ElFlacodelNorte/iStock via Getty Images

Description

I recommend going long on Sterling Check Corp. (NASDAQ:STER). STER is a technology-enabled service that provides background checks and identity verification services, and is a market leader in the United States, Canada, Europe, and the Asia-Pacific region. The demand for identity verification is increasing due to various reasons (as stated below), and I believe STER is well-positioned to take advantage of this trend.

Company overview

STER is a technology-enabled service that provides background checks and other forms of identity verification all over the world. Their service encompasses all aspects of the hiring process and risk assessment. The services are delivered through a custom cloud-based technology platform that offers businesses actionable insights in real time.

Identity verification is becoming more important than ever before

Several factors point to the present as a time when identity verification is becoming increasingly important, and I expect this trend to continue. One thing that all of these things have in common is the need for flexible, all-encompassing ways to screen candidates and choose staff.

The growth of the gig economy is the most obvious factor. Currently, in the United States, the number of gig workers (59 million) accounts for an alarming 36% of the total workforce, and this percentage is only expected to grow. Workers in the gig economy include freelancers, platform workers, employees of contracting companies, and temporary workers. With the growth of the gig economy and the contingent workforce, more and more people are finding work in temporary or on-demand positions. The proliferation of rival gig platforms, which has made it simpler for gig workers to switch platforms, is the primary factor leading me to believe that this number will increase.

Because of the more direct and personal nature of service provision in the gig economy and the continued adoption of such models by major corporations, there is a growing need for safer and more efficient methods of conducting background checks. As gig and contingent work models become more common, I think there will be a greater need for Sterling’s specialized knowledge and customized solutions.

And apart from that, everybody is familiar with the Great Resignation. As a result of structural changes in the workforce, there has been an uptick in voluntary employee churn, especially among younger workers. Job hopping is more common among Millennials and Gen Z workers than it was among older generations. Moreover, as younger workers are less likely to have been raised in a generation of defined pension plans, they face fewer incentives to remain in a specific role, resulting in lower switching costs for employees. By eliminating the historically difficult geographic matching challenge faced by employers and employees, the current structural shift from in-office to remote work not only reduces switching costs for employees but also expands talent pools for employers. These tendencies, in my opinion, support the growing need for efficient employment screening and identity verification services, which can only be met by large providers like Sterling.

Last but not least, the number of fake resumes has gone up. The consequences of candidates making false statements about their qualifications can be devastating to an organization. Expenses include not only base pay but also bonuses, extras, administration, and starting over with a new candidate pool. The worst-case scenario is that the employee causes harm at work, leading to claims of negligent hiring and, potentially, large damages or settlements for the company. In addition, the company’s standing could be severely damaged if trust in management is lost. Therefore, I think it’s helpful for businesses to use background and identification verification services to lower the likelihood of these kinds of problems.

STER is a market leader with global scale

STER serves customers in a wide range of sectors and regions by providing them with background checks and identity verification services enabled by cutting-edge technology. The prospectus claims that STER is the market leader in the United States, Canada, Europe, and the Asia-Pacific region, with global fulfillment capabilities backed by operations in 13 countries. This, in my opinion, sets Sterling apart from its peers. STER’s services are a good fit for both large, affluent clients and small businesses that need to hire quickly but don’t have the resources to do so effectively. This is what separates them from competing businesses.

These abilities are supported by STER’s in-house developed technology. Their global clientele can be accommodated with ease thanks to the scalable nature of the STER technology platform and its responsiveness to market shifts. What’s more, their data analytics platform is both adaptable and potent, providing clients with the knowledge they need to make data-driven decisions and improve program management, efficiency, and optimization in real time. For me, what sets STER apart is their ability to conduct background checks, with all their inherent complexity, on their own proprietary fulfillment platform. Sterling’s AI-driven and RPA-enhanced fulfillment platform yields high accuracy, low hiring costs, and quick time to hire.

In addition, STER has collaborated with many of the leading HCM and ATS platforms to develop a robust integration platform, allowing Sterling to be easily integrated with third-party HCM and ATS systems. Sterling’s platform supports integration with proprietary candidate workflow systems used by companies and clients in the contingent workforce. With this API, customers can connect to Sterling’s powerful services and take advantage of their many features, ways to make them their own, and ways to make them work well on mobile devices.

By facilitating easy integration, Sterling is able to help its customers become more productive and profitable, which in turn strengthens its relationships with those customers. Personally, I don’t think it would be possible to copy these proprietary systems without spending a lot of capital; hence, it is a barrier to entry for new players.

Finally, STER offers a full line of international products to satisfy a variety of intricate client needs. These needs include, but are not limited to, identity verification, background screening, credential verification, and more. That’s a crucial point to drive home, as most companies would rather work with a single vendor that offers a comprehensive suite of human resources services than with multiple vendors.

Diversified customer base to reduce volatility in economic cycles

STER, in my opinion, has been able to amass a client base that is large, diverse in industry, and geographically dispersed because of the company’s decades-long focus on learning about different markets around the world. STER is able to do this because they know the market well and use a delivery model that is tailored to specific industries and locations.

Over 40,000 businesses, including many in the Fortune 100 and 500, as well as thousands of small and medium-sized enterprises, are among STER’s current clientele. Based on the numbers for 2019 and 2020, the S-1 states that STER’s average tenure with its top 100 clients is nine years and rising. I think these numbers show just how deeply integrated STER is into their customers’ workflow processes. What’s more, STER serves a diverse set of markets across many different verticals. I think STER has built a highly credible name for itself in the market, and they are positioned to expand alongside our clients as the difficulty and nuance of talent acquisition for businesses continue to rise.

Valuation

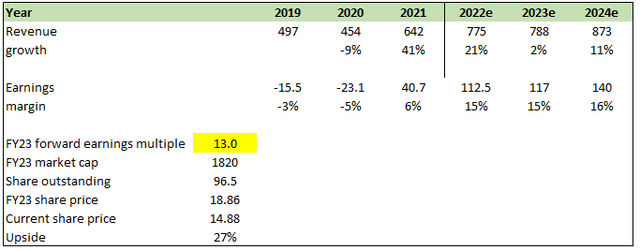

I believe STER is worth USD18.86/share in FY23, representing 27% upside from the date of writing.

This value is derived from my model based on the following assumptions:

- Revenue will meet management’s guidance in FY22, growth will slow down in FY23 due to a bad economic period and recover in FY24.

- I expect STER to meet FY22 earnings guidance as well and also to achieve similar margins moving forward

- STER currently trades at 13x forward earnings. While I expect it to mean revert overtime once we get past this recession, it is safer to assume that the multiples do not change.

Key Risks

Regulatory risk

STER is used by businesses to avoid violating regulatory requirements. If STER’s systems fail to detect this, the company could face a slew of lawsuits that could be financially and reputationally devastating.

Lesser employment

The primary growth driver for STER is the rate of employment, which means that during recessions, STER may experience slower growth as businesses seek to save money by reducing head counts.

Summary

STER seems to be undervalued based on my model. STER is a technology-enabled service that provides background checks and other forms of identity verification for businesses. They offer cloud-based technology that provides real-time insights. The growth of the gig economy, voluntary employee churn, and an increase in fake resumes are all factors that are driving the demand for STER’s services.

Be the first to comment