anyaberkut/iStock via Getty Images

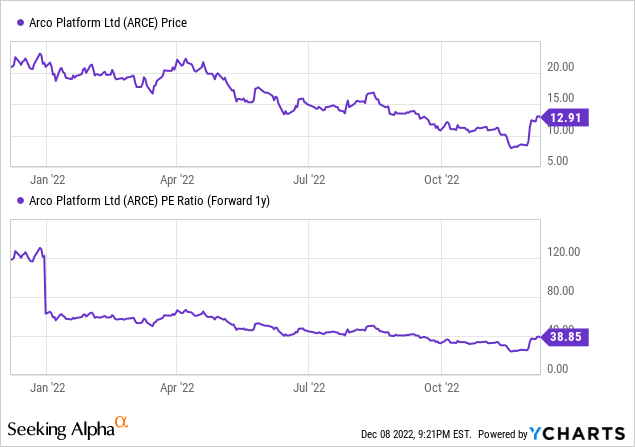

Despite Brazil-based edtech company Arco Platform’s (NASDAQ:ARCE) strong Q3 growth, margins (excluding share-based compensation) were less than satisfactory, driving expectations for this year’s adj EBITDA margin to come in close to the bottom of the guidance range. Meanwhile, the company’s decision to acquire fintech/edtech company isaac (announced prior to earnings) makes sense strategically but adding a cash-consuming business at this early stage of its lifecycle elevates financial risk. Given the unfavorable macroeconomic and capital markets backdrop, as well as the significant debt maturities due in the coming year or so, I am concerned about more dilutive fundraising down the line (via debt or equity). With the stock already trading well above the ~$11/share buyout offer from General Atlantic, I see limited upside at this juncture.

Recapping The Q3 2022 Results

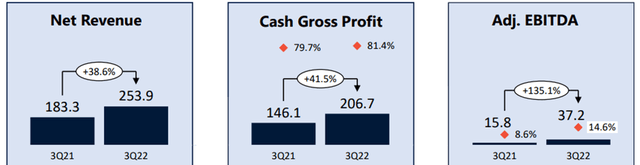

ARCE saw another quarter of strong headline revenue growth at +39% YoY, although this was closer to +20% YoY excluding M&A. Of note, ARCE converted 100% of its annual contract value (ACV) into revenues, with core ACV growth up by >20%, while supplemental education solutions growth was up by >30% (or >40% excluding international school). As a result, Q4 revenue guidance was strong, helped by contribution from 29%-34% of next year’s ACV, out of which 7-8% is guided to come from price increases (2-3%pts above inflation).

Arco Platform

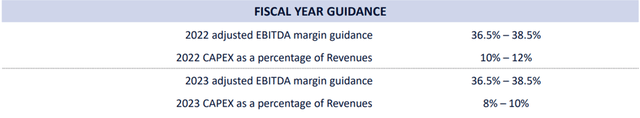

On the other hand, profitability was less impressive. Headline adj EBITDA of R$37m did outpace consensus on higher gross margins and lower selling expenses but was also helped by one-off reversals of bad-debt provisions. Including share-based compensation, adj EBITDA would have been closer to ~R$16m, which is above Q3 2021 but well below expectations. No surprise then that management updated its FY22 margin guidance to the lower end of the prior 36.5%-38.5% range. The guidance bar was set high for FY23, though, with ARCE projecting margin improvement and capex reductions, so there could still be some downward revisions ahead.

Arco Platform

Elevated Debt Load Weighs On The Outlook

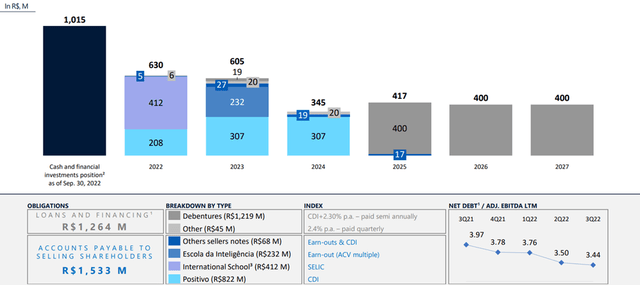

ARCE may have refinanced most of its debt maturities due in 2023, but it still has to navigate significant near-term maturities ahead. This includes a final payment of ~R$400m for its international school, which is pending a final decision at arbitration, as well as ~R$200m for the Escola da Inteligencia acquisition due in H1 2023 (note the final value could change based on the shape of next year’s ACV).

Arco Platform

Plus, there remains uncertainty related to the size and timing of the convertible debt issuance, as well as future financing needs related to the isaac acquisition. Given the R$1bn cash balance and the limited balance sheet capacity with net debt/EBITDA at 3.4x, the onus is on ARCE’s free cash generation sustaining through a downcycle. ARCE has already shown a willingness to dilute shareholders (note Arco issued shares at $12 to fund the isaac deal), so if cash generation falls short, I am concerned about more shareholder dilution ahead.

isaac Acquisition Adds Growth But Also Raises The Risk Profile

Earlier in October, Arco agreed to acquire the remaining 75% stake in fintech/edtech company isaac (note it already owned 25%, having invested via a seed round in August 2020 and a Series A round in February 2021) for ~$126m in equity. For context, isaac is an early-stage company focused on software and financial solutions for private schools in Brazil. The main offering is the ‘receita garantida’ working-capital solution (or ‘revenue guarantee’) that reduces default risk for schools by paying a predetermined amount upfront in exchange for a % take rate. Its competitive advantage is its credit assessment, based on long-term historical data from ERP solutions, which allows it to get paid for taking on the default risk. Disclosures indicate an >850 base of client schools with ~280k students, providing ~R$2.0bn payment value and ~R$188m of ARR while maintaining delinquency at an impressive low-single-digit % delinquency rate.

The growth potential is the key positive for this acquisition, given it expands ARCE’s ecosystem and addressable market opportunity into the high-growth K12 segment. That said, the financial terms seem dilutive at first glance. The terms of the stock deal outline that isaac shareholders receive ~10.4m ARCE shares (~9.4m newly issued and the remainder from treasury) and own ~16% of ARCE on a pro-forma basis, which implies a low-teens % dilution. At this early stage of its life cycle, isaac is cash consumptive as well, adding pressure to the balance sheet. ARCE has set expectations high, though, guiding for isaac being self-funding, so any disappointments here present downside risk to ARCE going forward. Having cleared antitrust approvals last month, the acquisition is expected to close in January 2023.

Financial Risks Loom Large

ARCE has seen tremendous revenue growth (organic and via acquisitions) since its IPO in 2018 while impressively maintaining solid >30% EBITDA margins. While growth continues to be good, financial risks are high. Full-year margins are already trending toward the bottom end of the guidance range, and following years of debt-fueled acquisitions, the company now has to contend with a complex, highly levered balance sheet. In an environment of rising interest rates and slowing economic growth, I am concerned that ARCE could be vulnerable – not only does it have numerous debt maturities due, but the acquisition of isaac will also add to the interest burden. In the meantime, General Atlantic has tabled an offer to buy out minority shareholders for $11/share; with the stock already at a premium, however, I would remain on the sidelines.

Be the first to comment