DNY59

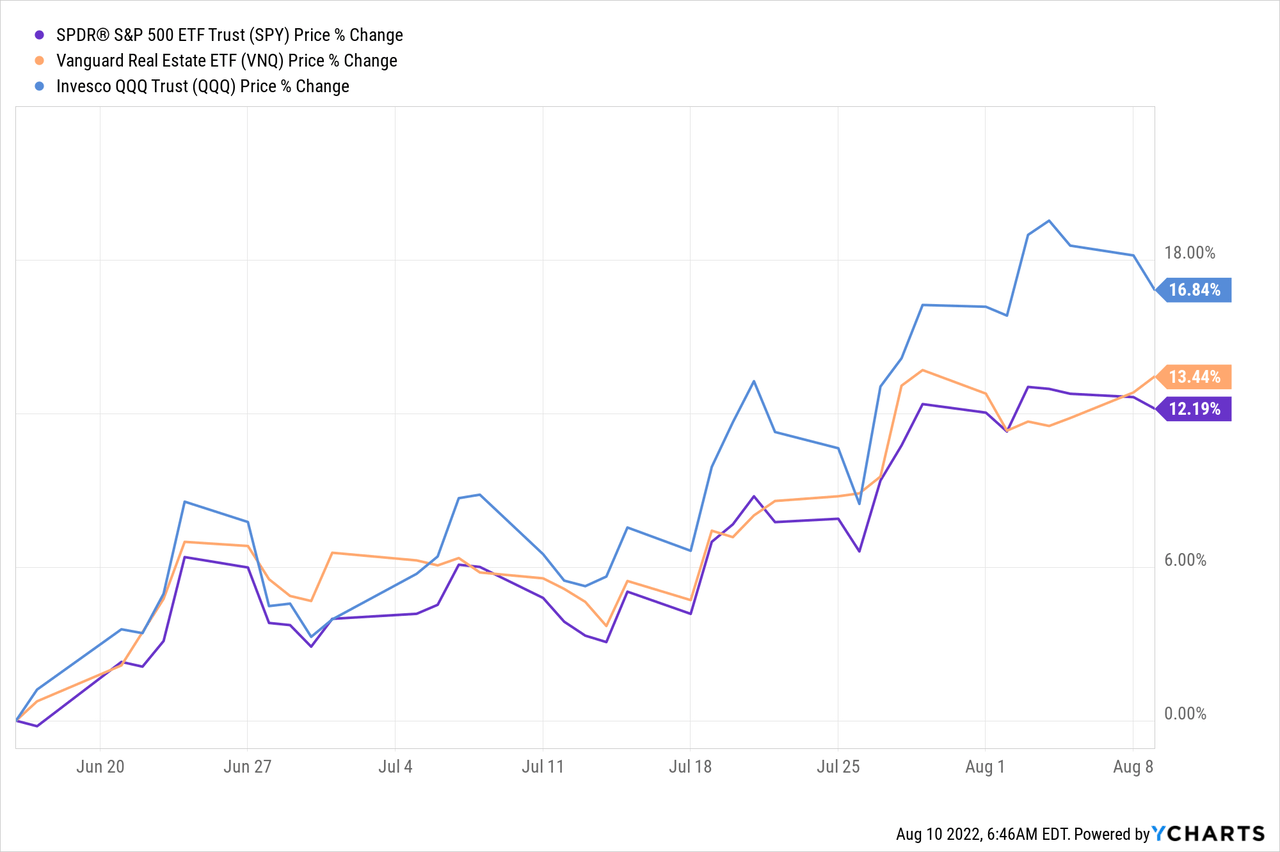

After the worst first half in history, the market has been strongly recovering over the past few weeks. The S&P 500 (SPY) is up 12%, REITs (VNQ) are up 13.5%, and Tech stocks (QQQ) are up as much as 16.8%:

Is this a dead-cat bounce or will the market continue its recovery?

That’s the question that I keep receiving at the moment.

It appears that a lot of investors fear that the recent recovery will be short-lived and followed by another leg down (=dead-cat bounce).

If that’s the case, now would be a good time to sell before the market dips again.

But I have news for you: timing the market is not possible.

Nobody knows if the market will continue to recover or dip in the coming weeks. Countless studies have proven that even professional investors cannot time the market, and that’s despite having significant resources and dedicating their lives to it.

So why even bother?

I get it that we live in an uncertain world with high inflation, rising rates, and a likely near-term recession, but the market is a forward-looking machine and it knows this already.

If predicting a market dip was this simple, we would all sell shortly before the recession, avoid the dip, buy back at lower prices, and we would compound so fast that we would all become billionaires.

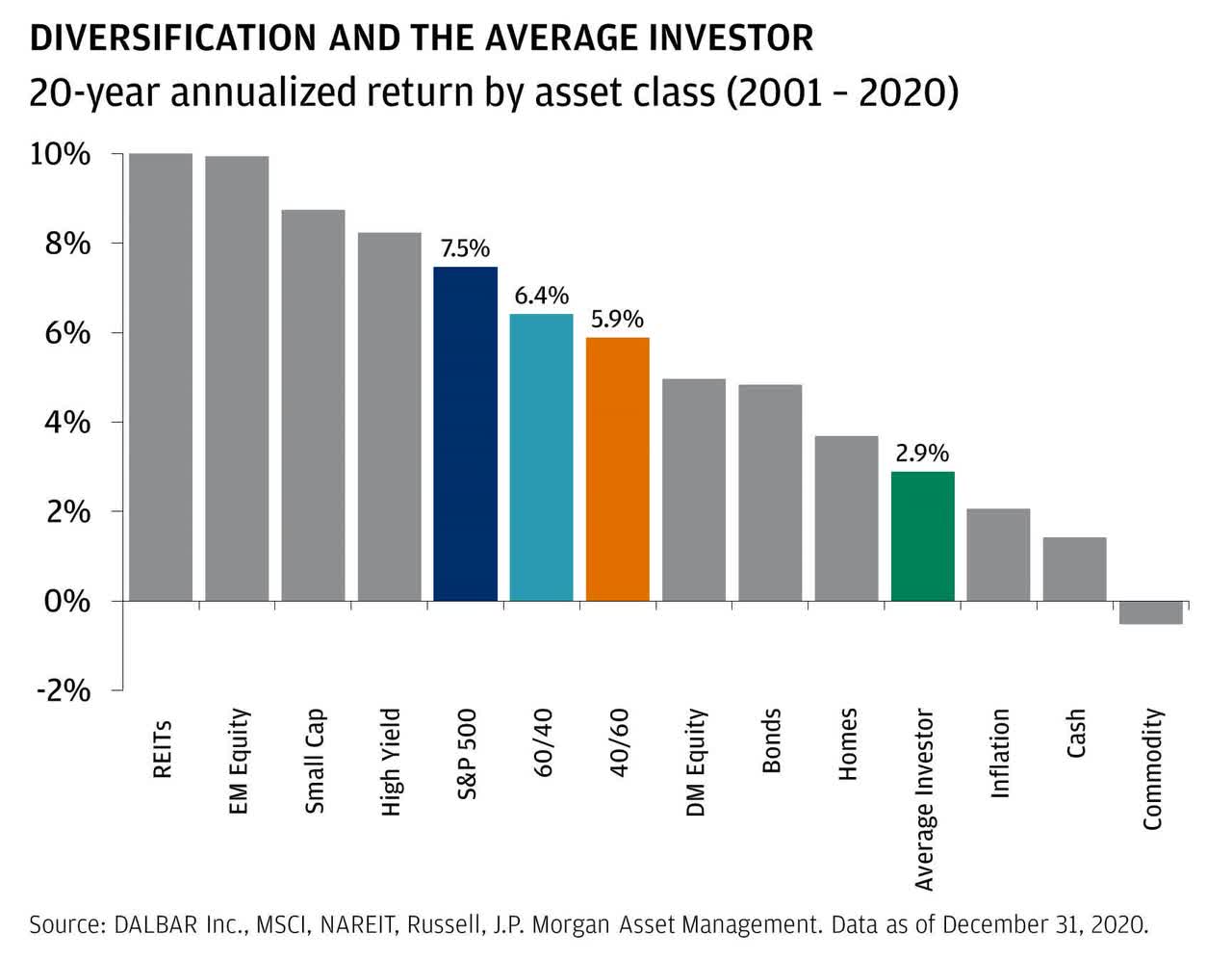

But the reality is the exact opposite: those investors who attempt to time earn poor returns on average and significantly underperform the market:

JPMorgan

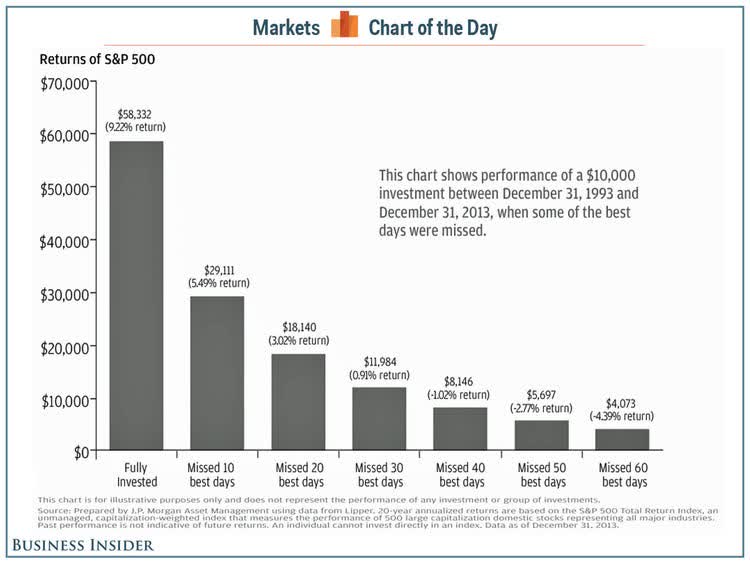

The above study is from JPMorgan (JPM). It shows what we know already from many other studies: getting in and out of the market is a big mistake. You cannot know what the market will do next and even if you were lucky and correctly timed a dip, you still wouldn’t know when to get back into the market, likely causing you to miss the recovery. Just missing a handful of green days will cause substantial and irreversible damage to your portfolio:

Business Insider

Not even Warren Buffett can time the market and he is very honest about it. Here’s what he said at a recent Berkshire Hathaway (BRK.A, BRK.B) shareholder meeting:

We haven’t the faintest idea what the stock market is gonna do when it opens on Monday – we never have. I don’t think we’ve ever made a decision where either one of us has either said or been thinking: we should buy or sell based on what the market is going to do. Or, for that matter, what the economy is going to do.

Coincidentally (or not), Warren Buffett has been aggressively buying the dips in 2022 and he has not stopped investing even as the market recovered.

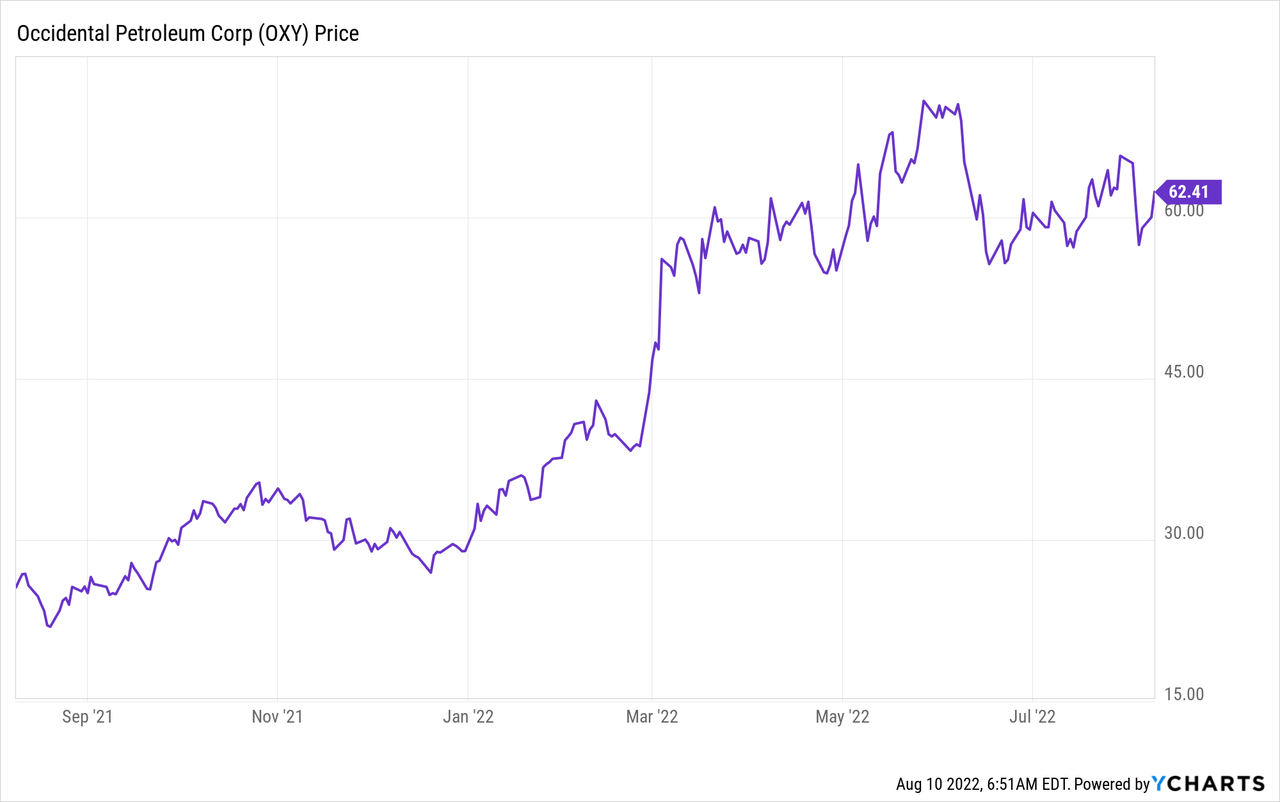

Berkshire disclosed late Monday that they had acquired another 6.68 million shares of the oil and gas company Occidental Petroleum (NYSE:OXY) during August 4-8.

He paid ~$400 million in multiple transactions at prices ranging from $57.32 to $60.01. This is quite interesting because earlier this year, OXY traded as low as $21 per share, and despite that, Buffett has kept buying more shares.

This shows that it is never too late to invest if you think that a stock is undervalued. Buffett does not mind paying triple the price of what the stock was a few months earlier if he thinks that it is still undervalued and will provide attractive long-term returns.

We follow a similar approach at High Yield Landlord.

We don’t try to make money by timing the market because there is just too much evidence that concludes that it is impossible.

Instead, we keep on buying as long as we can find good value in the market, and that’s still the case after the recent recovery.

Right now, we find the best value in listed real estate, and that’s where most of my capital is going at the moment.

Listed real estate is today a lot cheaper than non-listed private real estate. It is not uncommon to find even high-quality REITs trading at a 30% or greater discount on the underlying value of their properties. They are so cheap because the market overreacted to fears of rising interest rates, not understanding that REIT balance sheets are the strongest in history, and that the positive impact of high inflation is greater than the negative impact of rising rates.

Blackstone (BX), the biggest private equity firm in the world, has been buying out REITs left and right (APTS; ACC; PSB;…) and recently made the following comment:

The best opportunities today are clearly in the public markets on the screen and that’s where we’re spending a lot of time.

Therefore, we expect many more buyouts in the coming quarters as they seek to buy real estate at a discount through the public market.

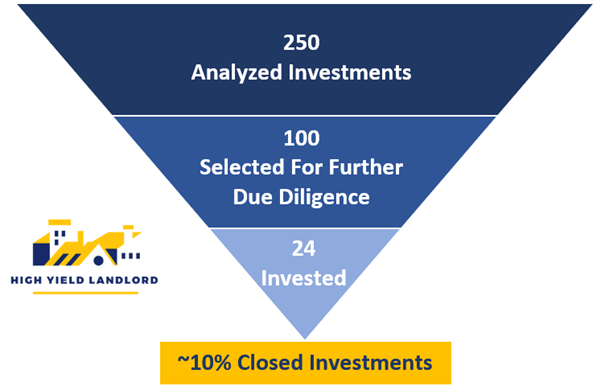

We have identified 24 REITs and other REIT-like entities that we are aggressively accumulating at High Yield Landlord:

High Yield Landlord

One good example is STAG Industrial (STAG), an e-commerce-focused industrial REIT that’s priced at a 30% discount to NAV. Its biggest tenant is Amazon (AMZN), it is hiking rents by 15%+ on new leases, and it pays a near 5% monthly dividend yield.

STAG Industrial STAG Industrial

Another good example is BSR REIT (OTCPK:BSRTF/AVB), a Texas-focused apartment REIT that’s greatly benefiting from Californian people and businesses moving to Austin, Dallas, San Antonio, and Houston. Its rents grew by 17% over the past year, and its NAV per share reached a new all-time high of $22.5 per share. Despite that, the share price is just $16.50, representing a near 30% discount to fair value. Typically, companies that own desirable assets and grow at such a rapid pace trade at a premium to NAV, not a steep discount. We expect significant upside and while we wait, we earn a monthly 3% dividend yield.

BSR REIT

One last example: RCI Hospitality (RICK) is perhaps my favorite opportunity right now. It is the only publicly listed strip club company. It is able to earn 25-33% cash on cash returns by buying strip clubs and their real estate. The management just had its quarterly conference call and noted that they expect to grow their FCF per share by 30% in 2022 and quite possibly another 30% in 2023. They are growing so fast because they are earning a huge spread over their cost of capital as they acquire new clubs. To give you an example, RICK recently bought a new club and most of it was paid via seller financing with a 6% interest rate. Despite growing so fast, the company is priced at just 8x FCF. We expect 100%+ upside.

RCI Hospitality

Bottom Line

You cannot time the market, so forget about it.

Just because prices are up over the past few weeks does not mean that it is now time to sell or too late to invest.

On the contrary, there are plenty of opportunities in today’s market, especially so in niche sectors like listed real estate securities.

We continue to accumulate larger positions in many of these companies, as we expect a lot more upside in the coming years as prices continue to recover.

Be the first to comment