%.

Operating Revenue (MarketWatch)

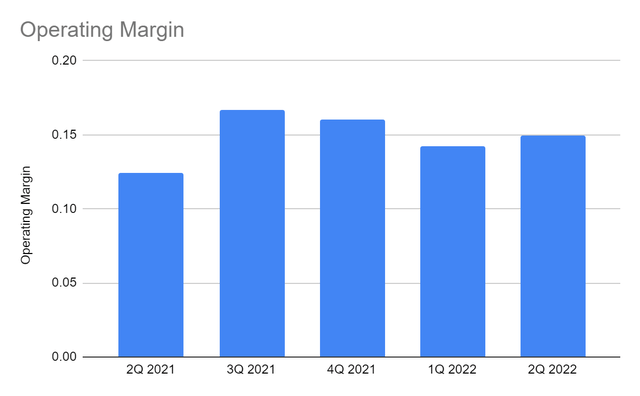

It continues to do a solid job to navigate its overall operations with ease and prudence. The thing is, it remains unperturbed while speeding up its organic growth. It was recently able to complete its M&A deal with Metropolitan Trucking, Inc, which is a timely move amidst the increased demand for door-to-door freight transport. It now has more carriers, matching its increased drivers. Meanwhile, it uses more capital, labor, and fuel. Also, it has to keep up with the rising prices which also raises costs and expenses. Even so, it maintains solid and prudent asset management. Its operating margin is 15% vs 12.4% in 2Q 2021. It is also higher than in 1Q at 14.2%. Note that the operating margin from 3Q 2021 to 1Q 2022 is in a downtrend. It could be attributed to the substantial increase in operating costs and expenses. We can say that it has a better grasp of the market changes this quarter.

Operating Margin (MarketWatch)

Potential Risks and Opportunities

P.A.M. Transportation Services, Inc. continues to show enticing growth prospects. It is geared towards expansion and efficiency with a larger network capacity. It is paying off with stable returns amidst market headwinds. But of course, it has to be more careful. It is still a challenge for businesses to improve supply chains and inventory levels. Port congestion is improving but remains slow-moving. It has to watch the price and demand changes closer to optimize its production capacity.

Retail giants also pose challenges in the industry. They influence the number of bookings, orders, and shipments through their responsive supply chains. They are quick to retract their orders, affecting the efficiency of trailers and logistics. Because of their supply chain networks, they are more flexible in managing inventory levels but at the expense of carriers. They also compete with air and water freight carriers. As such, they are more susceptible to risks associated with port congestion and lower orders.

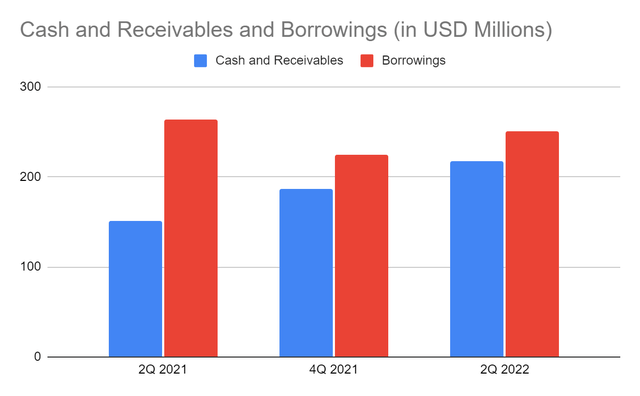

Fortunately, PTSI is well-positioned against these market challenges. Its excellent liquidity position allows it to cover its operating capacity and borrowings. Its larger operating capacity allows it to cater to more demand while remaining efficient. Cash and borrowings are stable even after completing its acquisition of Metropolitan Trucking, Inc. Its receivables are higher, given its increased capacity and customers. As such, the percentage of cash and receivables to borrowings is 87% vs 57% previously. Even better, cash and receivables comprise 32% of the total assets. If we use cash alone, the percentage is stable at 21-22%. So, despite the massive changes in operations, liquidity remains almost the same. Also, its Net Debt/EBITDA is 3.72x, which is still within the maximum value of 3.5-4x. It is earning enough to cover its borrowings. It is safe to say that the company sustains its rebound from my previous article. Its fundamentals are also more solid and intact.

Cash and Receivables and Borrowings (MarketWatch)

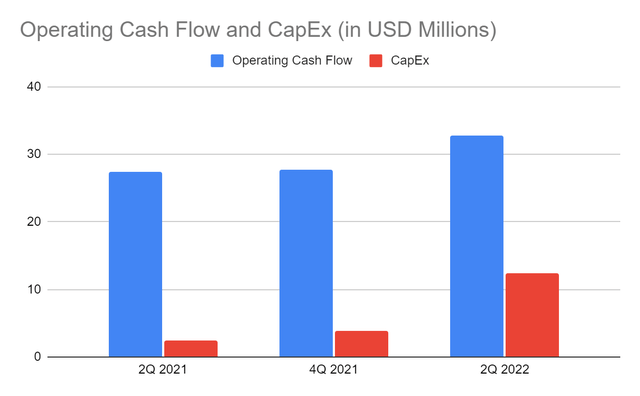

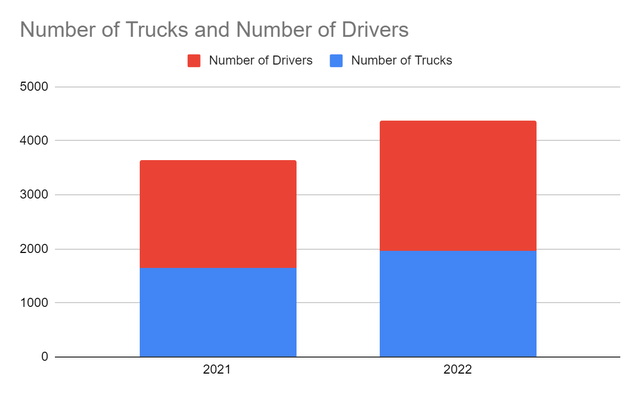

We can even confirm its liquidity using the Cash Flow Statement. The cash inflows from its operations amount to $32.78 million. Meanwhile, its CapEx is way higher than the comparative time series. It reflects the impact of the recent acquisition. Its FCF amounts to $20.45 million. So, it proves the stability of its cash levels amidst its expansion. Now, PTSI has over 2,000 trailers with 2,400 drivers. It remains sound despite driver shortages in the US.

Operating Cash Flow and CapEx (MarketWatch)

Number of Trucks and Drivers (P.A.M. Transport )

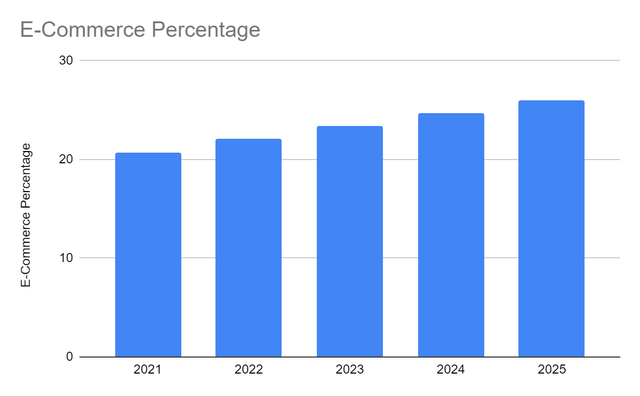

Another opportunity in the market may come from the boom in e-commerce. The e-commerce industry continues to evolve as it reaches its peak. It provides more market demand. Indeed, it is a good thing that PTSI expands its operations to increase its domestic presence. Note that many SMEs are in the market. In contrast to many giant retailers, their supply chains are less responsive. They have fewer distribution networks to retract their orders. Also, they don’t have a transportation service provider. So, they still depend on third-party transportation service providers. Their presence is favorable for trailers and logistics. It is evident in the US and Canada since they are two of the largest e-commerce markets. With the evolving market, e-commerce comprises 20% of the total retail sales and may increase to 26%.

E-Commerce Percentage (Statista)

Stock Price Assessment

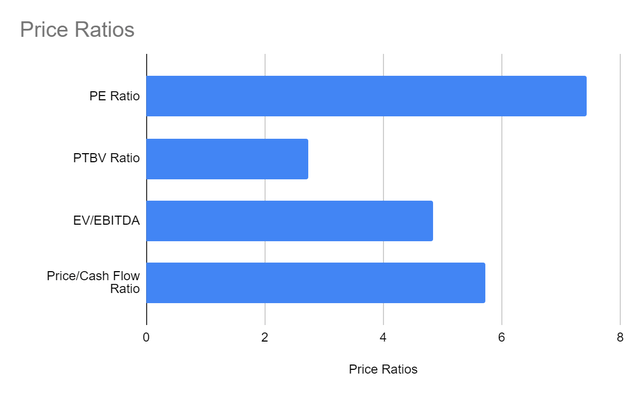

The stock price of P.A.M. Transportation Services, Inc. has already rebounded from its sharp dip. But, it has been in a slight downtrend in the last month. At $32, it remains 11% lower from the starting price but 33% higher from the dip. The PE Ratio, Price/Cash Flow Ratio, and EV/EBITDA show that the stock price is fairly valued. If you check my previous writing, the company has one the best EV/EBITDA Ratio in the industry. Meanwhile, the PTBV ratio shows potential overvaluation. Investors must watch it closer. To assess the stock price better, we can use the DCF Model and the EV/EBITDA.

DCF Model

FCFF $45,000,000

Cash $54,000,000

Outstanding Borrowings $251,000,000

Perpetual Growth Rate 4.8%

WACC 9.8%

Common Shares Outstanding 22,269,000

Stock Price $32

Derived Value $33.16

EV/EBITDA

EV $910,390,000

Net Debt $196,000,000

Common Shares Outstanding 22,269,000

Stock Price $32

Derived Value $30.38

The derived value of the two models shows two different things. But, we can infer that the stock price is still within the acceptable range. The motivation for an increase appears smaller than expected. There may be a potential upside of 4% and a downside of 8%. Investors must watch the stock price movement to find the target price.

Bottomline

P.A.M. Transportation Services, Inc. continues to expand amidst inflationary pressures. Its fundamentals are solid and intact, making it an ideal investment. Growth prospects are also attractive with its fundamental soundness and market opportunities. The stock price appears to be within the maximum range, so investors should wait to find a better entry point. The recommendation, for now, is that P.A.M. Transportation Services, Inc. is a hold.

Be the first to comment