Eoneren

The fiscal year 2022 will likely be recognized as one of the best years for Gladstone Capital (NASDAQ:GLAD) shareholders since both its share price and dividends outperformed the broader market index. The double-digit earnings growth has also diminished concerns about its dividend stability and growth potential. However, I think its shares are currently fairly priced based on valuations and net asset value, leaving little room for more upside. Gladstone does not appear attractive for new investors when compared to its peers since many other BDCs offer better cash returns as well as an attractive entry point. In my opinion, those looking to add BDCs to their portfolios should consider stocks with high dividend growth potential, backed by healthy net investment income and steady portfolio growth. The stock must also offer an attractive entry point because price performance always plays a critical role in enhancing total returns over the long term.

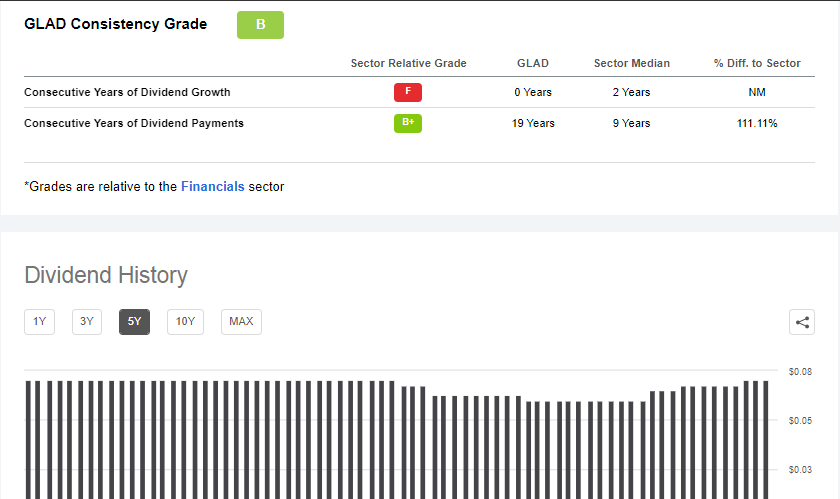

Gladstone Capital’s Dividend Growth is Safe

Seeking Alpha (Gladstone Capital’s dividend history)

Gladstone Capital’s net investment income increased 23.6% to $0.94 per share in fiscal 2022. With a robust increase in net investment income, the business development company increased its monthly dividend multiple times in 2022 to reach an annual dividend of $0.84 per share, up 16% from the past year. A dividend boost is likely in the following quarters due to the gap between earnings and dividend payments. Several other metrics also suggest that the company is well-positioned to raise its monthly dividends in the coming quarters. For instance, floating rate investments, which account for 89% of its entire investment portfolio, are exceeding floating rate liabilities by approximately $400 million, which will lead to a higher net interest margin. Robert Marcotte, Gladstone’s President, anticipates an increase of $1.25 million in net interest margin in the December quarter due to higher interest income.

In addition, the company’s strategy of investing in new and existing opportunities is likely to accelerate its net investment income in the following quarters. In fiscal 2022, Gladstone Capital invested $86 million in new and existing holdings, bringing its total investments to $649 million, an increase of 17% from the past year. A number of other factors could also significantly influence its future performance, including a 50% growth in originations, portfolio diversification to private equity investments, and a high weight of senior secured debt in the portfolio.

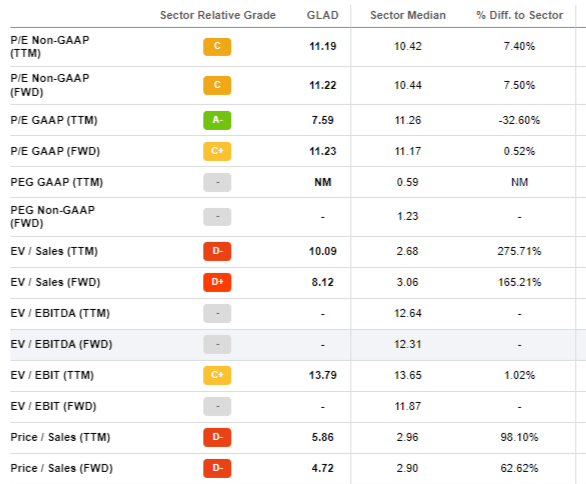

Shares Have Limited Upside

Seeking Alpha (Gladstone Capital’s Valuations)

In 2022, BDCs performed well due to high-interest rates and slowing venture capital investments. In fact, BDCs are turning out to be a perfect alternative financing option for startups because they enable them to avoid selling equity shares to venture capitalists at a significant discount. Consequently, a large number of BDCs outperformed the broader market index in 2022. In the case of Gladstone Capital, shares have dropped only 8.68% so far this year compared with a decline of around 16.8% for the S&P 500 index. As far as valuations and net asset values are concerned, its shares appear fairly valued. The stock trades at approximately 11 times forward earnings, which is significantly higher than the sector median and its closest competitors. The trailing and a forward price-to-sales ratio of around $5.86 and $4.72 is 98% and 62% higher than the sector’s median, respectively. Its current stock price of $10.50 also seems a little higher compared to its net asset value of just over $9.

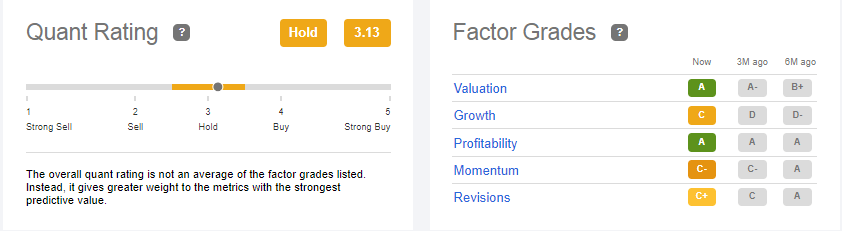

Quant Ratings

Seeking Alpha (Quant Grades)

Gladstone earned a hold rating from the Seeking Alpha quant system with a quant score of 3.13. There is a mixed picture across all five quant factors. It earned an A grade on valuations, which appears good at first glance, but if we dig deeper, most of the key valuations like forward price to earnings and sales ratios earned C and D grades. The company’s growth factor also scored a C grade, indicating a low rate of financial growth compared to peers. In terms of profitability, the company has steadily improved its profit margins.

Peers Look More Attractive Than Gladstone

Those seeking to add BDCs to their portfolios may find several attractive alternatives to Gladstone. TriplePoint Venture Growth (TPVG) and Trinity Capital (TRIN) are two of these options. There are several reasons to consider these companies including an attractive entry point, lofty yields, and high dividend growth. Aside from raising regular dividends, both companies have been announcing huge supplementary dividends, demonstrating their strong net investment income growth potential along with confidence in the future fundamentals. At present, the company’s dividend yield including special dividends hovers around 20%. Moreover, its regular dividends are growing at a healthy pace, with the latest quarterly dividend representing a growth of 7.1% over the previous quarter and 36% over a year ago. The company’s dividends are safe since its net investment income is growing at a robust pace. For instance, Trinity Capital generated a record net investment income of $38.7 million for the September quarter, up 15.5% sequentially and 77.5% from a year earlier. Furthermore, Trinity Capital offers a better entry point for new investors. It earned an A-plus grade on valuations from the Seeking Alpha quant system due to its strong financial growth along with a significant share price drop in the past few months. Read more about Trinity Capital and TriplePoint Venture Growth here: Trinity Looks Attractive Than TriplePoint Venture Growth.

Final Thoughts

There is no doubt that Gladstone Capital is one of the highest-yielding business development companies. The company raised its dividends in 2022, supported by its investment strategy and high-interest income margin. In addition, Gladstone still has room to raise its dividends in the following quarters due to the prospect of steady growth in investment income. Despite this, the company’s financial and dividend growth lags far behind competitors such as Trinity Capital and TriplePoint Venture Growth. The high valuations also make Gladstone stock expensive for new investors. Overall, Gladstone looks like a solid dividend stock, but many other names in the business development sphere are in a position to offer considerably higher returns in my opinion.

Be the first to comment