Pavel Vozmischev

Investment Thesis

Northwest Pipe Company (NASDAQ:NWPX) manufactures water-related infrastructure products in North America. It was founded in 1966 and headquartered in Vancouver. In this investment thesis, I will analyze their recent financial performance and discuss future growth prospects. I think NWPX is currently undervalued, and they have a bright future ahead, so looking at all the aspects, I believe this is the right time to invest in the company.

About NWPX

NWPX is North America’s leading manufacturer of engineered steel water pipeline systems. They supply and manufacture water-related infrastructure products. Their business can be classified into two segments, engineered steel pressure pipe (SPP) and precast infrastructure and engineered systems (Precast). The SPP segment produces large-diameter, high-pressure steel pipeline systems which can be used in water infrastructure applications, hydroelectric power systems, wastewater systems, and many more. The Precast segment offers precast and reinforced concrete products. To meet North America’s growing water and wastewater infrastructure needs, NWPX offers various solution-based products for a wide range of markets. They have 13 manufacturing facilities across North America.

Financial Analysis

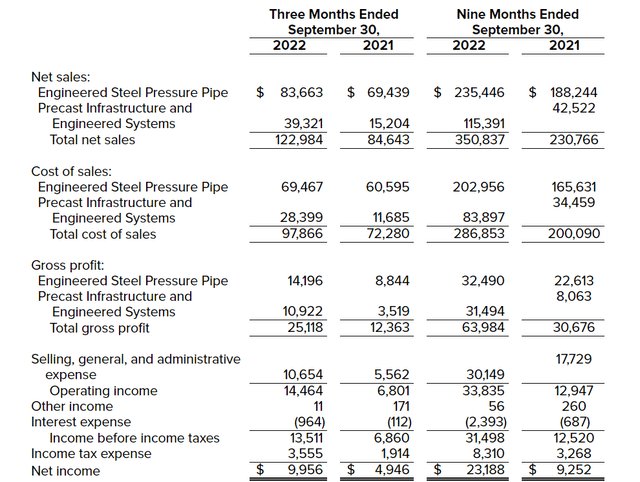

NWPX recently announced its Q3 FY22 results, and it is pretty impressive. They beat the market EPS estimate by a significant 34.6% and market revenue estimates by 7.8%. Both the segment (SPP) and (Precast) saw significant growth in their sales, which led to an impressive quarterly result. The SPP segment sales increased by 20.5% compared to the Q3 FY21. I think the main reason behind the increase was an increase in the production volume and a 3% increase in selling price per ton. Talking about the Precast segment, the sales increased by a staggering 158.6% compared to the Q3 FY21. The company stated that the main reason behind the increase was the park environmental equipment, LLC operations acquired in October 2021, which contributed $20.5 million in sales. I think another reason behind the Precast sales increase was the high demand for their concrete products.

The company reported net sales of $122.9 million for the Q3 FY22, a rise of 45% compared to the Q3 FY21. Growth in both segments (SPP) and (Precast) led to an increase in net sales. The net income for Q3 FY22 stood at $9.9 million, an increase of 101% compared to the corresponding quarter of last year, which is quite impressive. I think the increase in net sales, increased production volume in the SPP segment, increase in product pricing in both segments, and high demand for their concrete products led to the increase in the net income. Their diluted EPS for the Q3 FY22 was $0.99, a significant rise of 98% compared to the same quarter of last year. Overall the financials for this quarter is looking quite impressive and solid.

Technical Analysis

If we look at the price chart of NWPX, we can clearly see that the stock was continuously taking resistance from the level of $36 and could not close above the $36 level. The stock has been trying to break the level of $36 for the last two years. It touched the level three times in two years, and after touching it, the stock corrected more than 36% every time. It shows how major the resistance level was, but recently the stock gave a closing above $36 in a weekly time frame which shows how strong the momentum is. Technically the stock is looking very strong. The next resistance level the stock will face is $40, and if it crosses this level, then the stock can gain a very strong momentum can reach the level of $60, giving the returns up to 65% from current levels, and I think it can reach the level of $60 in a one-year time frame. But this can only happen if it gives the closing above $40 in a weekly time frame.

Future Growth

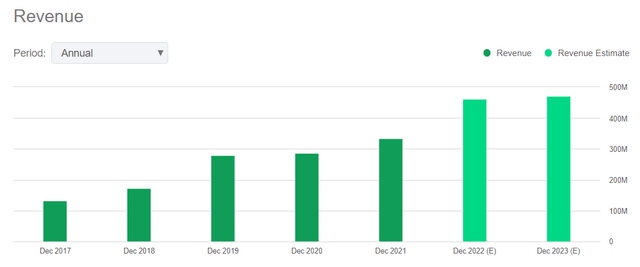

Talking about future growth, the company is very optimistic about it. Recently they were awarded a contract by S.J. Louis construction and alliance regional authority to produce engineered steel pressure pipe. This project will serve the water needs of 225,000 residents in Texas. In this project, they will manufacture over 18 miles of engineered steel pipe for alliance water. I think this project will increase the revenue of the company. Talking about the revenue estimates, they have predicted the annual FY22 revenue to be around $461.8 million, which is approximately 38.5% higher than the FY21 revenue of $333.3 million. This shows that they are on the right track, and in my opinion, they will continue to grow their revenues in the coming quarters.

Should One Invest in NWPX?

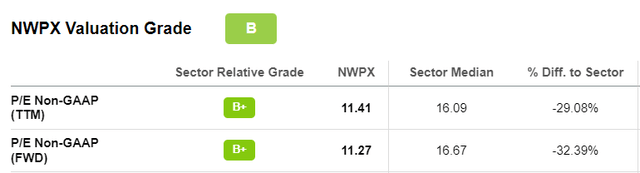

NWPX has a P/E (TTM) ratio of 11.4x compared to the sector P/E (TTM) ratio of 16x, which shows the company is undervalued and has a lot of growth potential in the future for them. They have a three-year revenue growth (CAGR) of 19.6%, revenue growth (YOY) of 51%, and (Diluted) EPS growth of 74.7%. Their growth aspects look very promising.

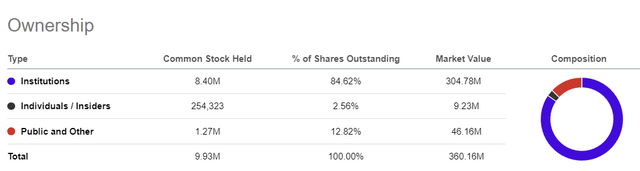

Now, another company parameter that can say a lot about them is the shareholding pattern. The shareholding pattern can say a lot about a company because companies with low market capitalization can be risky, and one can become hesitant to invest in them. A company in which the owners or big institutions own maximum shares is considered safe, and there is less volatility in their share price. So looking at the shareholding pattern of NWPX, 84% of the shares are owned by the institutions, and it shows the faith institutions have in them. Valuation-wise, it is undervalued, and the shareholding pattern also looks good. Constantly increasing revenues and increasing demands for their products, the big projects won by them recently show that the future of the company is bright by looking at all the facts. I am long on NWPX.

Risk

General And Local Economic Conditions

An economic slowdown or recession could adversely affect their business. A recession with decreasing purchasing power of people can result in declining company sales. If there is no purchasing power in the hands of people, then demand for the company’s product could fall. In the economic slowdown, we can see a downturn in government spending related to public projects, which could also adversely affect their business. They might not get more projects from the government, which could lead to a bad financial performance by the company. For instance, Covid-19 had severely affected the company’s growth in FY20. Compared to FY19, the revenues of FY20 didn’t show much growth; the revenue was flat in FY20. So a similar situation can occur in the future affecting their business.

Bottom Line

In my opinion, it is a very promising high-growth company. Constantly improving financial performance by them, management’s positive outlook for the future makes it an attractive buy. They are looking strong technically and fundamentally, and they are currently undervalued. So after analyzing all the parameters, I assign a buy recommendation for NWPX.

Be the first to comment