Adene Sanchez/E+ via Getty Images

Bio-Rad Laboratories (NYSE:BIO) is a manufacturer of healthcare, life science, analytical chemistry products, and other related markets. The company is originally from Berkeley, California, and is now based in Hercules, California. The company distributes its products globally, including a wide range of reagents, equipment, and tools used in laboratory analysis. The company is divided into two segments that each manage different areas of the market. The Life Science department is involved in manufacturing products used in research, processing, and testing. The Clinical Diagnostics segment offers support to test kits and systems, as well as quality control devices used in the sector by manufacturing and distributing its various products.

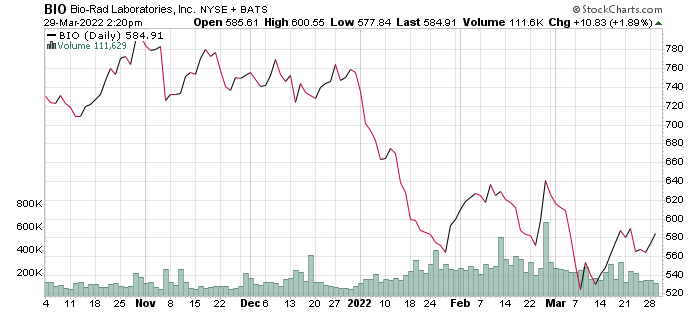

Stockcharts.com

The company has all the ingredients for success, supplying the types of products that are in demand and helping medical research efficiently address some of the world’s biggest concerns. The nature of those changes, as well as the company’s history, reveal why this otherwise unimpressive manufacturer is worth taking a closer look at.

Recent News

Bio-Rad has had an interesting track record, with the company having laid out a target revenue in 2017, foreseeing the company’s growth until 2020. Expecting a growth rate of 3-5%, the company exceeded that in the following years, growing from $2.26 billion in 2018 to $2.92 billion in 2021 and surpassing the estimated EBITDA margin of 20% projected for 2020. It will come as some encouragement as the company has expressed equal optimism going all the way to 2025. An expected compound annual growth rate of 9% and adjusted EBITDA estimated at 28% by the end of the forecast period. The industry saw increased growth with the COVID pandemic, with products and supplies seeing unprecedented demand, as well as a rapid increase in medical funding for research and development. Bio-Rad’s growth can be expected to see growth that will parallel the demand and access to funds that will continue to increase in the coming years.

Bio-Rad announced in March the closing of a $1.2 billion aggregate principal amount Notes offering. These include two types of Notes, one worth $400 million and due in 2027, with the remaining $800 million due by 2032. In the coming year, the company has announced its intent to focus on key franchises such as biopharma in order to drive growth through its intended portfolio transformation. This will also include taking measures to optimize costs, improve overall efficiency, and generate cash flow to support strategic acquisitions. As long as the company attends to the needs of rapid growth in particular areas of the healthcare sector, such as their work increase productivity, accuracy, and efficiency of laboratories, as well as continue making advances in molecular diagnostics, the company can expect to see continued growth in revenue.

Financials

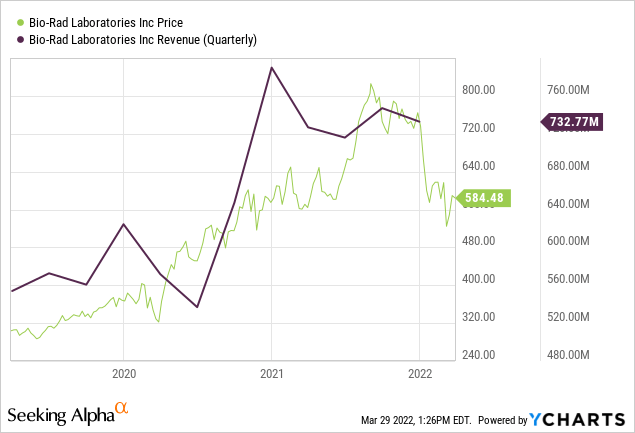

ycharts.com

An indication of why Bio-Rad feels it needs to change direction and prioritize areas that will prove more profitable can be seen in the company’s recent quarterly reports. The company reported fourth-quarter sales worth $732.8 million, which not only saw a decrease from the $747 million reported in the previous quarter, but a 7.2% decline from the $789.8 million reported at the end of 2020. On a more positive note, the entire fiscal year saw growth from the previous year, with the total revenue increasing from $2.456 billion in 2020 to $2.922 billion in 2021. Both of the company’s segments contributed to nearly half of the total revenue each, with the Life Science sector reporting sales worth $1.4 billion, while the Clinical Diagnostics sector reported the remaining sales. In the fourth quarter alone, the Clinical Diagnostics sector outpaced its partner, with net sales worth $404.9 million, with routine testing methods used across the globe driving the 12.8% year-on-year growth. Testing may not be at its peak with the pandemic, especially seeing the now high number of vaccinations, this sector will continue to grow but might soon not be the leader of the two. While Life Sciences reported quarterly sales of $326.6 million, a decrease of 23.8% from the same quarter in 2020, this was caused in part due to a combination of both $32 million incurred in damages, as well as a lower demand for PCR products with reduced testing. However, given the company’s efforts to focus more on what is viable, this particular sector should see more rapid growth.

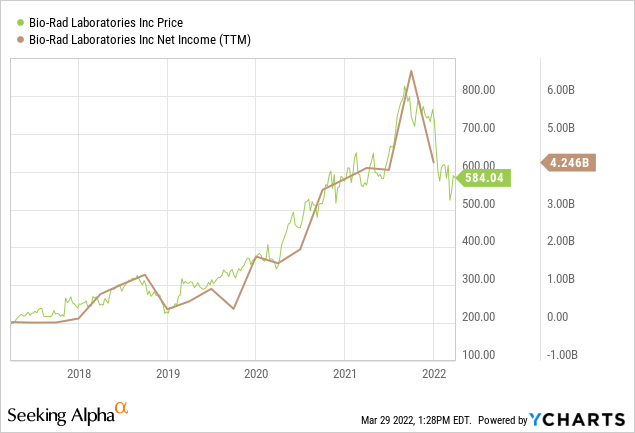

ycharts.com

The fourth quarter also saw losses in net income, with a reported $52.59 in losses per share, corresponding to an overall net loss of $1.574 billion applicable to shareholders. The company justified losses due to the holdings of the Sartorius AG investment, with changes in market value and equity securities primarily contributing to the negative changes. It may not have been the best close to 2021, but the company’s overall annual record is good, with the annual net income breaking past the $4 billion mark for a reported $4.246 billion in total, an improvement from the $3.806 billion reported in the previous year. The company intends to keep its growth going, with supply chain issues sorted out, product sales can expect to grow as delivery time improves.

Industry Overview

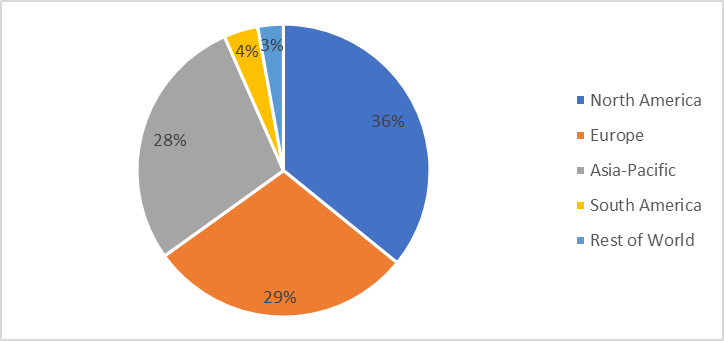

industryarc.com

Supporting Bio-Rad’s growth are the changes the Medical Laboratories market is facing, with technology advancements and services driving revenue growth, in an attempt to meet the global needs of a massive population. Growing at a compound annual rate of 4.7%, the overall market size is expected to reach $112.4 billion by 2027, with North America continuing to dominate the market. The region boasted a 36% market share as of 2021. Most advanced labs, supported by both private and government funding, will make see the continent continually lead the way in the medical field. Asia naturally poses itself as a competitor, as it is always expected to see massive growth in the next five years, helping solve global issues. The Clinically Laboratory market, which Bio-Rad also caters to, is expected to grow at a CAGR of 3.4% in the same period. The market size was valued at $231 billion in 2020 and the growing need to address certain chronic health issues, as well as the constant innovation and supply of cutting-edge products to aid the process, will all determine how fast the sector grows. The market value is expected to surpass $317.6 billion by 2027 at the forecasted growth rate.

Clinical Chemistry makes up the bulk of the Clinical Laboratory Services market share, as per 2020 reports, and is right up Bio-Rad’s alley. As the sector grows in experience, it becomes more and more focused on working to prevent illnesses from developing, as well as treating existing symptoms. As such, priority is being given to those who can supply the tools needed for research, making those already established in the market secure in the long term.

Conclusion

Bio-Rad is by no means a currently impressive company for investors, at least not by recent standards, and that makes it all the more of a strong buy at the moment. Earnings per share may have declined throughout the past year but are expected to see a steady rise in 2022. If past trends are anything to go by, investors can expect the company to beat forecasts, as it did all throughout 2021. Revenue will continue to increase as the company continues to work on its strategy and deliver on much-needed products. For those paying attention now, a bullish stance on the company could prove lucrative sooner rather than later.

Be the first to comment