fstop123/E+ via Getty Images

Introduction & Thesis

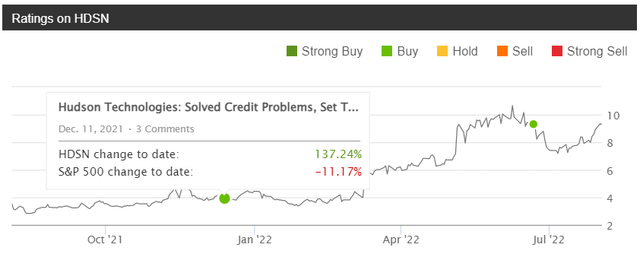

Hudson Technologies (NASDAQ:HDSN) is, in fact, the best stock pick I have ever made here on Seeking Alpha – I became aware of this small company in early winter 2021, a few months before it was listed as a Top-rated stock by SA’s Quant Rating System. Since then, HDSN is up > 137% while the S&P 500 corrected >11%:

Seeking Alpha, my profile, HDSN

At that time, the company had just freed itself from its past credit dependence and was about to expand its operations thanks to the tailwind in the form of the AIM act, which assumed a significant expansion of the addressable market, in which the company was already the leader at that time, with a share of over 30%.

Relatively recently, I reiterated my buy recommendation, noting:

a) the company’s still-low valuation multiples;

b) the longer-term phase-out of HFCs (by 2024), which should theoretically translate into longer-term EPS growth, and

c) the possibility of extending California-based OEMs requirements to other states, which should have expanded the company’s TAM even more going forward.

Hudson Technologies reported its quarterly earnings yesterday, beating analysts’ consensus estimates for revenue and EPS by 8.23% and 115.38%, respectively.

In my article today, I would like to draw your attention to the recent corporate events and analyze the financial reports with management’s comments. My thesis remains unchanged based on the information I have analyzed – I still believe that HDSN stock has not yet fully realized its upside potential and should trade well above the current price level. The technical picture I described last time is still developing according to plan – if it continues like this, we will very likely see how the fundamental factors will be reflected in the development of quotations in the medium term.

Why do I think so?

HDSN’s 10-Q will likely be released in a few days, but until then, we have preliminary results of the company’s performance on key metrics that we can compare to previous quarters.

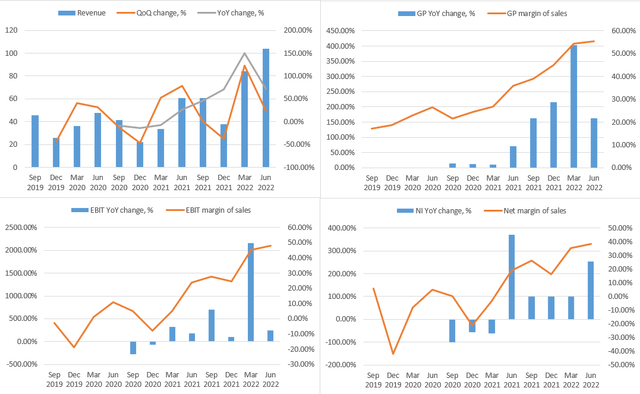

Author’s calculations, based on HDSN’s 8-K and Seeking Alpha

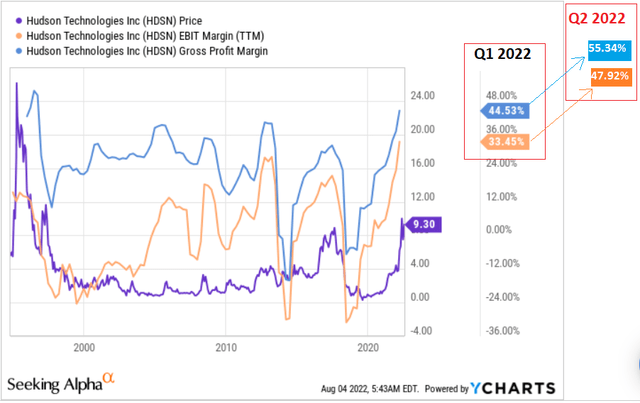

We see sales, gross profit, and EBIT growth slowing in Q2 2022, which some might take as a negative sign. However, I do not think so – if we look at the longer operating history, we recall that the company has had profitability issues in the past that HDSN had to solve with a very low starting point (I marked the growth from negative to positive as 100% in the chart above), and it is now perfectly normal for the growth rate to decline slightly. Much more important, in my opinion, is the company’s margins, which are exceptionally improving quarter by quarter.

In the second quarter of 2022, the company’s gross margin and EBIT margin were 55.34% and 47.92%, respectively – a record in recent decades:

Of course, the second quarter has historically been very successful for the company – as shown by the dynamics of absolute financial indicators in the first chart above. Therefore, it would be wrong to assume a gross margin of 55% for the whole FY2022. However, according to Mr. Coleman [CEO of HDSN], the company’s gross margin for the full year will be at least in the mid-40% range – close to its all-time highs [chart #2]. In addition, given rising refrigerant prices and tailwinds in the form of regulatory changes, management expects full-year 2022 revenue to exceed $290 million – 50.5% year-over-year growth.

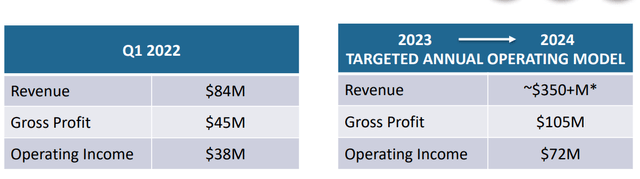

Previously, we also knew that Hudson was targeting EBIT of $72 million on sales of >$350 million.

Based on the results of the second quarter of 2022, management has decided to give even longer guidance:

As it relates to the AIM Act implementation, we have seen an accelerated shift to what we expect will be significantly higher sustained profitability for the business going forward. Assuming further HFC price increases related to HFC phasedown and applying a slower pace to price increases than we saw in 2022, we are targeting an annualized revenue of greater than $400 million by 2025, with gross margins remaining above historical levels, but moderating over the next 3 years to approximately 35%.

Source: HDSN’s Earnings Call

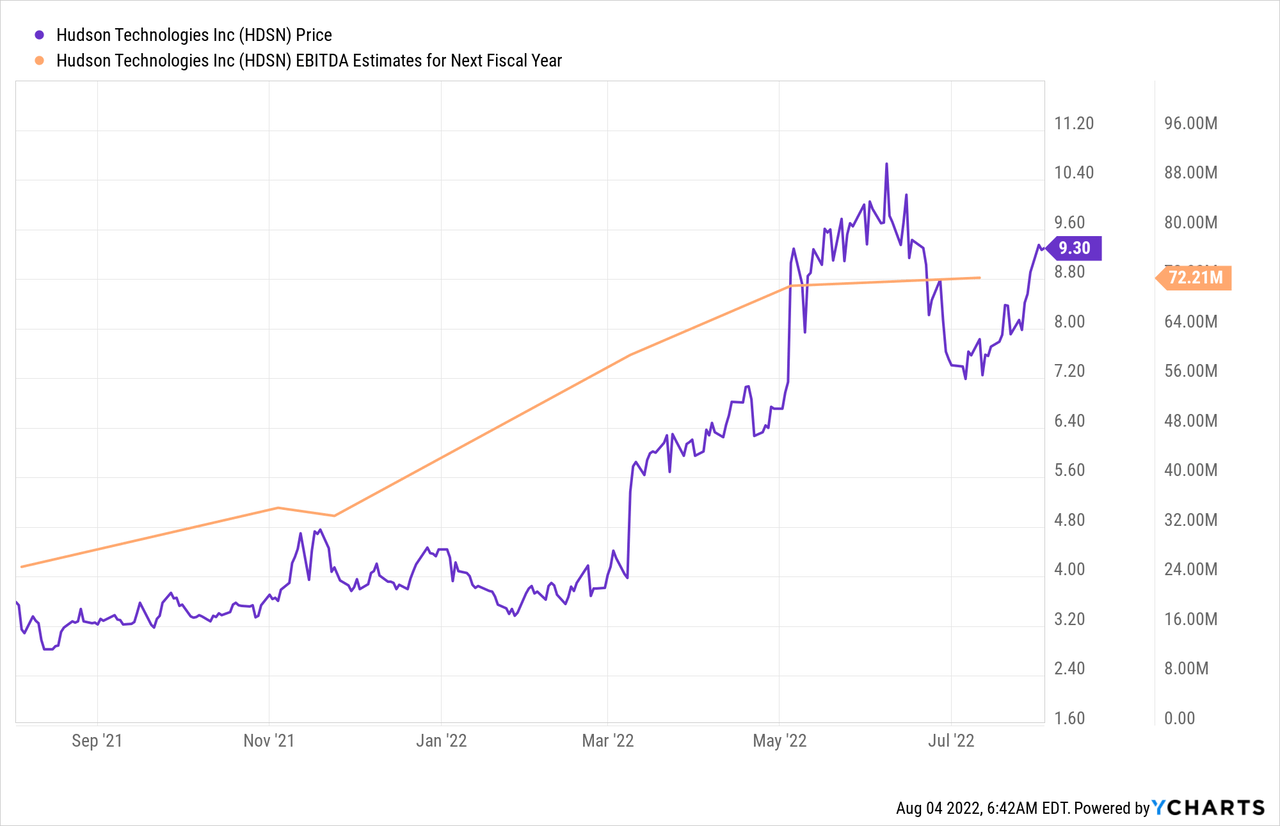

I tried to build a “napkin model” to understand how much EBITDA the company is set to generate in 2025, and soon realized that the market still does not seem to price management’s words appropriately.

Here’s why.

The Wall Street coverage of the company is rather poor – 3 analysts are covering the stock with a consensus 2023 EBITDA forecast of $72.21 million. EBITDA forecasts for 2024 and 2025 simply do not exist.

However, we recall that HDSN management has forecast 2024 EBIT of $72 million on gross revenue of $105 million. At first glance, it may seem like something is wrong – it is! The company’s presentation with these calculations has not been updated for several quarters – here are management’s projections as of November 21, 2021, on which I based my very first article:

HDSN’s IR presentation [November 23, 2021]![HDSN's IR presentation [November 23, 2021]](https://static.seekingalpha.com/uploads/2022/8/4/49513514-16596097917976894.png)

At the time, management expected the EBIT to gross margin (GP) ratio of 68.6% in E2024, not knowing that refrigerant prices would rise so much. Now they have already risen, but the financial projections remained unchanged in the presentation. If we assume that the EBIT of GP ratio in 2023 is at the same level as the old forecast, then HDSN should have an EBIT of $97 million if the gross profit margin is corrected according to the CEO’s guidance, and thus the EBITDA in 2023 will be more than $100 million, which is 38% above the current consensus. Moreover, such a forecast may prove to be quite understated, as Hudson Technologies has only generated EBITDA of over $90 million in the last 6 months – if refrigerant prices remain relatively high or do not drop sharply in 2023, then my forecast will be out of touch with reality.

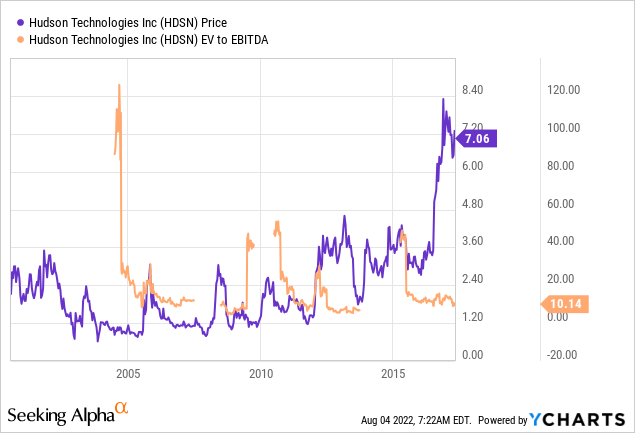

The company’s current enterprise value is $508 million, according to YCharts. Then it turns out that with a projected EBITDA of $100 million in 2023, HDSN is worth only 5x its forward EBITDA today – that’s 2 times less than the company was worth in 2017, and 2 times less than the median company in the Industrials sector is worth.

In my opinion, the 3 analysts covering this company should revise their forecasts soon, taking into account the updated guidance of the company’s management. At the same time, it would be nice to see an update of the targeted financials in the presentation of the company itself. Once that happens, the market should begin to re-evaluate HDSN’s prospects for the coming years. In my view, the stock is still undervalued by a factor of about 2 – once the market understands that, a rally should follow to correct such injustice.

Takeaway

I admit that I could be wrong in my calculations and choice of target valuation multiple for comparison – perhaps the company is rightly trading at 5x EV/EBITDA and the market is discounting its future operating success based on past failures. However, it is very clear to me that this is not the same company it was in 2017-18 – HDSN is earning more, growing faster, and has much more tailwinds than before against a backdrop of fewer headwinds (=less debt).

Another risk is a possible recession that could hit the demand side. However, during the last earnings call, the CEO assured that the industry might be better insulated than other markets – these words reassure me a bit as a shareholder.

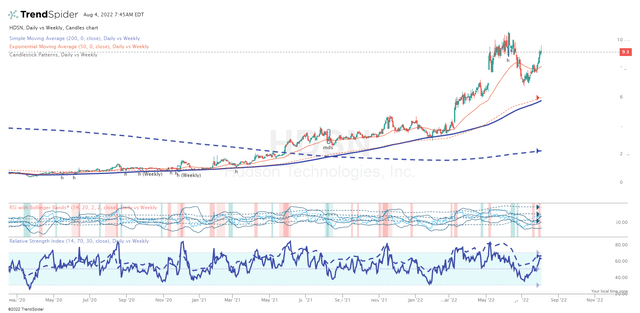

I am not a professional market technician, but my guess from the last article about the formation of a “handle” for a “cup” still stands:

TrendSpider Software, HDSN, Daily chart TrendSpider Software, HDSN, Weekly chart

The long-term moving average (weekly chart) has only recently begun to show a reversal (I use multi time frame analysis), so I hope that HDSN can still show its full glory in the medium term, despite the market’s strange negative reaction to such a strong report. So I reiterate my early Buy rating and recommend that all current shareholders continue to hold HDSN.

Final note: Hey, on September 27, we’ll be launching a marketplace service at Seeking Alpha called Beyond the Wall Investing, where we will be tracking and analyzing the latest bank reports to identify hidden opportunities early! All early subscribers will receive a special lifetime legacy price offer. So follow and stay tuned!

Be the first to comment