Annabelle Chih

Thesis

Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) stock surged more than 10%, after Buffett’s Berkshire Hathaway (BRK.A, BRK.B) disclosed a $4.1 billion stake in the chipmaker. Although Buffett’s track record as a technology investor is not the best, TSM stock clearly offers value hunters a lot to like – including a cheap valuation, strong profitability, and secular growth.

The stock is down approximately 37.5% YTD, and investors might like the risk/reward of acquiring a long-term equity stake.

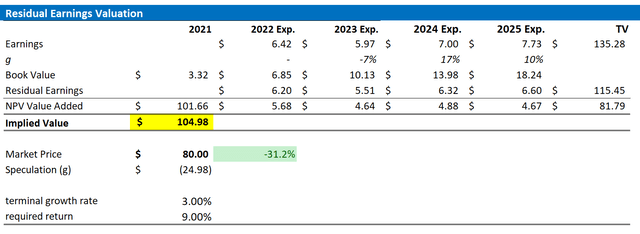

Personally, I believe TSM stock should be valued fairly at about $104.98/share. I base my thesis on a residual earnings model with analyst consensus EPS estimates as the key valuation anchor.

Thoughts On Buffett’s TSM Investment

On November 14th, Buffett’s Berkshire Hathaway filed the 13-F for the September quarter and disclosed a $4.1 billion stake in TSM. The company’s stock jumped 10% following the release, as arguably many investors were aiming to follow Buffett’s lead.

Investors should consider, however, that Buffett’s track-record as a technology investor is far from stellar. In 2011, Buffett acquired a large stake ($10 billion) in International Business Machines (IBM), which he closed for a significant loss in 2017. In addition, Buffett’s $4.2 billion stake in HP (HPQ) has so far turned out to be equally unsuccessful – estimated to be down more than 30% since purchased.

Investors pointing out that Buffett’s stake in Apple (AAPL) was the most successful investment of his career in terms of $ billions, should not forget that Apple is better described as a consumer than a tech company. Or in other words, Apple is consumer-facing (B2C), while IBM, HP and TSM are mostly business-facing (B2B).

But apart from this note – that Buffett’s tech picks have underperformed -, TSM checks multiple Buffett criteria for a successful investment, including: (1) fearful sentiment; (2) an attractive valuation; (3) strong profitability; and (4) long-term potential (no cigar-butt).

Be Greedy When Others Are fearful

Buffett loves to buy into fear – in fact, he authored the saying “be greedy when others are fearful.” And given U.S.-China tensions over Taiwan, the fear surrounding TSM is super high. Moreover, the slowing demand environment for semiconductors is certainly not helpful to alleviate concerns surrounding a TSM investment.

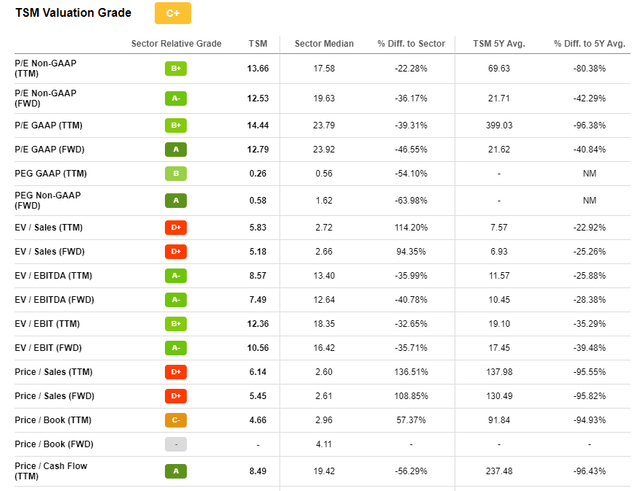

As a consequence, TSM stock has lost about 37.5% year-to-date and approximately 43% from all-time highs, making the company’s valuation quite appealing. As of mid-November, and only few days after Buffett disclosed his stake, TSM is valued at a one-year forward EV/EBIT of x10, which implies a 40% discount to the respective multiple for the IT sector median.

Industry Leading Profitability

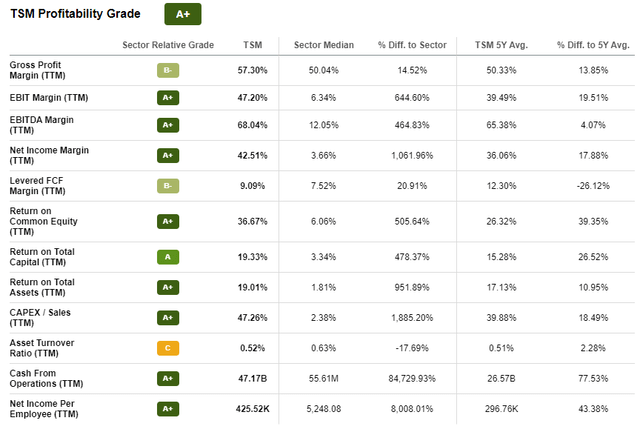

Despite the (arguably) temporary macro-concerns, TSM remains highly profitable – which not only reflects economic resiliency, but also a strong competitive moat.

For the trailing twelve months, TSM has managed to claim a gross profit margin of 57.3%, which is about 14% higher than what is the median for the technology sector. The company’s respective operating income margin (EBIT, TTM reference) is 47.2%, which implies a premium to the sector median of approximately 644% respectively.

TSM is also very capital efficient. For the trailing twelve months, the world’s largest chipmaker managed to generate a 19.3% return on total capital employed, which compares to 3.3% for the sector median. Moreover, TSM generates about $425 thousand of net income per employee, versus $5 thousand for the IT sector median respectively.

Secular Growth

TSM is not a cigar-butt investment, but rather a long-term bet on a structural growth opportunity.

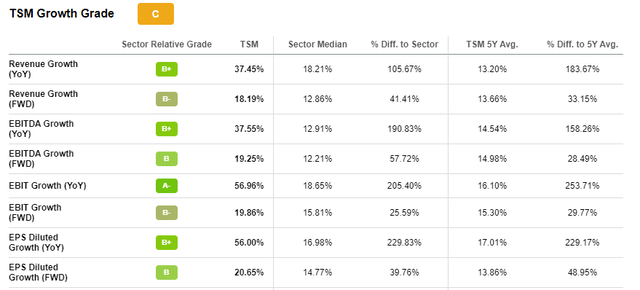

Looking at the past 5 years, TSM has grown revenues at a compounded growth rate of 13%, while TSM’s EBIT has expanded at a 16% respectively.

And this growth rate is expected to continue. According to analyst consensus estimates, TSM will likely grow revenues at an estimated 10% – 15% CAGR through at least 2025 (Source Bloomberg). Such an expectation could be reasonable, in my opinion, and is supported by a strongly growing market for semiconductor, which McKinsey estimates to reach $1 trillion by 2030.

Target Price Estimation

To estimate of a company’s fair implied valuation, I am a great fan of applying the residual earnings model, which anchors on the idea that a valuation should equal a business’ discounted future earnings after capital charge. As per the CFA Institute:

Conceptually, residual income is net income less a charge (deduction) for common shareholders’ opportunity cost in generating net income. It is the residual or remaining income after considering the costs of all of a company’s capital.

With regard to my eBay stock valuation model, I make the following assumptions:

- To forecast EPS, I anchor on the consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise.

- To estimate the capital charge, I anchor on TSM’s cost of equity at 9%.

- For the terminal growth rate after 2025, I apply 3%, which is about one percentage point above estimated nominal GDP growth – and arguably very conservative in my opinion.

Given these assumptions, I calculate a base-case target price for TSM of about $104.98/share.

Analyst Consensus EPS; Author’s Calculation

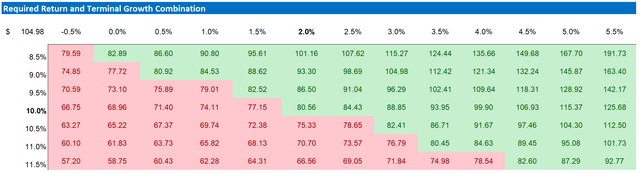

My base case target price does not calculate a lot of upside. But investors should also consider the risk reward profile. To test various assumptions of TSM’s cost of equity and terminal growth rate, I have constructed a sensitivity table. Note that the matrix looks very favorable from a risk/reward perspective.

Analyst Consensus EPS; Author’s Calculation

Risks

The major risk when considering an investment in TSM is arguably anchored on political tensions over Taiwan. While I personally do not see a war as likely, investors should consider that if a war would indeed happen, TSM is likely to drop sharply – as business disruptions could be far-reaching, extensive and enormously costly.

In addition, I would like to highlight that some of TSM’s growth exposure, including the metaverse, IoT expansion and AI-driving technology, are entrepreneurial bets. They can pay-off handsomely, but there is no guarantee

Finally, investors should consider that sentiment towards risk assets such as stocks remains strongly depressed. And given multiple macroeconomic headwinds, TSM stock may suffer from share price volatility even though the company’s fundamentals remain unchanged.

Conclusion

Taiwan Semiconductor stock surged more than 10%, after Buffett’s Berkshire Hathaway disclosed a $4.1 billion stake in the chipmaker. Although Buffett’s track record as a technology investor is not the best, TSM stock clearly offers value hunters a lot to like. An investment thesis on TSM can be anchored on: (1) fearful sentiment; (2) an attractive valuation; (3) strong profitability; and (4) long-term potential (no cigar-butt). Personally, I believe TSM stock should be valued fairly at about $104.98/share. “Buy.”

Be the first to comment