Just_Super

The iShares Cybersecurity and Tech ETF (NYSEARCA:IHAK) is generally still able to eke out sequential growth even as quarters are pressured on the demand side by a higher rate environment. Part of the reason is that cybersec is still underinvested and is non-discretionary. Its valuation and economics are much more similar to infrastructure than many other parts of tech. While very resilient, there is the issue that nothing can escape higher rates. Markets are moderating as rates are expected to keep rising, and for some reason major CEOs are only now beginning to sound the alarm on a recession. But we think peak rates are coming.

IHAK Breakdown

IHAK is mostly a cybersec ETF. There’s some general cloud exposure in there, but it’s usually with companies that do either consulting or provide services related to cloud security as well. Even the more diversified companies are known for their cybersec exposures. There’s a mix between companies that focus on professional services and consulting and those that focus on software issues. Consulting tends to matter a lot, and labor is an important input.

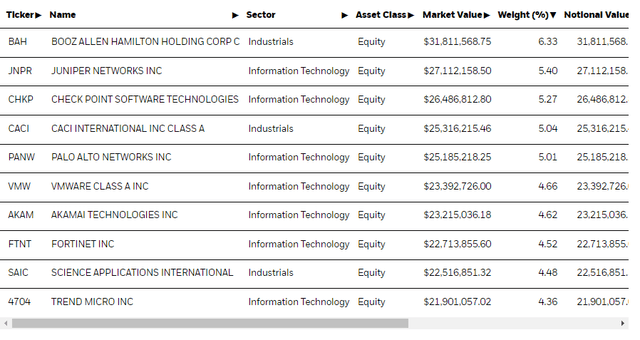

Cybersec is non-discretionary, and some of the IHAK exposures demonstrate it more than others. Booz Allen Hamilton (BAH) is an example, which serves government customers primarily. Their services really are mission-critical. Others are more on network and infrastructure service and hardware products like Juniper Networks (JNPR). There are plenty other more typical cybersec threat management and detection companies like Fortinet (FTNT) and Palo Alto Networks (PANW). There are plenty of companies that deal with cloud, cloud security and cloud migration too.

Top Holdings (iShares.com)

Bottom Line

The PE on the IHAK is very high at almost 40x. This implies an earnings yield between 2-3%, which is lower than long-term expectations on Treasury bonds. This is because there is expectation of earnings growth of a very secular nature. Indeed, the multiple resembles that of tech infrastructure stocks such as datacenters and IXs (internet exchanges). The multiple reflects not so much the quantum of growth expectations but the duration. In the case of cybersec, the still low penetration of cybersec into tech budgets means that there’s scope for greater growth to expand wallet share within companies. With growing digitalisation and volumes of data, the secular opportunity means also more places for cybersec to land. With crimes like identity fraud and attempts at cyberattacks being more common now than ever before, accelerated by the pandemic, there are lots of reasons to be optimistic about cybersec. In almost every respect cybersec are infrastructural and necessary expenses to maintain stores of data in an organisation.

In terms of delivering on earnings growth we are seeing sequential improvement still in companies with large US wallets that are focused on cybersec. YoY data is more mixed because of how blockbuster 2021 was for technology in general, but sequential growth is what’s important to see because it demonstrates resilience against growing pressures from the demand side as rates rise.

The problem with cybersec is not going to be demand, but the effect of rates on the overall market. The large multiple is aggressively subject to the gravity of higher interest rates, and the rate cycle explains the 24% YTD declines in IHAK. We think peak rates are coming in though and that it’s not the wrong time for tech. Energy prices have fallen substantially, and pressure in US housing markets are turning around rents which are a dangerous source of inflation expectations in households. Logistics is coming down too in price. Major cost-push factors are coming off of inflation and markets could get very excited in the next couple months.

When that happens, we expect revaluation in tech and IHAK included.

The negatives on IHAK are clear though, besides the fact that inflation could persist. The expense ratio is 0.47%, which is pretty high, and with such a low earnings yield that ratio eats away at returns. In the end, some of the IHAK stocks have large client books, and are therefore themselves diversified. Single stocks are better as a cybersec play.

Thanks to our global coverage we’ve ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment