Scott Olson/Getty Images News

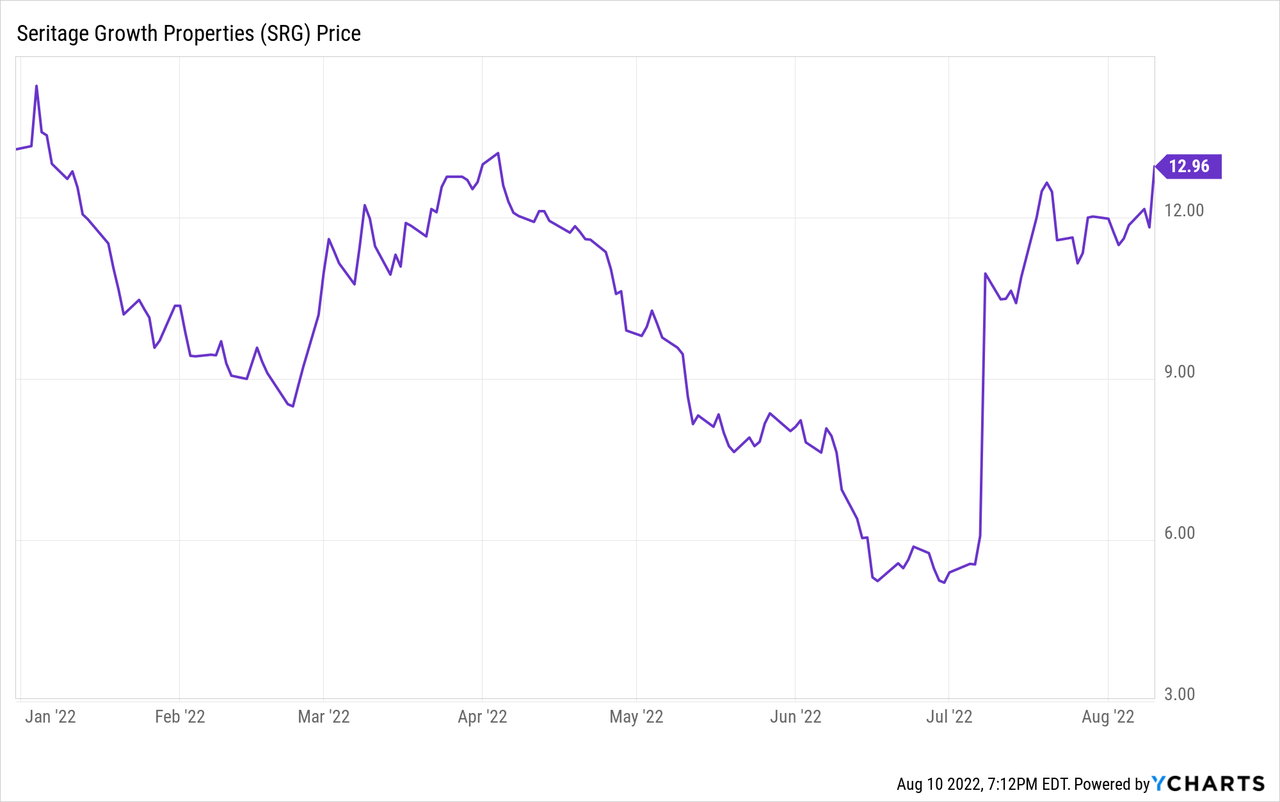

Last month, Seritage Growth Properties (NYSE:SRG) stock doubled, after the company filed a preliminary proxy statement that asks shareholders to approve a “plan of sale” that would result in selling all of its real estate and winding down operations.

In the proxy documents, Seritage estimated that after covering all of its expenses and known liabilities, it would ultimately distribute between $18.50 and $29 per share to shareholders (see p. 65). Even after its big rally in July and a strong earnings report posted this week, Seritage stock closed at $12.95 on Wednesday: a 45% discount to the midpoint of the estimated distribution range.

Seritage probably won’t make meaningful distributions to shareholders for at least a year, so it makes sense for the stock to trade at a discount to NAV (net asset value). That said, with Seritage stock under $13, the discount is unreasonably large. As Seritage sells assets, repays debt, reduces cash burn, and ultimately begins distributing cash, shareholders could earn a 50% return over the next 18 months or so.

A straightforward asset play

In its draft proxy statement, Seritage estimates that it would take 18 to 30 months to sell all of the company’s assets, assuming shareholders approve the plan of sale (which is virtually certain).

Even if the process were to take 30 months and net proceeds came in at the low end of the range that the company has set out, Seritage shareholders would earn mid-teens annualized returns during the winddown process, turning $12.95 into $18.50 in less than three years. Most investors would be delighted with that kind of performance. The returns would be even better if Seritage sells its assets (or at least the bulk of them) more quickly and/or achieves relatively favorable valuations for its asset sales.

Management didn’t just pull its $18.50-$29 range out of thin air. The company has been engaged in a careful asset-by-asset review for over a year. It has sold dozens of properties over that period, giving it a good gauge of the market. Seritage also consulted with financial advisors including commercial real estate services giant CBRE. (The $18.50-$29 projected distribution range is also consistent with my prior estimate that Seritage’s real estate was worth approximately $3 billion as of late June.)

One big reason why Seritage trades at such a steep discount to its NAV is the stock’s poor long-term track record. Seritage shares have lost more than half of their value since the company went public seven years ago. That kind of performance breeds extreme skepticism. Negative sentiment about retail real estate (particularly mall real estate) is likely adding to the pressure on Seritage’s valuation.

To unlock big gains for shareholders, Seritage simply needs to demonstrate that it can sell its real estate at a relatively expeditious pace at valuations in line with management’s estimates. As downside risks are mitigated or eliminated, Seritage stock should move much closer to NAV.

Asset sales accelerating

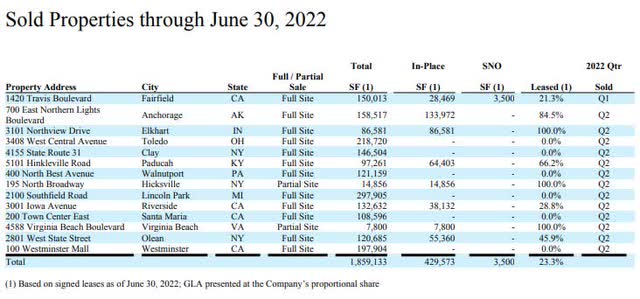

During the first quarter of 2022, while Seritage was waiting to finalize the termination of its status as a REIT, the company sold just one asset for $9 million. But since then, the pace of asset sales has picked up dramatically.

In early May, Seritage reported that it had already sold seven assets for $74.7 million since the beginning of the second quarter. It also had $85 million of sales under contract at that time.

Seritage ultimately completed 13 asset sales during Q2, including two partial-site sales, generating proceeds of $163.4 million (slightly ahead of the $160 million completed or under contract as of early May).

Source: Seritage Q2 2022 Supplemental Report.

Furthermore, Seritage has already sold about a dozen assets since the beginning of Q3, receiving gross proceeds of $102.3 million.

This activity allowed Seritage to prepay $100 million of its term loan last week, reducing the balance to $1.34 billion and saving $7 million in annual interest expense going forward. The company also invested $32 million of the proceeds into its properties, moving closer to bringing over $22 million of annual rent online from leases in its “SNO” (signed not yet open) pipeline.

For comparison, the assets Seritage sold in Q2 collectively generated annual NOI of just $2 million. Carrying costs for vacant properties offset a large chunk of the income from stabilized assets. In short, Seritage’s asset sales are helping the company reduce its cash burn.

Numerous irons in the fire

Looking ahead, Seritage already has another $260.8 million of asset sales under contract, positioning it to continue prepaying debt at a rapid pace. The company also said it has a pipeline of over $1.2 billion of future dispositions, including asset sales for which it is negotiating or evaluating offers, along with properties it is actively marketing.

All told, this means Seritage has roughly $1.5 billion of assets for sale. Seritage’s multitenant retail properties (which the company is marketing for a portfolio sale) likely account for the majority of this figure. This collection of assets could be worth around $900 million.

Image source: Seritage Growth Properties.

Seritage is also looking to monetize some of its most valuable properties. Its 22-acre site at Eastridge Mall in San Jose is currently under contract. Meanwhile, Seritage’s premier asset in Dallas recently hit the market. The company previously planned to build a 2 million square foot development on this land. Seritage may also be marketing its Redmond, Washington premier property.

These three sites, which collectively generate negative NOI today, could generate combined proceeds in the $300-$400 million range.

With several big transactions on the table, I expect Seritage to complete multiple high-value deals within the next 6 months or so. As the company updates investors on the value of assets under contract, completed asset sales, and debt prepayments, Seritage stock should move higher to reflect increased confidence in the estimated distribution range of $18.50 to $29 per share.

Key risks

Seritage Growth Properties’ looming debt maturity represents the biggest risk for shareholders. The company’s term loan (which now carries a balance of $1.34 billion) is due next July. Seritage has the right to extend the loan for two years if it reduces the balance to $800 million by the maturity date. In other words, it has a little less than a year to pay down $540 million of debt.

As noted above, Seritage is marketing numerous assets for sale that are collectively worth far more than $540 million. Still, there’s a small chance that macroeconomic issues could cause real estate markets to seize up, making it impossible to sell assets except at fire-sale prices.

A related risk is that macro risks such as persistently high inflation, rising interest rates, and the threat of recession dampen interest in Seritage’s properties. Even if the company can sell enough assets over the next year to extend its loan, poor market conditions could push property values to the low end of management’s estimate range. Moreover, a slow pace of asset sales would delay shareholder distributions, justifying a lower present value for Seritage stock.

The rapid pace of asset sales over the past few months suggests that this risk is modest, though. Just since late June, Seritage has sold more than a dozen assets. Market volatility hasn’t scared buyers away.

Importantly, Seritage defused another noteworthy risk this week, agreeing to pay a maximum of $35 million to settle claims that it acquired its properties below their market value in a fraudulent transfer from Sears Holdings (OTC:SHLDQ). The company hopes to recover at least some of that amount from insurers.

A clear path towards $20

I expect Seritage to close the $1.5 billion of asset sales in its current deal pipeline by this time next year. That would enable it to repay its remaining debt of $1.34 billion while also funding near-term cash burn, CapEx, and the $35 million settlement payment.

Eliminating the debt would reduce cash burn to a negligible level. And after redeeming Seritage’s $70 million of preferred stock, virtually all subsequent asset sale proceeds could be distributed to common shareholders. These distributions will likely start in late 2023 or early 2024 (although the timing depends on when Seritage’s asset sales close).

With Seritage likely to sell half or more of its assets by value over the next 12 months and begin distributing cash to shareholders soon thereafter, the range of plausible distribution amounts will narrow. Moreover, Seritage should be able to sell the bulk (if not all) of its portfolio by the end of 2024, with the proceeds going to shareholders.

This positions Seritage stock for a total return of around 50% between now and early 2024, lifting the stock to between $19 and $20 (less any distributions already made by that point). That would still leave roughly 20% upside to the midpoint of the $18.50-$29 estimated distribution range, providing adequate compensation for the level of remaining risk.

At $12.95, Seritage stock has very little long-term downside risk outside of black-swan scenarios. As such, Seritage shares continue to look highly attractive due to their upside potential and the ongoing asset sale catalyst.

Be the first to comment