designer491/iStock via Getty Images

(This article was co-produced with Hoya Capital Real Estate)

Introduction

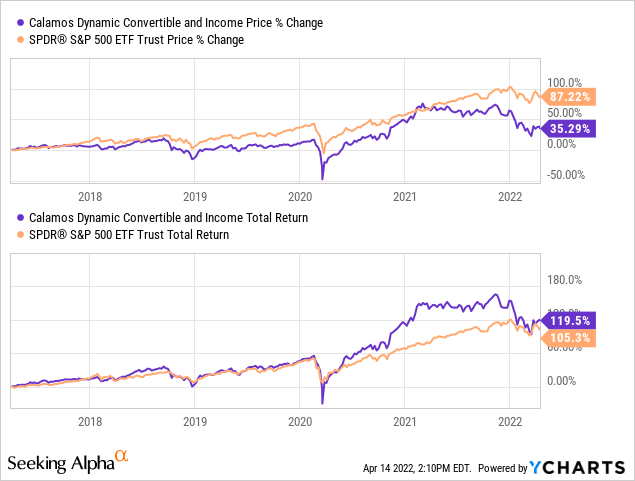

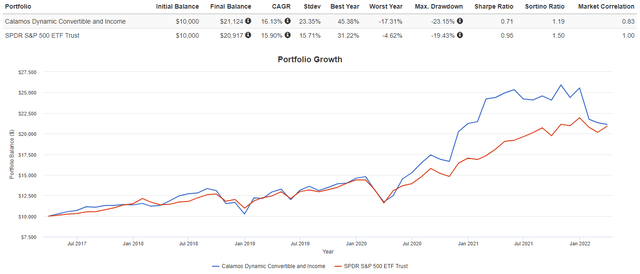

Considering how well Large-Cap stocks, as the SPDR S&P 500 Trust ETF (SPY) mostly invests in, have done recently, I was surprised to find a Fixed Income Fund that has actually had better returns over the past five years, but the Calamos Dynamic Convertible and Income Fund (NASDAQ:CCD) has a slight performance advantage over SPY since March 2017.

As with many higher yielding funds, that out-performance depended on the investor reinvesting each payout. Even when dividends are included, SPY was 95bps ahead if they were taken and not used to buy more shares.

If you expand the comparison back to 2015 when CCD started, CCD’s poor 2022 performance has SPY ahead in performance. That development is behind my Hold rating at this time.

Exploring the Calamos Dynamic Convertible and Income Fund

Seeking Alpha describes this CEF as:

Calamos Dynamic Convertible and Income Fund is a CEF that invests in the fixed income markets of the United States. It primarily invests in a portfolio of convertible securities, investment grade and below investment grade bonds, loans, equity-linked notes, and floating rate securities. The fund also invests through derivatives such as options. It employs fundamental analysis with a top-down global macroeconomic approach to create its portfolio. CCD also owns other investments that generate current income and dividends, including but not limited to common and preferred stocks, investment grade and below investment grade (high-yield or “junk”) bonds, loans, equity-linked notes, and floating rate securities. Benchmark: Bloomberg US Corporate High Yield TR USD. CCD started in 2014.

Source: seekingalpha.com CCD

CCD has $639m in assets and currently yield 8.8%. Total fees total 151bps, down from 210bps at the end of 2021. Current fees consist of:

- Management fees: 100bps

- Other expenses: 12bps

- Interest costs: 39bps

The leveraging costs will increase as rates climb. Currently CCD employs 35% in leverage. Calamos provides the following features investors get from owning their CEF:

- Aims to provide consistent income through monthly distributions set at levels we believe are sustainable.

- By investing at least 50% in convertibles, the fund seeks upside participation in equity markets with less downside exposure over a full market cycle.

- Actively allocates assets between convertibles, fixed-income and equity securities to optimize risk-managed returns.

- Term-limit structure optimizes market price relationship to NAV. The term limit will allow shareholders to elect collectively whether or not to liquidate the fund on its 15th anniversary in 2030.

- Judicious use of leverage seeks to enhance returns by achieving a positive spread on investments over borrowing costs.

CCD Holdings review

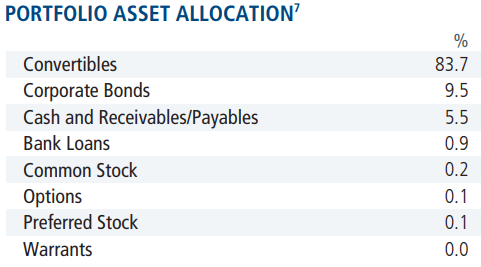

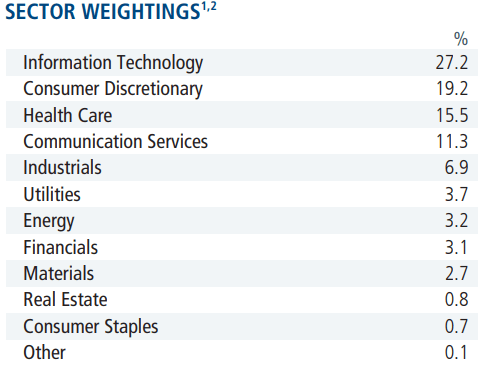

calamos.com CCD Factsheet

True to its name, almost 84% of the assets are in Convertible securities. The only other significant asset class is Corporate bonds.

calamos.com CCD Factsheet

With Technology in the lead, the top 4 sectors account for 73% of the asset exposure. The high Tech weighting helps explain why CCD could match performance against SPY, which also has a high weighting in Technology stocks.

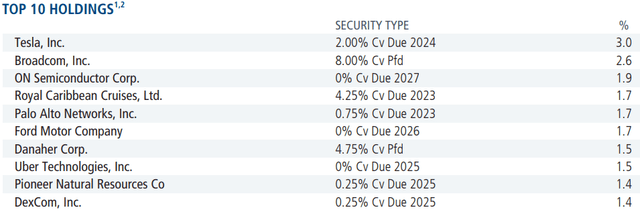

These 10 (out of over 600) assets are only 18% of the portfolio, reducing CCD’s dependency on a few holdings driving performance. Other useful portfolio facts include:

- The United States accounts for 87% of the assets, with Ireland second at 2%; most likely US companies incorporated there.

- Weighted Average Duration is 2 years; with Weighted Average Maturity at 3.5 years. A 2-year duration is good when rates are rising.

- 74% of the assets are not rated. Only 9% are rated investment-grade.

CCD Distribution review

Like many CEFs, Calamos has adopted a Managed Distribution Policy, which is defined as:

Calamos closed-end funds adhere to a managed distribution policy in which we aim to provide consistent monthly distributions through the disbursement of the following:

- Net investment income

- Net realized short-term capital gains

- Net realized long-term capital gains

- And, if necessary, return of capital

We set distributions at levels that we believe are sustainable for the long term. Our team focuses on delivering an attractive monthly distribution, while maintaining a long-term emphasis on risk management. The level of the Fund’s distribution can be greatly influenced by market conditions, including the interest rate environment, the individual performance of securities held by the Fund, our view of retaining leverage, Fund tax considerations, and regulatory requirements.

Source: CCD Annual Report

Unlike other CEFs, it is not set as a percent of the NAV.

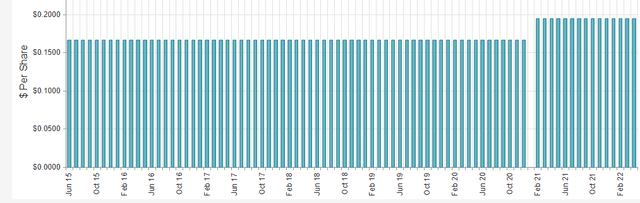

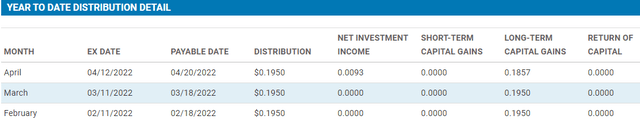

Starting in 2021, the monthly payout went to $.195 from $.167. So far in 2022, most of the payouts have come from investment gains, none from ROC.

In the past Fiscal year, 99% of the payouts were from investment gains, mostly LT ones.

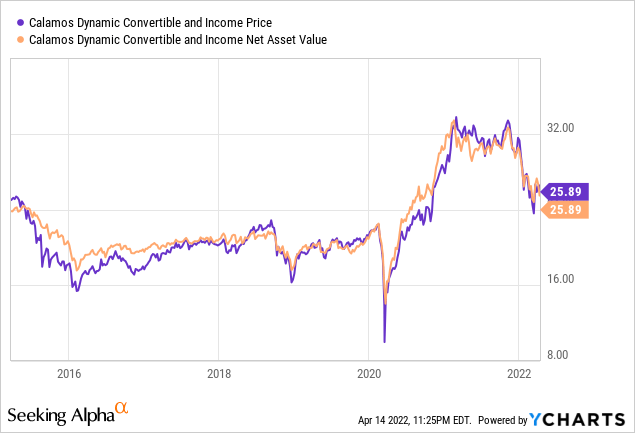

CCD Price and NAV review

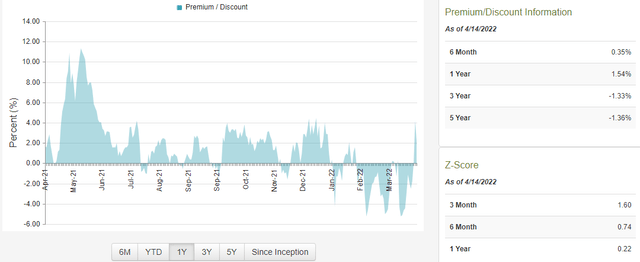

Most of the time, CCD has traded between a 5% Discount and a 5% Premium.

After going into Discount territory when Ukraine was invaded, CCD recently returned to selling at a Premium; currently 2.2%. The positive Z-scores indicate that is above recent levels, evaluated at three time periods.

Portfolio Strategy

When an article picks the time frame, the first questions readers should be asking is “Did that make a difference?”. Here the answer is yes. CCD has two more years of history and when those are included, SPY did over 370bps annually better. The 5-year decision was made before the results were known by me, and that time frame is one I like when evaluating a fund. But as the say ” Please remember that past performance may not be indicative of future results.”, you just have to look at the CAGR charts:

I chose to stay with the 5-year chart as it better illustrates the point I want to make here. Until COVID-19 crashed the market, CCD and SPY didn’t deviate much. From then, for just over a year, CCD crushed SPY in performance. Then, when inflation popped and fear of rising interest rates, which are bad for both bonds and high P/E growth stocks, became concerns for investors, CCD gave up all the advantage in return it had generated since the COVID-19 market bottom.

Final Thoughts

This article reviews CCD in detail so investors can decide whether their 5-year superior returns will continue. Recent history brings that into question. I rate CCD as a Hold.

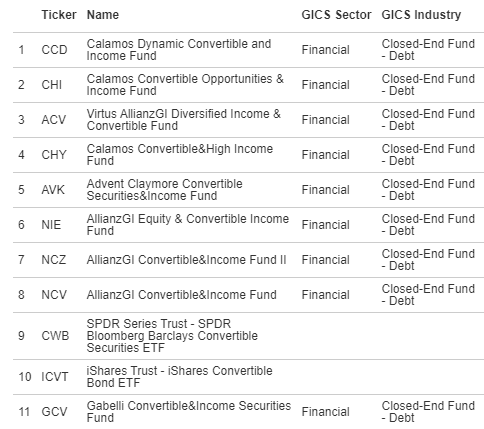

Seeking Alpha readers follow 9 CEFs and 2 ETFs that focus on Convertibles.

seekingalpha.com

Of these funds, only the Virtus AllianzGI Diversified Income & Convertible Fund (ACV) has also outperformed SPY over the past five years. Like CCD, that return required investors to experience a higher level of risk. Also like CCD, ACV’s performance followed the same path versus SPY.

Be the first to comment