Igor-Kardasov/iStock via Getty Images

Note: I have covered Teekay Corporation (NYSE:TK) previously, so investors should view this as an update to my earlier articles on the company.

Since my last article on Teekay Corporation (“Teekay”) almost seven months ago, there have been a number of positive developments for the company:

1. Teekay Tankers Value Appreciation

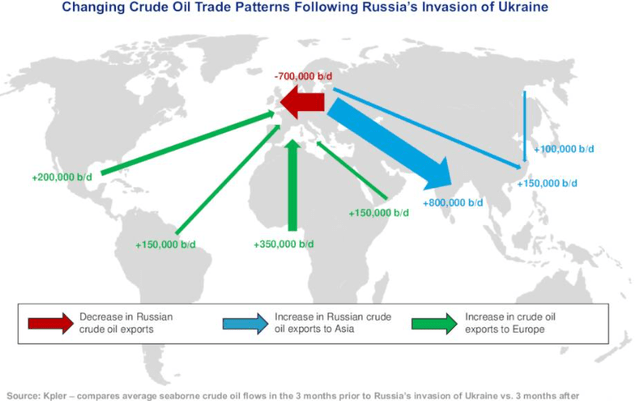

Russia’s assault on Ukraine has reshaped the tanker markets as sanctions have led to trade recalibration towards longer distances with refinery dislocation adding further to ton-miles.

As a result, the company’s subsidiary Teekay Tankers (TNK) is generating decent amounts of cash with an estimated free cash flow yield north of 20% at current charter rate levels.

Not surprisingly, Teekay Tankers’ shares have rallied to new multi-year highs thus more than doubling the value of the company’s 28.6% stake to approximately $305 million.

Just a couple of weeks ago, Teekay disposed of 906,429 recently acquired Teekay Tankers shares at an average price of $25.20 for a net gain of $12.8 million.

Unfortunately, Teekay Tankers is unlikely to reinstate its dividend anytime soon given the company’s stated intent to focus on debt reduction for the time being.

2. Cash Outflows From FPSO Exit Contained

In July, the company closed on the sale of its last remaining FPSO unit Sevan Hummingbird (also known as Hummingbird Spirit) for net proceeds of $13.0 million.

The proceeds from the sale of the Sevan Hummingbird FPSO combined with a contractual lump sum from our customer on the Petrojarl Foinaven FPSO, which is expected to be received in the third quarter of 2022, are anticipated to largely cover the remaining decommissioning costs relating to these two units and we expect to substantially complete the wind-down of our FPSO segment by the end of the year.”

Kudos to management for avoiding an expensive green-recycling of the Sevan Hummingbird while at the same time securing the funds required to complete the wind down of the company’s FPSO segment later this year.

3. New Share Buyback Program

On August 11, Teekay announced a new, up to $30 million share repurchase program which I would expect to be utilized sooner rather than later given the shares’ eye-catching discount to net asset value (“NAV”).

4. Net Asset Value At Multi-Year Highs

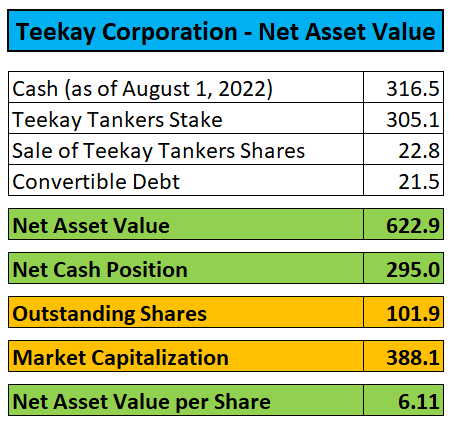

The above-discussed appreciation of the company’s stake in Teekay Tankers has lifted NAV to new multi-year highs:

Company Press Release / Yahoo Finance

Quite frankly, with more than 80% of the current share price covered by the company’s cash position, an almost 40% discount to NAV seems excessive even when considering the ongoing uncertainty regarding Teekay’s future strategic direction:

As the world pushes for greater energy diversification and a lower environmental footprint, we expect to see investment opportunities in both the broader shipping sectors and potentially in new and adjacent markets.

Bottom Line

While Teekay’s NAV has increased by almost 30% since my last update on the company in February, shares are up by just 12% despite additional positive developments like the sale of the Sevan Hummingbird and the recently announced share repurchase program.

Apparently, market participants have little confidence in management’s capital allocation abilities and the sustainability of the current tanker market bonanza. While some sort of discount might indeed be appropriate, it’s difficult to justify the shares trading almost 40% below NAV with almost 80% of the current stock price covered by the company’s cash position.

Speculative investors with the ability to keep a close eye on tanker markets should consider using temporary setbacks to scale into the shares.

Be the first to comment