Dekdoyjaidee/iStock via Getty Images

Even after a recent bounce, KKR (NYSE:KKR) shares are down over 38% year-to-date despite a solid operating performance and bright long-term outlook. While investors seem to think Private Equity is a volatile businesses dependent on successful IPOs, the reality is that a large percentage of KKR’s earnings come from recurring management fees on committed capital. I view this disconnect between perception (volatile earnings) and reality (stable fees on committed capital) as presenting a great opportunity for long-term investors to buy a premier private equity franchise at a discounted price.

Long-Term Tailwinds Drive Steady Growth in Fee Income

KKR was founded 45 years ago by cousins Henry Kravis and George Roberts. Today the company manages just shy of $500 billion in total assets under management. While the company was founded as a US-based buyout shop (private equity), today the company has expanded the scope of its operations to include private credit, infrastructure, and real estate funds globally.

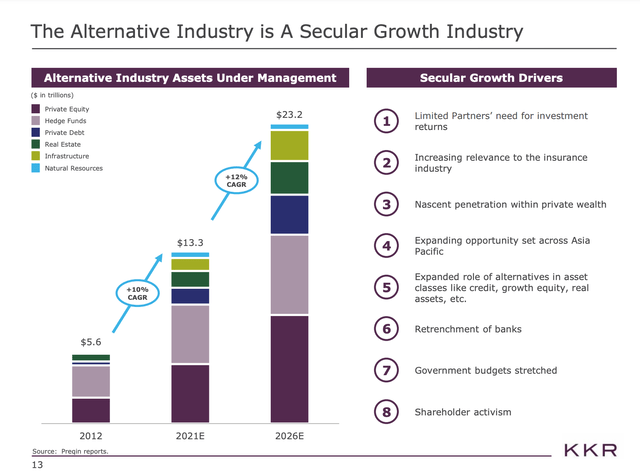

Alternative Asset Growth over Time (KKR Investor Presentation)

As shown above, the alternative asset space has experienced significant growth over the past decade. KKR has grown faster than the industry with assets under management increasing 20% annualized since 2012. KKR’s ability to grow by launching new funds is a testament to the value it has created for its clients – as shown below, KKR funds have delivered excellent long-term performance:

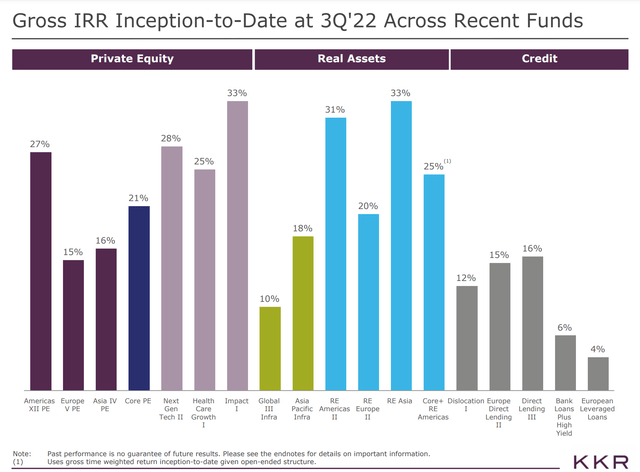

Investment Performance (KKR Investor Presentation)

The successful performance delivered by KKR has enabled it to raise capital from clients to seed new strategies. KKR has launched several funds (real estate, infrastructure) over the past decade. As these funds now have established track records, KKR is able to raise more money in subsequent raises (i.e., Real Estate Fund 2 will be larger than Real Estate Fund 1 as more investors are willing to invest behind a successful track record).

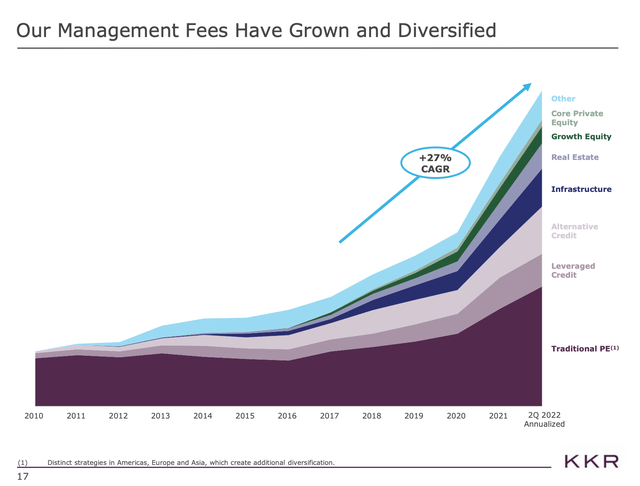

As shown below, scaling new funds has led to significant growth in KKR’s recurring management fees.

Growth in Recurring Fees (KKR Investor Presentation)

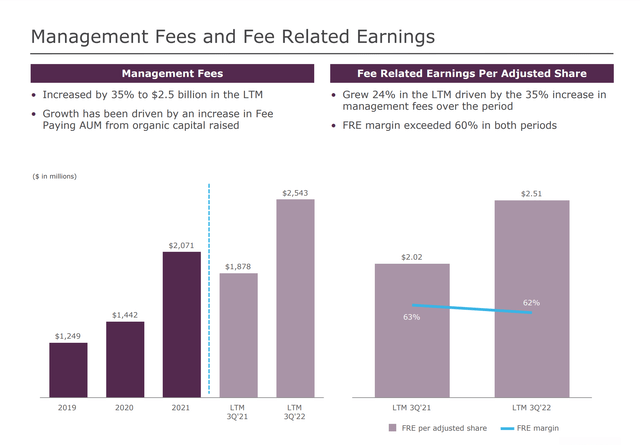

The beauty of management fees (recurring fees earned on private equity, debt, real estate and infrastructure) is their stability – irrespective of investment markets. Fees are earned as a percentage of long-term committed capital. Capital is generally locked up for 7+ years and fees are earned on committed capital (not subject to mark-to-market or mark-to-model). While investment markets have been volatile (and the IPO market is virtually closed), KKR has demonstrated tremendous growth (24%) in fees year-over-year as shown below.

Fee Income Growth (KKR 3Q22 Investor Presentation)

Valuation & Conclusion

At today’s price of $49, a buyer of KKR shares receives the following:

– $19.93/share worth of net cash and investments in KKR Funds. KKR differs from other private equity managers in that it retains earnings and invests heavily in its own funds.

– $2.00 in after-tax fee related earnings ($2.50 pre-tax). As mentioned above this is a fast growing, recurring source of income. Given its durability and solid growth (management guides to 12-13% annualized growth), I value this earnings stream at a 20x P/E which equates to $40 per share.

Adding $19.93 in net cash & investments to the value of recurring fee related earnings gets me to a value of $60/share, or 22% above the current stock price. In addition, investors own the lucrative, albeit lumpy performance fee earnings stream. In a good year like 2021, performance fees can be ~$1 per share whereas these fees can be a zero in a tough year. This volatility in performance fees are worthy of a lower multiple, say 10x on an average of $0.60 per share (after tax) or another $6/share in value suggesting a total value of $66/share (34% above the current price).

Despite a favorable industry backdrop, a terrific investment track record, and a steadily growing stream of recurring management fees, KKR is selling at a significant discount to my appraisal of its intrinsic value and represents a compelling investment opportunity at today’s price.

Be the first to comment