Drew Angerer

As we look forward to a potential year-end market rebound, one category that is usually guilt-free to invest in is value-oriented growth stocks. In this regard, few names stand out more than Dropbox (NASDAQ:DBX), one of the world’s most popular file-sharing and storage services.

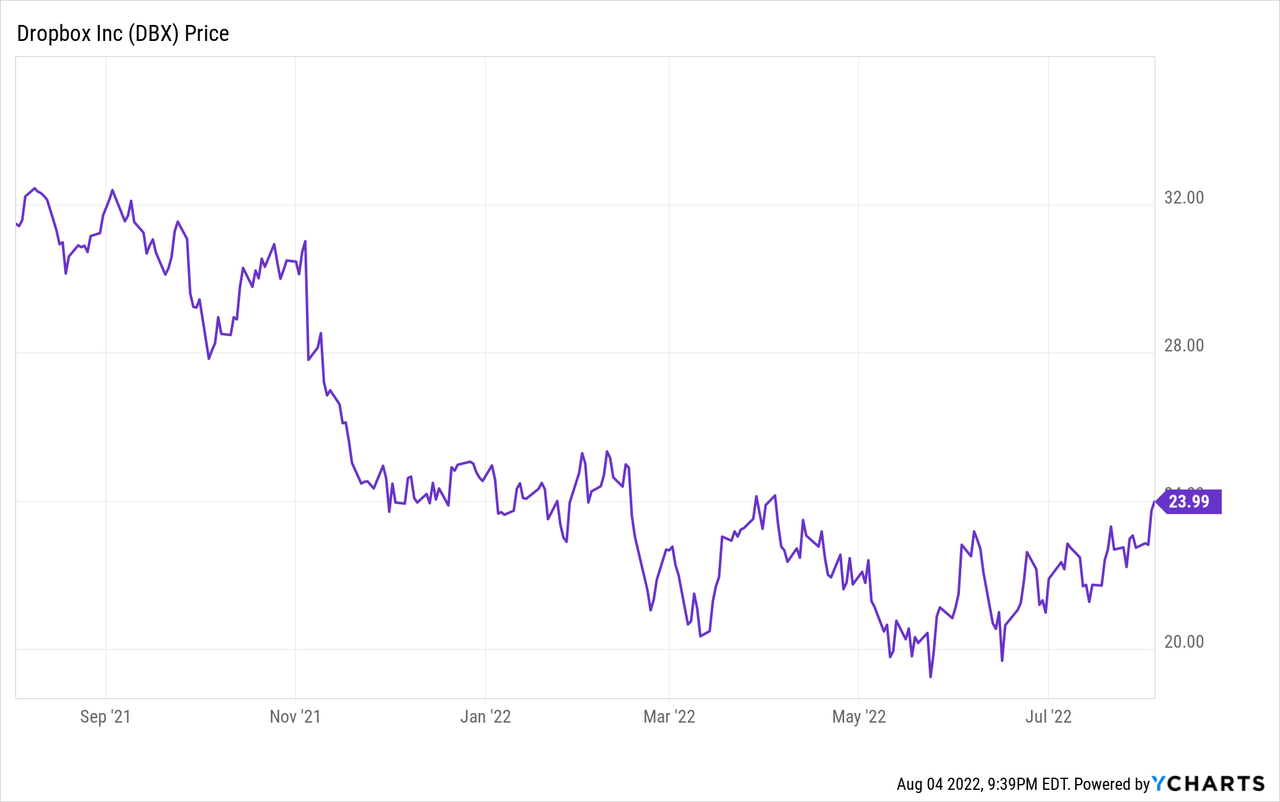

Year to date, Dropbox’s value orientation has already shielded the stock from much of the carnage that its SaaS peers have suffered. Dropbox stock is down ~4% year to date, far better than many software names that have lost 30%+ as well as the S&P 500. The issue here is that Dropbox is no longer really that exciting, and the stock shed a few points after releasing a ho-hum Q2 earnings print.

No, Dropbox’s growth deceleration isn’t fun to watch. At the same time, however, investors do need to shift their evaluation of this stock away from a growth/tech mindset and pay more attention to Dropbox’s bottom line, which has always been rich with cash flow. In my view, Dropbox still remains a fantastic recurring-revenue business that sits on a steady, profitable subscription base. I remain bullish here and think that Dropbox will continue to beat the market, regardless of whether the tide continues to turn upward or shifts sideways.

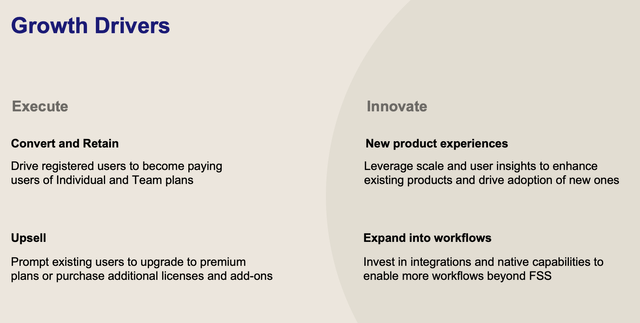

And it’s not like Dropbox has simply stopped growing, either. The slide below lists a number of Dropbox’s key growth drivers, including upsells to existing customers (which has been the trend each and every quarter) as well as a potential expansion of its platform to become a collaboration/workflow tool more in-line with Asana (ASAN) or Atlassian (TEAM), which may potentially boost Dropbox’s TAM.

Dropbox growth drivers (Dropbox Q2 earnings materials)

Here’s a full rundown on what I believe to be the key bullish drivers for Dropbox:

- Dropbox isn’t just trading on a pie-in-the-sky future projection, but on real free cash flow today, singling out from other SaaS stocks in this risk-averse environment. Growth and paying premiums for growth stocks is out; value is in. The fact that Dropbox has routinely dangled a target of hitting $1 billion in annual FCF by FY24 while continuously raising operating margins quarter after quarter is a big draw for investors. Note that in FY21, Dropbox already hit north of $700 million in free cash flow, so I think it’s highly likely that this original $1 billion target gets replaced with something more aggressive.

- Consumer upsells. More and more freelancers have emerged from the pandemic, untethering themselves from a corporate lifestyle and building brands and businesses of their own. Tools like Dropbox have become necessary infrastructure, and one with very low barriers to entry and ease of setup. Accordingly, Dropbox has differentiated itself from Box by appealing to these professional solo acts and small businesses, which is reflected by Dropbox’s greater upsells to premium paid plans.

- Enterprise market opportunity. Dropbox’s traditional strength has always been in smaller/consumer users, though it has started ramping its enterprise efforts lately. There’s still plenty of opportunities for Dropbox to take market share from Box here.

- E-signature opportunity. The addition of an enterprise tool like DocSend will further flex Dropbox’s muscles in the enterprise space, helping it catch up to its rival Box (the latter of which has long touted superior security capabilities). DocSend also makes a welcome addition to Dropbox’s growing portfolio of collaboration tools, alongside HelloSign (a direct competitor to DocuSign (DOCU)). Like the rest of Dropbox’s product portfolio, DocSend has a range of plans and pricing for users of various budgets and levels of sophistication, giving it immediate cross-sell applicability to all segments of Dropbox’s customer base.

- Buyback boost. Earlier this year, Dropbox’s board approved another $1.2 billion in share buybacks, which is a great way for the company to capitalize recent share price declines. This authorization covers a whopping ~13% of Dropbox’s current market cap.

From a valuation perspective: at current share prices near $24, Dropbox trades at a market cap of $9.01 billion. After we net off the $1.29 billion of cash and $572.6 million of debt on Dropbox’s most recent balance sheet, the company’s resulting enterprise value is $8.94 billion.

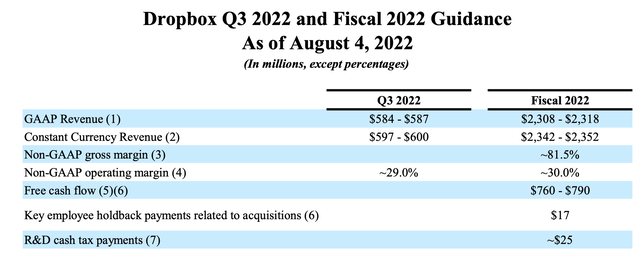

For the current fiscal year, meanwhile, Dropbox is guiding to $2.308-$2.318 billion in revenue, representing 8% y/y growth, and $760-$790 million in FCF, or a 33.5% FCF margin.

Dropbox outlook (Dropbox Q2 earnings materials)

Against these targets, Dropbox trades at just:

- 3.9x EV/FY22 revenue

- 11.5x EV/FY22 FCF

The free cash flow multiple (especially as Dropbox has a near-term plan to grow to $1 billion in cash flow) is what investors should continue to focus on, and I think it gives Dropbox a great differentiator in this relatively more risk-averse stock market.

The bottom line here: Dropbox may have lost its growth stock star status, but that doesn’t mean it’s not worth buying for its rich cash flow, its steady subscription business, and cheap valuation. Stay long here.

Q2 Download

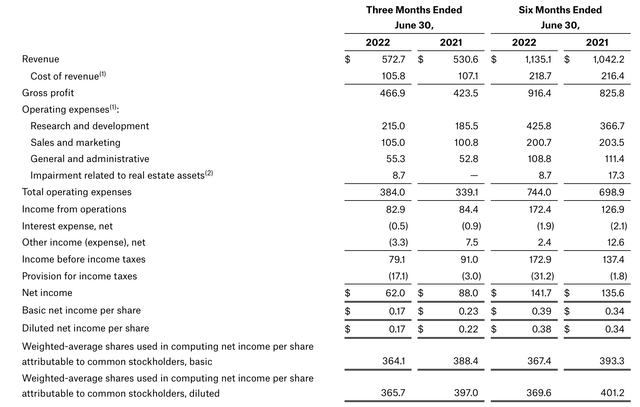

Let’s now cover Dropbox’s latest Q2 results in greater detail. The Q2 earnings summary is shown below:

Dropbox Q2 results (Dropbox Q2 earnings materials)

Dropbox’s revenue grew 8% y/y to $572.7 million, only slightly beating Wall Street’s expectations of $571.3 million by roughly only 20bps. In the absence of currency movements, Dropbox’s revenue growth would have been 9% y/y.

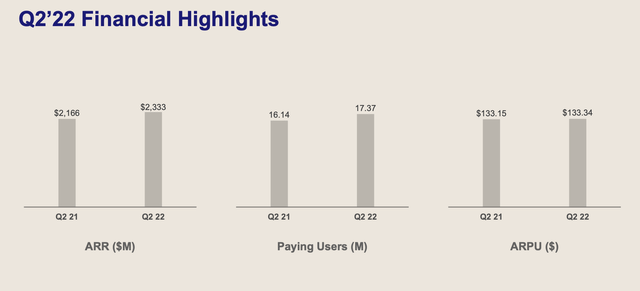

The company continued its customer expansion journey. It added 260k net-new paid users in the quarter, growing to 17.37 million by the end of Q2 (up 7% y/y). ARPU also continued to rise slightly, driven by adoption of more premium plans. Looking ahead, additional features like workflow and collaboration tools may help provide a “step function” lift to ARPU.

Dropbox key metrics (Dropbox Q2 earnings materials)

We note as well that ARR grew by $43 million sequentially and 8% y/y, and that the $2.33 billion of ARR is greater than Dropbox’s annual revenue guidance.

Here’s some helpful commentary from CEO Drew Houston on go-to-market performance and the company’s key priorities looking ahead, taken from his prepared remarks on the Q2 earnings call:

I’m really pleased with the resilience of our business and our execution in Q2, especially against the challenging macroeconomic backdrop. We saw continued growth in our Professional and Teams plans and strong performance in our managed sales business. We also saw increased adoption of some of our newer products, Dropbox Backup and Capture, and we announced the pricing and packaging update for Standard and Advanced plans in June, delivering more value to our Teams customers around security and data protection […]

While we’re certainly keeping an eye on the macro environment, we remain confident in our strategy that we outlined at the beginning of the year. First, we’re continuing to evolve our core FSS business by improving retention and monetization to stabilize growth. Second, we’re driving more adoption of workflows beyond FSS around video and documents to better serve distributed teams, small businesses, solopreneurs and creators. Finally, we’re maintaining operational excellence by continuing the growth and profitability. And with a healthier and more stable foundation in our core business, we’re laying the groundwork to achieve our vision of being a solution that organizes all your cloud content and the workflows around it.”

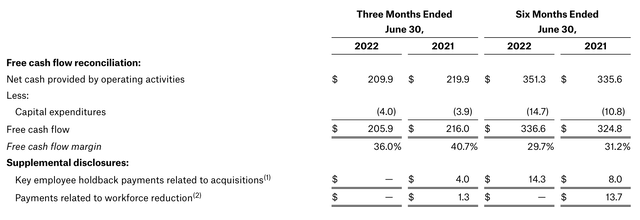

Pro forma operating margins held flat at 32%. A slight uptick in gross margin to 83% (two points higher than in the second quarter of FY21) was offset by slightly higher operating spend. Free cash flow for the first six months of the year grew 4% y/y to $336.6 million, representing a 150bps margin decay to 29.7% – but from a linearity standpoint, considering the back half of the year tends to bring substantially more cash flow, Dropbox is still well on track to hit its $760-$790 million guidance target.

Dropbox FCF (Dropbox Q2 earnings materials)

Key Takeaways

Buy Dropbox for value. This is a company whose valuation and underlying FCF strength are compelling enough that you don’t have to worry about whether it will perform in an up or down market. Take advantage of the slight post-earnings dip as a buying opportunity.

Be the first to comment