jiefeng jiang

Thesis

Amidst the China Vs. USA technology war, (1) a slowing semiconductor cycle (2), and the ongoing broad market sell-off that is especially brutal for technology firms (3), Intel (NASDAQ:INTC) and Nvidia (NASDAQ:NVDA) are getting a lot of attention. Previously, I have claimed that Intel is a value trap and Nvidia is pressured by multi-faceted problems. At the same time, I argued that the valuation of both companies has about 30% downside.

Since my respective analyses, Intel is down about 18% and Nvidia has lost approximately 27%. As the valuations are slowly approaching my price targets, is there a dip buying opportunity for either Nvidia or Intel? Which stock is better positioned for a share-price rebound? In this article, I highlight a few arguments for consideration.

Share Price Performance

Before we look at financial metrics, let’s have a brief discussion about Nvidia and Intel’s share price performance. This should serve as a reference that condenses multi-dimensional information into one single time-dependent path.

Year to date, both Nvidia and Intel have lost a material share of their respective equity value: INTC is down 45% versus a loss of 56% for NVDA. Accordingly, Intel performed slightly better.

However, if an investor takes a more long-term perspective, then Nvidia is clearly the winner. For the past 5 years, NVDA stock is up 181%, while Intel lost about 21% of shareholders’ equity value.

And if we judge based on the past 10 years, then Nvidia outperformed Intel by some 3,240 percentage points.

(1:0 for Nvidia)

Technology & Products

The relative share price performance highlights a very important takeaway: Nvidia is a structural growth company, while Intel – as I have highlighted in my article – gives signals that indicate a value trap.

Notable highlights of Nvidia’s product portfolio include (not exhaustive):

- GeForce GPUs to power a cutting-edge gaming experience, as well as GeForce NOW to support computing-power intensive game streaming services and related infrastructure

- vGPU software to support cloud-based visual and virtual computing

- The ‘Omniverse’ software for 3D immersive and virtual worlds

- Various solutions for data-center and cloud computing

- Nvidia Drive for autonomous driving technology

- And, of course, high-performance processors for cryptocurrency mining.

Accordingly, Nvidia is well positioned to grow alongside the gaming industry, the crypto industry, the virtual reality revolution, the cloud-computing and datacenter expansion, as well as the autonomous driving revolution.

Intel offers (not exhaustive):

- CPUs, serving all major personal computer manufacturers. Although Intel is the market leader, the company has consistently lost share to AMD over the recent past

- GPUs

- Software products such as OneAPI suite, Command Center, XeSS, and more

- Mobileye, which is Intel’s own self-driving car project

- Solutions for connectivity, including Intel Wi-Fi, Intel Ethernet, Killer and Thunderbolt

- Supercomputers

Arguably, Intel is also positioned to grow with the gaming industry, the cloud-computing and datacenter expansion, and the autonomous driving revolution. However, Intel’s product strategy covers a much broader set of opportunities. This has been a challenge for the company in the past, as Intel has struggled to defend market share in most verticals and has lost technological edge against more focused players, such as Nvidia and AMD (AMD).

(2:0 for Nvidia)

Growth

Looking at the major structural trends in technology, notably AI computing (1), immersive gaming and the metaverse (2) and high-performance data-analytics (3), I argue Nvidia is better positioned than Intel to support the next-generation chip technology. This has been – and likely will continue to be – reflected in Nvidia’s relative growth versus Intel.

With reference to the past 5 years, Nvidia has grown at an annual compounded growth rate of 25%, while over the same period Intel has grown at a less than 1% CAGR.

Moreover, according to analyst consensus estimates, this trend is expected to continue. The one-year forward year-over-year revenue growth for Nvidia is estimated at 24%, versus a topline contraction of 4% for Intel.

(3:0 for Nvidia)

Profitability

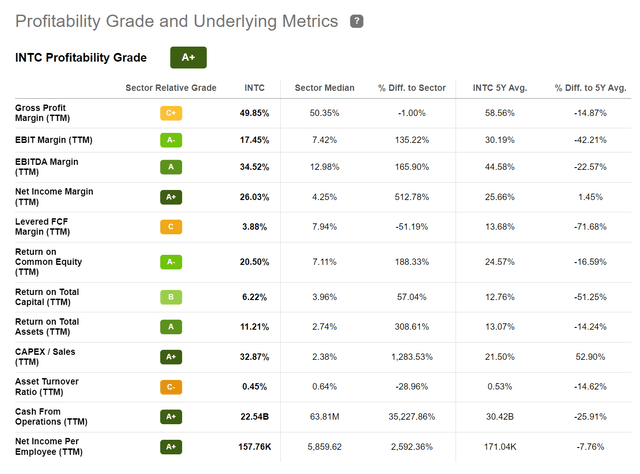

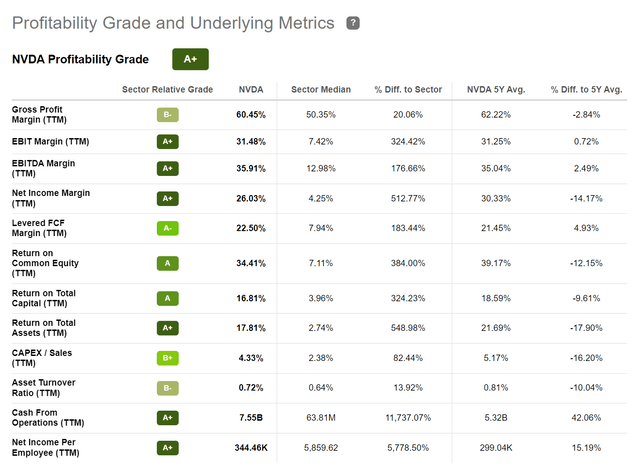

Both Nvidia and Intel operate a profitable business. But on a relative basis, Nvidia wins once more. For the trailing twelve months, Intel has claimed a gross profit margin of 50%, which is in line with the sector median. But Nvidia has achieved a 60% gross profit margin (20% higher than Intel). Also, the operating income margin (EBIT, TTM reference) is materially higher for Nvidia: 31% versus 17%.

In addition, investors should consider, that Nvidia operates much more capital efficient. Nvidia’s return on capital is 16% (TTM reference), versus 6% for Intel respectively. Moreover, Nvidia generates double the net-income per employee: $344,000 versus $158,000.

Intel Profitability

Nvidia Profitability

(4:0 for Nvidia)

Valuation

Both stocks are down significantly YTD, so their price is much cheaper than it was only a few months ago. But on a relative basis, Intel trades cheap, while Nvidia expensive.

According to data compiled by Seeking Alpha, Intel is valued at a one-year forward P/E of x11. This implies a 46% discount to the sector. Nvidia’s one year forward P/E is x72, which is a 247% premium respectively.

Accounting for financial leverage, the picture is a little more favorable for Nvidia. But the dispersion is still significant. Nvidia’s one year forward EV/EBIT is x35 (123% premium to the sector) versus x12 for Intel (20% discount to the sector).

(4:1 for Nvidia)

Conclusion

Intel is cheaper than Nvidia. But Nvidia wins with regards to the company’s product portfolio (1), business growth (2) and profitability (3). This has been reflected in the relative performance of NVDA vs. INTC, as NVDA has outperformed the latter by 3,240 percentage points.

To sum up the situation, as I see it, Nvidia is clearly taking advantage of emerging technology trends such as the metaverse and AI-computing, while Intel is playing a more defensive strategy. As a consequence, while the former is poised to claim massive new growth opportunities, the latter struggles to maintain market share. Accordingly – although I think it is too early for semiconductor stocks to rebound – I personally would feel much more comfortable buying the dip in NVDA stock.

Be the first to comment