tupungato/iStock Editorial via Getty Images

Published on the Value Lab 17/4/22

Nordea (NRDBY)(OTCPK:NBNKF) is in the crosshairs for today as we continue to focus on plays that could benefit from a higher rate environment. We think Nordea’s green exposure and Nordic exposure helps it to support loan growth even if economic activity declines. Moreover, the duration gap is probably relatively favourable if rates increase more than expected. While the asset management business could suffer in the case of rate increases, the other divisions will protect it. Overall, we think Nordea’s fundamentals can weather rate increases as central banks strike at inflation, and can support the ample dividend. With a low multiple, Nordea’s return opportunity is alright given a weak economic outlook.

Our Economic Angle

Our analysis here is based on the following premise: rates will need to increase to about 6% on the lowest risk instruments like treasuries and equivalent to deal with inflation. Our view on inflation hasn’t really changed too much. Fundamentally, we think that the vast majority of the inflation is an excess demand problem that would solve itself as manufacturers push for capacity increases across industries. The pandemic related shift of consumption from services to goods has created scarcity and risk premiums on commodities as supply chains are shocked, hence inflation. However, now that people are concerned about inflation, it can persist through inflation expectations effects, making it no longer a fundamentals issue but a speculation issue. So central banks will have to eliminate fully the excess demand, even if for only a little while, to nip it in the bud. 6% would be quite a bit above the market expectations, and it will cause downrating across sectors but probably an opportunity for retail and corporate banking.

Nordea and Rates

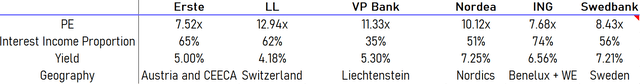

If we enter a higher rate environment than expected by markets, lenders that are exposed to corporate banking, where more income comes from interest on loans rather than other fees like credit card earnings, are relatively attractive. Moreover, lenders that will be rolling over lots of loans in the higher rate environment are also relatively attractive too. Nordea seems to check these boxes to a decent extent. The investment banking and equities business, which is actually not investment banking but just large cap corporate banking, further contributes to the importance of interest based income in the mix and creates opportunities.

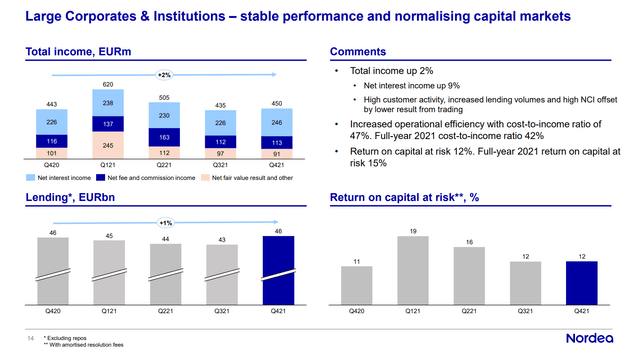

IB Business (Q4 2021 Pres Nordea)

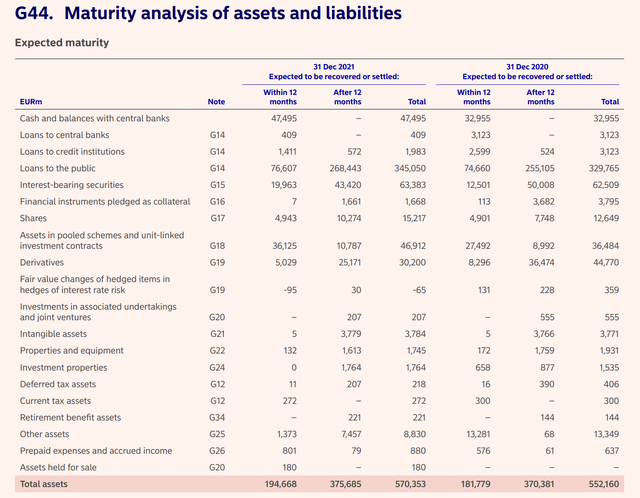

From a duration gap perspective, while the figure is not provided, the maturity analysis seems to suggest a relatively favourable situation. Compared to other companies we’ve looked at, Nordea has a 25% proportion of loan assets coming due within the next 12 months. Moreover, longer maturities probably have variable rate components and are not a disaster. Liabilities are unsurprisingly shorter term as is almost always the case for banks.

Maturity Analysis (Annual Report 2021 Nordea)

51% of its income is not interest based. This is lower than some other regional banks, but not by much. The Nordea situation is also substantially compensated for the fact that the exposures are primarily Nordic, including Norway (20%) which is benefiting massively from the current commodity environment, with Sweden (30%) also being a very interesting geography due to a housing shortage which is supporting Nordea mortgage businesses, as also an economy that has come from a political move to take a laissez-faire approach to COVID-19. These markets are going to be less hit on the non-interest based businesses than most other regional European markets, as well as supporting loan growth in the higher rate environment, or at least stemming loan declines, as the economy takes a dive going forward thanks to green mandates (5% of Nordea loans are green) as well as those market’s fundamentals. These countries will still have to increase rates however as excess demand for goods is clearly a global, mostly logistical problem that needs to be calmed down.

Comps (VTS)

Conclusions

The asset management business has been buoyed by the current environment, increasing by 31% due to net inflows. We think this could reverse somewhat as low rates generate bad performance. However, thanks to Nordic market fundamentals, we’re not too worried. As mentioned, the rate based businesses should benefit from a rate increase environment more so than some other banks. Payout ratios are at 66%, which well protects the dividend, and with fundamentals being decent, we think that the company can continue to compensate investors with that dividend going forward. Overall, relative to other banks we’ve looked at, Nordea has something going for it to at least support that nice yield.

Be the first to comment