imaginima/iStock via Getty Images

Investment Thesis

EOG Resources (NYSE:EOG) is an oil and gas company that came out of 2021 with a meaningfully transformed business. Its balance sheet is now robust and it was able to start paying out a special dividend in March.

As we look ahead to 2022, the stock doesn’t appear richly valued at less than 11x free cash flow.

Even if WTI prices were to rapidly revert down to the 5-year average of $65 to $70, I estimate that its current free cash flow multiple would expand to around 16x free cash flows, which still doesn’t appear all that expensive.

Indeed, this appears very attractive particularly when we consider the multiples that investors are paying elsewhere in the market.

What’s more, EOG has a rewarding dividend yield, which should offer some support to the share price, if crude prices were to turn lower and stay lower.

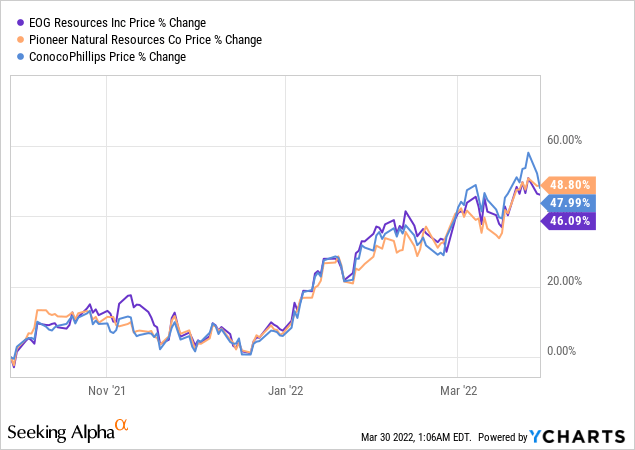

Investment Sentiment Towards Oil and Gas Companies

Despite all the volatility in the market these past 6 months, oil and gas stocks have been on a tear higher. And there are good reasons for this, as you know.

With the price of crude at close to triple-digits or sometimes slightly above this price, this has led to a massive re-rating higher for the stocks in this space.

And I believe that we will continue to see this sector trend higher in 2022.

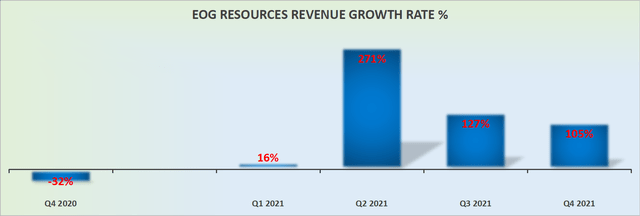

EOG Resources’ Revenue Growth Rates Expected to Stay Strong

EOG revenue growth rates

EOG finished 2021 with sizzling topline growth. Now, as we look ahead, at least to the early parts of 2022, we can expect to see a very strong Q1 2022 result.

Accordingly, given that EOG has a capex breakeven price of $32 WTI, this implies that with prices finding support around $90 to $100 WTI, we can reasonably infer that at least H1 2022 will see strong topline growth.

Why EOG Resources? Why Now?

EOG explores and produces crude oil, natural gas liquids (”NGLs”), and natural gas primarily in major producing basins in the US. EOG relies on hydraulic fracturing technology (fracking) to be a low-cost operator, with capex breakeven of around $32 WTI.

Next, as Europe faces an energy crisis after Europe leaned too aggressively on the green agenda, the US will not want to face these same problems.

Therefore, as Europe has had to make an about-turn to ensure it has energy security, the US is more likely than not to make a knee-jerk move in the opposite direction to secure its own energy path and ensure that it makes it as easy as possible for companies to get the necessary permits to drill and produce oil and gas.

This puts EOG in a very favorable environment.

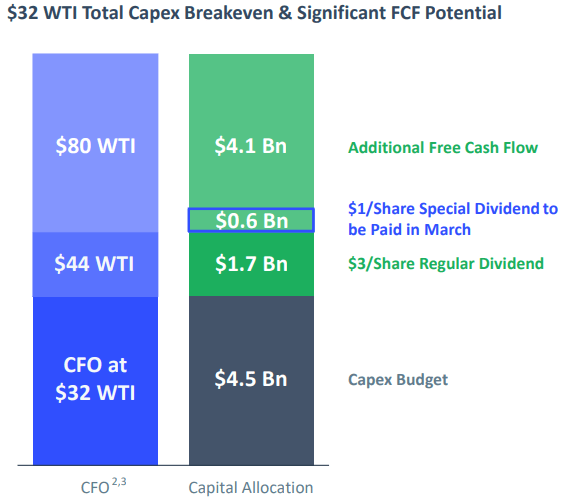

Robust Free Cash Flows in 2022

EOG had a terrific 2021, where it generated a record $5.5 billion of free cash flow. This transformed its balance sheet into a net-neutral position, where its cash and debt equal each other.

What this means in practical terms is the following:

EOG investor presentation

If we were to presume that during 2022, WTI prices averaged $80, this would mean that EOG would generate around $6.4 billion in free cash flow. For shareholders, this would be a nice reward.

This would mean that shareholders would get a 2.5% dividend yield going forward, not to mention that there would still be a further $4 billion of excess cash for EOG to return to shareholders.

This means that after the dividend gets paid out, shareholders would still be likely to get a further 5.6% capital return via buybacks and perhaps further special dividends.

EOG Stock Valuation – Positive Risk-Reward

The first rule of investing in commodities is you don’t pay a low multiple to free cash flow, because that typically means that it’s the end of the cycle.

That rule has worked extremely well during the past 10-plus years. However, the ”this time it’s different” could truly be the time that paying a low multiple just shows how utterly disenchanted investors have become towards this sector.

If we were to make the assumption that WTI prices this year average somewhere around $80 to $85 for 2022 as a whole, this puts the stock priced at less than 11x free cash flows.

This appears to be cheaply valued, but then we have to counterbalance the argument by highlighting the obvious.

Nobody knows where oil prices are going to be in 2023. If we rationally assume that oil prices were to return lower to around $65 to $70 WTI, the multiple that investors are paying now could rapidly expand to around 16x free cash flow, which starts to be slightly less attractive.

On the other hand, I charge that even if that were to happen, paying around 16x free cash flows isn’t such an elevated multiple for a dividend-paying stock, if that happens to be a close approximation of a bearish scenario.

The Bottom Line

My concluding thoughts are that EOG is attractively priced, even now, to offer shareholders an attractive risk-adjusted return. While I don’t own this name, I own something very similar, albeit with a slightly smaller market cap.

However, my point is this, the game here is not to pick the ”best one”. I contend that the way to get meaningful returns will come from picking a name and having the ”sticktoitiveness” to, well, just stick with it!

Too often investors run around trying to chase the best name in town when the best returns are often made in just learning to sit on one’s hands. Whatever you decide, good luck and happy investing.

Be the first to comment