skynesher/E+ via Getty Images

Investment Thesis

Peloton (NASDAQ:PTON) is down significantly, but it’s not undervalued. In fact, I believe that Peloton is soon going to dilute shareholders to raise capital to support its balance sheet.

I make the argument that Peloton this year will burn through $2 billion of free cash flow and that by Q3 2022 its balance sheet will have less than $1.3 billion of cash left.

Peloton is an unprofitable company that is not worthy of your capital. The best course of action right now is to exit one’s position.

Peloton Interactive – Investor Sentiment Cuts Both Ways

Two months ago I wrote a bearish article on Peloton where I quoted David Einhorn,

Two times a silly price is still a silly price. Half a silly price doesn’t mean it is deep value.

In that article I went on to say,

The past few days have seen countless speculation that Peloton would potentially be acquired. Anyone with deep pockets was noted as likely to rescue Peloton. Consequently, its share price has soared.

However, as a seasoned investor, I can categorically inform you to stay away from this investment. There’s nothing here worthwhile rescuing while having to pay a $12 billion market cap.

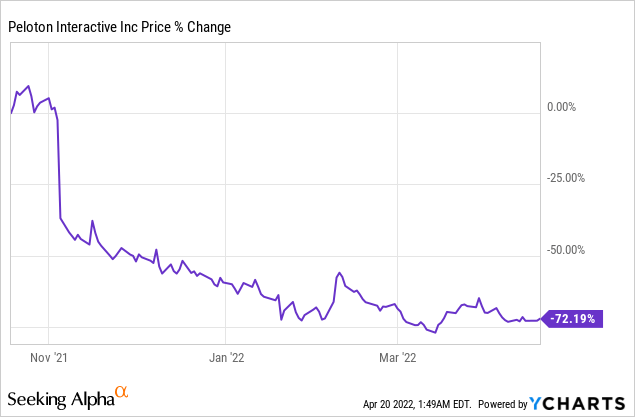

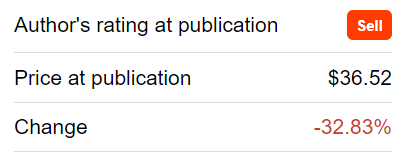

What follows is the share performance since that time:

Peloton author coverage

Since my call to sell, the stock is down 33%. I now note that Peloton is likely going to dilute shareholders soon.

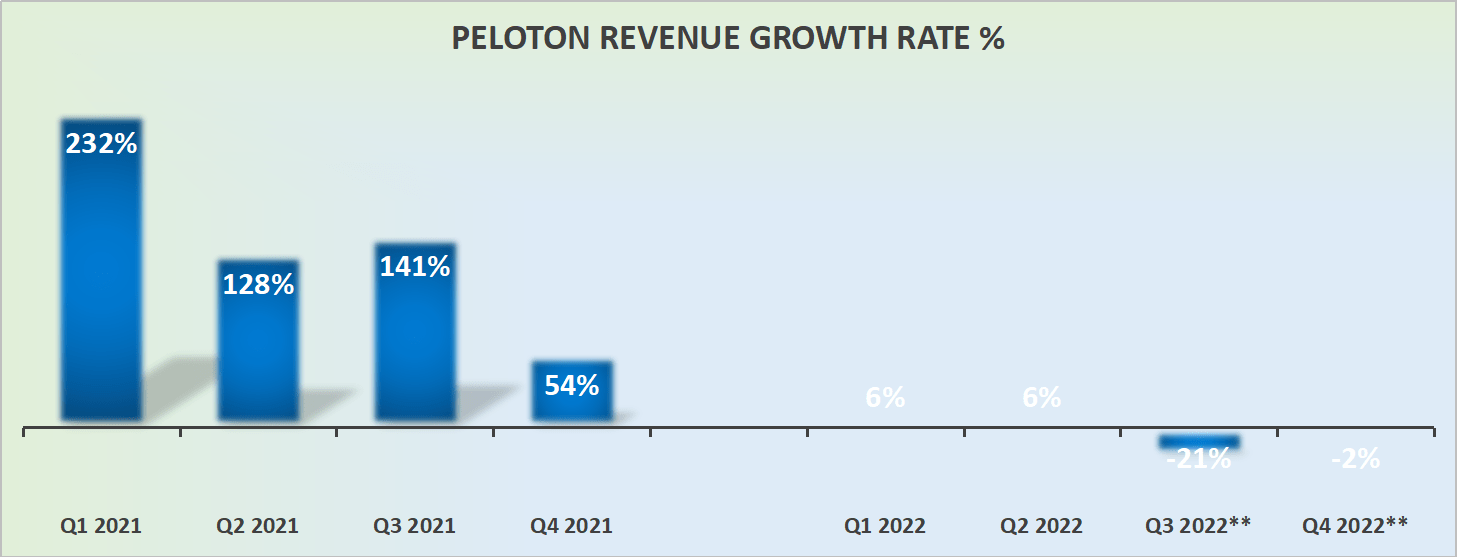

Peloton’s Revenue Growth Rates Move in the Wrong Direction

Peloton revenue growth rates

There’s been increasing news in the last few days that since March, Russia’s war in Europe is having a knock-on effect on Europe’s economic growth.

I make the case that first and second-order ramifications will directly impact Peloton’s revenue growth rates and that analysts are going to be downwards revising their revenue estimates further in the coming weeks, ahead of its fiscal Q3 2022 earnings results.

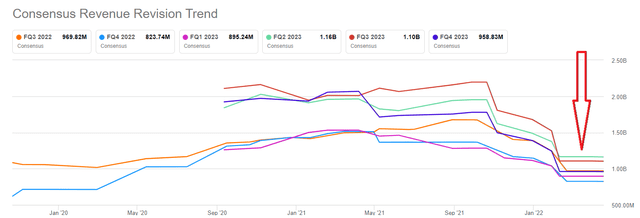

Peloton’s consensus revenue estimates

When you invest, you don’t want to be investing in a stock that analysts are downwards revising their estimates. That’s an easy way to lose your investment capital.

In the section that follows I’ll explain why analysts will downwards revise their revenue estimates.

Peloton’s Prospects, The Problem

Peloton has a truly impressive story. One that matches its strong brand to its very high NPS score. That’s the narrative. But the problem here is that its financials keep getting in the way of its compelling narrative.

Next, as I look ahead, I struggle to find a rational bullish case for why Peloton is a compelling long.

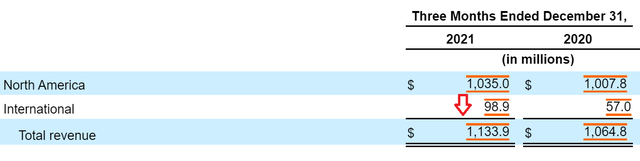

Peloton 10-Q

As you can see above, Peloton’s International revenues were up 73% y/y in Q2 2022. This was in a period when its North America revenues were essentially flat.

Said another way, the only driver of Peloton’s growth prospects had been coming from its International segment. This is predominantly made up of the United Kingdom and Germany.

Consequently, given the lackluster economic backdrop in these two countries, I strongly assert that Peloton’s consumer discretionary bikes are not going to be growing significantly in Q3 2022.

Thus, if its International segment ends up growing slower than investors expect, this implies that there’s a high likelihood that Peloton may miss its revenue growth consensus estimates.

Peloton Interactive’s Profit Margins May Suffer Further

Peloton was previously guided to end fiscal 2022 at approximately $625 million of negative EBITDA. However, this guided EBITDA guidance was given before events in Europe had a knock-on impact on global economic growth.

Thus, with that in mind, I fully expect that Peloton will have fewer economies of scale than it had envisioned back in Q2 2022.

In practical terms, I believe that Peloton’s Q3 2022 gross margins may in fact end up closer to 20% to 21% rather than 23% in gross margins that Peloton had previously guided towards.

Consequently, the impact here will be that Peloton’s fiscal 2022 EBITDA approximates a negative $700 million.

This will translate into Peloton’s EBITDA margins being negative 18% for the year.

On the other hand, one could make the argument that if that’s the case, this would imply that Peloton’s fiscal H2 2022 would report a massive improvement from the negative 27% reporting in H1 2022.

And while that is certainly a valid possibility, I still don’t believe that to be a compelling enough argument to buy Peloton’s stock. Here’s why:

PTON Stock Valuation – Why This Still Doesn’t Make Sense

Peloton finished Q2 2022 with $2.1 billion in total liquidity, this includes its $500 million undrawn revolver. But we know that Peloton is on target to burn through more than $600 million of free cash flow in H2 2022.

Altogether, this means that Peloton’s balance sheet, when it reports its Q3 2022 results will only carry $1.3 billion of cash on its balance sheet.

This implies that the company may have to raise cash imminently. Now, the problem with this is that you can’t raise debt on anything but the most onerous terms. Peloton should have raised debt sooner, but it didn’t. So now, it may have to dilute shareholders.

Here is my math. By my estimates, Peloton is going to burn $2 billion of free cash flow this year. This means that even after it drastically reduces its workforce and seeks to pay its executives with stock-based compensation, Peloton will exit fiscal 2022 with less than $1 billion worth of cash on its balance sheet.

Further complicating the case for Peloton is that its 2026 convertible senior notes have covenants in place to ensure that Peloton doesn’t overleverage its balance sheet. This means that only other option likely available is for Peloton to dilute shareholders.

The Bottom Line

I’ve laid out the case that Peloton is clearly not a growth company. What’s more, I contend that its near-term revenue growth rates will be worse than analysts presently expect.

Furthermore, Peloton is evidently not a profitable company. And to make matters worse, given that Peloton is a cash incinerator, it may be forced to dilute shareholders imminently to bolster up its operations.

With all this in mind, I believe that there are much easier investments available. Whatever you decide, good luck and happy investing.

Be the first to comment